2024-12-25 21:51

A l'instar de l'industrieOverview of the PO3 Trading Strategy

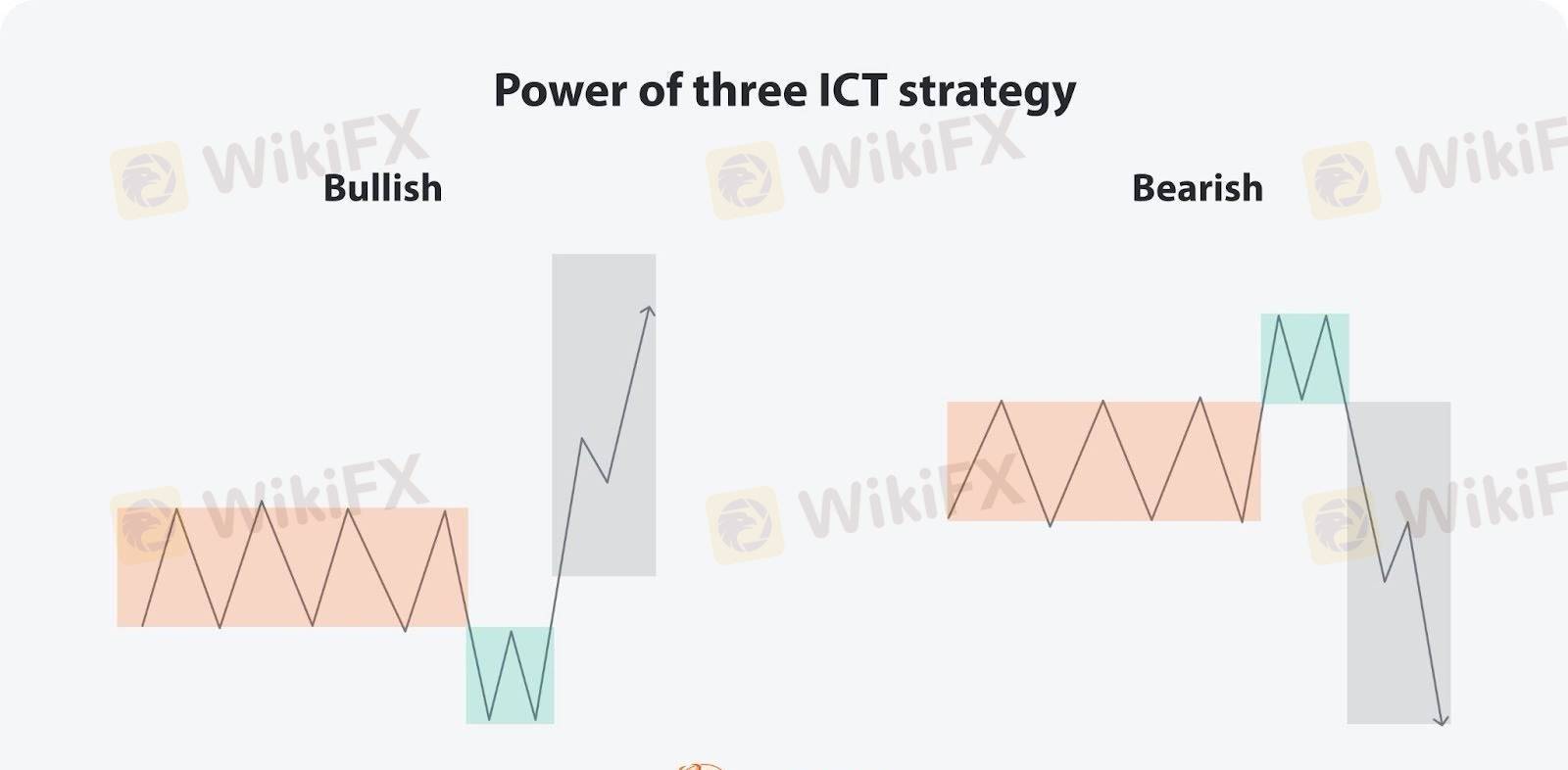

The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

J'aime 0

Kevin Cao

ट्रेडर

Discussions recherchées

A l'instar de l'industrie

WikiFX recrute: Un(e) spécialiste e-marketing Forex à temps partiel

A l'instar de l'industrie

WikiFX recrute un(e) spécialiste marketing

A l'instar de l'industrie

Tirages au sort WikiFX - Tentez votre chance pour gagner un crédit d’appel !

Analyse de marché

construction

A l'instar de l'industrie

Chemin à la fortune : Indications de l'activité Airdrop WikiBit

A l'instar de l'industrie

Route à la Fortune : Indications de l'activité Airdrop Spécial WikiBit

Catégorisation des marchés

Plateformes

Signalement

Agents

Recrutement

EA

A l'instar de l'industrie

Marché

Indicateur

Overview of the PO3 Trading Strategy

Hong Kong | 2024-12-25 21:51

Hong Kong | 2024-12-25 21:51The Power of Three (PO3) is a concept introduced by ICT (Inner Circle Trader) that describes market price movements in three phases: Accumulation, Manipulation, and Distribution.

1. Accumulation Phase

During this phase, the price consolidates within a narrow range as institutional players accumulate positions. The market often exhibits low volatility, typically occurring at the start of the trading day or before significant events.

2. Manipulation Phase

Large players create false breakouts to lure retail traders into the wrong direction, clearing stop-loss orders and building liquidity. Prices may breach key support or resistance levels but quickly reverse afterward.

3. Distribution Phase

The market enters the main trend direction, with prices accelerating toward targeted zones. Institutional players distribute their positions during this phase, marked by increased volatility and a clear price trend.

---

Application and Strategy

In intraday or short-term trading, the PO3 model helps identify key market moves. For example, the opening session often corresponds to the Accumulation phase, false breakouts occur during the Asian session (Manipulation), and trend expansions usually happen during the European or U.S. sessions (Distribution).

Typical Strategy:

1. Wait for Manipulation to Complete: Identify false breakouts and look for reversal signals, such as order blocks.

2. Enter the Main Trend in the Distribution Phase: Enter at key areas (e.g., Fair Value Gaps) and set targets like previous highs or lows.

3. Leverage Time Zones: Use ICT's Kill Zones (e.g., London or New York sessions) to improve accuracy.

By understanding the PO3 concept, traders can better capture market dynamics and enhance the precision and success of their trades.

J'aime 0

Je veux faire un commentaire aussi.

Poser une question

0commentaires

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !

Poser une question

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !