Sigma Primary

Extrait: Sigma Primary claims to be a forex and CFD brokerage based in the UK, but the available information raises serious doubts about its legitimacy. The company was registered with the domain sigma-primary.co.uk in February 2022, indicating it is a new and unestablished business. However, no evidence of registration or authorization by the UK's Financial Conduct Authority (FCA) is found, and there are no records of “Sigma Primary” in UK company databases. The website provides a contact address for a virtual office space in London, which raises concerns about its actual physical presence. The platform promises attractive trading conditions, but there is no supporting evidence for these claims, and the website looks unprofessional with copied content and grammatical errors. Additionally, there are no reputable forex review sites or listings of regulated UK brokers that link to Sigma Primary, further suggesting its dubious nature. As a result, caution is advised, and it is recommended to a

| Aspect | Information |

| Registered Country/Area | UK |

| Founded year | February 2022 |

| Company Name | Sigma Primary |

| Regulation | None |

| Minimum Deposit | $30 (Beginner Account) |

| Maximum Leverage | 1:1000 (Beginner Account) |

| Spreads | 2 pips (Major currency pairs) |

| 3-5 pips (Minor and exotic pairs) | |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable assets | Forex, metals, stocks, cash, oil, cryptocurrencies, indices, commodities (CFDs) |

| Account Types | Beginner Account, Pro Account, LP Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Payment Methods | Bank wire transfers, credit/debit card deposits, online payment processors (Skrill, Neteller, PayPal) |

| Educational Tools | Not specified |

Overview

Sigma Primary claims to be a forex and CFD brokerage based in the UK, but the available information raises serious doubts about its legitimacy. The company was registered with the domain sigma-primary.co.uk in February 2022, indicating it is a new and unestablished business. However, no evidence of registration or authorization by the UK's Financial Conduct Authority (FCA) is found, and there are no records of “Sigma Primary” in UK company databases. The website provides a contact address for a virtual office space in London, which raises concerns about its actual physical presence. The platform promises attractive trading conditions, but there is no supporting evidence for these claims, and the website looks unprofessional with copied content and grammatical errors. Additionally, there are no reputable forex review sites or listings of regulated UK brokers that link to Sigma Primary, further suggesting its dubious nature. As a result, caution is advised, and it is recommended to avoid this platform entirely due to the indications of it being an unregulated offshore broker or scam operation with no real presence in the UK.

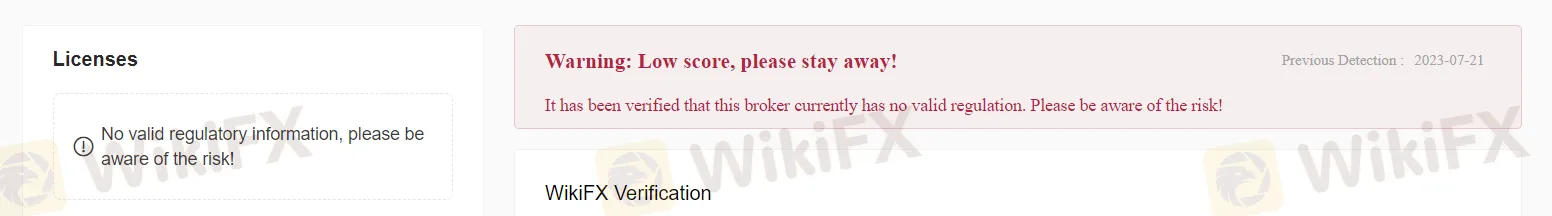

Regulation

None.

A company operating without regulation, like Sigma Primary, raises serious concerns about its legitimacy and credibility. The absence of regulatory oversight leaves clients vulnerable to potential scams, fraud, and unreliable services. Without accountability, investor protection, or financial safeguards, engaging with an unregulated company poses significant risks, such as potential financial losses, limited legal recourse, and the possibility of illegal activities. It is essential to exercise extreme caution and opt for reputable, regulated companies to ensure the safety and security of investments and financial transactions.

Market Instruments

Sigma Primary presents itself as a brokerage offering trading services in forex (foreign exchange) and CFDs (contracts for difference). In forex trading, clients can engage in the buying and selling of currency pairs, enabling them to speculate on the exchange rate fluctuations between two currencies. The forex market is known for its high liquidity, operating 24/5, and providing various currency pairs for trading, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

Furthermore, Sigma Primary claims to offer CFDs, a derivative financial product that allows traders to speculate on the price movements of various underlying assets without physically owning them. Through CFDs, clients can trade a diverse range of instruments, such as:

Commodities: CFDs on commodities like gold, silver, oil, natural gas, and agricultural products, giving traders the opportunity to profit from the price fluctuations of these physical goods without taking ownership.

Indices: Clients can access CFDs on major stock market indices, such as the S&P 500, NASDAQ, FTSE 100, and more. Trading on indices enables investors to gauge the overall market sentiment and participate in the performance of specific markets or industries.

Cryptocurrencies: With the growing popularity of cryptocurrencies, Sigma Primary may offer CFDs on digital assets like Bitcoin, Ethereum, Ripple, and other prominent cryptocurrencies. Traders can take advantage of the highly volatile nature of these digital currencies without owning them directly.

Stocks: CFDs on individual company stocks may be available, allowing traders to speculate on the price movements of well-known corporations without physically owning the shares.

While Sigma Primary advertises these trading instruments, it is crucial to approach their offerings with extreme caution due to the lack of regulation and credibility. Engaging with unregulated brokers can expose traders to significant risks, such as potential scams, fraudulent activities, and a lack of investor protection. To safeguard their investments, traders should prioritize regulated brokers with established reputations and transparency in their operations. Conducting thorough research and due diligence before choosing a brokerage is essential for a safe and secure trading experience.

Account Types

Sigma Primary offers three tiered trading account types designed to cater to traders with varying experience levels and investment budgets: Beginner Account, Pro Account, and LP Account.

Beginner Account:

The Beginner Account is tailored for novice traders who are just starting in the forex and CFD markets. With a maximum leverage of 1:1000, this account type allows traders to control positions up to 1000 times the size of their account balance, offering potential high returns. The minimum deposit requirement is as low as $30, making it accessible for traders with smaller budgets. The account provides access to forex and metals trading, allowing beginners to focus on the essentials without overwhelming them with a wide range of products. No specific information about spreads, supported EAs, depositing or withdrawal methods, or commission is provided for this account type, which may raise concerns about transparency.

Pro Account:

The Pro Account is designed for more experienced traders seeking enhanced trading features and a wider product range. With a maximum leverage of 1:500, traders can still have significant control over their positions. The minimum deposit requirement for the Pro Account is $100, offering a middle-ground option between the Beginner and LP accounts. This account type supports trading in forex, metals, stocks, cash, oil, and cryptocurrencies, providing greater opportunities for diversification. However, important details such as minimum spreads, supported EAs, and commission information are not disclosed, which may leave traders questioning the complete picture of trading conditions.

LP Account:

The LP Account caters to experienced traders with larger investment capacities. It offers a maximum leverage of 1:100, allowing clients to trade at a more conservative level compared to the other account types. The minimum deposit requirement for the LP Account is $1,000, which may appeal to traders looking for higher-tier services. This account type supports trading in forex, metals, stocks, cash, oil, and cryptocurrencies, providing extensive trading options. The minimum position size is 0.1, indicating a higher level of precision in trade sizing. Like the other accounts, specific details about spreads, supported EAs, depositing or withdrawal methods, and commission information are not provided, leaving traders with limited visibility into the complete trading environment.

Table:

| Account Type | Maximum Leverage | Minimum Deposit | Products | Minimum Position |

| Beginner | 1:1000 | $30 | Forex, Metals | 0 |

| Pro | 1:500 | $100 | Forex, Metals, Stocks, Cash, Oil, Crypto | 0 |

| LP | 1:100 | $1,000 | Forex, Metals, Stocks, Cash, Oil, Crypto | 0.1 |

Leverage

Sigma Primary claims to offer a maximum trading leverage of 1:1000 for the Beginner Account, 1:500 for the Pro Account, and 1:100 for the LP Account. These leverage levels allow traders to control positions that are up to 1000, 500, and 100 times the size of their account balance, respectively.

While high leverage can potentially amplify profits, it also comes with significant risks. Traders should be cautious when utilizing high leverage, as it can magnify potential losses and expose them to greater market volatility.

Considering Sigma Primary's unregulated and questionable status, traders should approach the claimed leverage levels with extreme caution. Unregulated brokers may not adhere to industry standards or provide adequate risk management measures, which can lead to adverse trading outcomes.

It is essential for traders to prioritize their safety and financial security by choosing reputable, regulated brokers with transparent and regulated leverage offerings. Conducting thorough research and due diligence is crucial in selecting a broker that aligns with their trading goals and risk tolerance. Always remember that while high leverage can enhance trading opportunities, it also entails higher risk exposure, and responsible risk management is vital for successful trading.

Spreads & Commissions

Sigma Primary offers three trading account types, attempting to attract traders of different experience levels, but their lack of regulation and transparency remains deeply concerning.

The Beginner Account claims to be a starting point for novice traders, but the spreads of 2 pips for major currency pairs and 3 to 5 pips for minor and exotic pairs could eat into profits, especially for inexperienced traders. Despite the absence of commissions, the broker's revenue generation through spreads raises doubts about potential hidden costs.

Moving up to the Pro Account supposedly offers tighter spreads, starting from 1.5 pips for major currency pairs. However, without clear details about additional fees or commissions, traders are left wondering about the complete cost structure. Sigma Primary's unwillingness to disclose crucial information raises red flags for traders seeking transparency.

The LP Account, catering to experienced traders, boasts even more favorable trading conditions with spreads as low as 1 pip for major currency pairs. However, similar to the other account types, the lack of commission details and complete trading costs leaves traders in the dark about the true expenses associated with this account.

Sigma Primary's unregulated status exacerbates the concerns surrounding their account offerings. Unregulated brokers may not adhere to industry standards or provide adequate investor protection, exposing traders to potential risks.

Traders must exercise extreme caution when dealing with Sigma Primary and consider alternative options with reputable, regulated brokers that offer transparent and reliable trading conditions. Thorough research and due diligence are imperative to safeguarding one's investments and ensuring a secure and trustworthy trading experience.

Deposit & Withdrawal

Sigma Primary do provide the standard option of bank wire transfers, the drawback lies in the lengthy processing times, taking several business days for funds to reflect in the trading account. This delay could inconvenience traders who seek prompt access to their funds for trading purposes or urgent financial needs.

Another method offered by Sigma Primary is credit/debit card deposits, which may provide convenience with instant availability of funds. However, using credit cards for deposits could expose traders to potential high-interest rates and financial risks if not managed responsibly.

Moreover, Sigma Primary's reliance on online payment processors like Skrill, Neteller, or PayPal raises some red flags. While these platforms are widely used, their association with unregulated brokers like Sigma Primary raises concerns about the security and safety of financial transactions. There is a potential risk of funds being exposed to unauthorized access or fraudulent activities.

For withdrawals, Sigma Primary's preference for bank wire transfers and online payment processors could be worrisome. The extended processing times for bank wire transfers might inconvenience clients seeking timely access to their profits. Additionally, using online payment processors may not offer a comprehensive range of withdrawal options, limiting the flexibility for clients to receive their funds through preferred channels.

Overall, Sigma Primary's deposit and withdrawal methods seem to lack the reliability and efficiency that traders would expect from a reputable and regulated broker. The potential risks associated with these methods and the broker's unregulated status suggest that traders should proceed with extreme caution when considering engaging with Sigma Primary. It is strongly advised to prioritize regulated brokers with transparent and reliable payment options to ensure the safety and security of funds.

Trading Platforms

Sigma Primary offers the MT4 trading platform, which, while popular in the industry, does little to compensate for the overall concerning and unregulated nature of the broker. Despite its user-friendly interface and customizable features, the utilization of MT4 by Sigma Primary raises doubts about the legitimacy and security of the platform.

As an unregulated broker, Sigma Primary's provision of the MT4 platform may not be a reliable indicator of their credibility or commitment to clients' best interests. Traders should approach the platform with skepticism, considering the potential risks associated with unregulated brokers, including the lack of investor protection and potential exposure to fraudulent activities.

Furthermore, even if the MT4 platform offers powerful tools and charting capabilities, it does not address the underlying issues regarding Sigma Primary's lack of regulatory oversight and transparency. The platform's features become insignificant when weighed against the potential risks that traders may face while dealing with an unregulated entity.

In conclusion, Sigma Primary's utilization of the MT4 platform fails to outweigh the doubts and concerns arising from their unregulated status. It is strongly advised to steer clear of unregulated brokers altogether and opt for reputable, regulated brokers that prioritize transparency, security, and the protection of traders' funds and interests. Always conduct thorough research and due diligence before engaging with any brokerage or trading platform to ensure a safe and secure trading experience.

Customer Support

Customer Support at Sigma Primary is notably lacking and raises concerns about their commitment to assisting traders. Traders have reported that the broker can only be reached through a single channel, which is a phone number (+). The absence of multiple contact options, such as email or live chat, severely limits the accessibility of their support team. This limited availability may be problematic, especially in urgent situations or for international clients in different time zones.

Furthermore, there have been reports of delays and unresponsiveness when trying to contact customer support through the provided phone number. Traders have expressed frustration at the lack of timely assistance and the difficulty in resolving issues promptly.

The lack of a comprehensive customer support system may indicate a lack of dedication to providing quality service to clients. Reputable brokers typically offer various communication channels and ensure that their support teams are responsive and readily available to address traders' concerns.

Traders should be cautious when dealing with Sigma Primary due to the insufficient customer support options and potential difficulties in reaching the support team. It is crucial to prioritize brokers that offer efficient and reliable customer support through multiple communication channels, ensuring that traders can seek assistance whenever needed. Conducting thorough research and considering reviews from other traders can provide valuable insights into a broker's customer support capabilities and overall reliability.

Summary

Sigma Primary presents itself as a forex and CFD brokerage based in the UK, but its legitimacy is questionable due to multiple red flags. The lack of regulation, unestablished presence, and absence of clear company information raise serious concerns. The broker offers three account types, but the lack of transparency regarding spreads, commissions, and additional fees is worrisome. While it claims to provide various trading instruments, traders should be cautious considering its unregulated status. The deposit and withdrawal methods seem limited and may expose clients to potential risks. The utilization of the MT4 trading platform does not compensate for the broker's overall dubious nature. Additionally, customer support is insufficient, leaving traders with limited access to assistance.

Pros:

Provides access to forex and CFD trading.

Offers a variety of trading instruments, including major currency pairs and cryptocurrencies.

Utilizes the MT4 trading platform, which is popular and user-friendly.

Cons:

Lack of regulation and transparency raise concerns about the broker's credibility.

Unestablished presence and absence of clear company information.

Limited customer support options and reported delays in responsiveness.

Insufficient disclosure of spreads, commissions, and additional fees.

Potential risks associated with deposit and withdrawal methods.

Given the significant concerns surrounding Sigma Primary, it is strongly advised to avoid engaging with this broker entirely. Traders should prioritize reputable, regulated brokers that offer transparent trading conditions, reliable customer support, and investor protection to ensure a safe and secure trading experience. Thorough research and due diligence are crucial in safeguarding investments and avoiding potential risks associated with unregulated brokers.

FAQs

Q1: Is Sigma Primary a regulated broker?

A: No, Sigma Primary is not regulated by any financial authority, raising concerns about its legitimacy and investor protection.

Q2: What trading instruments does Sigma Primary offer?

A: Sigma Primary provides access to forex (foreign exchange) and CFDs (contracts for difference) on commodities, indices, cryptocurrencies, stocks, and more.

Q3: Can I trust Sigma Primary with my funds?

A: As an unregulated broker, Sigma Primary poses potential risks, and trusting it with your funds is not recommended. Choose regulated brokers for enhanced safety.

Q4: What is the minimum deposit for a Beginner Account?

A: The Beginner Account requires a minimum deposit of $30, making it accessible to traders with smaller investment budgets.

Q5: How can I contact Sigma Primary's customer support?

A: Sigma Primary's customer support can be reached only through a single phone number, limiting accessibility and responsiveness for traders seeking assistance.

Courtiers WikiFX

FXTM

Exness

DBG Markets

MultiBank Group

ATFX

CXM Trading

FXTM

Exness

DBG Markets

MultiBank Group

ATFX

CXM Trading

Courtiers WikiFX

FXTM

Exness

DBG Markets

MultiBank Group

ATFX

CXM Trading

FXTM

Exness

DBG Markets

MultiBank Group

ATFX

CXM Trading

Calcul du taux de change