2025-02-06 20:00

A l'instar de l'industrieCreating a Legacy Through Annual Investment Strate

#firstdealofthenewyearchewbacca

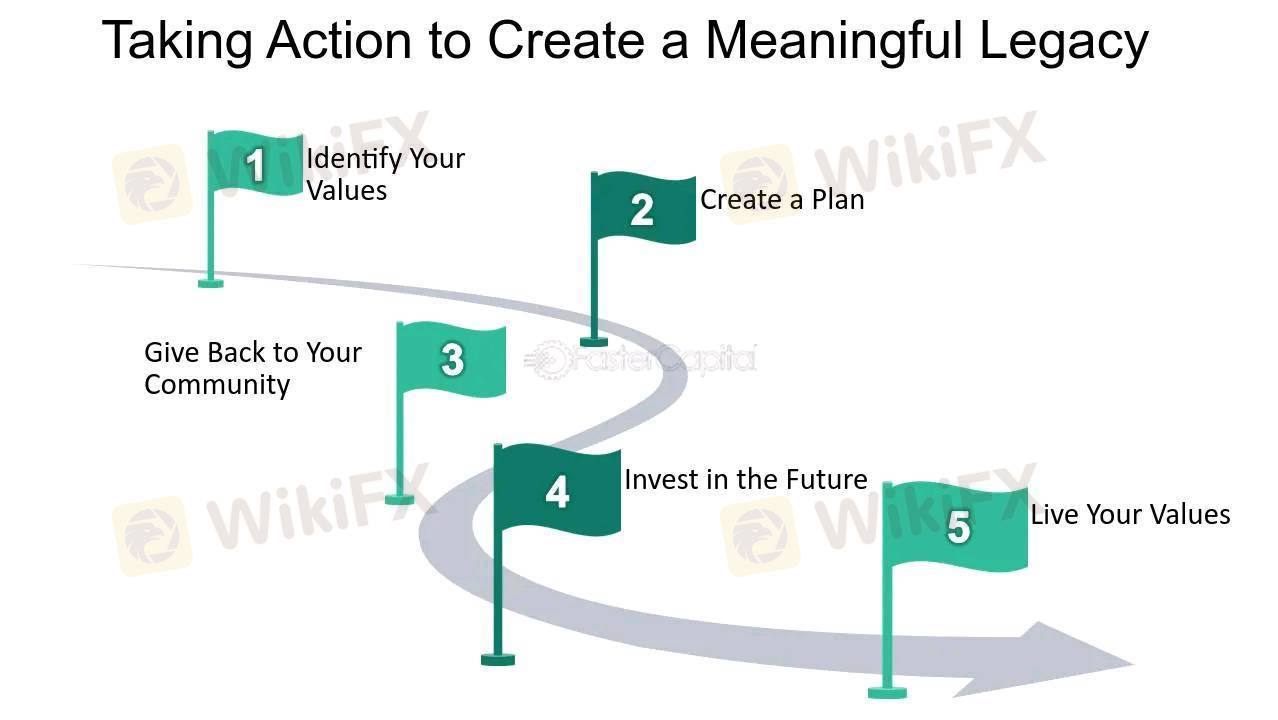

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

J'aime 0

bossbaby6527

المتداول

Discussions recherchées

A l'instar de l'industrie

WikiFX recrute: Un(e) spécialiste e-marketing Forex à temps partiel

A l'instar de l'industrie

WikiFX recrute un(e) spécialiste marketing

A l'instar de l'industrie

Tirages au sort WikiFX - Tentez votre chance pour gagner un crédit d’appel !

A l'instar de l'industrie

Chemin à la fortune : Indications de l'activité Airdrop WikiBit

Analyse de marché

construction

A l'instar de l'industrie

Route à la Fortune : Indications de l'activité Airdrop Spécial WikiBit

Catégorisation des marchés

Plateformes

Signalement

Agents

Recrutement

EA

A l'instar de l'industrie

Marché

Indicateur

Creating a Legacy Through Annual Investment Strate

Nigeria | 2025-02-06 20:00

Nigeria | 2025-02-06 20:00#firstdealofthenewyearchewbacca

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

J'aime 0

Je veux faire un commentaire aussi.

Poser une question

0commentaires

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !

Poser une question

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !