2025-02-06 23:38

A l'instar de l'industrieCORRELATION BETWEEN FOREX PAIRS

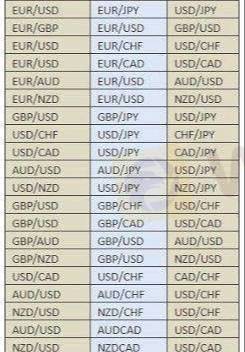

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

J'aime 0

BeastBoy2159

Nhà đầu tư

Discussions recherchées

A l'instar de l'industrie

WikiFX recrute: Un(e) spécialiste e-marketing Forex à temps partiel

A l'instar de l'industrie

WikiFX recrute un(e) spécialiste marketing

A l'instar de l'industrie

Tirages au sort WikiFX - Tentez votre chance pour gagner un crédit d’appel !

A l'instar de l'industrie

Chemin à la fortune : Indications de l'activité Airdrop WikiBit

Analyse de marché

construction

A l'instar de l'industrie

Route à la Fortune : Indications de l'activité Airdrop Spécial WikiBit

Catégorisation des marchés

Plateformes

Signalement

Agents

Recrutement

EA

A l'instar de l'industrie

Marché

Indicateur

CORRELATION BETWEEN FOREX PAIRS

Algérie | 2025-02-06 23:38

Algérie | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

J'aime 0

Je veux faire un commentaire aussi.

Poser une question

0commentaires

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !

Poser une question

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !