2025-02-21 18:03

IndustriyaThe role of the Fed in determining dollar strength

#FedRateCutAffectsDollarTrend

The Role of the Federal Reserve in Determining Dollar Strength

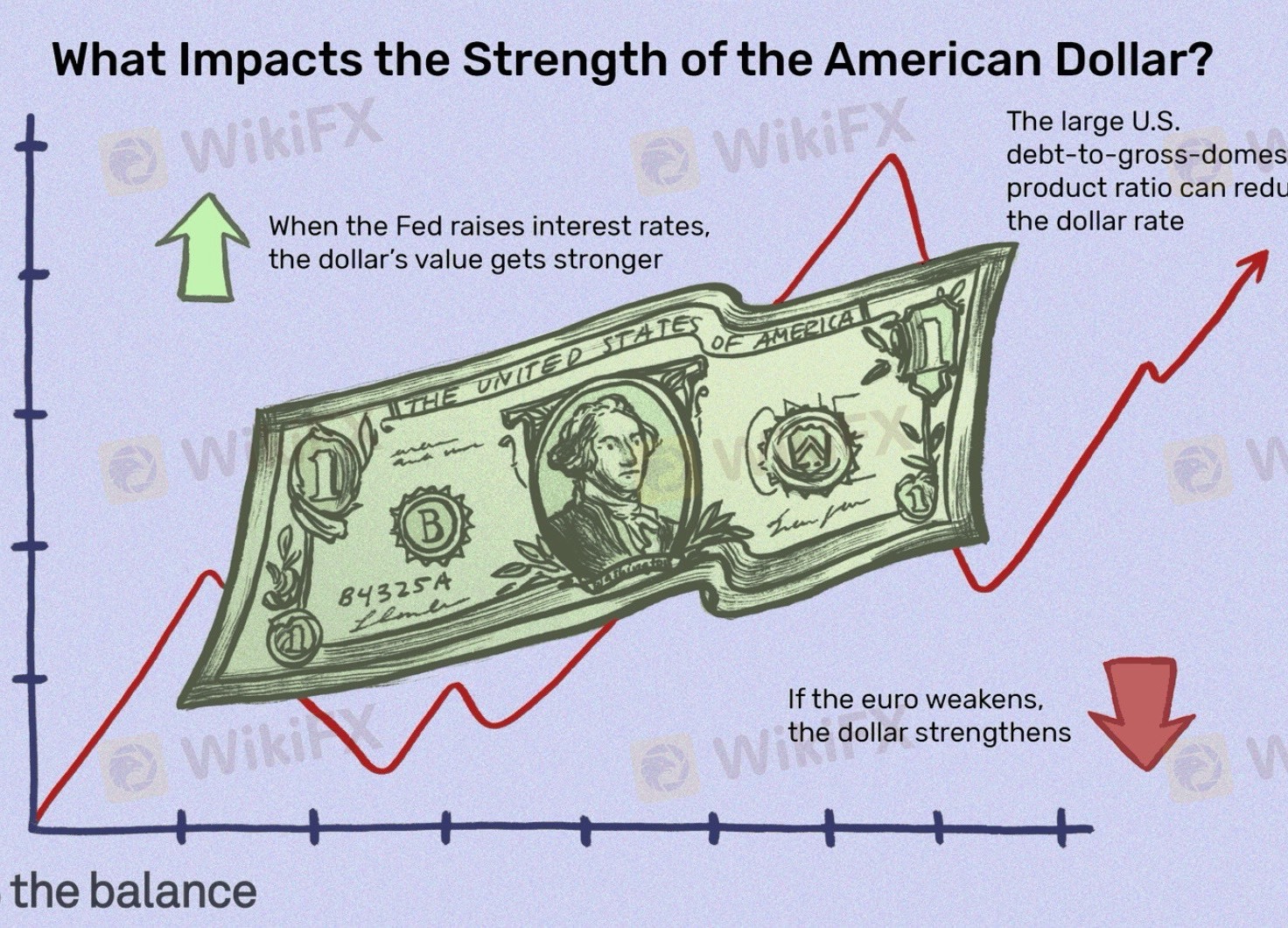

The Federal Reserve plays a crucial role in shaping the value of the U.S. dollar, but it is not the sole determinant. The Fed influences dollar strength primarily through monetary policy, interest rates, and market expectations, but global factors also come into play.

How the Fed Influences the Dollar

1. Interest Rate Policy & Yield Differentials

• The Fed sets the federal funds rate, which affects short-term interest rates.

• Higher rates → Stronger dollar (attracts foreign capital seeking higher returns).

• Lower rates → Weaker dollar (reduces demand for U.S. assets).

• The U.S. dollar’s strength depends on interest rate differentials—how U.S. rates compare to those in other economies.

2. Forward Guidance & Market Expectations

• The Fed signals future rate moves through speeches, dot plots, and policy statements.

• If markets expect faster rate cuts, the dollar weakens before the cuts even happen.

• If the Fed delays or slows cuts, the dollar strengthens due to higher-than-expected rates.

3. Quantitative Easing (QE) & Balance Sheet Policy

• QE (bond-buying programs) increases the money supply, typically weakening the dollar over time.

• Balance sheet tightening (QT), where the Fed reduces its holdings, can support the dollar.

• Example: 2009-2011 → The Fed’s aggressive QE weakened the dollar as liquidity surged.

4. Inflation Control & Purchasing Power

• If the Fed fights inflation aggressively with rate hikes, the dollar strengthens (e.g., 2022).

• If the Fed allows inflation to rise, the dollar’s purchasing power declines.

• Example: In the 1970s, high inflation weakened the dollar until the Fed raised rates sharply in the early 1980s.

Limits to the Fed’s Control Over the Dollar

1. Global Economic Conditions

• If global markets are unstable (e.g., financial crises), demand for the dollar can increase as a safe haven, even if the Fed is cutting rates.

• Example: In early 2020 (COVID crisis), the dollar surged despite emergency rate cuts.

2. Other Central Banks’ Policies

• If the ECB, BoJ, or others are also easing, the dollar may stay strong despite Fed rate cuts.

• Example: In **

Katulad 0

FX2192840773

ट्रेडर

Mainit na nilalaman

Pagsusuri ng merkado

Dogecoin cheers coinbase listing as Bitcoin’s range play continues

Pagsusuri ng merkado

Grayscale commits to converting GBTC into Bitcoin ETF:

Pagsusuri ng merkado

Bitcoin's price is not the only number going up

Pagsusuri ng merkado

Theta Price Prediction:

Pagsusuri ng merkado

How to Research Stocks:

Pagsusuri ng merkado

Bitcoin (BTC), Ethereum (ETH) Forecast:

Kategorya ng forum

Plataporma

Eksibisyon

Ahente

pangangalap

EA

Industriya

Merkado

talatuntunan

The role of the Fed in determining dollar strength

India | 2025-02-21 18:03

India | 2025-02-21 18:03#FedRateCutAffectsDollarTrend

The Role of the Federal Reserve in Determining Dollar Strength

The Federal Reserve plays a crucial role in shaping the value of the U.S. dollar, but it is not the sole determinant. The Fed influences dollar strength primarily through monetary policy, interest rates, and market expectations, but global factors also come into play.

How the Fed Influences the Dollar

1. Interest Rate Policy & Yield Differentials

• The Fed sets the federal funds rate, which affects short-term interest rates.

• Higher rates → Stronger dollar (attracts foreign capital seeking higher returns).

• Lower rates → Weaker dollar (reduces demand for U.S. assets).

• The U.S. dollar’s strength depends on interest rate differentials—how U.S. rates compare to those in other economies.

2. Forward Guidance & Market Expectations

• The Fed signals future rate moves through speeches, dot plots, and policy statements.

• If markets expect faster rate cuts, the dollar weakens before the cuts even happen.

• If the Fed delays or slows cuts, the dollar strengthens due to higher-than-expected rates.

3. Quantitative Easing (QE) & Balance Sheet Policy

• QE (bond-buying programs) increases the money supply, typically weakening the dollar over time.

• Balance sheet tightening (QT), where the Fed reduces its holdings, can support the dollar.

• Example: 2009-2011 → The Fed’s aggressive QE weakened the dollar as liquidity surged.

4. Inflation Control & Purchasing Power

• If the Fed fights inflation aggressively with rate hikes, the dollar strengthens (e.g., 2022).

• If the Fed allows inflation to rise, the dollar’s purchasing power declines.

• Example: In the 1970s, high inflation weakened the dollar until the Fed raised rates sharply in the early 1980s.

Limits to the Fed’s Control Over the Dollar

1. Global Economic Conditions

• If global markets are unstable (e.g., financial crises), demand for the dollar can increase as a safe haven, even if the Fed is cutting rates.

• Example: In early 2020 (COVID crisis), the dollar surged despite emergency rate cuts.

2. Other Central Banks’ Policies

• If the ECB, BoJ, or others are also easing, the dollar may stay strong despite Fed rate cuts.

• Example: In **

Katulad 0

Gusto kong magkomento din

Ipasa

0Mga komento

Wala pang komento. Gawin ang una.

Ipasa

Wala pang komento. Gawin ang una.