Alpha Capital

Extrait:Alpha Capital is an unregulated financial institution based in Karachi, Pakistan, offering a range of services tailored to sharia-conscious clients, including Roshan Digital Account (RDA) customers. Their services encompass Shariah-compliant Equity Brokerage and Equity Research, with a dedicated trading platform for Shariah-compliant stocks. They provide access to a professional customer services desk and an Online Equity Trading Platform, serving various client types, from institutional clients to retail investors. Alpha Capital is authorized to facilitate equity brokerage for RDA account holders, offering them Shariah-compliant investment opportunities. Additionally, they offer a simplified account opening process known as Sahulat Account, which doesn't require proof of income, making it accessible to a wide range of individuals. Alpha Capital emphasizes investor education by redirecting users to jamapunji.pk, providing valuable resources for trading knowledge and financial insights.

| Aspect | Details |

| Company Name | Alpha Capital |

| Regulation | Not regulated |

| Services Offered | - Shariah-compliant Equity Brokerage - Equity Research - Approval for Roshan Digital Account (RDA) Customers - Sahulat Account Opening - Investor Education Resources |

| Equity Brokerage | - Facilitation of Shariah-compliant stock trading - Dedicated trading platform for Shariah-compliant stocks - Services for institutional clients, HNWIs, family offices, and retail clients - Access to a professional customer services desk - Online Equity Trading Platform |

| Equity Research | - Conducted through parent company, Akseer Research - A large research desk with seven experienced analysts - Coverage of 30 stocks across various sectors listed on the Pakistan Stock Exchange (PSX) |

| Roshan Digital Account (RDA) Approval | - Authorized Equity Broker for several Islamic banks for RDA customers |

| Customer Support | - Contact through registered office and stock exchange branch- Registered agents for personalized assistance - Phone and email support |

Overview

Alpha Capital is an unregulated financial institution based in Karachi, Pakistan, offering a range of services tailored to sharia-conscious clients, including Roshan Digital Account (RDA) customers. Their services encompass Shariah-compliant Equity Brokerage and Equity Research, with a dedicated trading platform for Shariah-compliant stocks. They provide access to a professional customer services desk and an Online Equity Trading Platform, serving various client types, from institutional clients to retail investors. Alpha Capital is authorized to facilitate equity brokerage for RDA account holders, offering them Shariah-compliant investment opportunities. Additionally, they offer a simplified account opening process known as Sahulat Account, which doesn't require proof of income, making it accessible to a wide range of individuals. Alpha Capital emphasizes investor education by redirecting users to jamapunji.pk, providing valuable resources for trading knowledge and financial insights. However, it's essential to note that Alpha Capital operates without government or financial regulatory oversight, which can entail risks for investors.

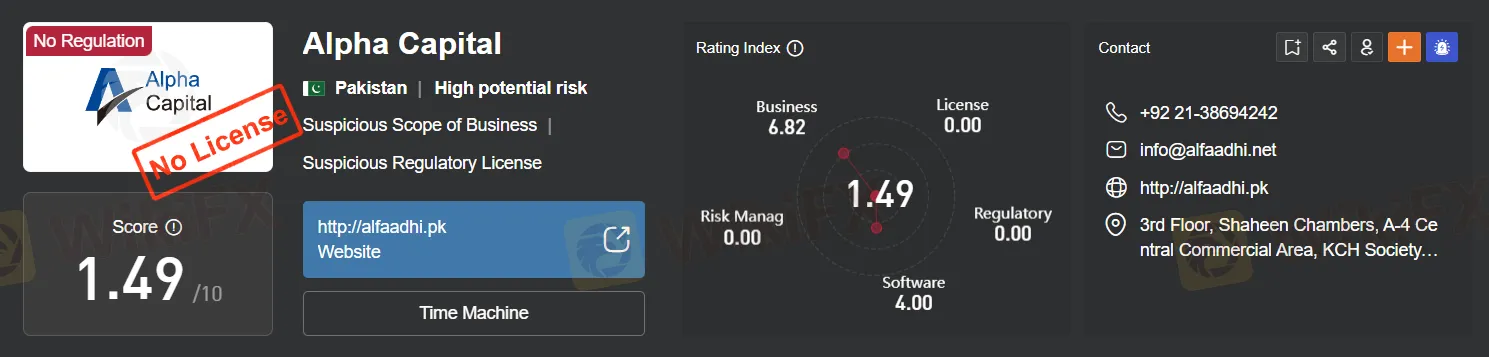

Regulation

Alpha Capital is not regulated, which means it operates without oversight or supervision from a government or financial regulatory authority. This lack of regulation can pose significant risks to investors, as there may be no safeguards in place to protect their interests. Without regulatory compliance, Alpha Capital may not be required to adhere to industry standards, conduct regular audits, or provide transparency in its financial operations. Investors should exercise caution when dealing with unregulated entities like Alpha Capital, as there may be limited recourse in the event of disputes or financial losses. It is advisable to research and consider the potential risks associated with unregulated financial institutions before engaging in any transactions with them.

Pros and Cons

Alpha Capital offers a range of financial services, specializing in Shariah-compliant offerings. However, it's important to note that Alpha Capital is not regulated, which can pose risks to investors due to the absence of oversight. Here's a summary of the pros and cons of Alpha Capital:

| Pros | Cons |

| - Specializes in Shariah-compliant services. | - Not regulated, lacking oversight and safeguards. |

| - Dedicated trading platform for Shariah stocks. | - Potential risks for investors due to lack of regulation. |

| - Extensive equity research coverage. | - Limited recourse in case of disputes or financial losses. |

| - Approval for Roshan Digital Account (RDA). | - Uncertain adherence to industry standards and transparency. |

| - Simplified Sahulat Account opening process. | |

| - Access to educational resources for investors. |

Alpha Capital's focus on Shariah-compliant services and the simplified Sahulat Account opening process can be advantageous for specific investors, particularly those adhering to Islamic finance principles. However, the absence of regulatory oversight raises concerns about investor protection and industry compliance. It's crucial for individuals considering Alpha Capital's services to carefully assess the associated risks and exercise caution when engaging with an unregulated financial institution. Additionally, the availability of educational resources can help clients make informed decisions and navigate the financial markets effectively.

Services

Alpha Capital offers a range of Shariah-compliant financial services tailored to meet the needs of sharia-conscious clients, particularly those holding Roshan Digital Accounts (RDA). The services provided by Alpha Capital include:

Equity Brokerage: Alpha Capital provides Shariah-compliant equity brokerage services. This means they facilitate the buying and selling of stocks in compliance with Islamic finance principles. They have a dedicated trading platform specifically designed for Shariah-compliant stocks. This service caters to various types of clients, including institutional clients, High Net Worth Individuals (HNWIs), family offices, and retail clients. Retail clients have access to a professional customer services desk and an advanced Online Equity Trading Platform for trading convenience.

Equity Research: Alpha Capital's equity research is conducted through its parent company, Akseer Research. They maintain one of the largest research desks in Pakistan, comprising seven experienced analysts with a combined research experience of over 40 years. The research team actively covers 30 stocks across a wide range of sectors listed on the Pakistan Stock Exchange (PSX). Their research aims to provide valuable insights and analysis to assist clients in making informed investment decisions within the Shariah-compliant framework.

Approval for Roshan Digital Account (RDA) Customers: Alpha Capital is an approved Equity Broker for several Islamic banks for Roshan Digital Account (RDA) customers. This designation implies that they are authorized to provide equity brokerage services to RDA account holders, ensuring that these clients have access to Shariah-compliant investment opportunities.

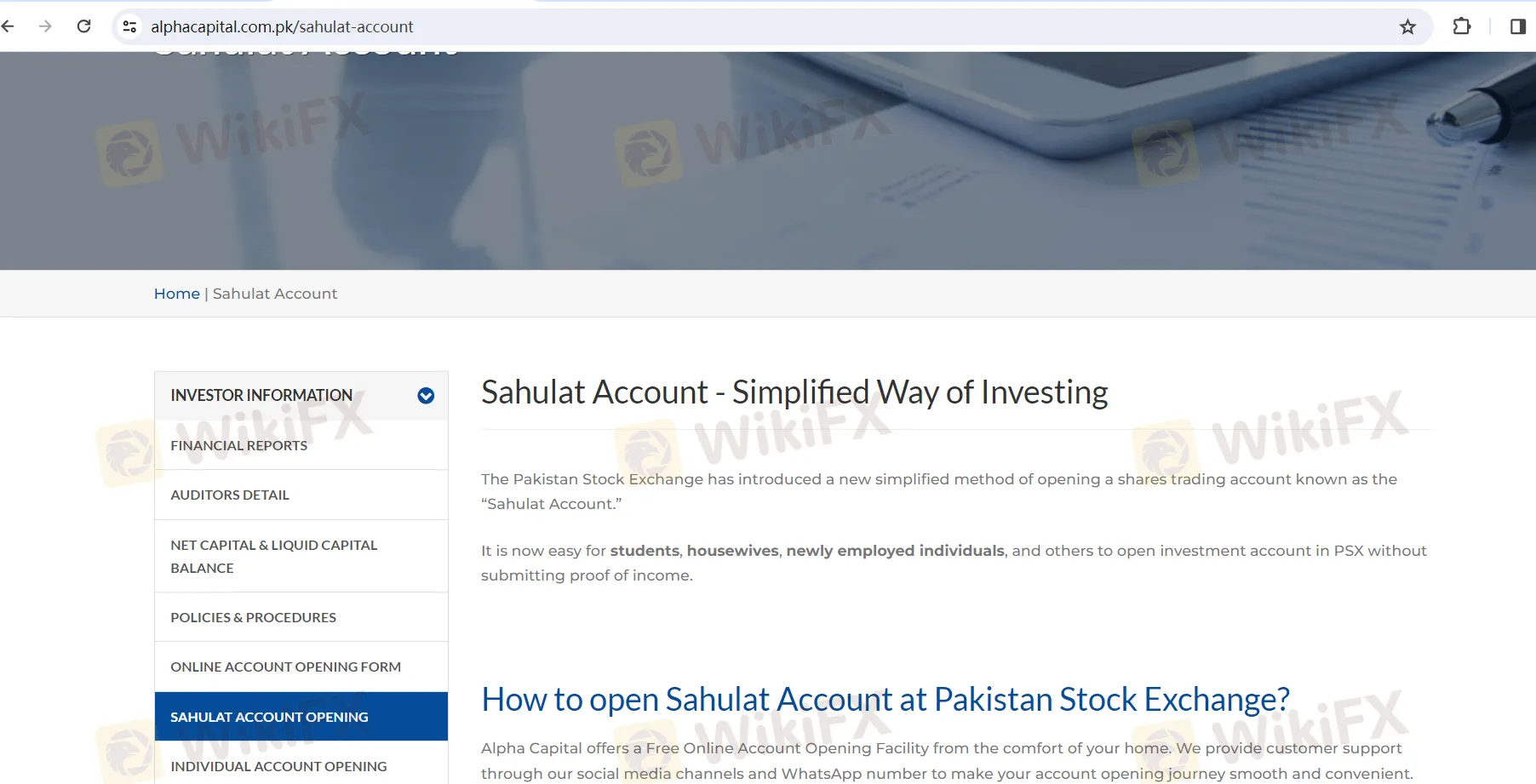

How to open a Sahulat Account?

Opening a Sahulat Account at the Pakistan Stock Exchange (PSX) through Alpha Capital is a simplified process, especially designed for individuals who may not have to provide proof of income. Here's a step-by-step guide on how to open a Sahulat Account:

Step 1: Gather Required Documents

Before you begin, make sure you have the following documents and information ready:

CNIC (Computerized National Identity Card) of the Account Holder.

Registered Mobile Number.

IBAN (International Bank Account Number) Number.

Mother's Name.

Step 2: Contact Alpha Capital

You can contact Alpha Capital through their provided customer support channels, including social media channels and WhatsApp number. They will guide you through the account opening process and provide assistance as needed.

Step 3: Account Opening

Alpha Capital offers a Free Online Account Opening Facility from the comfort of your home. They will likely provide you with an online form or application where you can fill in your details and upload the required documents.

Step 4: Verification

After submitting your application, Alpha Capital will verify the provided information and documents. This may involve checking the authenticity of your CNIC, mobile number, and other details.

Step 5: Approval

Once your application is approved and the verification process is complete, Alpha Capital will inform you of the successful opening of your Sahulat Account.

Key Features of Sahulat Account:

Sahulat Account can be opened by individuals, and it does not allow joint account holders.

Account holders have the flexibility to convert their Sahulat Accounts into regular trading accounts at any time.

Trading in the Regular Delivery Contract Market (Ready Market) is allowed.

However, trading in leveraged products, such as Margin Trading System, Margin Financing, Stock Lending Borrowing, and Negotiated Deals Market, is restricted to protect investors from unnecessary risk.

Account holders can use Alpha Capital's Mobile App for trading convenience from anywhere.

Investors can buy shares worth up to PKR 800,000 and execute gross trades of up to PKR 1.6 million per day, with net trades of up to PKR 800,000 per day.

Sahulat Account Holders can sell securities up to their full value.

Opening a Sahulat Account through Alpha Capital provides a simplified and accessible way for various individuals, including students, housewives, and newly employed individuals, to participate in the Pakistan Stock Exchange without the stringent income proof requirements typically associated with traditional trading accounts.

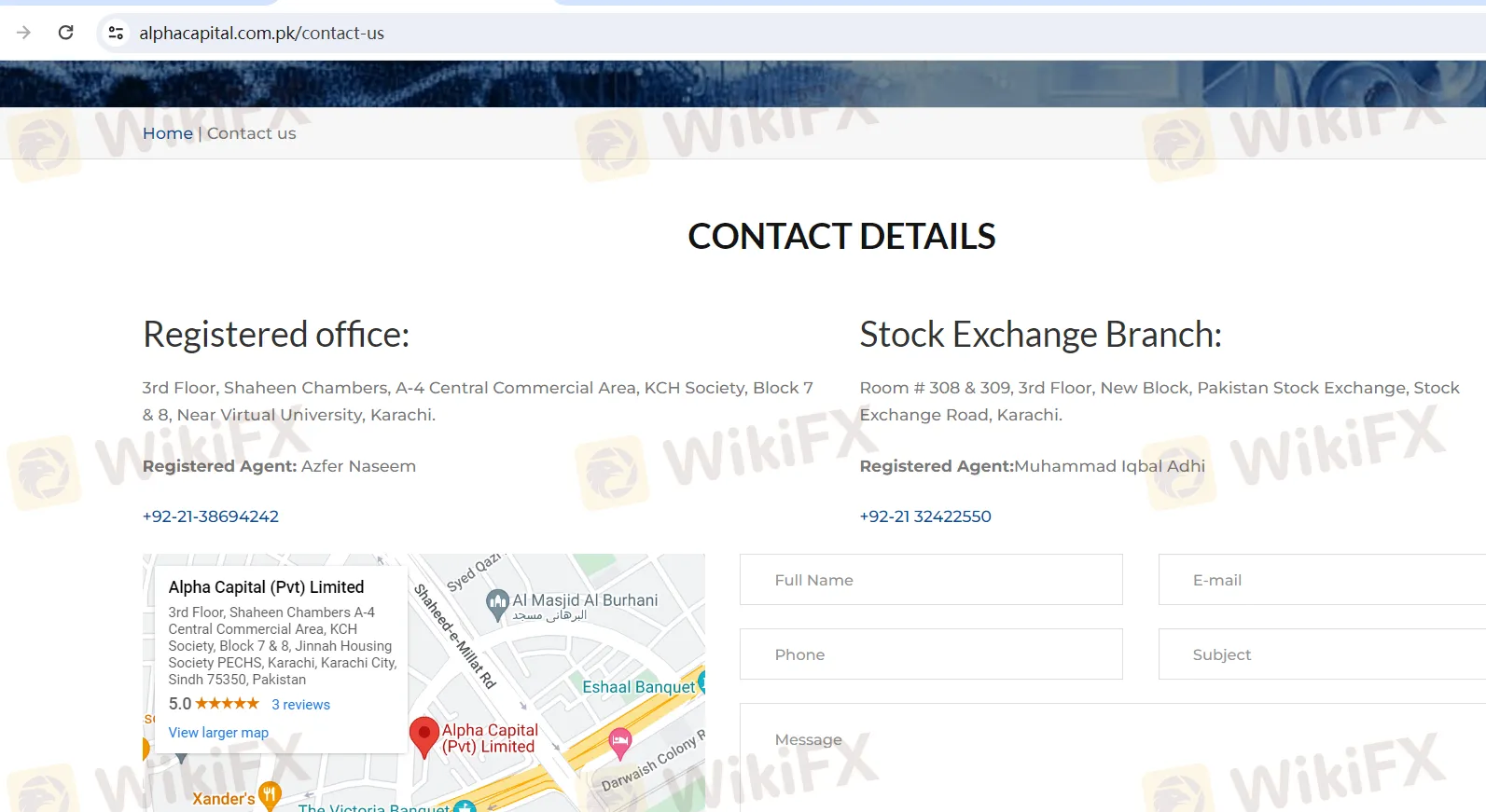

Customer Support

Alpha Capital ensures comprehensive customer support through its various contact channels. Their registered office, located at the 3rd Floor of Shaheen Chambers in Karachi's KCH Society, serves as the central hub for administrative and corporate matters. Here, clients and interested parties can address inquiries related to the company's operations and services. The presence of a registered office underscores Alpha Capital's commitment to transparency and accountability in its business operations.

For matters specific to stock trading and brokerage services, Alpha Capital operates a branch office within the Pakistan Stock Exchange building, situated at Room # 308 & 309 on the 3rd Floor of the New Block. This branch office, staffed by a registered agent named Muhammad Iqbal Adhi, provides clients with a dedicated point of contact for stock-related queries and trading activities. It facilitates direct engagement with the Pakistan Stock Exchange, enhancing convenience for investors.

The presence of registered agents, such as Azfer Naseem and Muhammad Iqbal Adhi, underscores Alpha Capital's commitment to providing personalized assistance to its clients. These agents can offer insights, guidance, and support on various financial and investment-related matters, helping clients make informed decisions in line with their investment goals.

Clients can easily reach Alpha Capital's customer support team through two provided contact numbers: +92-21-38694242 for the registered office and +92-21-32422550 for the Stock Exchange branch. These contact numbers offer direct access to the company's representatives, enabling clients to seek assistance and clarification promptly.

In addition to phone support, Alpha Capital extends its customer service reach through email communication. Clients and potential customers can reach out to them via email atinfo@alphacapital.com.pk. This email address serves as a convenient channel for written inquiries, account-related matters, and general information.

Alpha Capital's customer support is dedicated to addressing a wide spectrum of queries and providing assistance across various aspects of financial and investment services. Whether clients seek guidance on account opening, investment options, trading procedures, or general information about the company's services, Alpha Capital aims to ensure that their clients receive the information and support they need to navigate the world of finance effectively.

Overall, Alpha Capital's customer support infrastructure is designed to offer clients a seamless and convenient experience. They provide a combination of in-person and online support, catering to clients' preferences and requirements, and ensuring that clients can access assistance and information easily for their financial and investment needs.

Educational Resources

Alpha Capital prioritizes investor education and offers a valuable resource through its “Investor Education” section. By clicking on this button, users are redirected to the website https://jamapunji.pk/. This platform provides an excellent opportunity for individuals to enhance their trading knowledge and gain insights into the world of finance. Through jamapunji.pk, users can access a wealth of educational content, including articles, tutorials, and resources designed to empower them with the necessary skills and information for successful trading and investing. This commitment to investor education reflects Alpha Capital's dedication to helping clients make informed decisions and navigate the financial markets with confidence.

Summary

Alpha Capital is an unregulated financial institution offering a range of Shariah-compliant services, including equity brokerage and research, catering to sharia-conscious clients, including Roshan Digital Account (RDA) customers. While their services appear tailored to specific needs, it's crucial to note their lack of regulatory oversight, which can pose risks to investors. However, they offer a simplified process for opening a Sahulat Account, which does not require proof of income, making it accessible to various individuals. Comprehensive customer support is available through their registered office and stock exchange branch, staffed with registered agents, as well as via phone and email. Additionally, Alpha Capital emphasizes investor education through a redirect to jamapunji.pk, aiming to empower users with trading knowledge and financial insights.

FAQs

Q1: Is Alpha Capital regulated by any financial authority?

A1: No, Alpha Capital is not regulated by any government or financial regulatory authority.

Q2: Can I open a Sahulat Account without providing proof of income?

A2: Yes, Alpha Capital offers a simplified Sahulat Account opening process that doesn't require proof of income.

Q3: What are the maximum trade limits for Sahulat Account holders?

A3: Sahulat Account holders can buy shares worth up to PKR 800,000 and execute gross trades of up to PKR 1.6 million per day, with net trades of up to PKR 800,000 per day.

Q4: Can Sahulat Account holders convert their accounts into regular trading accounts?

A4: Yes, Sahulat Account holders have the flexibility to convert their accounts into regular trading accounts at any time.

Q5: How can I access educational resources provided by Alpha Capital?

A5: You can access educational resources by clicking on the “Investor Education” section, which redirects you to the website https://jamapunji.pk/, where you can find articles, tutorials, and resources to enhance your trading knowledge and financial insights.

Courtiers WikiFX

FXTM

ATFX

XM

FXCM

STARTRADER

DBG MARKETS

FXTM

ATFX

XM

FXCM

STARTRADER

DBG MARKETS

Courtiers WikiFX

FXTM

ATFX

XM

FXCM

STARTRADER

DBG MARKETS

FXTM

ATFX

XM

FXCM

STARTRADER

DBG MARKETS

Calcul du taux de change