2025-02-06 23:38

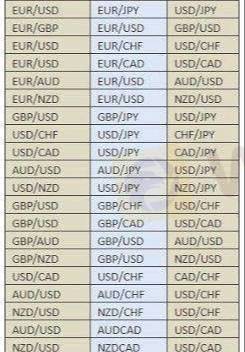

IndustriyaCORRELATION BETWEEN FOREX PAIRS

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Katulad 0

BeastBoy2159

Nhà đầu tư

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

CORRELATION BETWEEN FOREX PAIRS

Algeria | 2025-02-06 23:38

Algeria | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.