2024-07-22 11:35

A l'instar de l'industrieAUDUSD H4 Report - 22 July 2024

combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

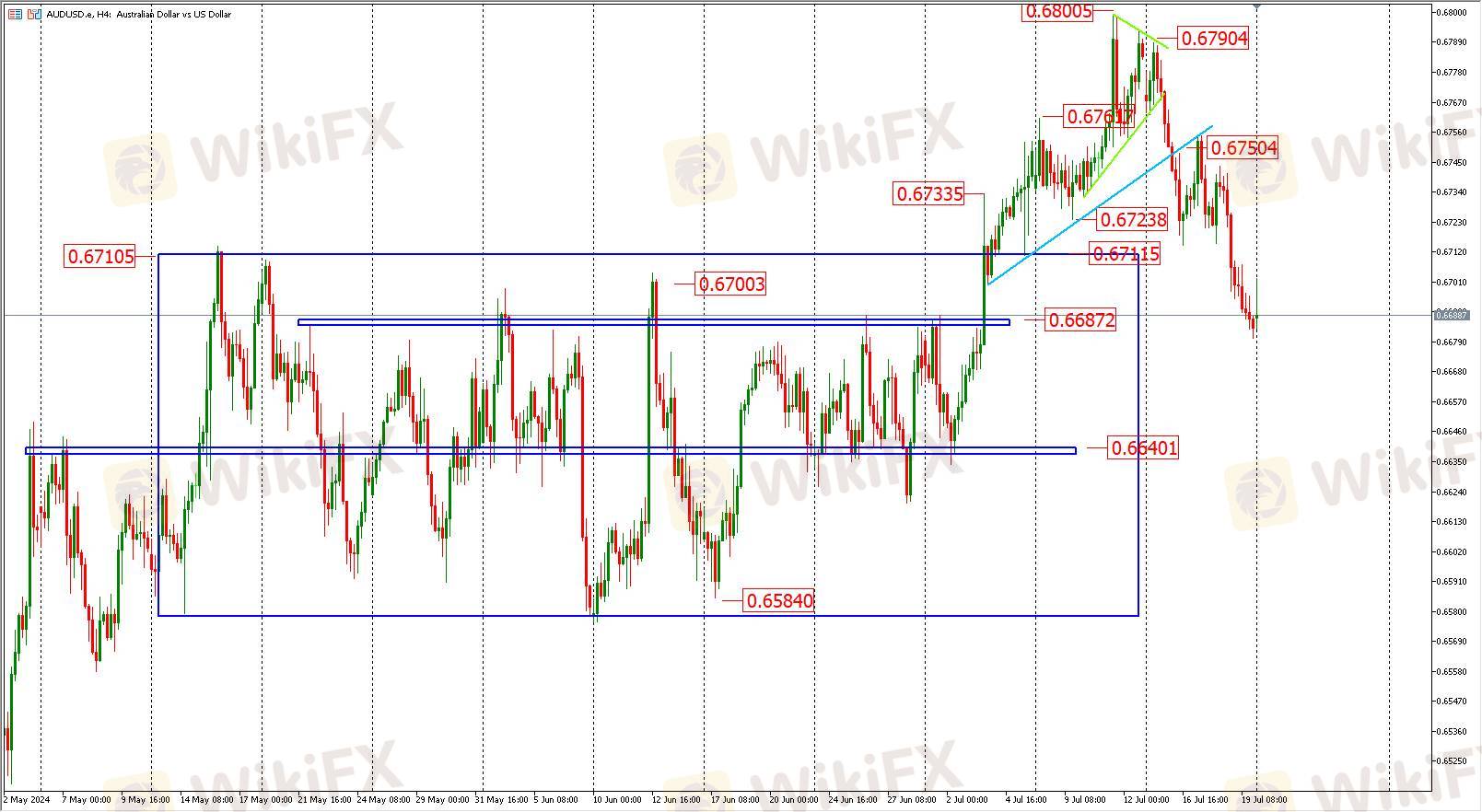

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

J'aime 0

FPGv 我baconjellyy

Trader

Discussions recherchées

A l'instar de l'industrie

WikiFX recrute: Un(e) spécialiste e-marketing Forex à temps partiel

A l'instar de l'industrie

WikiFX recrute un(e) spécialiste marketing

A l'instar de l'industrie

Tirages au sort WikiFX - Tentez votre chance pour gagner un crédit d’appel !

Analyse de marché

construction

A l'instar de l'industrie

Chemin à la fortune : Indications de l'activité Airdrop WikiBit

A l'instar de l'industrie

Route à la Fortune : Indications de l'activité Airdrop Spécial WikiBit

Catégorisation des marchés

Plateformes

Signalement

Agents

Recrutement

EA

A l'instar de l'industrie

Marché

Indicateur

AUDUSD H4 Report - 22 July 2024

| 2024-07-22 11:35

| 2024-07-22 11:35combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

J'aime 0

Je veux faire un commentaire aussi.

Poser une question

0commentaires

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !

Poser une question

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !