KTrade

abstrak:KTrade Securities Limited (formerly known as Khadim Ali Shah Bukhari Securities Limited), a cutting-edge stock and commodity brokerage firm operating in Pakistan. KTrade offers a diverse range of market instruments including equities, forex, commodities, oil, and gold. It ensures accessibility with a minimum deposit requirement of Rs. 5,000. However, it is not regulated.

| KTrade Review Summary | |

| Registered Country/Region | Pakistan |

| Regulation | Unregulated |

| Market Instruments | Equities, forex, commodities, oil & gold |

| Demo Account | Unavailable |

| Leverage | N/A |

| EUR/ USD Spread | N/A |

| Trading Platforms | App, Web terminal, Desktop terminal platforms |

| Minimum Deposit | Rs.5,000 |

| Customer Support | Telephone, fax, email, online messaging, Twitter, Facebook, Instagram, YouTube, WhatsApp and Linkedin |

What is KTrade?

KTrade Securities Limited (formerly known as Khadim Ali Shah Bukhari Securities Limited), a cutting-edge stock and commodity brokerage firm operating in Pakistan. KTrade offers a diverse range of market instruments including equities, forex, commodities, oil, and gold. It ensures accessibility with a minimum deposit requirement of Rs. 5,000. However, it is not regulated.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

- Diverse Range of Instruments: KTrade offers a diverse range of market instruments including equities, forex, commodities, oil, and gold, providing clients with ample opportunities to diversify their portfolios and explore different investment options.

- Versatile Trading Platforms: With user-friendly platforms like the App, Web terminal, and Desktop terminal, KTrade ensures accessibility and convenience for traders, allowing them to monitor their investments and execute trades from anywhere, anytime.

- Low Minimum Deposit: KTrade sets a relatively low minimum deposit requirement of Rs. 5,000, making it accessible to a broader range of investors, including those who may be starting with smaller capital.

- Robust Customer Support: KTrade offers extensive customer support through various channels including telephone, email, online messaging, and social media platforms, ensuring that clients can receive assistance promptly and effectively.

Cons:

- Unregulated Environment: One potential drawback of KTrade is that it operates in an unregulated environment. This lack of regulation may raise concerns about investor protection and transparency, as there may be fewer safeguards in place compared to regulated brokers.

- No Demo Account: Unlike some other brokers, KTrade does not offer a demo account option. A demo account can be valuable for new traders to practice trading strategies and familiarize themselves with the platform before risking real capital.

Is KTrade Safe or Scam?

Investing with KTrade poses inherent risks due to its lack of valid regulation. Without government or financial authority oversight, there are no established safeguards to ensure the integrity and transparency of its operations. This absence of regulation leaves investors vulnerable to potential malpractices or fraudulent activities by the individuals running the platform. Since there are no regulatory obligations in place, the operators of KTrade could potentially misappropriate investors' funds without being held accountable for their actions.

Market Instruments

KTrade provides a diverse range of trading instruments across various asset classes, catering to the preferences and strategies of different traders.

- Equities: KTrade allows traders to buy and sell shares or stocks of publicly listed companies. Traders can access a wide range of equities from various stock exchanges around the world, enabling them to diversify their portfolios and capitalize on opportunities in different industries and regions.

- Forex (Foreign Exchange): KTrade enables traders to participate in the foreign exchange market, where they can trade currency pairs such as EUR/USD, GBP/JPY, or USD/JPY. Forex trading offers opportunities to profit from fluctuations in exchange rates between different currencies, with the ability to go long (buy) or short (sell) on currency pairs.

- Commodities: KTrade provides access to commodity trading, allowing traders to buy and sell a variety of physical goods such as oil, gold, silver, agricultural products, and more. Commodity trading enables traders to speculate on the price movements of these assets, with the potential to profit from changes in supply and demand dynamics, geopolitical factors, and economic trends.

- Oil: KTrade specifically offers trading opportunities in oil, which is one of the most actively traded commodities in the world. Traders can engage in oil trading to take advantage of price movements in crude oil markets, influenced by factors such as global supply levels, geopolitical tensions, and economic indicators.

- Gold: KTrade facilitates trading in gold, a popular precious metal that is widely traded for investment and speculative purposes. Traders can trade gold prices, seeking to capitalize on market trends and factors affecting the demand and supply of gold, including inflation, currency movements, and global economic uncertainty.

Account Types

KTrade offers two types of accounts tailored to different trading objectives:

Oil and Gold Investment Account: This type of account is designed specifically for investors interested in trading oil and gold. Here are some key features of this account: The account is primarily focused on trading commodities, specifically oil and gold. Traders can buy and sell these commodities, aiming to profit from price movements in the markets.

Start Trading with KTrade Account: This account option is more general and versatile, catering to a broader range of trading preferences and strategies. Here are some characteristics of this account: The account offers access to a wide range of trading instruments, including equities, forex, commodities, and potentially other asset classes. Traders using this account have the flexibility to trade various instruments based on their preferences, market conditions, and trading strategies.

The minimum amount required to set up an account is Rs. 5,000.

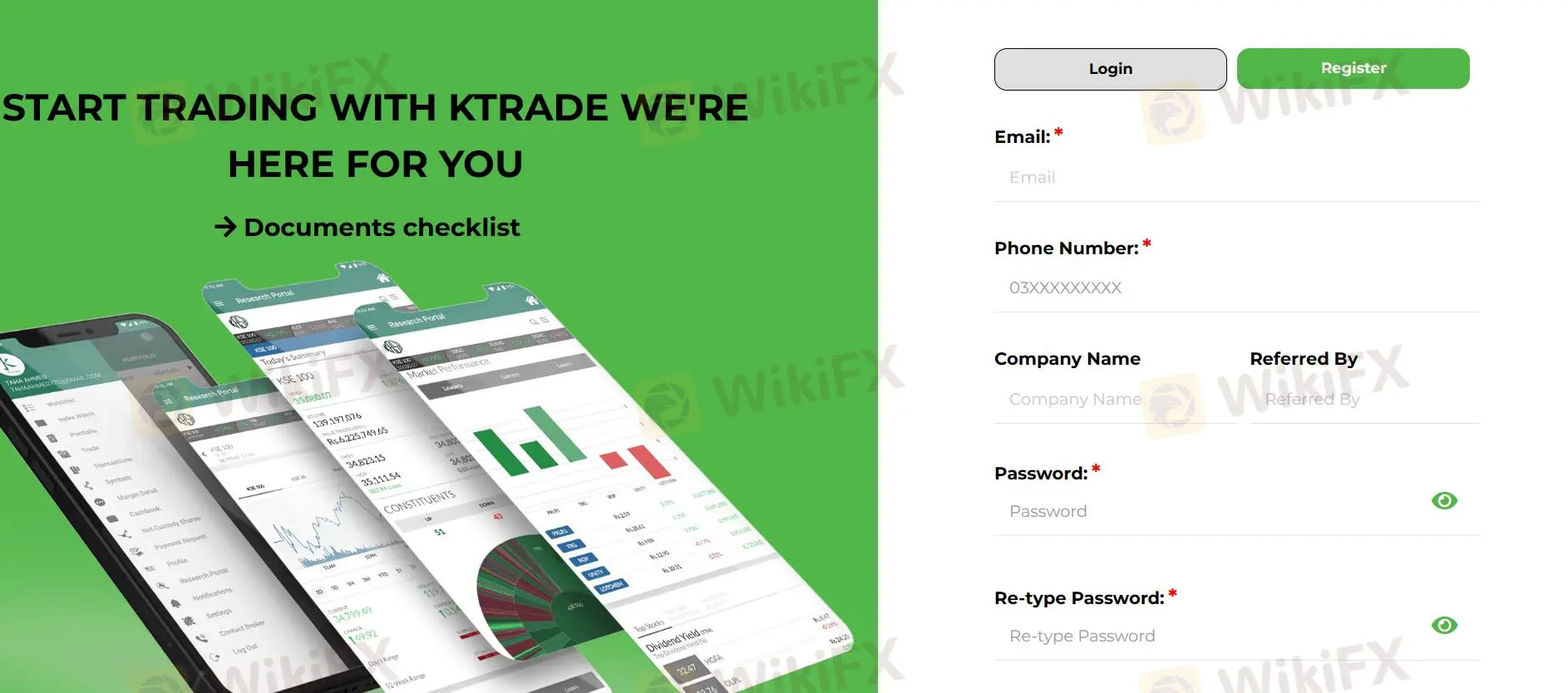

How to Open an Account?

To open an account with KTrade, please follow these steps:

| Step 1 | Go to KTrade website | Navigate to the official KTrade website. |

| Step 2 | Click on “Open an Account” | Look for the option to open a new account and click on it. |

| Step 3 | Fill out the Registration Form | Enter required information such as email, phone number, and company name (if referred by a company). |

| Step 4 | Choose a Password | Create a secure password for your account. |

| Step 5 | Re-type Password | Confirm your chosen password by entering it again. |

| Step 6 | Agree to Terms and Conditions | Read and agree to KTrade's terms and conditions. |

| Step 7 | Submit Registration | Click on the “Submit” or “Register” button to complete the registration process. |

| Step 8 | Verify Email | Check your email inbox for a verification link sent by KTrade. Click on the link to verify your email address. |

| Step 9 | Account Activation | Once your email is verified, your account will be activated, and you can log in to start trading. |

Trading Platforms

KTrade offers its clients a range of versatile trading platforms tailored to meet the needs of traders at different levels of expertise and preferences.

The KTrade App

The KTrade App provides traders with the convenience of monitoring their portfolios on the go, directly from their mobile devices. With intuitive design and user-friendly interfaces, the app allows traders to stay updated with real-time market data, track their investments, execute trades swiftly, and manage their accounts seamlessly from anywhere, anytime.

Web Terminal

In addition to the mobile app, KTrade also offers a Web Terminal, providing traders with a web-based platform accessible through standard web browsers. The Web Terminal offers a comprehensive set of features, including advanced charting tools, customizable watchlists, real-time market news, and in-depth analytical capabilities. Traders can execute trades directly from their web browsers, without the need for any software installation, making it a convenient option for those who prefer to trade from their desktop or laptop computers.

Desktop Terminal platform

For traders seeking a more advanced and customizable trading experience, KTrade provides a Desktop Terminal platform. Designed for active traders and professionals, the Desktop Terminal offers a wide range of sophisticated tools and features, including advanced charting packages, customizable trading layouts, comprehensive research tools, and direct market access. With lightning-fast execution speeds and advanced order types, the Desktop Terminal empowers traders to execute complex trading strategies efficiently and effectively.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: 021-111-115-272 and (+92)-21-35873221-2

Fax: (+92)-21-35873223

Email: info@kasb.com

Address: Office # Room 201 & 202, 2nd Floor Plot # 33-C, Khayaban-e-Bukhari, DHA, Phase 6, Karachi

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube, WhatsApp and Linkedin.

Whats more, KTrade provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information.

KTrade offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

In conclusion, KTrade presents itself as a dynamic stock and commodity brokerage firm. With its diverse range of market instruments including equities, forex, commodities, oil, and gold, KTrade offers clients ample opportunities to diversify their investment portfolios. The availability of versatile trading platforms such as the App, Web terminal, and Desktop terminal ensures accessibility and convenience for traders of all levels. However, KTrade operates in an unregulated environment, which may raise concerns about investor protection and transparency.

Frequently Asked Questions (FAQs)

| Q 1: | Is KTrade regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does KTrade offer demo accounts? |

| A 2: | No. |

| Q 3: | What is the minimum deposit for KTrade? |

| A 3: | The minimum initial deposit to open an account is Rs. 5,000. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Broker ng WikiFX

Exchange Rate