Crypto defi Management Information Revealed

abstrak:Crypto DeFi Management, based in the United Kingdom, operates in the crypto space for 1-2 years. The legitimacy of Crypto DeFi Management remains uncertain, as it operates in an unregulated environment, which poses inherent risks. They offer market instruments like lending, borrowing, spot trading, futures trading, and options trading on various cryptocurrencies. Account types cater to individual, family office, and fund investors, with varying features and minimum investment requirements. Leverage of up to 30x is available for trading pairs. Spreads, commissions, and minimum deposits are present, and fees apply to deposits and withdrawals. Various trading platforms, including centralized and decentralized options, are accessible to users. Customer support can be contacted through email and phone.

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 1-2 years |

| Company Name | Crypto DeFi Management |

| Regulation | Unregulated |

| Minimum Deposit | $10 |

| Maximum Leverage | Up to 30x |

| Spreads | 0.1% - 0.5% |

| Trading Platforms | Various, including Centralized Exchanges (Binance, Coinbase, FTX, Kraken, Crypto.com), Decentralized Exchanges (Uniswap, SushiSwap, PancakeSwap), DeFi protocols (Aave, Compound, Yearn.finance, Synthetix), Hybrid Exchanges (Maiar DeFi, ZenGo Wallet), and Portfolio Management tools (Koinly, Zengo Wallet) |

| Tradable Assets | Various cryptocurrencies, including BTC, ETH, USDT, USDC, BNB, XRP, SOL, LUNA, DOT, AVAX, and more |

| Account Types | Individual Accounts (Standard, Premium, Institutional), Family Office Accounts (Multi-Account Structure, Trust Account), Fund Accounts (Hedge Fund, Venture Capital Account) |

| Customer Support | Email: info@cryptodefimgt.com, Phone: +44 7503 762571 |

Overview of Crypto defi Management

Crypto DeFi Management, based in the United Kingdom and operational for 1-2 years, presents a financial landscape with inherent uncertainties and lack of regulatory oversight. It's essential to exercise caution when considering involvement in this space due to associated risks.

In terms of market instruments, Crypto DeFi Management supports lending and borrowing of cryptocurrencies such as Bitcoin, Ethereum, Tether, USD Coin, and Binance Coin, with the opportunity to earn interest or borrow at low interest rates. They also facilitate spot trading, futures trading, and options trading on a range of cryptocurrencies. These instruments allow clients to engage in price speculation and risk management.

Account types vary, catering to individual investors, families, high-net-worth individuals, and institutional investors, offering different features and levels of support. Leveraging of up to 30x is possible on select trading pairs. The platform operates with spreads and commissions ranging from 0.1% to 0.5% and 0.1% to 0.25%, respectively. The minimum deposit required is $10, and deposit and withdrawal fees range from 0.05% to 0.1%, varying based on the cryptocurrency and network used.

Crypto DeFi Management provides a range of trading platforms, including centralized exchanges, decentralized exchanges, and DeFi protocols, enabling users to engage in both traditional and decentralized trading. Their customer support is accessible via email and phone.

In conclusion, Crypto DeFi Management offers various opportunities and account types for crypto investors, but its unregulated nature and associated risks should be approached with caution.

Pros and Cons

Crypto DeFi Management offers a range of pros and cons to consider. On the positive side, it provides diverse investment opportunities and allows for leverage options, making it attractive to traders. The platform also offers low spreads and commissions. With a low minimum deposit requirement, it's accessible to a broad range of investors. However, there are notable drawbacks, including the lack of regulatory oversight, which raises concerns about investor protection. Additionally, the platform's main website being down can be a hindrance, and while it offers a variety of trading platforms, the complexity of choosing the right one may be challenging. Moreover, while email and phone support are available, there are limited support options for users.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

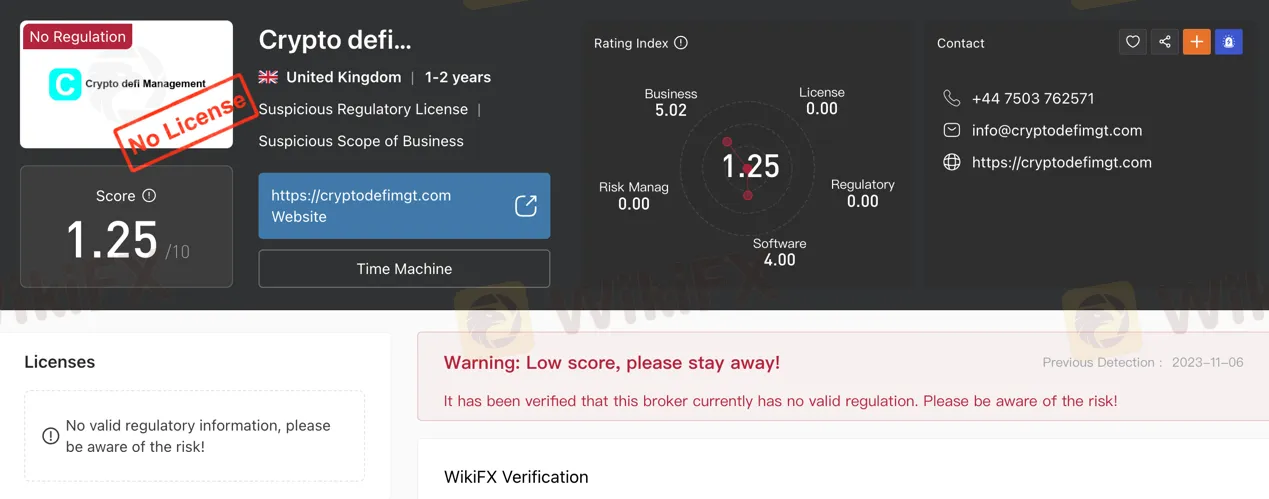

Is Crypto defi Management Legit?

Crypto DeFi management remains unregulated, indicating a lack of valid oversight. Caution is advised due to the associated risks.

Market Instruments

Lending and borrowing: Clients can lend their crypto assets, such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), and Binance Coin (BNB), to other users, earning interest.

Spot trading: Crypto DeFi Management supports spot trading on a range of cryptocurrencies, including BTC, ETH, USDT, USDC, BNB, XRP, SOL, LUNA, DOT, and AVAX. This allows clients to buy and sell cryptocurrencies at the current market price.

Futures trading: Clients can engage in futures trading on various cryptocurrencies, including BTC, ETH, USDT, USDC, BNB, XRP, SOL, LUNA, DOT, and AVAX. Futures trading enables clients to speculate on the future price movements of cryptocurrencies.

Options trading: Crypto DeFi Management offers options trading on a variety of cryptocurrencies, such as BTC, ETH, USDT, USDC, BNB, XRP, SOL, LUNA, DOT, and AVAX. This provides clients with the ability to hedge against losses or speculate on the future price of cryptocurrencies.

| Pros | Cons |

| Opportunity for earning interest through lending and borrowing | Lack of regulatory oversight |

| Access to spot trading for various cryptocurrencies | High risk in futures and options trading |

| Options trading allows hedging against losses | Complexity and potential for speculative losses |

Account Types

INDIVIDUAL ACCOUNTS

Crypto Defi Management provides several individual account types, each tailored to meet the specific needs of investors. The Standard Account is designed for beginners, offering a lower minimum investment requirement and access to a range of DeFi assets. In contrast, the Premium Account targets more seasoned investors, providing advanced features and a broader selection of DeFi assets. It mandates a higher minimum investment and includes the support of a dedicated account manager. The Institutional Account is aimed at institutional investors managing DeFi investments on behalf of clients. It involves a substantial minimum investment and a dedicated account team to meet their unique requirements.

FAMILY OFFICE ACCOUNTS

For families and high-net-worth individuals interested in collective DeFi investments, Crypto Defi Management offers family office account types. The Multi-Account Structure allows the creation of multiple accounts under a single umbrella account, facilitating tax planning and asset protection. The Trust Account option enables families and high-net-worth individuals to establish a trust for the management of DeFi assets, serving purposes like estate planning and asset protection.

FUND ACCOUNTS

Designed for investment funds seeking DeFi asset investments, Crypto Defi Management offers various fund account types. The Hedge Fund Account is tailored for hedge funds managing DeFi assets on behalf of their clients. It requires a high minimum investment and comes with the support of a dedicated account team. The Venture Capital Account caters to venture capital firms interested in DeFi asset investments. It has a high minimum investment requirement and provides the backing of a dedicated account team to address their specific needs.

| Pros | Cons |

| Tailored account types for investors | High minimum investment for some accounts |

| Options for family and high-net-worth individuals | Complex account structure for funds |

| Dedicated account managers for specific accounts | Limited accessibility for small investors |

Leverage

Crypto defi Management offers leverage of up to 30x on certain trading pairs. This means that you can borrow up to 30x your initial deposit to trade an asset. For example, if you have a deposit of $1,000, you can borrow up to $29,000 to trade an asset.

Spreads & Commissions

Crypto defi Management has spreads of 0.1% - 0.5% and commissions of 0.1% - 0.25%.

Minimum Deposit

Crypto defi Management has a minimum deposit of $10.

Deposit & Withdrawal

Crypto defi Management has deposit and withdrawal fees of 0.05% - 0.1%. These fees may vary depending on the cryptocurrency and the network. For example, if you deposit $1,000 worth of Bitcoin, you will pay a fee of $0.5 - $1. If you withdraw $1,000 worth of Bitcoin, you will also pay a fee of $0.5 - $1.

| Pros | Cons |

| Low deposit and withdrawal fees (0.05% - 0.1%) | Fees may vary depending on the cryptocurrency |

| and the network | |

| Fees can add up, impacting overall returns |

Trading Platforms

Crypto DeFi Management provides various trading platforms to cater to different needs. They offer Centralized Exchanges, including Binance, Coinbase, FTX, Kraken, and Crypto.com for traditional cryptocurrency trading. Additionally, they support Decentralized Exchanges like Uniswap, SushiSwap, PancakeSwap, as well as DeFi protocols such as Aave, Compound, Yearn.finance, and Synthetix for those who prefer decentralized trading and lending. Hybrid Exchanges like Maiar DeFi and ZenGo Wallet offer a mix of centralized and decentralized features. They also provide Portfolio Management tools such as Koinly and Zengo Wallet for users to track and manage their cryptocurrency investment. Lastly, Crypto DeFi Management includes a wide range of trading options, including Uniswap, SushiSwap, PancakeSwap, Binance, Coinbase, FTX, Kraken, and Crypto.com, providing a comprehensive trading experience for their users.

| Pros | Cons |

| Diverse range of trading platforms | Complexity in choosing the right platform |

| Options for both centralized and decentralized trading | May overwhelm inexperienced users |

| Portfolio management tools available | Potential for user interface issues |

Customer Support

Crypto DeFi Management offers customer support through their email address at info@cryptodefimgt.com and can be reached via phone at +44 7503 762571.

Conclusion

In conclusion, Crypto DeFi Management presents a range of services with both advantages and disadvantages. On the positive side, it offers various market instruments like lending, spot trading, futures trading, and options trading. It provides multiple account types catering to different investor profiles, including individuals, family offices, and investment funds. Leverage up to 30x is available for certain trading pairs, and there is a relatively low minimum deposit requirement. However, there are drawbacks to consider, such as the lack of regulatory oversight, potentially high spreads and commissions, as well as deposit and withdrawal fees. The availability of a diverse selection of trading platforms and customer support channels adds to the overall picture.

FAQs

Q: Is Crypto DeFi Management a regulated service?

A: No, Crypto DeFi Management remains unregulated, which means it lacks valid oversight. Users should exercise caution due to associated risks.

Q: What market instruments are available with Crypto DeFi Management?

A: Crypto DeFi Management offers lending and borrowing, spot trading, futures trading, and options trading on a variety of cryptocurrencies.

Q: What types of accounts does Crypto DeFi Management offer?

A: Crypto DeFi Management provides individual accounts, family office accounts, and fund accounts, each tailored to meet the specific needs of different types of investors.

Q: What is the leverage offered by Crypto DeFi Management?

A: Crypto DeFi Management offers leverage of up to 30x on certain trading pairs, allowing users to borrow up to 30 times their initial deposit for trading.

Q: How can I contact customer support at Crypto DeFi Management?

A: You can reach Crypto DeFi Management's customer support via email at info@cryptodefimgt.com and by phone at +44 7503 762571.

Broker ng WikiFX

Exchange Rate