Introduction of BullionVault

Extrait:BullionVault, established in 2003 and headquartered in the United Kingdom, operates as an unregulated entity, offering a platform for trading precious metals such as gold, silver, platinum, and palladium. BullionVault implements several protective measures for its clients. BullionVault operates with a complex fee structure, which clients should carefully consider before engaging with the platform. The company provides a user-friendly Gold App as its trading platform.

| BullionVault Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Gold, silver, platinum and palladium |

| Demo Accounts | Unavailable |

| Trading Platforms | Gold App |

| Minimum Deposit | N/A |

| Customer Support | (9 am to 8:30 pm (UK), Monday to Friday) telephone, email, online messaging, Twitter, Facebook, YouTube and Linkedin |

What is BullionVault?

BullionVault, established in 2003 and headquartered in the United Kingdom, operates as an unregulated entity, offering a platform for trading precious metals such as gold, silver, platinum, and palladium. BullionVault implements several protective measures for its clients. BullionVault operates with a complex fee structure, which clients should carefully consider before engaging with the platform. The company provides a user-friendly Gold App as its trading platform.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

| Secure Storage | Unregulated |

| Protective Measures | Complex Fee Structure |

| Convenient Trading | No Demo Accounts |

| Multiple Contact Channels |

Pros:

- Secure Storage: The platform offers allocated storage, ensuring that each customer owns specific bars or coins that are physically allocated to them in BullionVaults vaults. This provides maximum security and peace of mind for investors.

- Protective Measures: BullionVault implements several protective measures, such as segregated and pooled trust accounts and using multiple banks to handle client funds. This helps enhance the safety and security of client assets.

- Convenient Trading: With its user-friendly Gold App trading platform, BullionVault offers convenient and accessible trading options for investors.

- Multiple Contact Channels: The company provides comprehensive customer support services, including assistance via telephone, email, online messaging, and social media platforms, ensuring that clients can receive help when needed.

Cons:

- Unregulated: BullionVault operates as an unregulated entity, which may raise concerns for some investors about the lack of oversight and regulatory protections.

- Complex Fee Structure: The platform has a complex fee structure, which may be difficult for some investors to understand. Investors should carefully consider these fees before engaging with the platform.

- No Demo Accounts: BullionVault does not offer demo accounts for investors to practice trading without risking real money. This may be a disadvantage for those who prefer to test out a platform before committing funds.

Is BullionVault Legit or a Scam?

BullionVault provides several protection measures for clients, including the use of segregated and pooled trust accounts. This segregation ensures that client funds are kept separate from BullionVault's own operational funds. Furthermore, BullionVault uses three completely separate banks to enhance the safety of these arrangements. Client funds are held in accounts at either Lloyds Bank (UK) or Wells Fargo (US). The company's trading commissions are accumulated in these accounts and periodically transferred to BullionVault's Barclays Bank account, from which operational costs are paid.

However, despite these protective measures, BullionVault is not currently regulated by any government or financial authority. This lack of oversight may pose risks for investors, as there is no external body monitoring the company's operations. Without regulation, there is potential for the individuals running the platform to misappropriate client funds or engage in fraudulent activities without facing legal consequences. Additionally, the platform could cease operations abruptly and without warning, leaving investors with no recourse for recovering their assets.

Market Instruments

BullionVault offers a range of trading instruments for precious metals, including gold, silver, platinum, and palladium. These instruments are traded in the form of allocated bullion, which means that each customer owns specific bars or coins that are physically allocated to them in BullionVault's vaults.

When trading these metals, customers can buy or sell any quantity of these metals at the prevailing market price. BullionVault provides a platform for trading these metals 24 hours a day, 7 days a week, allowing customers to access the market at their convenience.

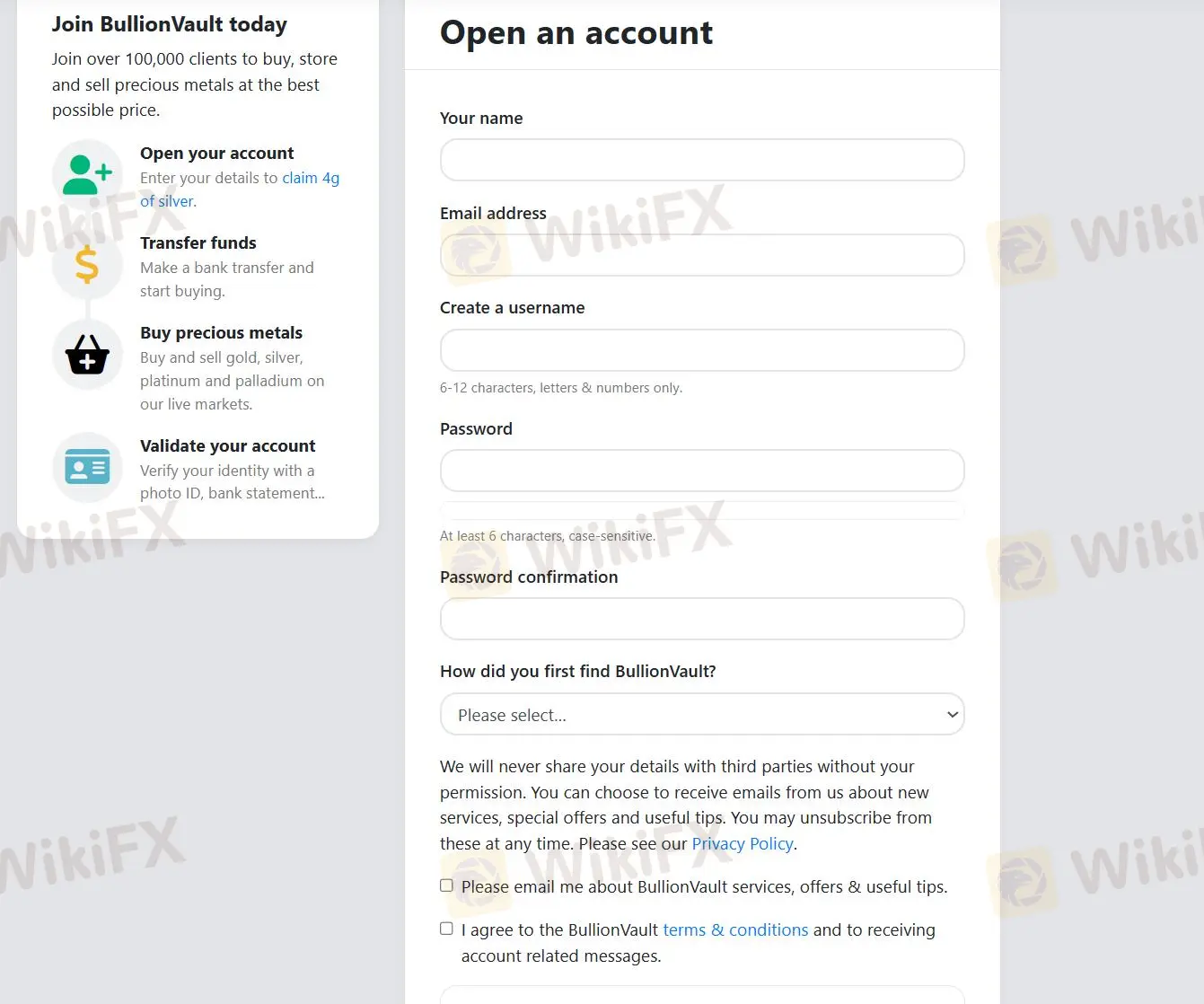

How to Open an Account?

To open an account with BullionVault, please follow these steps:

| Step 1 | Visit the BullionVault website. |

| Step 2 | Click on the “Open Account” button. |

| Step 3 | Fill out the registration form with the required information: |

| - Your full name | |

| - Email address | |

| - Create a username (6-12 characters, letters & numbers only) | |

| - Password (at least 6 characters, case-sensitive) | |

| - Password confirmation | |

| - How you first found BullionVault (select from the options provided) | |

| Step 4 | Optionally, choose to receive emails about BullionVault services, offers, and useful tips. |

| Step 5 | Agree to the BullionVault terms & conditions and to receiving account-related messages. |

| Step 6 | Click on the“Create Account” button to complete the registration process. |

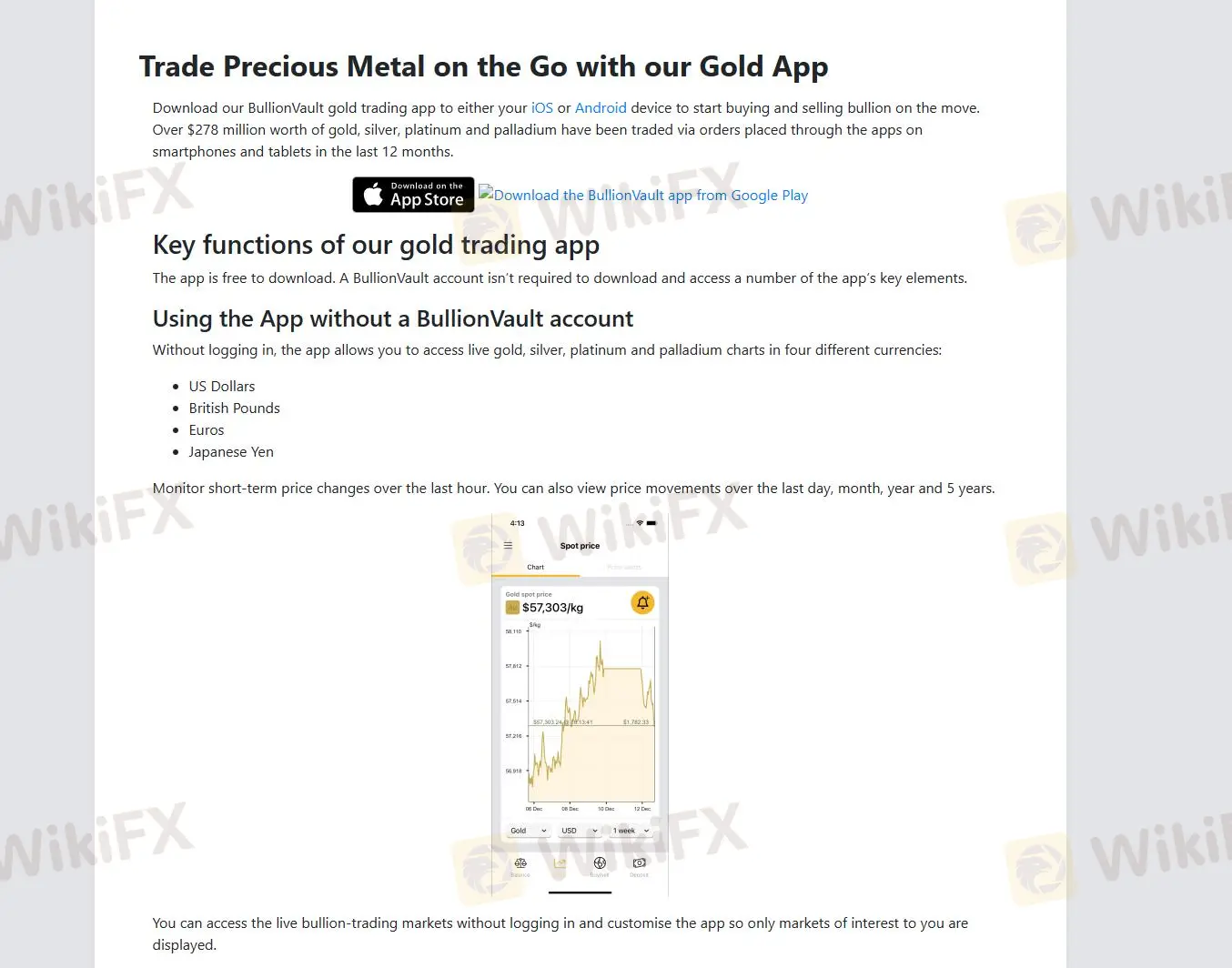

Trading Platform

BullionVault's trading platform, including its mobile app, provides users with a convenient and accessible way to trade precious metals on the go. Whether you're using the app on your iOS or Android device, you can seamlessly buy and sell gold, silver, platinum, and palladium with ease. With over $278 million worth of trades executed via the app in the last 12 months alone, it's clear that users trust and rely on its functionality.

For BullionVault account holders, the app offers even more functionality, allowing for seamless integration with their existing accounts. Users can execute trades, monitor their portfolios, and manage their accounts with ease, all from the convenience of their mobile devices. The app's user-friendly interface ensures that both novice and experienced traders can navigate the platform efficiently, enabling them to capitalize on trading opportunities wherever they are.

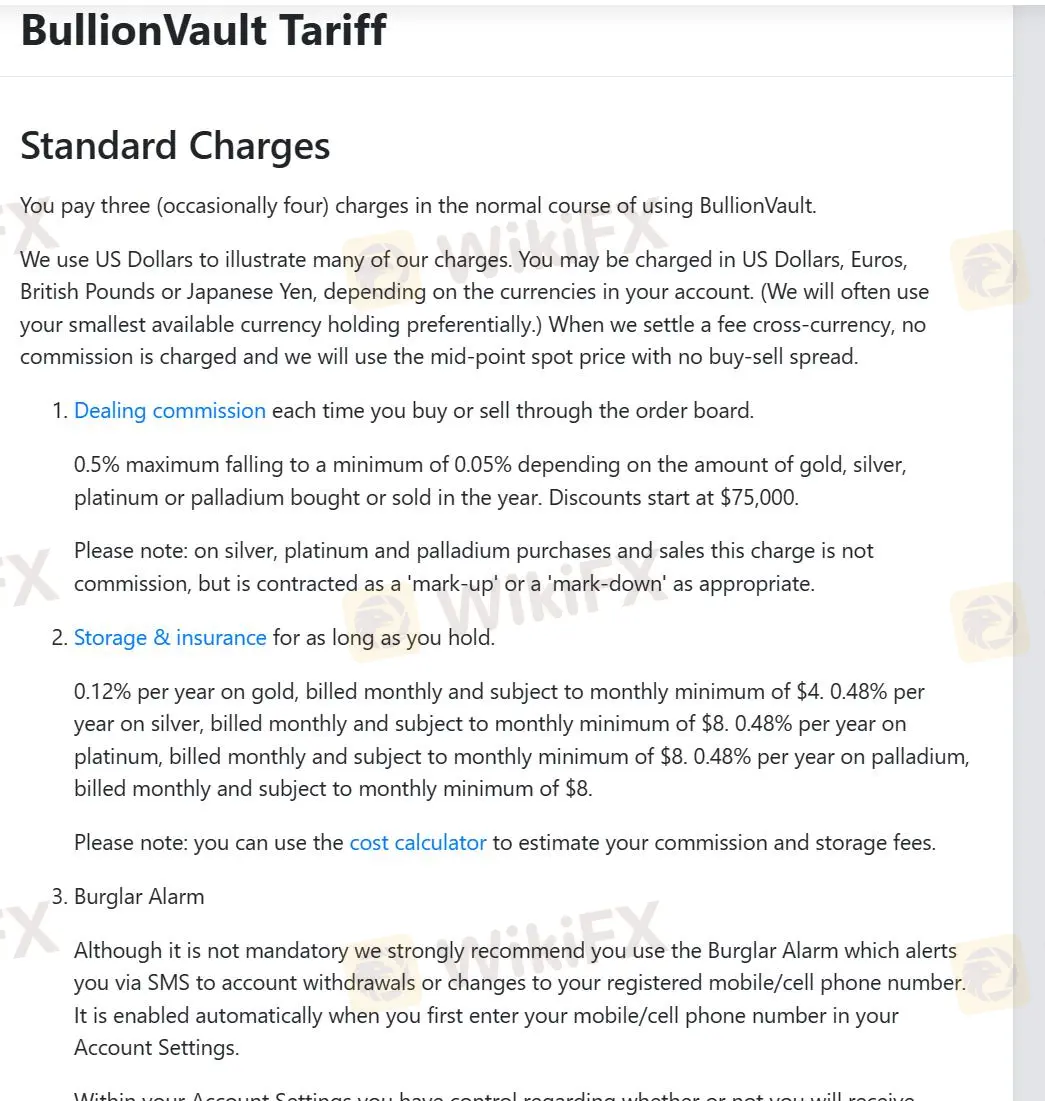

Fees

When trading precious metals like gold, silver, or platinum on their order board, clients pay a commission ranging from a maximum of 0.5% to as low as 0.05%, depending on the investment amount. This reduction in commission encourages larger investments, with rates falling notably for investments exceeding $75,000. Additionally, transactions made at the Daily Price incur a flat commission of 0.5%, with an additional 0.3% currency-switching fee for orders in British Pounds, Euros, or Japanese Yen.

Storage charges for gold are remarkably competitive, set at wholesale rates of 0.12% per annum with insurance included, translating to a minimum of $4 per month. This represents a significant saving compared to storage fees imposed by retail banks, amounting to less than a tenth of their charges.

Moreover, it's substantially lower than the annual fees typical of exchange-traded gold funds (ETFs), which usually exceed three times the rate BullionVault offers. For silver and platinum, storage charges stand at 0.48% per year, with a minimum monthly fee of $8, maintaining BullionVault's commitment to transparent and cost-effective services across all precious metals.

More details can click: https://www.bullionvault.com/help/tariff.html.

| Fee Type | Rate | |

| Trading Commission | Commission for trading precious metals on the order board. Rates vary based on investment amount, ranging from 0.5% to as low as 0.05%. | Maximum of 0.5% to as low as 0.05% |

| Daily Price Transaction Commission | Flat commission for transactions made at the Daily Price. | 0.5% |

| Currency Switching Fee | Additional fee for orders placed in British Pounds, Euros, or Japanese Yen. | 0.3% |

| Gold Storage Charge | Annual storage charge for gold, including insurance, set at wholesale rates. | 0.12% per annum |

| Silver Storage Charge | Annual storage charge for silver. | 0.48% per annum |

| Platinum Storage Charge | Annual storage charge for platinum. | 0.48% per annum |

| Minimum Monthly Storage Fee | Minimum monthly fee for storage services. | $4 for gold, $8 for silver/platinum |

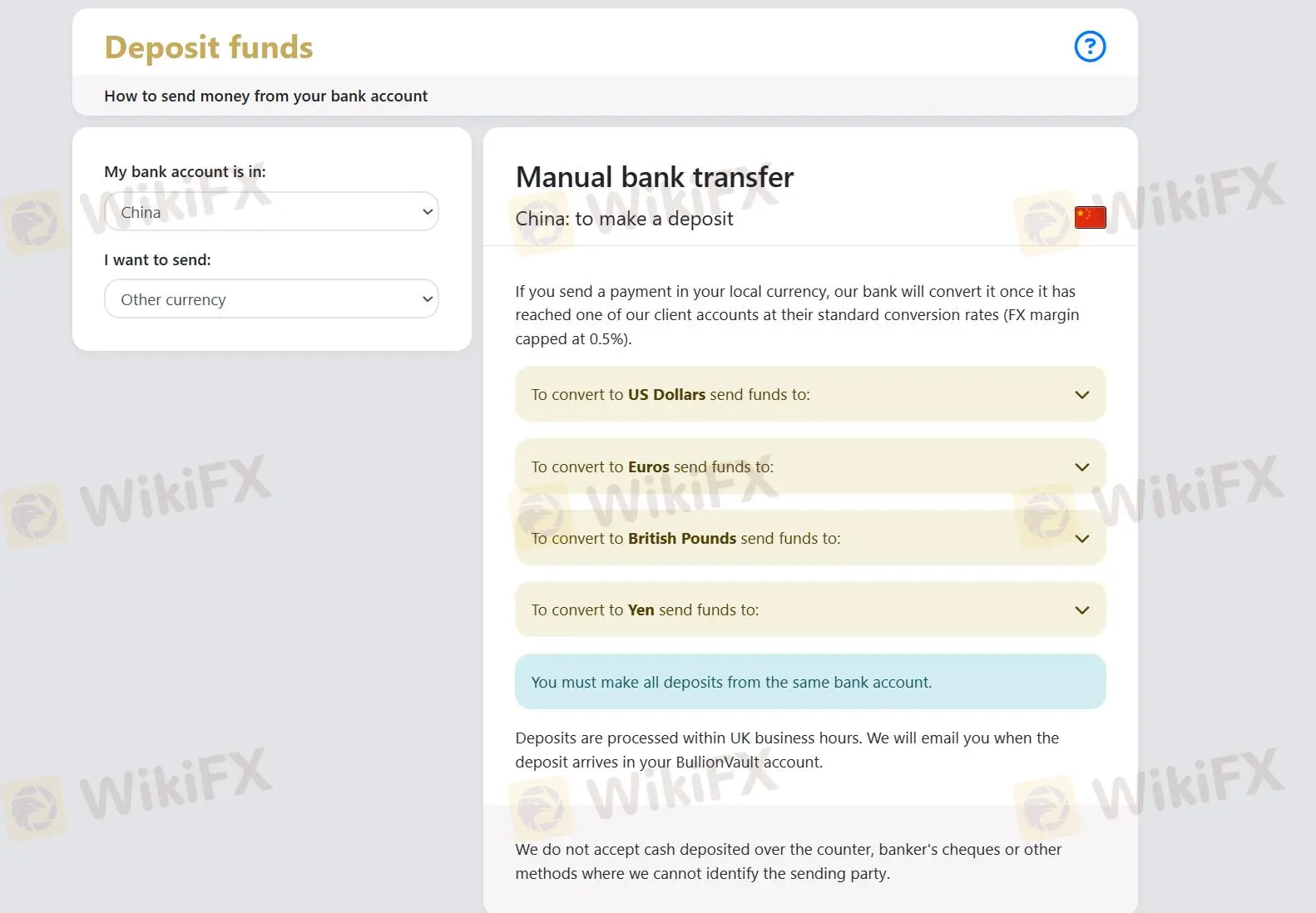

Deposits & Withdrawals

Depositing funds into BullionVault account is a straightforward process designed to ensure efficiency and security. Once you've logged into your account, you'll navigate to the “Deposit” section where you'll find instructions tailored to your region. For instance, if you're depositing funds from a bank account in China, you'll typically opt for a manual bank transfer.

BullionVault provides you with specific bank account details based on your desired currency conversion. If you're sending funds in your local currency from China, BullionVault will convert it into the desired currency upon receipt using their standard conversion rates. These rates are fair, with an FX margin capped at 0.5%, ensuring you get the best value for your money.

Upon initiating the manual bank transfer, you'll include BullionVault's provided banking details, ensuring the deposit is made from the same bank account consistently for security purposes. Deposits are processed during UK business hours.

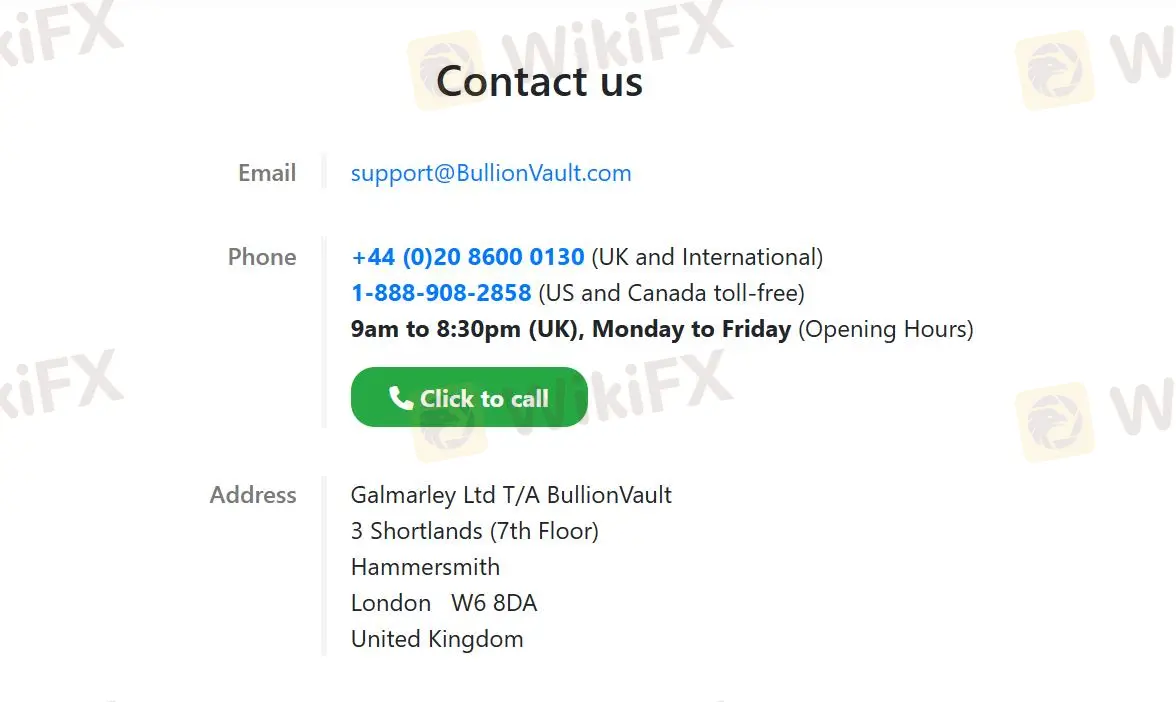

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

9am to 8:30pm (UK), Monday to Friday (Opening Hours)

Telephone: +44 (0)20 8600 0130 (UK and International)

1-888-908-2858 (US and Canada toll-free)

Email: support@BullionVault.com

Address: Galmarley Ltd T/A BullionVault, 3 Shortlands (7th Floor), Hammersmith, London, W6 8DA, United Kingdom

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, YouTube and Linkedin.

Whats more, BullionVault provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information. The FAQ section aims to address common queries and concerns that investors may have regarding the company's services, processes, and investment opportunities. By offering this resource, BullionVault aims to provide transparency and clarity to their clients, helping them make informed decision.

BullionVault offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

In conclusion, BullionVault presents itself as a platform for individuals seeking exposure to the precious metals market. It offers secure storage options and robust protective measures.

However, BullionVault operates as an unregulated entity, which can be a concern for some investors, alongside its complex fee structure and limited demo account availability.

Frequently Asked Questions (FAQs)

| Question 1: | Is BullionVault regulated by any financial authority? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | How can I contact the customer support team on BullionVault? |

| Answer 2: | You can contact via (9am to 8:30pm (UK), Monday to Friday) telephone: +44 (0)20 8600 0130 (UK and International) and 1-888-908-2858 (US and Canada toll-free), email: support@BullionVault.com, online messaging, Twitter, Facebook, YouTube and Linkedin. |

| Question 3: | Does BullionVault offer demo accounts? |

| Answer 3: | No. |

| Question 4: | What platform does BullionVault offer? |

| Answer 4: | It offers Gold App. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Courtiers WikiFX

ATFX

FOREX.com

Pepperstone

Vantage

FBS

GO MARKETS

ATFX

FOREX.com

Pepperstone

Vantage

FBS

GO MARKETS

Courtiers WikiFX

ATFX

FOREX.com

Pepperstone

Vantage

FBS

GO MARKETS

ATFX

FOREX.com

Pepperstone

Vantage

FBS

GO MARKETS

Calcul du taux de change