2025-01-29 17:05

A l'instar de l'industrieSwing Trading Strategies

#firstdealofthenewyearFateema

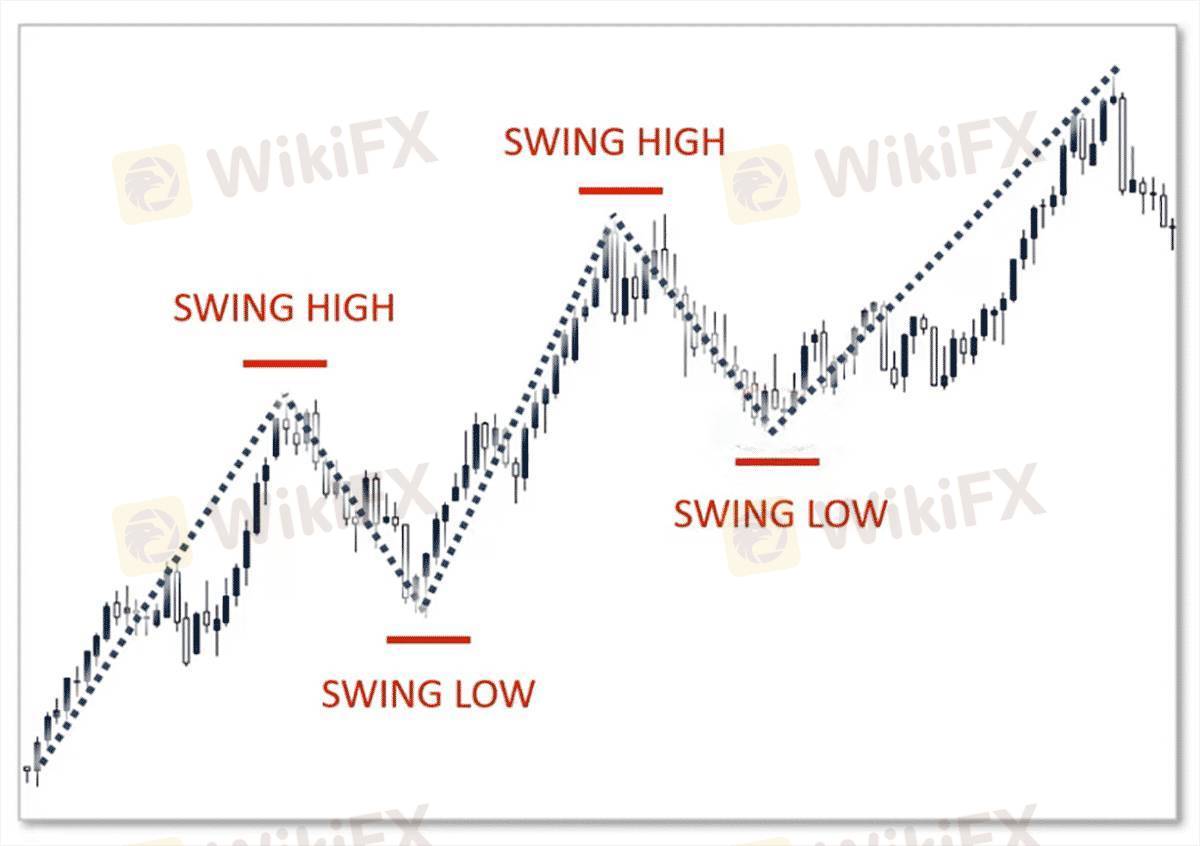

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

J'aime 0

Veinticinco25

Trader

Discussions recherchées

A l'instar de l'industrie

WikiFX recrute: Un(e) spécialiste e-marketing Forex à temps partiel

A l'instar de l'industrie

WikiFX recrute un(e) spécialiste marketing

A l'instar de l'industrie

Tirages au sort WikiFX - Tentez votre chance pour gagner un crédit d’appel !

A l'instar de l'industrie

Chemin à la fortune : Indications de l'activité Airdrop WikiBit

Analyse de marché

construction

A l'instar de l'industrie

Route à la Fortune : Indications de l'activité Airdrop Spécial WikiBit

Catégorisation des marchés

Plateformes

Signalement

Agents

Recrutement

EA

A l'instar de l'industrie

Marché

Indicateur

Swing Trading Strategies

Nigeria | 2025-01-29 17:05

Nigeria | 2025-01-29 17:05#firstdealofthenewyearFateema

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

J'aime 0

Je veux faire un commentaire aussi.

Poser une question

0commentaires

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !

Poser une question

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !