Questrade-Some important Details about This Broker

Extrait: Questrade, founded in 1999, is a well-known Canadian internet broker regulated by the CIRO. It provides a diverse selection of investment products, including stocks, ETFs, options, FX, CFDs, and more, as well as numerous account kinds customized to specific financial objectives.

| Questrade Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Canada |

| Regulation | CIRO |

| Market Instruments | Stocks, ETFs, options, GICs, mutual funds, bonds, forex, CFDs, IPOs, international equities, precious metals |

| Demo Account | ✅ |

| Trading Platform | Questrade Trading (web), QuestMobile (iOS, Android), Questrade Edge (web/desktop/mobile), Questrade Global (forex & CFDs) |

| Minimum Deposit | $10 |

| Customer Support | Live chat |

Questrade Information

Questrade, founded in 1999, is a well-known Canadian internet broker regulated by the CIRO. It provides a diverse selection of investment products, including stocks, ETFs, options, FX, CFDs, and more, as well as numerous account kinds customized to specific financial objectives.

Pros and Cons

| Pros | Cons |

| $0 commission on stocks and ETFs | No MetaTrader (MT4/MT5) support |

| Wide range of account types (retirement, TFSA, RESP, forex/CFD, corporate) | Some products (e.g., international equities) have high minimum fees |

| Advanced and user-friendly proprietary platforms | No Islamic (swap-free) accounts offered |

Is Questrade Legit?

Yes, Questrade is legitimate. It is regulated by the Canadian Investment Regulatory Organization (CIRO) under a Market Maker (MM) license.

What Can I Trade on Questrade?

Questrade provides a wide range of investing products, including stocks, ETFs, options, GICs, mutual funds, bonds, FX, CFDs, IPOs, overseas equities, and precious metals.

| Tradable Instruments | Supported |

| Stocks | ✓ |

| ETFs | ✓ |

| Options | ✓ |

| GICs | ✓ |

| Mutual Funds | ✓ |

| Bonds | ✓ |

| Forex | ✓ |

| CFDs | ✓ |

| IPOs | ✓ |

| Equities | ✓ |

| Precious Metals | ✓ |

| Indices | ✗ |

| Cryptocurrencies | ✗ |

Account Type

Questrade provides a comprehensive range of live accounts designed to meet specific life and financial goals, such as tax-free, retirement, education, home savings, trust, corporate, margin, and forex/CFD accounts. It also offers demo accounts for practicing. However, there is no mention of Islamic (swap-free) accounts in their official publications.

| Account Type | Suitable for |

| TFSA (Tax-Free Savings Account) | Individuals wanting tax-free growth & withdrawals |

| RRSP (Registered Retirement Plan) | Retirement savers looking for tax benefits |

| RESP (Registered Education Savings) | Parents saving for childrens education |

| FHSA (First Home Savings Account) | First-time homebuyers saving for down payment |

| Spousal RRSP, Locked-In RRSP, LIRA, etc. | Couples and retirees managing long-term funds |

| Trust Accounts (Formal/Informal) | Families or entities managing funds under trust |

| Individual & Corporate Forex/CFDs | Active forex and CFD traders, individuals or businesses |

| Margin & Cash Accounts (Individual, Joint, Corporate) | Traders and investors using leverage or cash trading |

Questrade Fees

Questrade's overall fees are lower than many industry competitors, particularly for stock and ETF trading, which includes no commissions. Certain products, such as options, mutual funds, bonds, international equities, and precious metals, have specified fees or minimums.

| Trading Product | Fee |

| Stocks | $0 |

| ETFs | |

| Options | $0 + ¢99 per contract |

| Forex (FX) | Spread from 0.08 pips |

| CFDs | |

| Mutual Funds | $9.95 per trade; deferred sales charge if withdrawn early |

| Bonds | Minimum $5,000 purchase |

| GICs | Minimum $5,000 purchase; fees if withdrawn early |

| International Equities | Minimum $195 + exchange/stamp fees; ~1% of trade value |

| IPOs / New Issues | Minimum $5,000 purchase; free to buy |

| Precious Metals | $19.95 USD per trade |

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | 0 |

| Inactivity Fee | 0 |

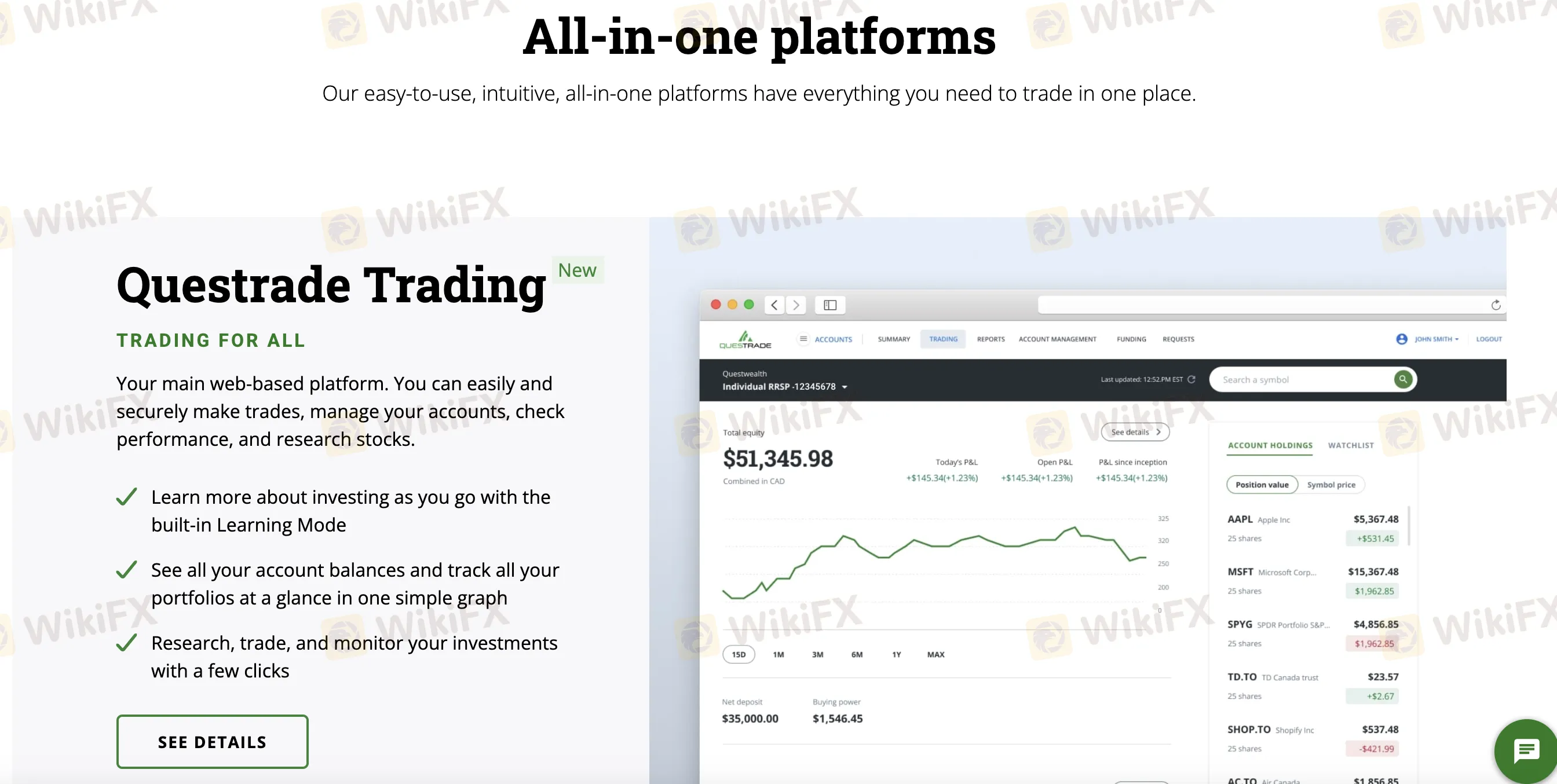

Trading Platform

| Trading Platform | Supported | Available Devices |

| Questrade Trading | ✔ | Web |

| QuestMobile | ✔ | iOS, Android |

| Questrade Edge | ✔ | iOS, Android, Windows, macOS, Web |

| Questrade Global | ✔ | Web |

| MetaTrader (MT4/MT5) | ❌ | — |

Deposit and Withdrawal

Questrade does not impose any deposit or withdrawal fees. When making an Instant amount via Visa Debit or Interac, the minimum amount is $10 (CAD).

Deposit Options

| Deposit Method | Minimum Deposit | Deposit Fees | Deposit Time |

| Visa Debit (Instant) | $10 CAD | 0 | Instant (up to daily limit, e.g., $10,000) |

| Interac e-Transfer | Instant (within banks transfer time) | ||

| Bank Transfer (Bill Pay) | $50 CAD | 1–2 business days | |

| EFT (Electronic Funds Transfer) |

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| EFT | 0 | Up to 5 business days |

| Wire Transfer | Varies by bank | |

| Request Withdrawal (online) | Depends on withdrawal method |

Courtiers WikiFX

FXTM

Exness

DBG Markets

XM

Doo Prime

EBC

FXTM

Exness

DBG Markets

XM

Doo Prime

EBC

Courtiers WikiFX

FXTM

Exness

DBG Markets

XM

Doo Prime

EBC

FXTM

Exness

DBG Markets

XM

Doo Prime

EBC

Calcul du taux de change