SHANDONG GOLD

abstrak:SHANDONG GOLD, established in 2015 in China, is a CFFEX-regulated company offering trading in commodities and financial futures. The platforms used are Shanjin Futures CTP Express, Shanjin Futures App and so on, and it offers a demo account. It supports bank-futures transfer.

| SHANDONG GOLD Review Summary | |

| Founded | 2015 |

| Registered Country/Region | China |

| Regulation | Regulated by CFFEX |

| Market Instruments | Commodity futures and financial futures |

| Demo Account | ✅ |

| Trading Platform | Shanjin Futures CTP Express V3, Shanjin Futures Infinitely Easy, Shanjin Futures App, Mandarin goes with him, Straight Flush Futures APP and so on |

| Min Deposit | 500 yuan |

| Customer Support | Hotline: 4006188700 |

SHANDONG GOLD, established in 2015 in China, is a CFFEX-regulated company offering trading in commodities and financial futures. The platforms used are Shanjin Futures CTP Express, Shanjin Futures App and so on, and it offers a demo account. It supports bank-futures transfer.

Pros and Cons

| Pros | Cons |

| Regulated by CFFEX | Limited payment options |

| Demo software available | Limited contact channels |

| Multiple trading software | |

| Low minimum deposit |

Is SHANDONG GOLD Legit?

Yes, SHANDONG GOLD is regulated by the China Financial Futures Exchange (CFFEX). It holds Futures License with No. 0310.

| China Financial Futures Exchange (CFFEX) |

| Regulatory Status | Regulated |

| Regulated by | China |

| Licensed Institution | 山金期货有限公司 |

| Licensed Type | Futures License |

| Licensed Number | 0310 |

What Can I Trade on SHANDONG GOLD?

SHANDONG GOLD offers commodity futures and financial futures trading such as crude oil.

Account Type

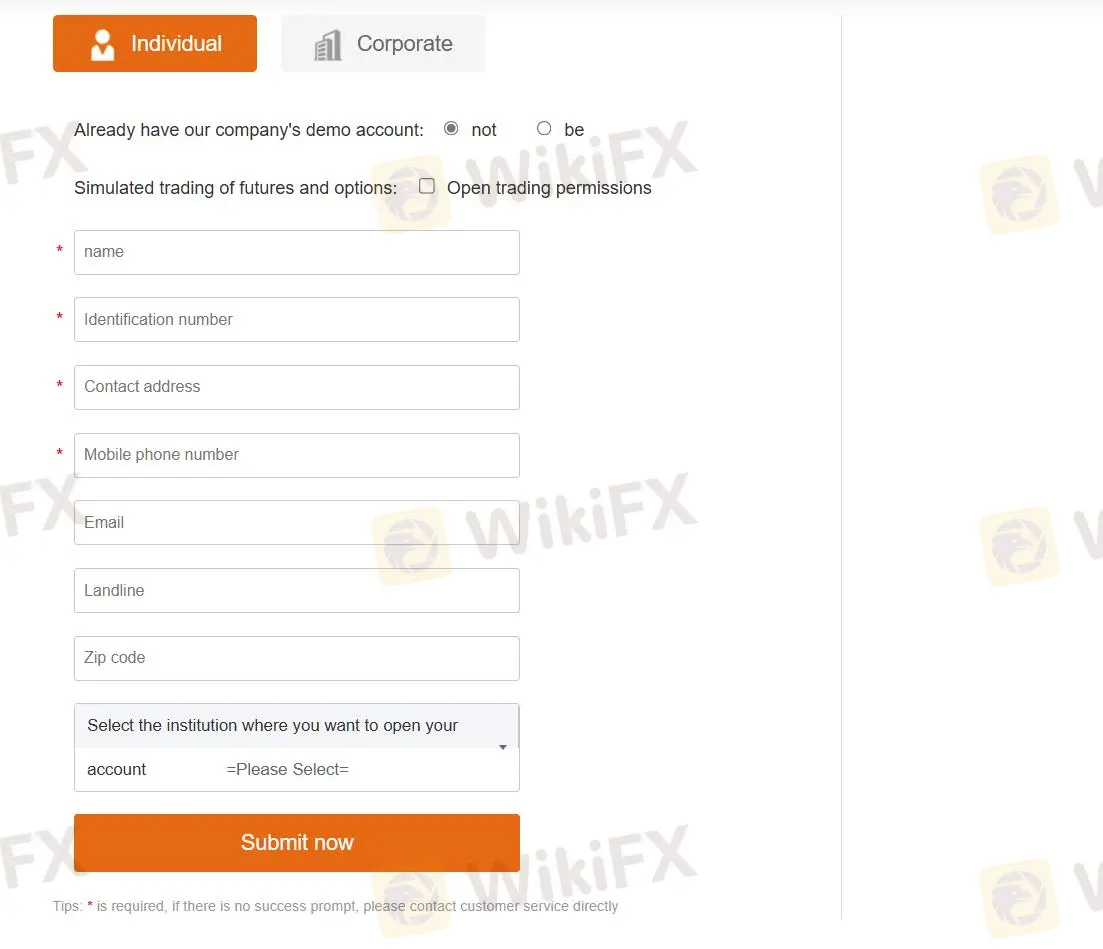

SHANDONG GOLD offers future and option accounts, commodity accounts and online accounts.

There are many ways to open an account of SHANDONG GOLD including online and on-site.You should provide personal information for verification.

Trading Platform

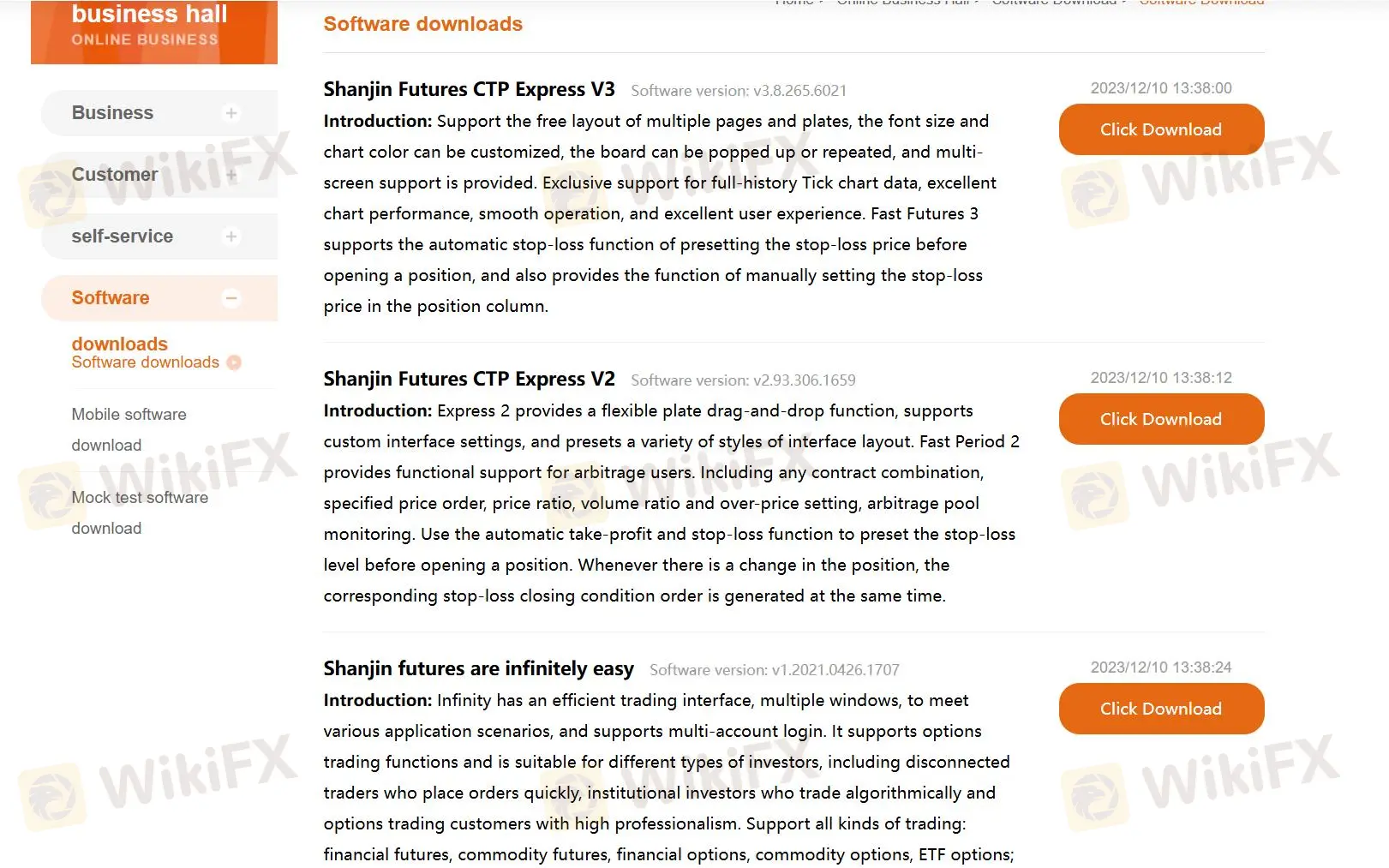

SHANDONG GOLD offers three kinds of trading platforms including software, mobile and mock test trading platforms.

Software:

-Shanjin Futures CTP Express V3 (v3.8.265.6021): This version supports customizable layouts, font sizes, and chart colors, and allows for multi-screen usage. It features an exclusive full-history Tick chart data support, automatic stop-loss functions before opening positions, and manual stop-loss settings in the position column.

- Shanjin Futures CTP Express V2 (v2.93.306.1659): Offers flexible plate drag-and-drop functionality and customizable interface settings. It is tailored for arbitrage users with features like contract combinations and arbitrage pool monitoring. This version also includes automatic take-profit and stop-loss functions.

- Shanjin Futures Infinitely Easy (v1.2021.0426.1707): Designed with an efficient trading interface, it supports multiple windows and multi-account login. Suitable for various types of investors, it supports options trading and a variety of trades.

Mobile Software:

Shanjin Futures App, Mandarin goes with him, Straight Flush Futures APP and so on.

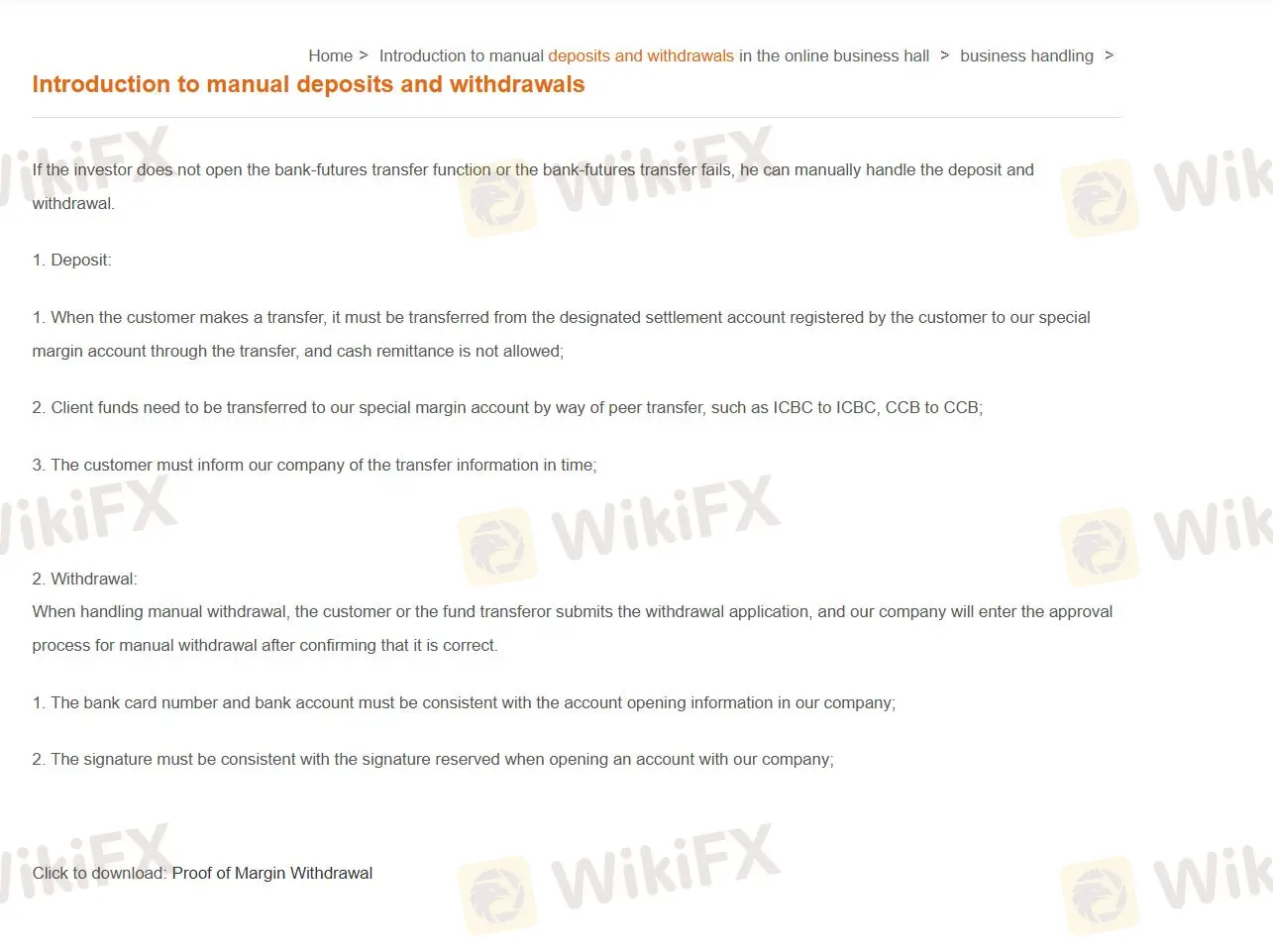

Deposit and Withdrawal

SHANDONG GOLD accepts bank-futures transfer.

Deposit:

- Transfer from designated settlement account to their margin account.

- Use peer-to-peer transfer (e.g., ICBC to ICBC).

- Notify them promptly of transfer details.

Withdrawal:

- Submit withdrawal application.

- Verify bank card and account details against account opening information.

- Ensure signatures match those on file.

Broker ng WikiFX

Exchange Rate