2024-12-23 13:57

A l'instar de l'industrieMarket analysis on December 23

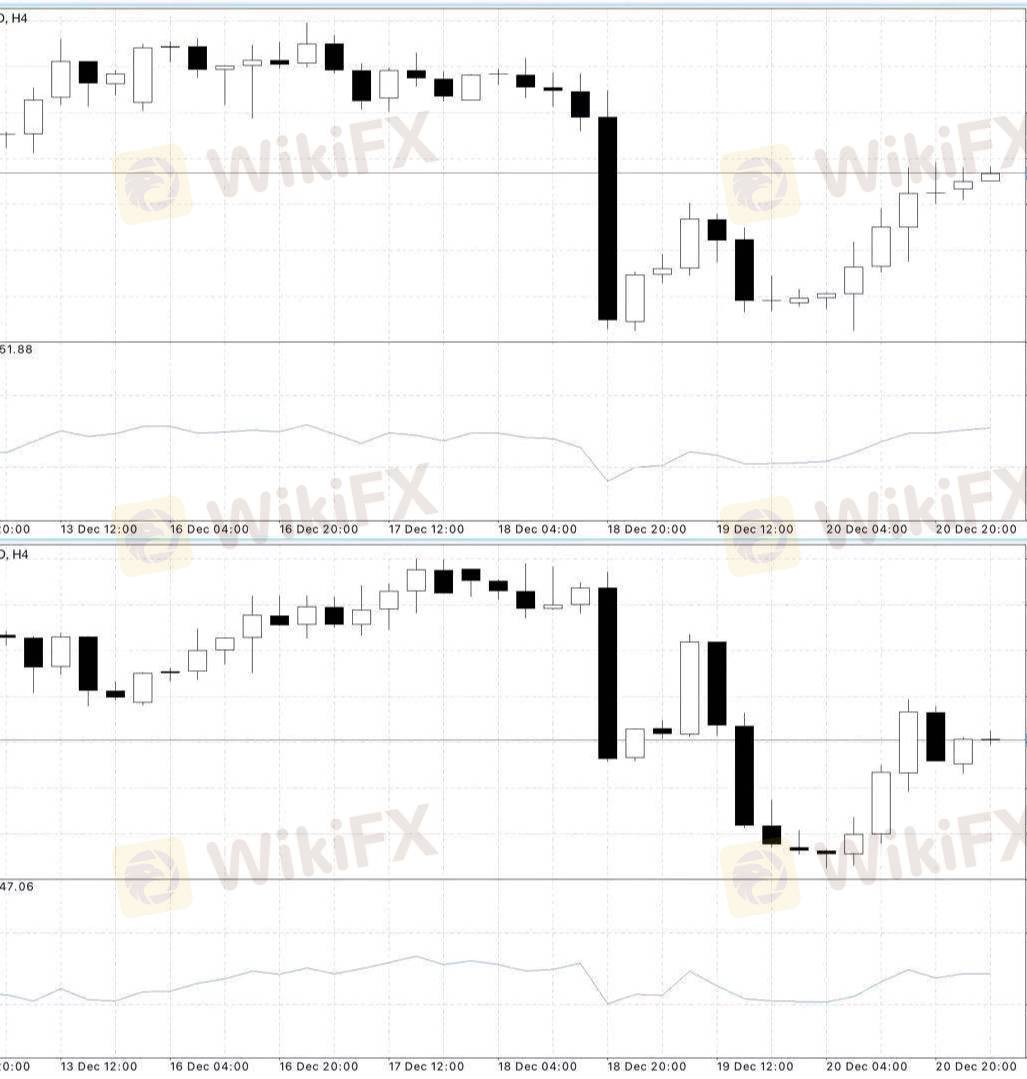

Last Friday, one of the inflation indicators that the Fed pays attention to - the US core PCE data are lower than expected, the market for March 25 interest rate cut expectations have increased, the USDX fell from a two-year high, and finally closed at 107.82, down 0.55%, but continued to rise for three weeks. Treasury yields were weaker across the board, with the 2-year yield closing at 4.317 percent and the 10-year yield at 4.519 percent.

Again, considering the arrival of Christmas, which compresses the entire trading week, the market is less volatile and the dollar is more likely to fluctuate at high levels.

At present, it seems that the Federal Reserve will only cut interest rates twice next year, respectively in March and June next year, and the major central banks may have some opposing measures.

EUR/USD:

First support: 1.0436 First resistance: 1.0444

Second support: 1.0432 Second resistance: 1.0448

GBP/USD:

First support: 1.2582 First resistance: 1.2590

Second support: 1.2577 Second resistance: 1.2593

J'aime 0

Steven123

โบรกเกอร์

Discussions recherchées

A l'instar de l'industrie

WikiFX recrute: Un(e) spécialiste e-marketing Forex à temps partiel

A l'instar de l'industrie

WikiFX recrute un(e) spécialiste marketing

A l'instar de l'industrie

Tirages au sort WikiFX - Tentez votre chance pour gagner un crédit d’appel !

Analyse de marché

construction

A l'instar de l'industrie

Chemin à la fortune : Indications de l'activité Airdrop WikiBit

A l'instar de l'industrie

Route à la Fortune : Indications de l'activité Airdrop Spécial WikiBit

Catégorisation des marchés

Plateformes

Signalement

Agents

Recrutement

EA

A l'instar de l'industrie

Marché

Indicateur

Market analysis on December 23

Hong Kong | 2024-12-23 13:57

Hong Kong | 2024-12-23 13:57

Last Friday, one of the inflation indicators that the Fed pays attention to - the US core PCE data are lower than expected, the market for March 25 interest rate cut expectations have increased, the USDX fell from a two-year high, and finally closed at 107.82, down 0.55%, but continued to rise for three weeks. Treasury yields were weaker across the board, with the 2-year yield closing at 4.317 percent and the 10-year yield at 4.519 percent.

Again, considering the arrival of Christmas, which compresses the entire trading week, the market is less volatile and the dollar is more likely to fluctuate at high levels.

At present, it seems that the Federal Reserve will only cut interest rates twice next year, respectively in March and June next year, and the major central banks may have some opposing measures.

EUR/USD:

First support: 1.0436 First resistance: 1.0444

Second support: 1.0432 Second resistance: 1.0448

GBP/USD:

First support: 1.2582 First resistance: 1.2590

Second support: 1.2577 Second resistance: 1.2593

J'aime 0

Je veux faire un commentaire aussi.

Poser une question

0commentaires

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !

Poser une question

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !