W7 Broker&Trading

Extrait:W7 Broker & Trading, established in 2019 and based in Saint Vincent and the Grenadines, offers a range of trading opportunities across various financial markets. Operating without regulation, the company provides access to a MetaTrader 5 trading platform for both Windows and Mac users, alongside a diverse selection of tradable assets including currency pairs, CFDs on stocks, indices, metals, energies, and cryptocurrencies. With minimum deposits starting at $100 for the Standard ECN account and leverage of up to 1:200, traders can choose from different account types tailored to their experience and preferences. While a demo account is available for practice, reports of scam allegations raise concerns about the company's reputation, urging traders to exercise caution and conduct thorough research before engaging with W7 Broker & Trading.

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2019 |

| Company Name | W7 Broker & Trading |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:200 |

| Spreads | From 1.0 pips for Standard ECN account |

| Trading Platforms | MetaTrader 5 for Windows and Mac |

| Tradable Assets | Currency pairs, CFDs on stocks, indices, metals, energies, cryptocurrencies |

| Account Types | Standard ECN, Professional ECN, Privilege ECN |

| Demo Account | Available |

| Customer Support | Email (support@w7bt.com), a contact form on website |

| Payment Methods | Bitcoin, Neteller, SEPA Transfer, bank transfers |

Overview

W7 Broker & Trading, established in 2019 and based in Saint Vincent and the Grenadines, offers a range of trading opportunities across various financial markets. Operating without regulation, the company provides access to a MetaTrader 5 trading platform for both Windows and Mac users, alongside a diverse selection of tradable assets including currency pairs, CFDs on stocks, indices, metals, energies, and cryptocurrencies. With minimum deposits starting at $100 for the Standard ECN account and leverage of up to 1:200, traders can choose from different account types tailored to their experience and preferences. While a demo account is available for practice, reports of scam allegations raise concerns about the company's reputation, urging traders to exercise caution and conduct thorough research before engaging with W7 Broker & Trading.

Regulation

W7 Broker&Trading operates in a regulatory vacuum, lacking oversight from any governing body.This absence of regulation raises concerns regarding the integrity and reliability of its trading practices. Without regulatory scrutiny, there is a heightened risk of malfeasance, including potential fraud, manipulation, and other unethical behaviors that could harm investors. Investors may find themselves exposed to greater financial vulnerabilities due to the lack of safeguards typically provided by regulated entities. Moreover, the absence of oversight undermines trust in the financial system, deterring potential investors from engaging with the platform. As such, the unregulated status of W7 Broker&Trading poses significant risks to both individual investors and the broader financial market.

Pros and Cons

W7 Broker & Trading presents both advantages and drawbacks for traders. On the positive side, it offers a comprehensive range of market instruments, including forex, stocks, indices, metals, energies, and cryptocurrencies, providing traders with ample opportunities for diversification and profit potential. Additionally, the MetaTrader 5 trading platform enhances the trading experience with its advanced features and user-friendly interface. However, the absence of regulation raises concerns about the integrity of the platform's trading practices, while high minimum deposit requirements and extended withdrawal processing times may deter potential traders.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Market Instruments

W7 Broker&Trading offers a comprehensive range of market instruments, providing traders with diverse opportunities to engage in various sectors of the financial markets:

Currency Pairs: A total of 67 currency pairs are available for forex trading, allowing investors to speculate on the exchange rates of major and minor currency pairs.

CFDs on Stocks: With 20 contracts for difference (CFDs) on stocks, traders can participate in the price movements of individual equities without owning the underlying shares, facilitating exposure to various companies across different sectors.

Indices: The platform offers 13 indices CFDs, enabling traders to track and trade on the performance of major stock indices worldwide, including popular benchmarks such as the S&P 500, FTSE 100, and Nikkei 225.

Metals: W7 Broker&Trading provides access to 7 metals, including precious metals like gold and silver, allowing investors to hedge against inflation or geopolitical uncertainties by trading these commodities.

Energies: Traders can engage in the dynamic energy markets with 4 energy products offered by the platform, including contracts for difference on crude oil and natural gas, providing opportunities to capitalize on fluctuations in energy prices.

Cryptocurrencies: Recognizing the growing demand for cryptocurrencies, W7 Broker&Trading includes a selection of digital currencies, enabling traders to participate in the volatile yet potentially lucrative crypto market.

Overall, this organized array of market instruments empowers traders with a wide range of options to diversify their portfolios, implement various trading strategies, and capitalize on opportunities across different sectors of the financial markets.

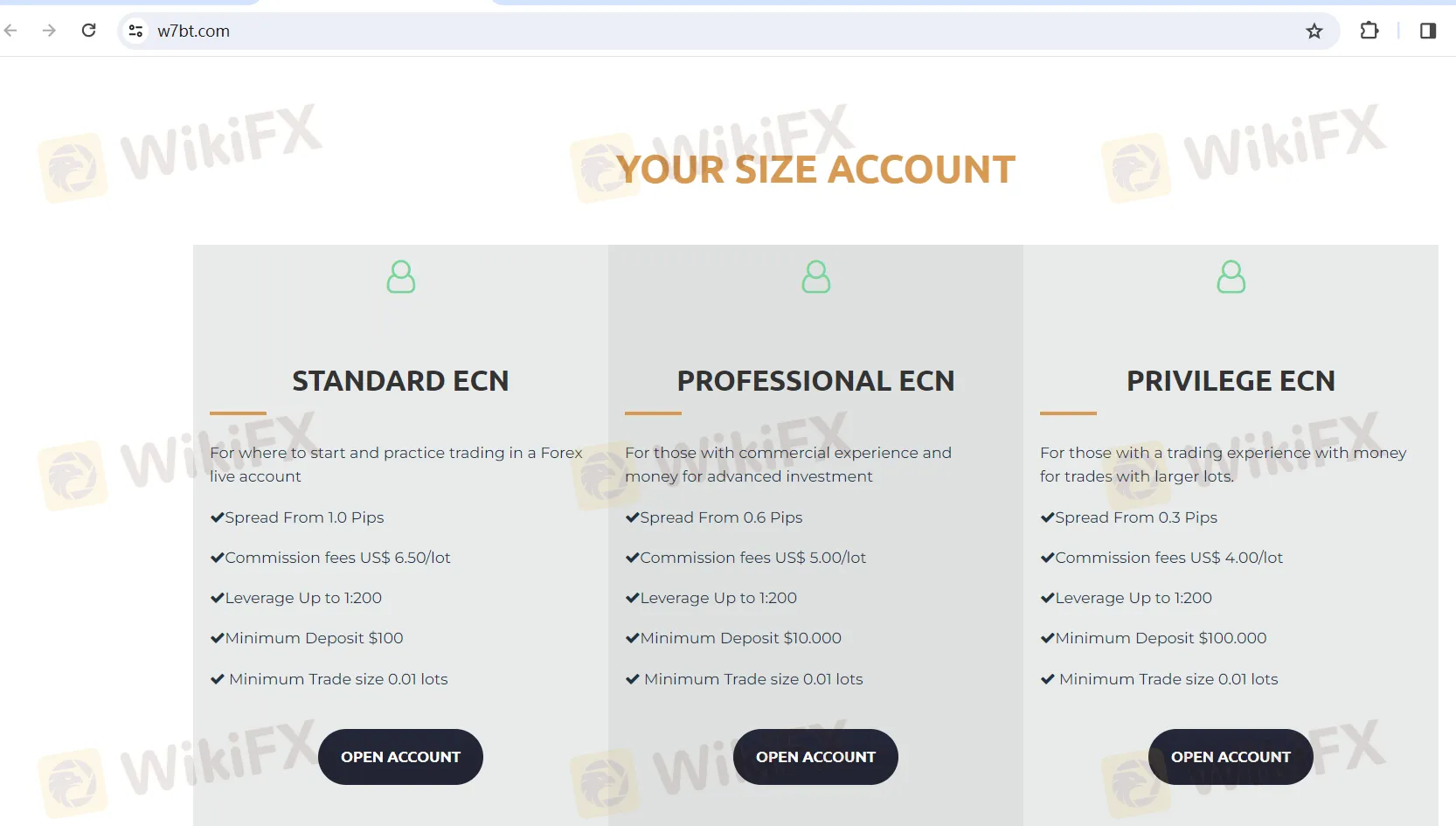

Account Types

W7 Broker&Trading offers three distinct account types tailored to cater to traders with varying levels of experience, investment capital, and trading preferences:

Standard ECN Account:

Professional ECN Account:

Maintains a minimum trade size of 0.01 lots, enabling precision in trade execution.

Provides leverage of up to 1:200, with a higher minimum deposit of $10,000.

Offers tighter spreads starting from 0.6 pips and lower commission fees of US$ 5.00 per lot.

Designed for traders with commercial experience and a desire for advanced trading capabilities.

Privilege ECN Account:

Requires a minimum trade size of 0.01 lots, catering to traders who prefer granularity in position sizing.

Allows leverage of up to 1:200, with a substantial minimum deposit requirement of $100,000.

Boasts the tightest spreads starting from 0.3 pips and the lowest commission fees of US$ 4.00 per lot.

Catered to experienced traders with significant capital for larger lot trades.

Demo Account:

Serves as a valuable tool for building confidence and honing skills before transitioning to live trading.

Enables users to familiarize themselves with the platform's features and experiment with different strategies.

Provides access to virtual funds for trading across various financial instruments.

Available for traders of all levels to practice and refine trading strategies in a risk-free simulated environment.

Tailored for beginners and those seeking to practice live trading in the forex market.

Features spreads starting from 1.0 pips and commission fees of US$ 6.50 per lot.

Leverage of up to 1:200 is available, with a minimum deposit requirement of $100.

Allows for a minimum trade size of 0.01 lots, providing flexibility for risk management.

Overall, W7 Broker&Trading's account types are structured to accommodate traders of all experience levels and investment sizes, providing a range of options with varying spreads, commission fees, and minimum deposit requirements to suit individual trading needs and preferences.

Leverage

The maximum trading leverage offered by W7 Broker&Trading is up to 1:200. Leverage allows traders to control a larger position size in the market with a relatively smaller amount of capital. With a leverage ratio of 1:200, traders can amplify their trading positions by up to 200 times the amount of their initial investment. This means that for every $1 of capital deposited, traders can potentially control a position worth up to $200 in the market. While leverage can magnify profits, it also increases the potential for losses, as losses are also amplified proportionally to the size of the leveraged position. Therefore, traders should exercise caution and implement risk management strategies when trading with leverage to mitigate the associated risks.

Spreads and Commissions

Based on the information provided, W7 Broker&Trading offers varying spreads and commissions depending on the type of trading account chosen by the investor.

Spreads refer to the difference between the bid and ask prices of a financial instrument and serve as the primary cost of trading. The broker offers spreads starting from 1.0 pips for the Standard ECN Account, 0.6 pips for the Professional ECN Account, and as tight as 0.3 pips for the Privilege ECN Account. The tighter the spread, the lower the cost of trading for the investor.

Commissions are additional fees charged by the broker for facilitating trades and vary based on the account type. The Standard ECN Account incurs commission fees of US$ 6.50 per lot traded, while the Professional ECN Account offers lower commission fees of US$ 5.00 per lot. The Privilege ECN Account boasts the lowest commission fees at US$ 4.00 per lot.

In summary, while spreads and commissions may vary across different account types, investors can select an account that aligns with their trading preferences and budget. Traders seeking tighter spreads and lower commissions may opt for the Professional or Privilege ECN Accounts, while those starting out may find the Standard ECN Account more suitable. It's essential for traders to consider both spreads and commissions when evaluating the overall cost of trading and selecting the most appropriate account type for their trading needs.

Deposit & Withdrawal

W7BT provides a range of deposit and withdrawal methods for traders, ensuring flexibility and convenience in managing their accounts. The minimum initial deposit required to start trading is $100, making the platform accessible to a wide range of investors.

For depositing funds, the company offers various payment options, including Bitcoin, Neteller, SEPA Transfer, as well as traditional bank transfers. This diverse selection allows traders to choose the method that best suits their preferences and location.

However, it's worth noting that while the initial deposit for the Standard ECN account is relatively low, the requirements for the Professional and Privilege ECN accounts are significantly higher, at $10,000 and $100,000 respectively. This may pose a barrier to entry for some traders, particularly those who are new to the market or have limited capital.

Regarding withdrawals, there is a potential downside as the processing time for withdrawal requests may take up to 5 business days. This extended processing period could inconvenience traders who require prompt access to their funds. Typically, such processes should be completed within 1 business day to ensure efficient fund management.

On a positive note, the absence of inactivity fees, bonuses, and stringent withdrawal conditions, as stated in the Terms and Conditions document, is advantageous for traders. This transparency helps prevent unexpected charges or restrictions that can sometimes catch traders off guard.

Trading Platforms

W7 Broker&Trading offers the MetaTrader 5 trading platform for both Windows and Mac operating systems, providing traders with a versatile and powerful tool for accessing global financial markets. With an intuitive interface and customizable features, MetaTrader 5 allows users to seamlessly navigate the platform and adapt it to their individual trading preferences. Traders can access a diverse range of financial instruments, including forex, stocks, commodities, and cryptocurrencies, enabling them to diversify their portfolios and capitalize on various market opportunities. The platform's advanced charting tools, extensive technical indicators, and analytical resources empower traders to conduct in-depth market analysis and make informed trading decisions. Furthermore, MetaTrader 5 supports automated trading through expert advisors (EAs), allowing traders to automate their trading strategies and execute trades automatically. With its robust features and user-friendly interface, MetaTrader 5 is a preferred choice for traders seeking a comprehensive and efficient trading platform offered by W7 Broker&Trading.

Customer Support

W7 Broker & Trading offers customer support through multiple channels to ensure that traders receive assistance promptly and efficiently. Traders can reach out to the company's support team via email at support@w7bt.com. Additionally, the company provides a contact form on its website, allowing traders to fill in their queries or concerns directly. The support team is based at the company's headquarters in Saint Lucia, enhancing accessibility for traders and enabling them to address any issues or inquiries effectively. experience for its clients.

Conclusion

Despite offering a comprehensive range of market instruments and the MetaTrader 5 trading platform, W7 Broker & Trading operates without regulation, raising concerns about the integrity and reliability of its trading practices. The absence of oversight increases the risk of malfeasance and undermines trust in the financial system, potentially harming investors. Additionally, the platform's high initial deposit requirements for certain account types and lengthy withdrawal processing times may deter potential traders. While the absence of inactivity fees and transparent terms is beneficial, reports of scam allegations from some users warrant caution when considering this broker. Investors should conduct thorough research and exercise caution before engaging with W7 Broker & Trading.

FAQs

Q1: Is W7 Broker & Trading regulated?

A1: No, W7 Broker & Trading operates without regulation, which may raise concerns about the oversight of its trading practices.

Q2: What are the minimum deposit requirements for W7 Broker & Trading?

A2: The minimum initial deposit required to start trading is $100 for the Standard ECN account, while higher minimum deposits are required for the Professional and Privilege ECN accounts.

Q3: What trading platforms does W7 Broker & Trading offer?

A3: W7 Broker & Trading offers the MetaTrader 5 trading platform for both Windows and Mac operating systems, providing traders with a versatile and powerful tool for accessing global financial markets.

Q4: What financial instruments can I trade with W7 Broker & Trading?

A4: W7 Broker & Trading provides access to a wide range of financial instruments, including currency pairs, CFDs on stocks, indices, metals, energies, and cryptocurrencies, allowing traders to diversify their portfolios and capitalize on various market opportunities.

Q5: How can I contact customer support at W7 Broker & Trading?

A5: Traders can reach out to W7 Broker & Trading's customer support team via email at support@w7bt.com or by filling in a contact form on the company's website, with support based at the company's headquarters in Saint Lucia.

Courtiers WikiFX

FXTM

Exness

DBG Markets

AvaTrade

Doo Prime

ATFX

FXTM

Exness

DBG Markets

AvaTrade

Doo Prime

ATFX

Courtiers WikiFX

FXTM

Exness

DBG Markets

AvaTrade

Doo Prime

ATFX

FXTM

Exness

DBG Markets

AvaTrade

Doo Prime

ATFX

Calcul du taux de change