Lakefox Capital

Extrait:Lakefox Capital is an unregulated forex broker based in the United Kingdom. It offers trading in forex, metals, indices, and oil. It has been in operation for 2-5 years and offers four account types: Demo Account, Standard Account, Premium Account, and VIP Account. The minimum deposit for a standard account is $200. The maximum leverage is 1:500 for forex, 1:200 for commodities, and 1:100 for indices. The spreads are typically around 1 pip for forex and 5-10 pips for commodities and indices. The trading platform is MT5 (MetaTrader 5). Lakefox Capital is an unregulated broker, which means that it is not subject to the same regulations as regulated brokers. This means that there is a higher risk associated with trading with Lakefox Capital.

| Company Name | Lakefox Capital |

| Registered in | United Kingdom |

| Regulated | Unregulated |

| Years of Establishment | 2-5 years |

| Trading Instruments | Forex, Metals, Indices, Oil |

| Account Types | Demo Account, Standard Account, Premium Account, VIP Account |

| Minimum Initial Deposit | Standard Account: $200; Premium Account: $5000; VIP Account: $10,000 |

| Maximum Leverage | Up to 1:500 (Forex), Up to 1:200 (Commodities), Up to 1:100 (Indices) |

| Minimum Spread | Forex: Typically around 1 pip; Commodities and Indices: 5-10 pips (range) |

| Trading Platform | MT5 (MetaTrader 5) |

| Deposit and Withdrawal Methods | Not specified |

| Customer Service | Email, Contact form on the website |

Overview of lakefox

Lakefox Capital is an unregulated forex broker based in the United Kingdom. It offers trading in forex, metals, indices, and oil. It has been in operation for 2-5 years and offers four account types: Demo Account, Standard Account, Premium Account, and VIP Account. The minimum deposit for a standard account is $200. The maximum leverage is 1:500 for forex, 1:200 for commodities, and 1:100 for indices. The spreads are typically around 1 pip for forex and 5-10 pips for commodities and indices. The trading platform is MT5 (MetaTrader 5).

Lakefox Capital is an unregulated broker, which means that it is not subject to the same regulations as regulated brokers. This means that there is a higher risk associated with trading with Lakefox Capital.

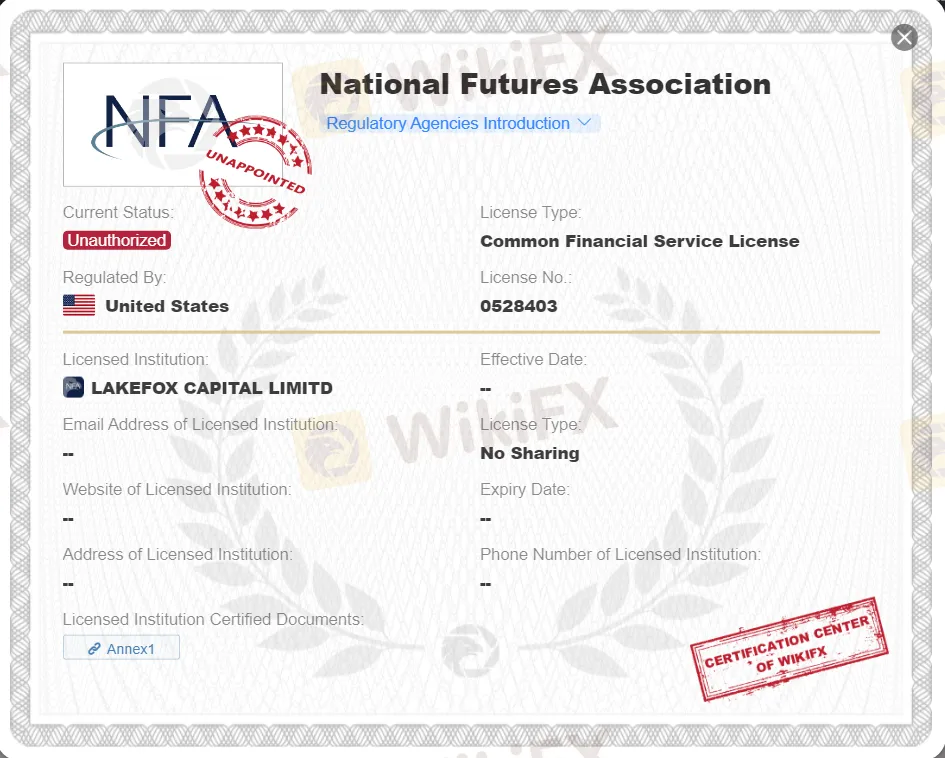

Is lakefox legit or a scam?

Lakefox Capital is an unregulated broker, lacking regulation from a recognized financial authority.

Unregulated brokers pose risks such as lack of oversight, transparency, and protection for traders. There may be fewer safeguards against fraud, financial instability, and unethical practices.

Regulation ensures fair practices, segregation of client funds, and dispute resolution mechanisms. It provides oversight, transparency, and protection for traders, reducing the risk of fraud and ensuring a more secure trading environment.

Traders should be aware of the risks associated with unregulated brokers and consider trading with regulated brokers that adhere to specific rules and standards. Research and due diligence are important to choose a reputable and regulated broker, providing greater confidence and protection in the trading process.

Pros and Cons

Lakefox offers a wide range of market instruments, providing traders with options to trade in forex, metals, indices, and oil markets. This variety allows for diversification and the opportunity to capitalize on different market trends. Additionally, Lakefox offers multiple account types, catering to the specific needs of different traders.

Furthermore, the availability of a demo account is beneficial for both novice and experienced traders. It allows users to practice trading strategies, familiarize themselves with the platform, and gain confidence without risking real money. Lastly, Lakefox supports the MT5 trading platform, a popular and robust software known for its advanced features, user-friendly interface, and compatibility across various devices.

One notable concern is Lakefox's unregulated status. The absence of regulation poses potential risks to traders, as there is no authoritative oversight or protection in place. Traders may face challenges regarding transparency, fair practices, and dispute resolution. Another aspect to consider is the commission charges applied to certain trading products. Additionally, withdrawal processing time can vary, which may lead to delays in accessing funds. This could be inconvenient for traders who require prompt access to their funds. Lastly, Lakefox's customer support options appear to be limited.

| Pros | Cons |

| Wide range of market instruments | Unregulated |

| Multiple account types | Commission charges on certain trading products |

| Access to demo account | Withdrawal processing time may vary |

| Support for MT5 trading platform | Limited customer support options |

Market Instruments

Lakefox Capital offers a range of market instruments for trading in forex, metals, index, and oil markets. For forex trading, Lakefox Capital provides access to a wide selection of currency pairs, allowing traders to exchange one foreign currency for another. These currency pairs include major pairs like EUR/USD and GBP/USD, as well as minor and exotic pairs. In the metal market, Lakefox Capital offers opportunities to trade and hold physical precious metals such as gold, silver, platinum, and palladium, either through physical delivery or derivative contracts.

For index trading, Lakefox Capital provides access to CFDs that track the performance of various stock indices from around the world, enabling traders to speculate on the price movements of these indices without owning the underlying assets. Lastly, Lakefox Capital facilitates trading in the oil market, allowing investors to participate in the price fluctuations of crude oil through various instruments like futures contracts or CFDs.

Account Types

Lakefox offers a variety of account types to suit the needs of different traders.

Demo Account: This is a free account that allows you to trade with virtual funds. It is a great way to learn about the platform and test out different trading strategies without risking any real money.

Standard Account: This is the most basic account type offered by Lakefox. It has a minimum deposit requirement of $200 and offers leverage up to 1:500.

Premium Account: This account has a minimum deposit requirement of $5000 and offers a number of benefits, including lower spreads, faster execution, and access to exclusive trading tools.

VIP Account: This account has a minimum deposit requirement of $10000 and offers the highest level of benefits, including even lower spreads, faster execution, and dedicated account management.

| Account Type | Minimum Deposit | Leverage | Commission |

| Demo Account | Free | N/A | N/A |

| Standard Account | $200 | 1:500 | $2/lot |

| Premium Account | $5,000 | 1:500 | $1/lot |

| VIP Account | $10,000 | 1:500 | $0.50/lot |

How to Open an Account?

To open an account with Lakefox Capital, you can follow these five steps:

Step 1: Visit the Website

Go to the Lakefox Capital website by typing “https://www.lakefoxcapital.com/” into your web browser's address bar and press Enter.

Step 2: Navigate to Account Opening

Once you're on the Lakefox Capital website, look for a menu or navigation bar that includes options like “Accounts,” “Register,” or “Open an Account.” Click on the relevant link to proceed.

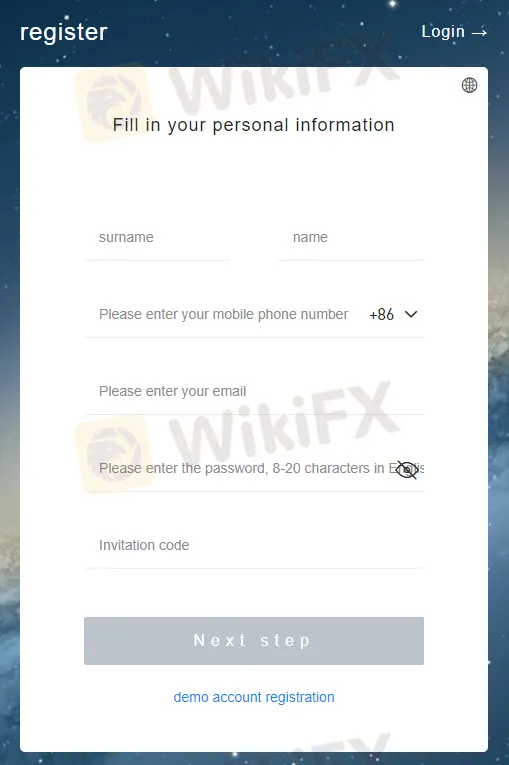

Step 3: Choose Account Type

Lakefox Capital may offer various types of accounts, such as individual accounts, joint accounts, retirement accounts, or corporate accounts. Select the type of account that suits your needs and click on it to proceed.

Step 4: Complete the Application

You'll be directed to an online application form where you'll need to provide personal information, including your name, contact details, social security number (or equivalent), employment information, and financial details. Fill out the form accurately and double-check the information for any errors.

Step 5: Submit and Verify

After completing the application form, review the information once again to ensure its accuracy. If everything is correct, submit the application. Lakefox Capital may require additional documents or verification steps to confirm your identity and financial information. Follow their instructions for any required documentation and provide the necessary verification to finalize the account opening process.

It's important to note that the above steps are a general guideline, and the actual process may vary depending on Lakefox Capital's specific requirements and procedures.

Leverage

Lakefox Capital offers leverage options to its clients, allowing them to control larger positions in the market relative to their initial deposit. The maximum leverage provided by Lakefox Capital is as follows:

Forex Pairs: Lakefox offers leverage up to 1:500 on forex pairs. This means that for every dollar of your initial deposit, you have the potential to control a position worth up to 500 dollars. Higher leverage can amplify both potential profits and losses, so it is important for traders to exercise caution and employ appropriate risk management strategies when trading with leverage.

Commodities: Lakefox Capital offers leverage up to 1:200 on commodity trading. This allows traders to control positions that are up to 200 times the value of their initial deposit. Commodities include assets such as gold, silver, oil, and other natural resources.

Indices: For trading indices, Lakefox Capital provides leverage of up to 1:100. This means that traders can control positions that are up to 100 times their initial deposit. Indices represent the performance of a specific group of stocks from a particular market, providing traders with exposure to the overall market sentiment.

Spreads & Commissions

Lakefox Capital offers spreads and charges a commission on certain trading products.

Spreads on Forex Pairs: Lakefox Capital typically offers spreads around 1 pip on forex pairs. Spreads refer to the difference between the bid (sell) and ask (buy) prices of a currency pair. A tighter spread can be advantageous for traders as it reduces the cost of entering and exiting positions. With a 1-pip spread, traders can execute trades at relatively narrow price differentials.

Spreads on Commodities and Indices: For commodity and index trading, Lakefox Capital generally offers spreads in the range of 5-10 pips. The specific spread can vary depending on market conditions, liquidity, and the specific instrument being traded. Commodities and indices often have slightly wider spreads compared to major forex pairs due to their underlying market dynamics.

Commission Charges: Lakefox Capital charges a commission of $2 per lot traded. A lot is a standardized trading unit in forex and represents a specific quantity of the base currency in a currency pair. The commission is a separate fee charged on top of the spreads.

Trading Platform

Lakefox Capital offers the MT5 (MetaTrader 5) trading platform for Windows, Android, and iPhone devices. The MT5 platform is a powerful and popular trading software known for its advanced features and user-friendly interface.

The MT5 platform offered by Lakefox Capital is designed to cater to the needs of traders of all experience levels. It provides a comprehensive set of trading tools and features, empowering traders to implement various trading strategies. The platform supports a no third-party bridge setup, ensuring direct access to the markets without any intermediaries, which can enhance trade execution speed and reliability.

Additionally, the platform unlocks all foreign exchange trading strategies, including scalping, allowing traders to pursue their preferred trading style with flexibility.

Moreover, traders using the MT5 platform with a Lakefox Capital account gain free access to expert advisors (EAs) and a virtual private server (VPS). EAs are automated trading systems that can execute trades based on predefined rules or algorithms, enabling traders to automate their strategies. The VPS service allows traders to maintain uninterrupted connectivity to the trading platform, even if their computer or device is turned off, ensuring a seamless trading experience.

Deposit & Withdrawal

Lakefox Capital accepts deposits in multiple currencies, including USD, EUR, and GBP. This allows clients to deposit funds in their preferred currency, avoiding additional conversion fees. To facilitate deposits, Lakefox supports various payment methods.

Clients can use credit cards, such as Visa or Mastercard, for instant and secure transactions. Debit cards are also accepted, providing flexibility and convenience.Additionally, bank transfers are available for clients who prefer to transfer funds directly from their bank accounts.

Withdrawal requests are processed promptly, with a typical turnaround time of within 24 hours. It's important to note that the actual processing time may vary based on factors such as the client's account verification status and the chosen withdrawal method. Lakefox allows clients to withdraw funds using the same payment methods used for deposits. This means clients can withdraw funds directly to their credit or debit cards or opt for bank transfers for larger withdrawals.

Customer Support

Lakefox Capital provides customer support services to assist clients with their inquiries, concerns, and any assistance they may need. With the provided contact information, customers can reach out to Lakefox Capital through email:lakefox@lakfox.com, QQ:1524056080, or by submitting their queries through the contact form on the website.

To ensure prompt responses, it is advisable for customers to provide their name, email address, phone number, and specific details of their query or concern when contacting customer support. This information allows the support team to understand the nature of the inquiry and provide appropriate assistance.

Educational Resources

The educational resources offered by Lakefox may include a variety of materials such as tutorials, articles, videos, webinars, and market analysis. These resources cover various topics related to trading, including fundamental and technical analysis, risk management, trading psychology, and market trends.

By providing access to educational materials, Lakefox empowers traders with the necessary tools to expand their understanding of the financial markets and potentially enhance their trading performance. Traders can take advantage of these resources to deepen their knowledge, stay updated with market developments, and refine their trading approach.

Conclusion

Lakefox Capital is an unregulated forex broker offering a variety of trading instruments, multiple account types, and access to the MT5 trading platform. While the wide range of market instruments and account options provide flexibility for traders, it's important to consider the risks associated with trading with an unregulated broker. The absence of regulation may pose challenges in terms of transparency, fair practices, and dispute resolution. Additionally, commission charges on certain trading products, potential delays in withdrawal processing, and limited customer support options are factors to consider. Traders should carefully evaluate the potential risks and benefits before deciding to trade with Lakefox Capital.

FAQs

Q1: Is Lakefox Capital a regulated broker?

A1: No, Lakefox Capital is an unregulated broker.

Q2: What is the minimum deposit requirement at Lakefox Capital?

A2: The minimum deposit requirement at Lakefox Capital is $200.

Q3: What is the maximum leverage offered by Lakefox Capital?

A3: Lakefox Capital offers a maximum leverage of 1:500.

Q4: What trading platform does Lakefox Capital provide?

A4: Lakefox Capital provides the MT5 (MetaTrader 5) trading platform.

Q5: How long does it take to process withdrawals at Lakefox Capital?

A5: Withdrawals at Lakefox Capital are typically processed within 24 hours.

Courtiers WikiFX

FXTM

ATFX

XM

FXCM

AVATRADE

Blueberry Markets

FXTM

ATFX

XM

FXCM

AVATRADE

Blueberry Markets

Courtiers WikiFX

FXTM

ATFX

XM

FXCM

AVATRADE

Blueberry Markets

FXTM

ATFX

XM

FXCM

AVATRADE

Blueberry Markets

Calcul du taux de change