2025-02-18 01:13

IndustriyaHow to calculate position sizing.

#forexrisktip

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

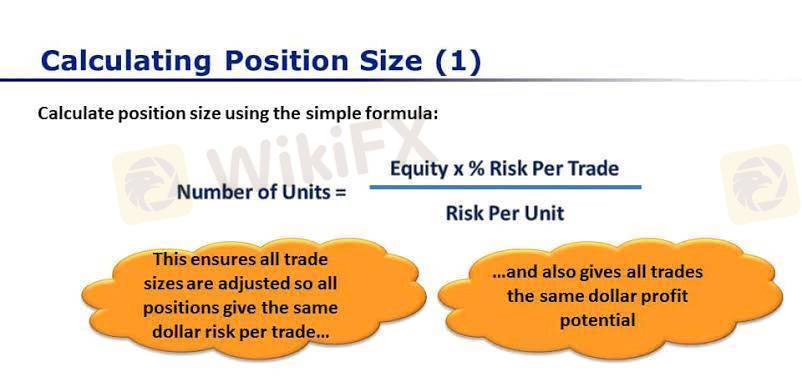

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

Katulad 0

Forextrederr73

المتداول

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

How to calculate position sizing.

India | 2025-02-18 01:13

India | 2025-02-18 01:13#forexrisktip

Position sizing is a risk management technique used by traders and investors to determine the appropriate number of units of an asset to buy or sell in order to control the potential loss from a trade. It involves calculating the position size based on the trader's account balance, risk tolerance, and the stop-loss level for the trade.

The basic formula for calculating position size is:

Position size = (Account balance * Risk percentage) / (Entry price - Stop-loss price)

For example, if a trader has an account balance of $10,000, a risk tolerance of 2%, an entry price of $100, and a stop-loss price of $95, the position size would be:

Position size = ($10,000 * 2%) / ($100 - $95) = 200 shares

This means that the trader should buy 200 shares of the asset. If the trade goes wrong and the price falls to the stop-loss level of $95, the trader will lose $1,000, which is 2% of their account balance.

Position sizing is an important risk management tool that can help traders to limit their losses and protect their capital. By carefully calculating the position size for each trade, traders can ensure that they are not risking more than they can afford to lose.

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.