2025-02-21 18:09

A l'instar de l'industrieHow the speed of rate cuts affects USD trends

#FedRateCutAffectsDollarTrend

How the Speed of Rate Cuts Affects U.S. Dollar Trends

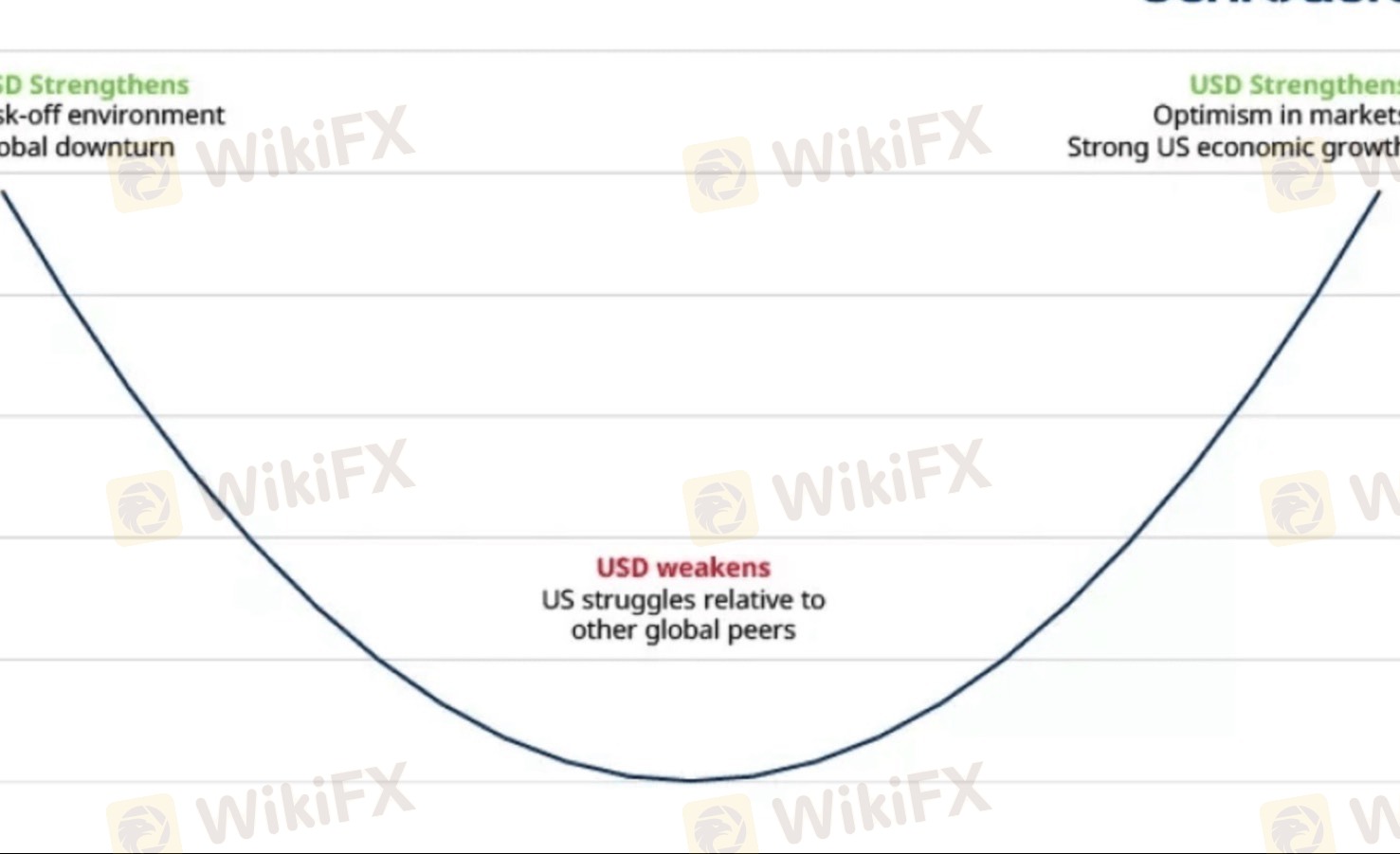

The pace at which the Federal Reserve cuts interest rates can significantly impact how the U.S. dollar reacts. Faster cuts tend to signal economic distress, while gradual cuts can be seen as precautionary.

1. Fast, Aggressive Rate Cuts → Short-Term Dollar Strength, Long-Term Weakness

When the Fed cuts rates aggressively (e.g., multiple cuts within months), it often signals economic trouble, triggering a flight to safety into the U.S. dollar. However, once markets stabilize, the dollar tends to weaken.

Examples of Fast Rate Cuts:

• 2008 Global Financial Crisis:

• The Fed slashed rates from 5.25% to 0% in just over a year.

• The dollar initially strengthened as investors sought safety, but later weakened as easy monetary policy took effect.

• 2020 COVID-19 Crisis:

• The Fed cut rates from 1.75% to near 0% in March 2020.

• The dollar surged temporarily, then declined as liquidity flooded markets.

Why This Happens:

• Safe-haven demand drives short-term dollar strength.

• As liquidity increases and risk appetite returns, the dollar weakens over time.

2. Slow, Gradual Rate Cuts → More Predictable, Less Volatile Dollar Decline

When the Fed cuts rates slowly and incrementally, the impact on the dollar is more predictable. Markets have time to adjust, leading to a gradual depreciation rather than a sharp move.

Examples of Gradual Rate Cuts:

• 2019 Fed Rate Cuts:

• The Fed lowered rates three times by 25 bps each over six months.

• The dollar remained relatively strong because the cuts were slow and other central banks were also easing.

Why This Happens:

• A measured approach prevents panic, limiting short-term safe-haven flows into the dollar.

• Investors shift away from the dollar gradually as yields decline, leading to a more controlled depreciation.

Key Takeaways

Speed of Rate Cuts Short-Term Dollar Impact Long-Term Dollar Impact

Fast & Aggressive Strengthens due to safe-haven demand Weakens as easy policy takes effect

Slow & Gradual Mild decline or stability Gradual depreciation over time

Would you like insights on how upcoming Fed rate cuts in 2024-2025 might impact the dollar?

J'aime 0

FX3557755512

Trader

Discussions recherchées

A l'instar de l'industrie

WikiFX recrute: Un(e) spécialiste e-marketing Forex à temps partiel

A l'instar de l'industrie

Tirages au sort WikiFX - Tentez votre chance pour gagner un crédit d’appel !

A l'instar de l'industrie

WikiFX recrute un(e) spécialiste marketing

A l'instar de l'industrie

Chemin à la fortune : Indications de l'activité Airdrop WikiBit

Analyse de marché

construction

A l'instar de l'industrie

Route à la Fortune : Indications de l'activité Airdrop Spécial WikiBit

Catégorisation des marchés

Plateformes

Signalement

Agents

Recrutement

EA

A l'instar de l'industrie

Marché

Indicateur

How the speed of rate cuts affects USD trends

Inde | 2025-02-21 18:09

Inde | 2025-02-21 18:09#FedRateCutAffectsDollarTrend

How the Speed of Rate Cuts Affects U.S. Dollar Trends

The pace at which the Federal Reserve cuts interest rates can significantly impact how the U.S. dollar reacts. Faster cuts tend to signal economic distress, while gradual cuts can be seen as precautionary.

1. Fast, Aggressive Rate Cuts → Short-Term Dollar Strength, Long-Term Weakness

When the Fed cuts rates aggressively (e.g., multiple cuts within months), it often signals economic trouble, triggering a flight to safety into the U.S. dollar. However, once markets stabilize, the dollar tends to weaken.

Examples of Fast Rate Cuts:

• 2008 Global Financial Crisis:

• The Fed slashed rates from 5.25% to 0% in just over a year.

• The dollar initially strengthened as investors sought safety, but later weakened as easy monetary policy took effect.

• 2020 COVID-19 Crisis:

• The Fed cut rates from 1.75% to near 0% in March 2020.

• The dollar surged temporarily, then declined as liquidity flooded markets.

Why This Happens:

• Safe-haven demand drives short-term dollar strength.

• As liquidity increases and risk appetite returns, the dollar weakens over time.

2. Slow, Gradual Rate Cuts → More Predictable, Less Volatile Dollar Decline

When the Fed cuts rates slowly and incrementally, the impact on the dollar is more predictable. Markets have time to adjust, leading to a gradual depreciation rather than a sharp move.

Examples of Gradual Rate Cuts:

• 2019 Fed Rate Cuts:

• The Fed lowered rates three times by 25 bps each over six months.

• The dollar remained relatively strong because the cuts were slow and other central banks were also easing.

Why This Happens:

• A measured approach prevents panic, limiting short-term safe-haven flows into the dollar.

• Investors shift away from the dollar gradually as yields decline, leading to a more controlled depreciation.

Key Takeaways

Speed of Rate Cuts Short-Term Dollar Impact Long-Term Dollar Impact

Fast & Aggressive Strengthens due to safe-haven demand Weakens as easy policy takes effect

Slow & Gradual Mild decline or stability Gradual depreciation over time

Would you like insights on how upcoming Fed rate cuts in 2024-2025 might impact the dollar?

J'aime 0

Je veux faire un commentaire aussi.

Poser une question

0commentaires

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !

Poser une question

Aucun commentaire pour l'instant. Soyez le premier de faire un commentaire !