DBS

Extrait:DBS, formerly known as Development Bank of Singapore, is the largest commercial bank in Singapore, established in 1968, providing a full range of financial services, including banking, SME banking, and large corporate banking in Asia. DBS entered China in 1993 with an office in Beijing. In 1995, DBS opened its first branch in China and was one of the first 10 foreign banks to receive an RMB license in 1998. DBS Bank (DBS) currently has over 280 branches in Hong Kong, China, Mainland China, India, Malaysia, and Taiwan, China. DBS (Hong Kong) Inc. has over 30 branches. DBS Bank (DBS) is fully licensed by the FCA in the UK (Licence No. 204650), and its branch in Malaysia is fully licensed by the Labuan Financial Services Authority (LFSA) in Malaysia. , formerly known as Development Bank of Singapore, is the largest commercial bank in Singapore, established in 1968, providing a full range of financial services, including banking, SME banking, and large corporate banking in Asia. DBS enter

| Aspect | Information |

| Broker Name | DBS |

| Regulatory Status | Regulated by the Labuan Financial Services Authority (LFSA) |

| UK FCA License | License number 204650 for Non-Forex activities |

| DBS Financial Services | - Offers a wide array of financial solutions |

| Services for Individual Clients | - Wealth Management |

| - Treasures Banking Privileges | |

| - DBS Lifestyle Privileges | |

| - Wealth Management Services | |

| - Wealth Preservation | |

| - Banking Services | |

| Services for Corporate Clients | - SME Banking (DBS IDEAL) |

| - Corporate Banking | |

| Sustainability Initiatives | - Commitment to achieving net-zero greenhouse gas emissions |

| - Investment in clean energy and supporting sustainability | |

| Customer Support | - Phone Support (Call BusinessCare) |

| - Online Enquiry (Enquiry Form) | |

| - Complaint Handling for Institutional Clients | |

| - BusinessCare Hotline | |

| - Email Support | |

| - Mailing Address |

Overview

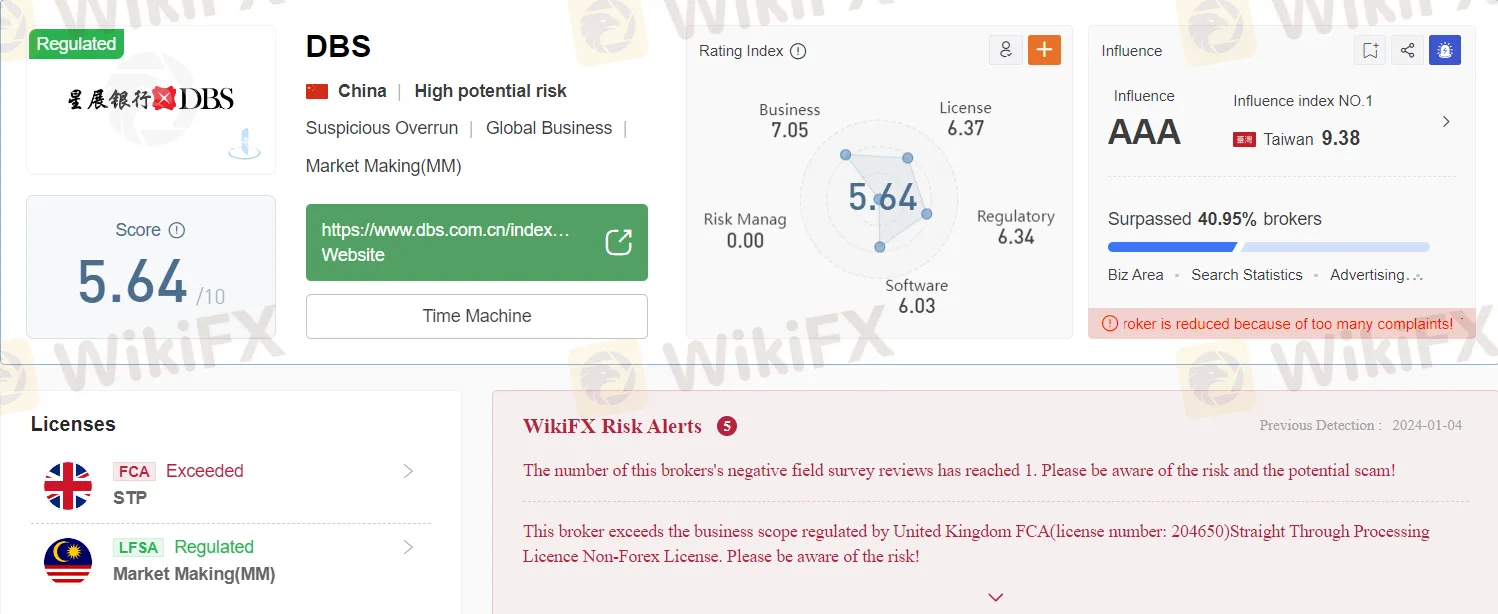

DBS is a regulated brokerage firm under the Labuan Financial Services Authority (LFSA) and holds a UK FCA license for Non-Forex activities. They offer a range of financial solutions for both individual and corporate clients, along with a commitment to sustainability initiatives. However, caution is advised due to increased negative reviews, and thorough due diligence and credibility assessment are strongly recommended before engaging their services, particularly if the UK's FCA oversight is a priority for investors.

Regulation

This broker operates beyond the business scope regulated by the United Kingdom's Financial Conduct Authority (FCA), with license number 204650, which specifically pertains to Straight Through Processing License Non-Forex activities. As a result, it is crucial for potential investors and clients to exercise caution and be aware of the associated risks when dealing with this broker. However, it's worth noting that this broker is regulated by the Labuan Financial Services Authority (LFSA), which implies that it may still adhere to the regulatory framework and oversight of another jurisdiction, albeit different from the UK FCA. Nonetheless, individuals should conduct thorough due diligence and assess the implications of the LFSA's regulatory jurisdiction when considering any financial transactions with this broker.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

DBS operates under the regulation of the Labuan Financial Services Authority (LFSA). On the other hand, there are concerns about the broker operating beyond the scope regulated by the UK's FCA, as well as increased negative field survey reviews, raising potential risks and reliability questions.

DBS offer a comprehensive range of financial solutions for both individual and corporate clients. The pros include their wealth management, banking, and sustainability services, along with robust customer support. However, there is limited information available on specific services and products, and details about fees and pricing are not provided.

Services

DBS (formerly known as The Development Bank of Singapore) offers a wide range of financial services, catering to both individual clients and corporate clients. Below is a detailed description of the services provided by DBS:

For Individual Clients:

Wealth Management: DBS offers wealth management services through its DBS Treasures program. This service is designed for individuals with a minimum deposit or investment threshold. It provides customers with access to qualified treasures who can assist in managing and growing their wealth. Additionally, DBS Treasures Privileges offer a range of customized services and exclusive benefits.

Treasures Banking Privileges: This service is tailored to provide wealth management expertise and exclusive banking privileges across Asia. It includes various investment and financial products to help individuals achieve their financial goals.

DBS Lifestyle Privileges: DBS values its customers and offers them curated indulgences and exclusive privileges, which can include discounts, special offers, and unique experiences.

Wealth Management Services: DBS offers opportunities to expand investment portfolios by leveraging assets linked to equities, commodities, currencies, and credits, with access to global markets. This service is designed to help customers accumulate wealth.

Wealth Preservation: DBS provides asset allocation plans tailored for individuals, including retirement plans, education foundations, and wealth transfer strategies. This helps clients protect and preserve their accumulated wealth.

Banking Services: DBS offers various banking services, including the DBS digibank app, which allows clients to manage their accounts conveniently on mobile devices. Clients can also access information on major markets, currency exchange rates, structured investment products, and more.

For Corporate and SME Banking:

SME Banking (DBS IDEAL): DBS IDEAL is a comprehensive platform designed to help small and medium-sized enterprises (SMEs) manage their working capital and transactions efficiently. It can be accessed through desktop, tablet, and mobile devices and offers features such as seamless security, easy maintenance, comprehensive services, and true mobility. SMEs can monitor funds, make payments, manage trade finance, and conduct mobile banking with ease.

Corporate Banking: DBS addresses climate change by advocating for collective efforts and sustainable business practices. They have committed to achieving net-zero greenhouse gas emissions by 2050 and have set decarbonization targets for various sectors, including Power, Oil & Gas, Automotive, Aviation, Shipping, Steel, and Real Estate. DBS is actively investing in clean energy and supporting Asia's transition to a low-carbon economy.

DBS's services are designed to meet the financial needs of both individual and corporate clients, offering a wide range of solutions for wealth management, banking, and sustainability in today's evolving financial landscape.

Interest Rates and Fees

The interest rate offered by DBS DBS Bank (Hong Kong) Limited in Hong Kong dollars is 5.25% per annum. Brokerage commission for securities trading in Hong Kong is 0.2% of the amount (minimum HK$100/RMB100), brokerage commission for transactions via automated telephone banking service, telephone banking service hotline, or express securities trading line is 0.35% of the transaction amount (minimum charge of HK$100/RMB100). SFC transaction levy is 0.0027% of the transaction amount, and stamp duty is 0.1% of the transaction amount. For more information on fees and charges, please refer to the official website of DBS Bank (Hong Kong) Limited.

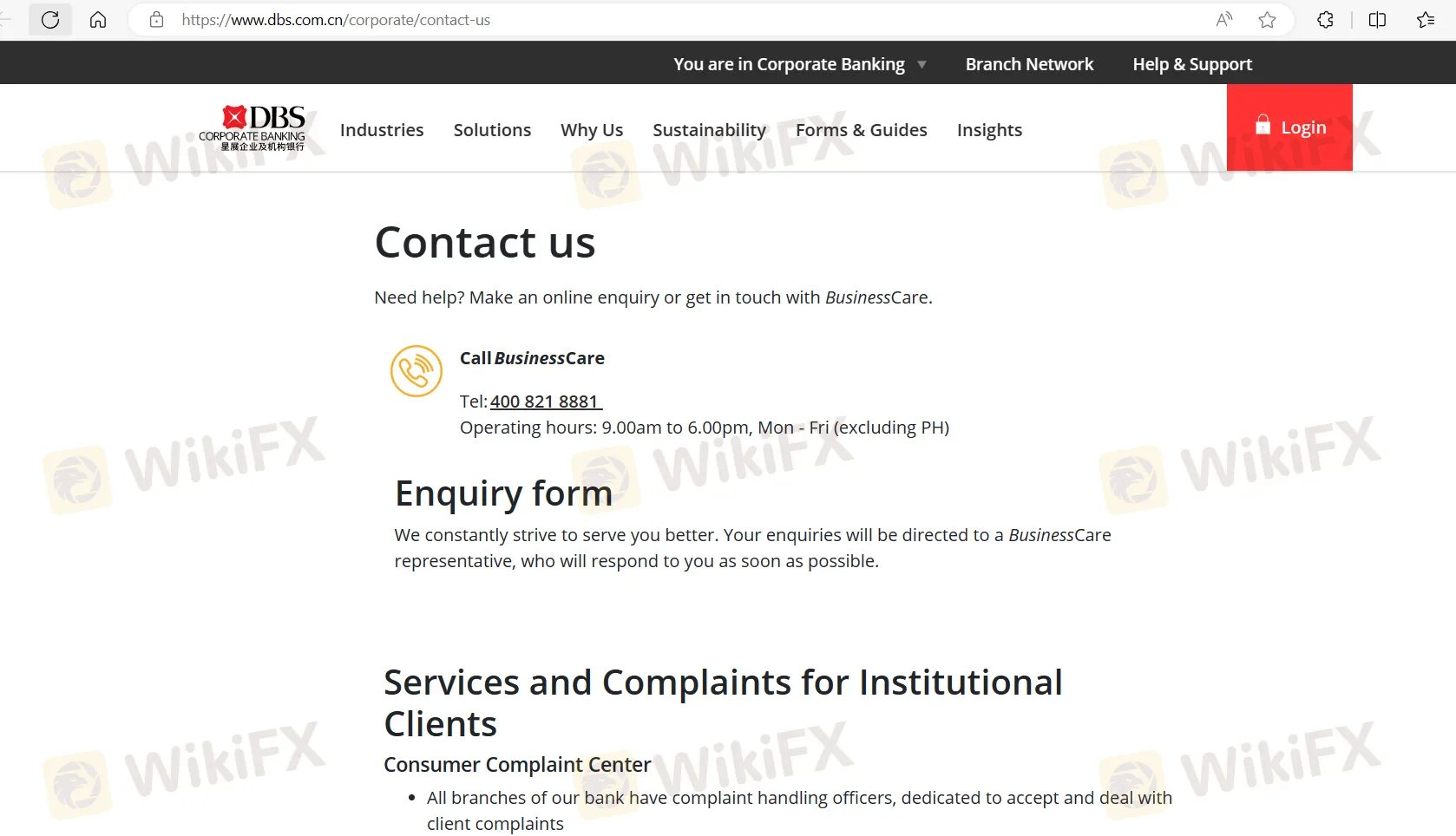

Customer Support

DBS offers comprehensive customer support through its BusinessCare service to assist customers and address their inquiries and concerns. Here is a description of their customer support services:

Phone Support (Call BusinessCare):

Telephone Number: 400 821 8881

Operating Hours: 9:00 AM to 6:00 PM, Monday to Friday (excluding Public Holidays)

Customers can reach out to DBS BusinessCare via phone during the specified operating hours. Trained representatives are available to provide assistance and address queries related to DBS's financial products and services.

Online Enquiry (Enquiry Form):

DBS encourages customers to submit their inquiries online using the provided enquiry form. These inquiries will be directed to a BusinessCare representative who will respond as promptly as possible.

Complaint Handling for Institutional Clients:

DBS takes customer complaints seriously and has a dedicated process for handling them.

Each branch of the bank has complaint handling officers responsible for accepting and addressing client complaints.

The complaint handling process includes acknowledging the receipt of the complaint within 5 working days, providing a response to the client within 15 days, and ensuring complex cases receive attention within a maximum of 60 days.

Unresolved complaints are escalated to the complaint management department at the bank's head office for further investigation and resolution.

BusinessCare Hotline:

Hotline Number: 400 821 8881

Hotline Service Hours: Monday to Friday, 9:00 AM to 6:00 PM

Customers can reach DBS BusinessCare via the hotline during the specified service hours for immediate assistance with their banking-related inquiries and issues.

Email Support:

Customers can also contact BusinessCare via email at the provided email address: businesscarecn@dbs.com. They can send their queries and receive responses through this channel.

Mailing Address:

For postal inquiries, DBS provides a mailing address for customers to send their correspondence:

DBS Businesscare

29/F, China Resources Building

5001 Shennan Dong Road

Shenzhen, PR China

DBS is committed to serving its customers efficiently and strives to provide timely and comprehensive support through multiple communication channels, ensuring that clients' needs are met and their concerns addressed effectively.

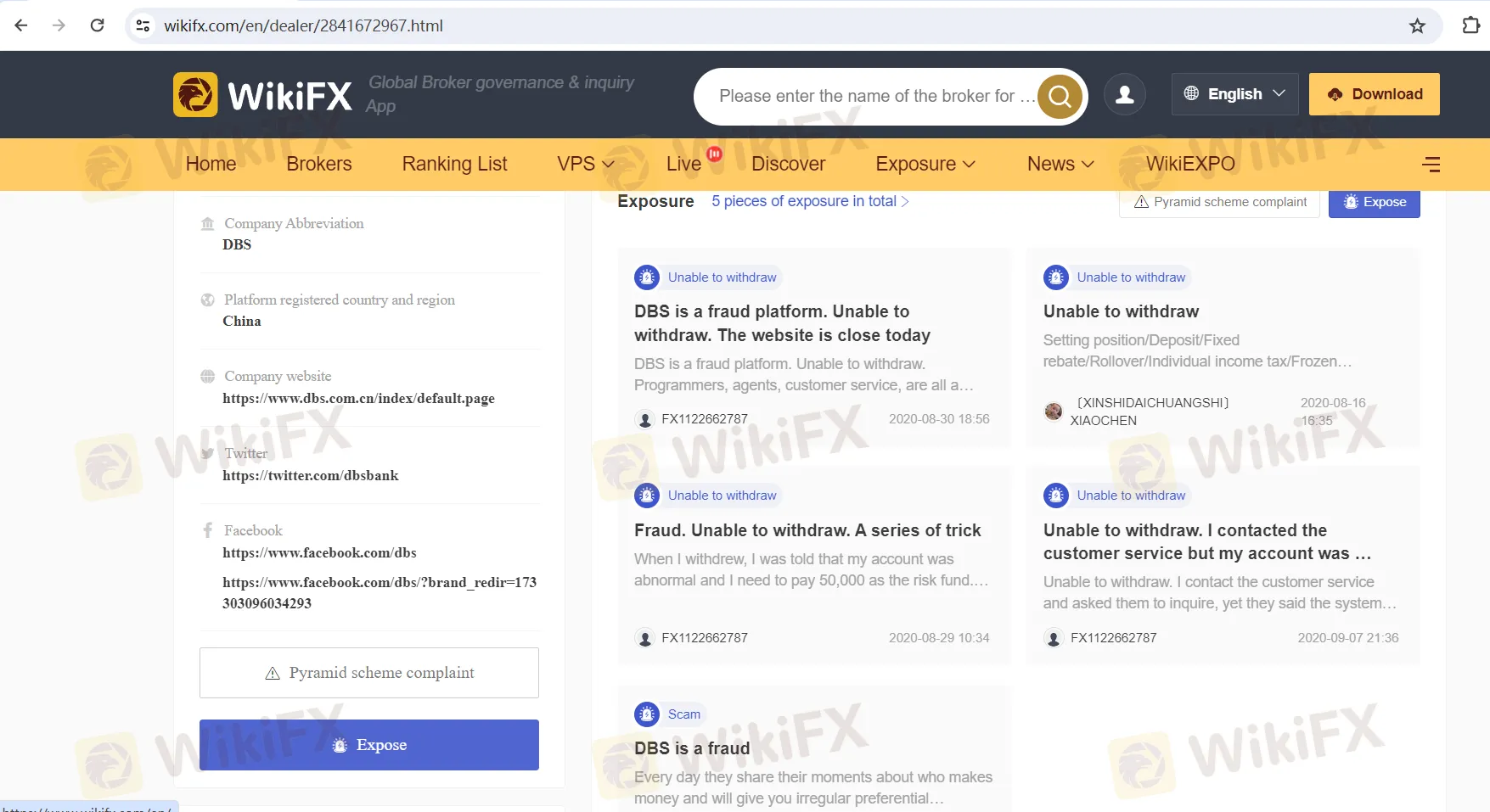

Warning

The number of negative field survey reviews concerning this broker has seen a notable increase recently, raising concerns about potential risks and the possibility of a scam. It is crucial for individuals to exercise caution and conduct thorough due diligence when considering any involvement with this broker. These negative reviews may indicate issues related to the broker's reliability, transparency, or legitimacy. To safeguard their interests and investments, individuals are strongly advised to carefully assess the broker's reputation, regulatory status, and track record before engaging in any financial transactions or investments with them. Staying informed and cautious is essential to mitigate potential risks and avoid falling victim to fraudulent activities.

Summary

In summary, this overview provides information about a broker's regulatory status, offering a cautionary note regarding increased negative reviews. Additionally, it highlights DBS's wide range of financial services for both individual and corporate clients, including wealth management, banking, and support for sustainability initiatives. The comprehensive customer support services offered by DBS are detailed, emphasizing various contact channels for inquiries and complaint resolution. The warning section advises caution when dealing with the broker due to an increase in negative field survey reviews. It urges individuals to conduct thorough due diligence and assess the broker's credibility.

FAQs

Q1: Is this broker regulated by any financial authority?

A1: Yes, this broker is regulated by the Labuan Financial Services Authority (LFSA), though it operates beyond the scope regulated by the United Kingdom's Financial Conduct Authority (FCA) license.

Q2: What services does DBS offer for individual clients?

A2: DBS offers individual clients wealth management services, banking privileges, lifestyle privileges, and assistance in wealth accumulation and preservation.

Q3: How can I contact DBS for customer support?

A3: You can contact DBS through their BusinessCare hotline at 400 821 8881, via email at businesscarecn@dbs.com, or by filling out an online enquiry form.

Q4: What is DBS's approach to sustainability and climate change?

A4: DBS is committed to sustainability and has set decarbonization targets for various sectors. They are actively investing in clean energy and supporting a transition to a low-carbon economy.

Q5: Why should I be cautious when dealing with the broker mentioned in the warning?

A5: Increased negative field survey reviews raise concerns about the broker's credibility and legitimacy. It is advisable to conduct thorough due diligence and assess their reputation before engaging in financial transactions to avoid potential risks.

Courtiers WikiFX

FXTM

FOREX.com

Exness

DBG Markets

EBC

AvaTrade

FXTM

FOREX.com

Exness

DBG Markets

EBC

AvaTrade

Courtiers WikiFX

FXTM

FOREX.com

Exness

DBG Markets

EBC

AvaTrade

FXTM

FOREX.com

Exness

DBG Markets

EBC

AvaTrade

Calcul du taux de change