ZNB Capital Information Revealed

Extrait:ZNB Capital, a company operating in Cyprus for 1-2 years, lacks proper regulation, raising concerns for potential investors and traders. They offer various market instruments such as common stocks, preferred stocks, ETFs, and index funds. Account types include Individual, Corporate, Trust, Retirement, and Joint accounts, each with its own set of features. Orient Securities provides a 5:1 leverage, with spreads ranging from 0.10% to 0.20% and commissions of $5 to $10 per trade. Deposit and withdrawal methods include wire transfer, bank transfer, and cheque, with minimum amounts of HKD 10,000. They offer two trading platforms: Orient Online Trading Platform and Orient Mobile Trading Platform. Customer reviews on WikiFX are mixed, with concerns about excessive phone calls and questions about reliability due to the company's short existence.

| Aspect | Information |

| Registered Country/Area | Cyprus |

| Founded Year | 1-2 years |

| Company Name | ZNB Capital |

| Regulation | Not regulated; operates without proper regulation |

| Minimum Deposit | HKD 10,000 |

| Maximum Leverage | 5:1 (for every HKD 1, you can trade HKD 5 worth of securities) |

| Spreads | 0.10% to 0.20% for most securities |

| Trading Platforms | Orient Online Trading Platform, Orient Mobile Trading Platform |

| Tradable Assets | Common stocks, Preferred stocks, ETFs, Index funds, etc. (various securities) |

| Account Types | Individual Account, Corporate Account, Trust Account, Retirement Account, Joint Account |

| Demo Account | N/A |

| Islamic Account | N/A |

| Customer Support | Address: Panagiotis Kanellopoulou, 18, SAKKAS COURT 3, Floor 1, Flat/Office 6057 102, Larnaca, Cyprus |

| Payment Methods | Wire transfer, Bank transfer, Cheque |

Overview of ZNB Capital

Overview of ZNB Capital

ZNB Capital, a company based in Cyprus with 1-2 years of operation, faces scrutiny due to its lack of proper regulation. This regulatory absence raises concerns for potential investors and traders, necessitating caution. ZNB Capital offers investment options in various market instruments, including common and preferred stocks, exchange-traded funds (ETFs), and index funds.

The company provides different account types, such as individual, corporate, trust, retirement, and joint accounts, each accommodating specific investor needs. Leverage of 5:1 is available, enabling clients to trade securities exceeding their deposited amounts. While ZNB Capital charges spreads and commissions that may vary depending on factors like security and account type, it operates with minimum deposit and withdrawal amounts of HKD 10,000. Customer support services are available, but reviews on platforms like WikiFX reflect mixed feedback, highlighting concerns about unwanted solicitations and the company's relatively short track record.

Pros and Cons

ZNB Capital presents several advantages, including the convenience of multiple deposit methods, a diverse range of account types, and competitive spreads and commissions. Moreover, the availability of physical customer support adds to its appeal. However, the absence of proper regulation raises concerns about its legitimacy, and the limited variety of market instruments may limit investment options. Additionally, potential trading restrictions in retirement accounts, along with minimum deposit and withdrawal requirements of HKD 10,000, and associated withdrawal fees are notable drawbacks for prospective investors.

| Pros | Cons |

| Multiple deposit methods | Operates without proper regulation |

| Availability of various account types | Limited types of market instruments |

| Low spreads and commissions | Possible trading restrictions in retirement accounts |

| Customer support at a physical location | Minimum deposit and withdrawal amounts of HKD 10,000 |

| Fees for withdrawing funds |

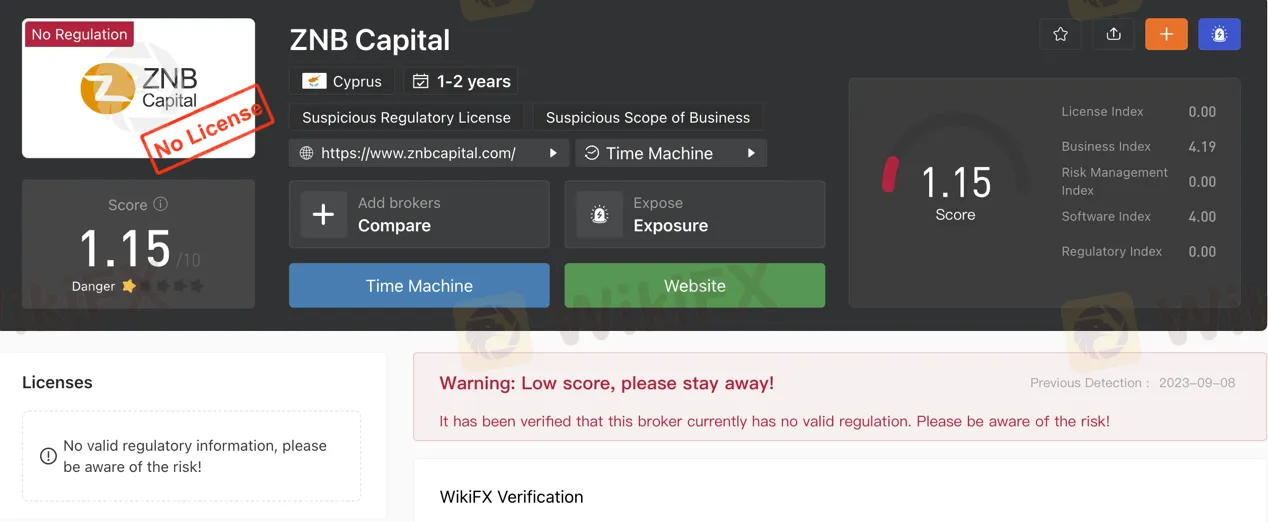

Is ZNB Capital Legit?

Indeed, ZNB Capital finds itself under scrutiny as it currently operates without proper regulation. This poses a significant risk to those considering investing or trading with them. This lack of oversight and regulation should lead to prudent caution being exercised by all prospective clients.

Market Instruments

Common stocks: These represent ownership in a company, entitling investors to a share of the company's profits, if any. Examples include shares of Apple Inc. and Microsoft Corporation.

Preferred stocks: These are also ownership shares in a company but hold a higher priority for dividend payments than common stocks. Examples include preferred shares of Verizon Communications Inc. and Pfizer Inc.

Exchange-traded funds (ETFs): ETFs are collections of stocks traded like individual stocks, offering a way to invest in specific markets or sectors. Examples include SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ).

Index funds: These funds track market indices such as the S&P 500, providing low-cost exposure to specific markets. Examples include Vanguard 500 Index Fund (VFIAX) and iShares Russell 2000 ETF (IWM).

Pros and Cons

| Pros | Cons |

| Diverse Investment Options | Limited Variety of Market Instruments |

| Potential for Profitable Investments | Lack of Comprehensive Information About Investments |

| Limited Risk Mitigation Tools (Hedging) |

Account Types

Individual Account: This account type is designed for individual investors looking to invest in securities. It can be opened by a single person and can be funded with either cash or securities. Investors can use this account to buy and sell securities on the open market.

Corporate Account: Orient Securities offers corporate accounts tailored for businesses seeking to invest in securities. These accounts can be opened by a company or other legal entity and accept funding in the form of cash or securities. They enable corporations to engage in the buying and selling of securities on the open market.

Trust Account: The trust account option is intended for trusts interested in securities investments. Trust accounts can be established by a trustee acting on behalf of a beneficiary. They are capable of receiving funding through cash or securities and can be utilized for trading securities in the open market.

Retirement Account: Orient Securities provides retirement accounts for individuals or couples aiming to save for their retirement. These accounts can be opened by an individual or a couple, accepting both cash and securities as funding sources. However, there may be certain trading restrictions when using this account to buy and sell securities on the open market.

Joint Account: Joint accounts are designed for groups of two or more individuals looking to invest in securities collectively. These accounts are versatile and can be opened by any number of people. Funding options include cash or securities, and they allow investors to engage in the buying and selling of securities on the open market.

Pros and Cons

| Pros | Cons |

| Individual, corporate, trust, and joint accounts | Possible trading restrictions in retirement accounts |

| Versatile account options | Limited information about specific account features |

| Allows for both cash and securities funding | Trading restrictions in retirement accounts not specified |

Leverage

The leverage offered by Orient Securities is 5:1. This means that for every HKD 1 you deposit, you can trade HKD 5 worth of securities.

Spreads & Commissions

Orient Securities typically charges spreads of 0.10% to 0.20% for most securities, and commissions of $5 to $10 per trade for individual accounts. The specific spreads and commissions charged may vary depending on the security, the trading volume, and the account type.

Deposit & Withdraw

Orient Securities offers three methods for depositing and withdrawing funds: wire transfer, bank transfer, and cheque. The minimum deposit amount is HKD 10,000, and the minimum withdrawal amount is also HKD 10,000. There are no fees for depositing funds, but there are fees for withdrawing funds, depending on the withdrawal method.

Pros and Cons

| Pros | Cons |

| Multiple deposit methods, including wire and bank transfers | Minimum deposit and withdrawal amount of HKD 10,000 |

| No fees for depositing funds | Fees for withdrawing funds depend on the withdrawal method |

Trading Platforms

Orient Securities offers two trading platforms: the Orient Online Trading Platform and the Orient Mobile Trading Platform. The Orient Online Trading Platform is a web-based platform that can be accessed from any computer with an internet connection. The Orient Mobile Trading Platform is a mobile app that can be used on smartphones and tablets.

Pros and Cons

| Pros | Cons |

| Accessible from any internet-connected PC | Limited platform options |

| Mobile app available for smartphones/tablets | No further details on platform features |

Customer Support

Orient Securities provides customer support services accessible at Panagiotis Kanellopoulou, 18, SAKKAS COURT 3, Floor 1, Flat/Office 6057 102, Larnaca, Cyprus.

Reviews

The reviews of Orient Securities on WikiFX include mixed feedback. One user expressed annoyance at receiving numerous phone calls and sales pitches from ZNB Capital, despite having no interest in trading with them, while another user inquired about the reliability of ZNB Capital, given its relatively short existence, seeking advice from others who have interacted with the company.

Conclusion

In conclusion, ZNB Capital operates without proper regulation, which poses a significant risk to potential investors or traders. This lack of oversight necessitates cautious consideration. The market instruments offered include common and preferred stocks, ETFs, and index funds. Account types cater to individual, corporate, trust, retirement, and joint investors, each with its own set of features. Leverage is offered at a 5:1 ratio, with spreads ranging from 0.10% to 0.20% and commissions varying by security, trading volume, and account type. Deposit and withdrawal options include wire transfer, bank transfer, and cheque, with associated fees for withdrawals. Two trading platforms, Orient Online Trading and Orient Mobile Trading are available. Customer support services are provided at a specific address in Cyprus. Reviews of ZNB Capital on WikiFX are mixed, with some users expressing annoyance at unsolicited phone calls and others seeking reliability insights due to the company's relatively short existence.

FAQs

Q: What is the regulatory status of ZNB Capital?

A: ZNB Capital currently operates without proper regulation, which raises concerns for potential investors and traders due to the lack of oversight.

Q: What types of market instruments can I trade with ZNB Capital?

A: ZNB Capital offers trading in common stocks, preferred stocks, exchange-traded funds (ETFs), and index funds.

Q: What account types are available at ZNB Capital?

A: ZNB Capital provides individual, corporate, trust, retirement, and joint account options to suit different investor needs.

Q: What is the leverage offered by ZNB Capital?

A: ZNB Capital offers leverage at a ratio of 5:1, allowing you to trade HKD 5 worth of securities for every HKD 1 deposited.

Q: What are the deposit and withdrawal options at ZNB Capital?

A: ZNB Capital offers wire transfer, bank transfer, and cheque methods for deposit and withdrawal, with a minimum deposit and withdrawal amount of HKD 10,000. Withdrawal fees may apply.

Q: What trading platforms does ZNB Capital offer?

A: ZNB Capital provides two trading platforms: the Orient Online Trading Platform and the Orient Mobile Trading Platform, catering to both web and mobile users.

Q: Where can I find customer support for ZNB Capital?

A: You can contact ZNB Capital's customer support services at their address in Larnaca, Cyprus.

Courtiers WikiFX

FXTM

Exness

DBG Markets

STARTRADER

ATFX

ZFX

FXTM

Exness

DBG Markets

STARTRADER

ATFX

ZFX

Courtiers WikiFX

FXTM

Exness

DBG Markets

STARTRADER

ATFX

ZFX

FXTM

Exness

DBG Markets

STARTRADER

ATFX

ZFX

Calcul du taux de change