2025-02-18 02:02

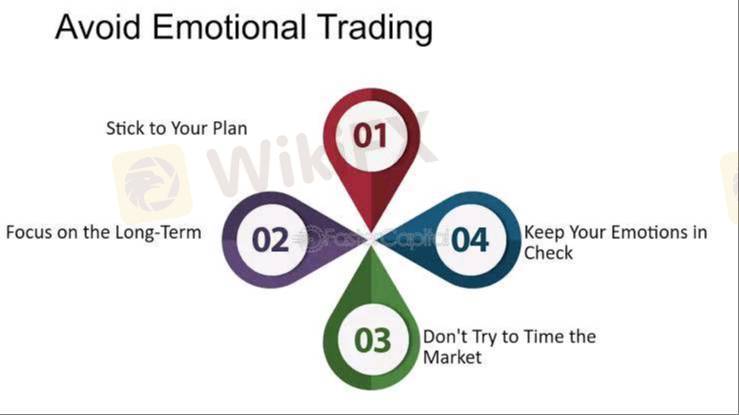

IndustriyaAvoiding emotional trading.

#forexrisktip#

Emotional trading is when you make investment decisions based on fear, greed, or other feelings, rather than on a sound, logical strategy. This often leads to poor choices and significant losses. Here are some strategies to avoid emotional trading:

* Have a solid trading plan:

* Define your goals, risk tolerance, and investment strategy.

* Set clear entry and exit points for your trades.

* Stick to your plan and avoid impulsive decisions.

* Manage your risk:

* Only invest money you can afford to lose.

* Use stop-loss orders to limit potential losses.

* Diversify your portfolio to spread risk.

* Control your emotions:

* Recognize your emotional triggers and learn to manage them.

* Avoid making trades when you're feeling stressed, angry, or overly excited.

* Take breaks when needed to clear your head.

* Be patient:

* Don't chase quick profits or try to time the market.

* Wait for the right opportunities and don't rush into trades.

* Remember that investing is a long-term game.

* Keep a trading journal:

* Track your trades and analyze your decisions.

* Identify patterns of emotional trading and learn from your mistakes.

* Seek support:

* Talk to other traders or financial advisors.

* Join online communities to share experiences and learn from others.

Remember, successful trading requires discipline, patience, and a rational approach. By following these strategies, you can minimize the impact of emotions on your trading and increase your chances of success.

Katulad 0

Jekam

Trader

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

Avoiding emotional trading.

India | 2025-02-18 02:02

India | 2025-02-18 02:02#forexrisktip#

Emotional trading is when you make investment decisions based on fear, greed, or other feelings, rather than on a sound, logical strategy. This often leads to poor choices and significant losses. Here are some strategies to avoid emotional trading:

* Have a solid trading plan:

* Define your goals, risk tolerance, and investment strategy.

* Set clear entry and exit points for your trades.

* Stick to your plan and avoid impulsive decisions.

* Manage your risk:

* Only invest money you can afford to lose.

* Use stop-loss orders to limit potential losses.

* Diversify your portfolio to spread risk.

* Control your emotions:

* Recognize your emotional triggers and learn to manage them.

* Avoid making trades when you're feeling stressed, angry, or overly excited.

* Take breaks when needed to clear your head.

* Be patient:

* Don't chase quick profits or try to time the market.

* Wait for the right opportunities and don't rush into trades.

* Remember that investing is a long-term game.

* Keep a trading journal:

* Track your trades and analyze your decisions.

* Identify patterns of emotional trading and learn from your mistakes.

* Seek support:

* Talk to other traders or financial advisors.

* Join online communities to share experiences and learn from others.

Remember, successful trading requires discipline, patience, and a rational approach. By following these strategies, you can minimize the impact of emotions on your trading and increase your chances of success.

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.