2025-02-18 01:02

IndustriyaFinancial Market Bubbles and Crashes

#firstdealofthenewyearastylz

A financial market bubble occurs when asset prices rise far above their intrinsic value due to speculation and investor euphoria. When sentiment shifts, the bubble bursts, leading to a market crash—a rapid price decline.

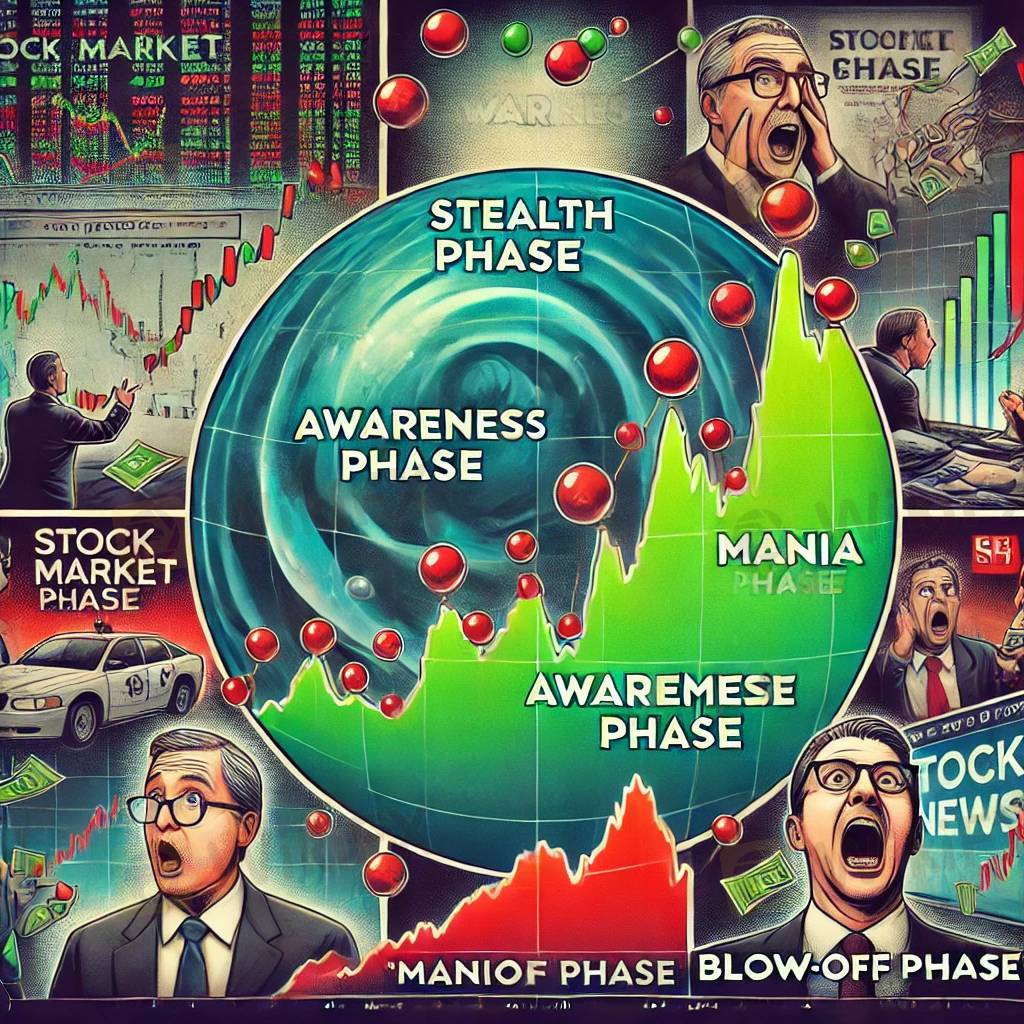

Phases of a Bubble:

1. Stealth Phase – Early investors buy in.

2. Awareness Phase – Institutions and media drive interest.

3. Mania Phase – Retail investors push prices to extremes.

4. Blow-off Phase – Panic selling causes a crash.

Examples:

Tulip Mania (1637) – Overpriced tulips led to a collapse.

Dot-com Bubble (2000) – Internet stocks crashed after hype faded.

2008 Financial Crisis – Housing market collapse triggered a global recession.

Bubbles repeat due to greed, speculation, and market psychology.

Katulad 0

Oleks5519

交易商

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

Financial Market Bubbles and Crashes

Hong Kong | 2025-02-18 01:02

Hong Kong | 2025-02-18 01:02#firstdealofthenewyearastylz

A financial market bubble occurs when asset prices rise far above their intrinsic value due to speculation and investor euphoria. When sentiment shifts, the bubble bursts, leading to a market crash—a rapid price decline.

Phases of a Bubble:

1. Stealth Phase – Early investors buy in.

2. Awareness Phase – Institutions and media drive interest.

3. Mania Phase – Retail investors push prices to extremes.

4. Blow-off Phase – Panic selling causes a crash.

Examples:

Tulip Mania (1637) – Overpriced tulips led to a collapse.

Dot-com Bubble (2000) – Internet stocks crashed after hype faded.

2008 Financial Crisis – Housing market collapse triggered a global recession.

Bubbles repeat due to greed, speculation, and market psychology.

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.