HERONG Futures -Some important Details about This Broker

Extrait:HERONG Futures CO., LIMITED is a professional futures company jointly financed by Bohai Securities Co. and Tianjin HeFinan Property Management Co. The controlling shareholder, Bohai Securities Co., Ltd. is a comprehensive securities company with strong influence and strength in China. The company's business scope covers commodity futures brokerage and financial futures brokerage. It is a member of five domestic futures exchanges and can provide customers with agency services for all futures trading varieties, and is one of the largest futures brokerage companies in Tianjin.CO., LIMITED is a professional futures company jointly financed by Bohai Securities Co. and Tianjin HeFinan Property Management Co. The controlling shareholder, Bohai Securities Co., Ltd. is a comprehensive securities company with strong influence and strength in China. The company's business scope covers commodity futures brokerage and financial futures brokerage. It is a member of five domestic futures exchanges an

| Attribute | Information |

| Company Name | HERONG Futures Co., Limited |

| Registered In | Tianjin, China |

| Regulated By | CFFEX |

| Years of Establishment | 2-5 years |

| Trading Instruments | Stock indices, Commodities, Forex |

| Account Types | Natural person, General unit, Specialized commodities and options |

| Minimum Initial Deposit | 500,000 yuan |

| Maximum Leverage | 1:500 |

| Minimum Spread | 0.7 pips (EUR/USD) |

| Trading Platform | BoYi Master, Esunny Polaris 9.3, Fast V2 system, etc. |

| Customer Service | 20:30 to 2:30 am, Phone and Email |

Overview of HERONG FUTURES

HERONG Futures Co., Limited is a well-established futures brokerage firm headquartered in Tianjin, China. Born from a joint venture between Bohai Securities Co. and Tianjin HeFinan Property Management Co., the company benefits from the solid reputation and financial stability of its parent companies, particularly the controlling shareholder, Bohai Securities. With its wide-reaching business scope that encompasses both commodity and financial futures, HERONG is a distinguished member of five significant domestic futures exchanges in China. By offering a comprehensive list of futures trading varieties, the company has positioned itself as a major player in the financial markets of Tianjin and beyond. This sort of breadth in offerings and robust backing lends the company a competitive edge, making it an intriguing choice for individual and institutional investors alike.

Is HERONG FUTURES legit or a scam?

HERONG Futures is a legitimate business with credible backing and a broad range of services. It holds Futures License and Regulated by CFFEX. It operates in a regulatory framework and is associated with known financial entities like Bohai Securities Co., which adds to its credibility. The company's membership in five domestic futures exchanges further underscores its legitimacy. Nonetheless, as with any financial dealings, potential clients should conduct their own research and due diligence. Regulatory checks, customer reviews, and additional third-party assessments are essential steps in verifying the authenticity and reliability of a financial services provider.

Pros and Cons

| Pros | Cons |

| Strong backing from Bohai Securities | Limited customer support hours |

| Wide range of market instruments | Potential language barriers |

| High-tech trading software | Lack of transparency on account types, leverage, and spreads |

| Comprehensive information system |

Pros:

Strong Backing: HERONG Futures enjoys robust financial and strategic backing from Bohai Securities, a leading name in the Chinese financial market. This association not only lends credibility but also provides the company with the resources to expand and innovate.

Wide Range of Market Instruments: The company offers an expansive range of market instruments, giving investors multiple avenues for investment. From stock indices like the Dow Jones to commodities, clients can diversify their portfolio effortlessly.

High-Tech Trading Software: HERONG Futures provides an array of software options to cater to diverse trading needs. Whether you are a beginner or a seasoned trader, the variety of platforms ensures you have the technology to support your trading strategies.

Comprehensive Information System: The company employs an information system that allows real-time analytics and data tracking across a multitude of markets. This feature is invaluable for investors who require immediate and precise data for better decision-making.

Cons:

Limited Customer Support Hours: With customer service only available during specific trading hours, there could be potential limitations in resolving issues or queries that occur outside of these hours.

Potential Language Barriers: The company's primary market appears to be Chinese-speaking clients. Non-Chinese speakers might face language barriers, which could be a crucial factor for global investors.

Lack of Transparency: The absence of information on topics like account types, leverage, and spreads makes it challenging for potential clients to make an informed choice. Detailed inquiries and consultations are necessary to fill in these gaps.

Market Instruments

HERONG Futures gives investors an impressive array of market instruments to choose from. With the support of their state-of-the-art information systems, clients can access real-time market information on a multitude of international and domestic financial markets. From stock indices like Dow Jones, Nasdaq, and Hang Seng to foreign exchange markets and commodities, the company provides a panoramic view of global and local investment opportunities. This widespread access enables clients to build a diversified portfolio and engage in various trading strategies.

Account Types

Herong Futures provides a range of account options to cater to diverse investment needs. The first one is for natural person investors, individual investors who wish to engage in futures trading. The account set-up process has been specifically streamlined for individuals, enabling them to effortlessly navigate the investment landscape.

The second account type caters to general unit customers, which could include companies or other forms of trade organizations. These units have unique needs that necessitate a custom approach to account set-up. Lastly, Herong Futures offers accounts for specialized commodities and options investors. These encompass a very specific aspect of trading, and the process to increase open services within these categories has been meticulously tailored. This comprehensive approach ensures that all prospective investors find an account type suited to their specific investment preferences.

How to Open an Account?

HERONG Futures offers a streamlined online process for account opening.

Step 1: Choose Your Opening Method

Mobile Users: Download the HeRong Mobile Assistant app via QR code or from the App Store.

Computer Users: Visit https://hrqh.cfmmc.com.

Step 2: Prepare Necessary Documents

Gather your valid ID, a debit card from a recognized bank, and a picture of your handwritten signature. Make sure you have a mobile phone that meets the minimum system requirements.

Step 3: Register and Upload Documents

Open the HeRong Mobile Assistant app or website, create an account, and upload the required photos and documents. Make sure to read and agree to all policies and terms.

Step 4: Verify and Assess

Choose the type of investor you are (general or professional) and complete the risk tolerance questionnaire. Perform a video verification for identity confirmation.

Step 5: Finalize and Confirm

Install your unique digital certificate, read and sign all necessary agreements, and confirm the account creation. You should now have successfully opened your futures account.

Leverage

HERONG Futures presents traders with the potential to significantly magnify their trading capital by offering leverage up to 1:500. This high leverage capacity is especially attractive for traders looking to maximize their short-term profits, although it must be approached cautiously as it equally amplifies the risks associated with trading. It's a double-edged sword; while the potential for profits is greatly expanded, so too is the risk of losses.

The actual leverage that you will be offered depends on multiple factors such as your account type and your trading experience. HERONG Futures typically conducts a suitability and risk tolerance assessment to determine an appropriate level of leverage for each client. Newer traders or those with less experience may find that they are offered lower leverage to minimize risk, typically around the 1:50 or 1:100 range.

Spreads & Commissions

HERONG Futures competes robustly in the market when it comes to spreads, particularly on popular currency pairs like EUR/USD, where the average spread stands at just 0.7 pips. This tight spread minimizes the cost of trading and is an appealing feature for scalpers and high-frequency traders who operate on thin margins. Tight spreads mean that the market has to move only slightly in your favor to start realizing a profit.

Trading Platform

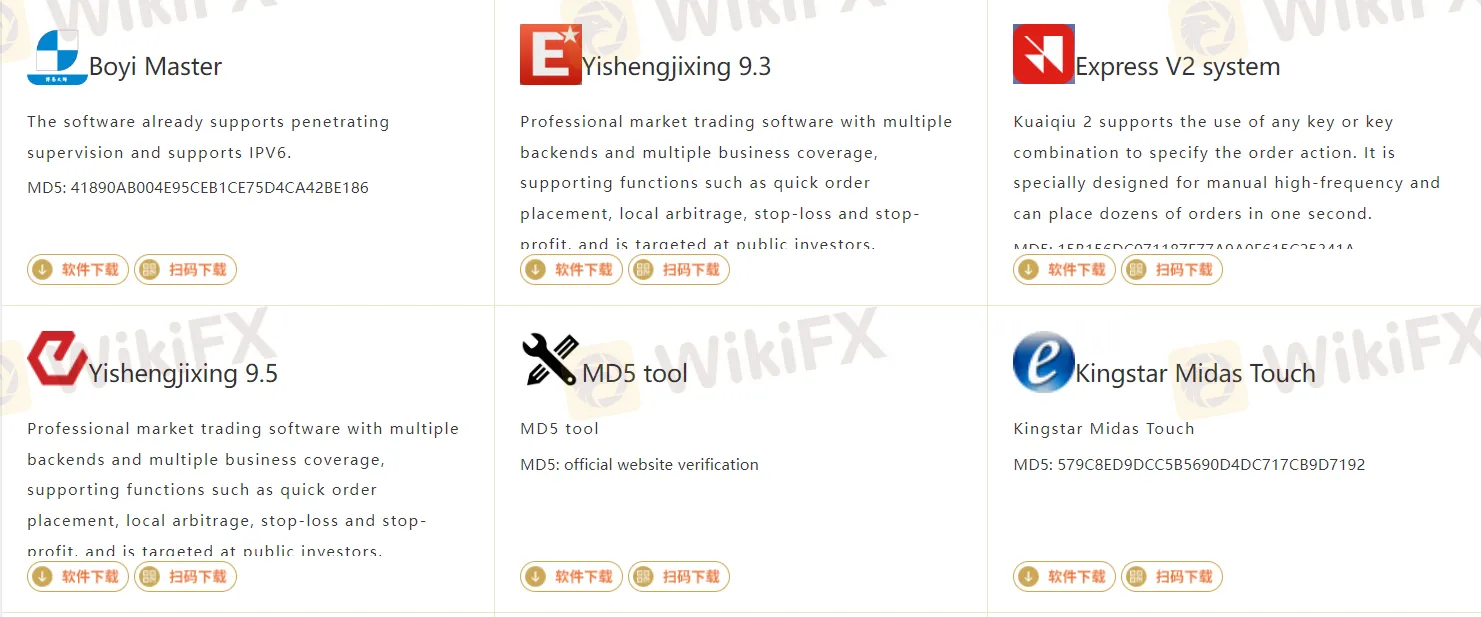

Herong Futures is a highly intuitive and advanced trading platform that supports various software for seamless trading operations. Some of the software available includes BoYi Master, Esunny Polaris 9.3, Fast V2 system, and Esunny Polaris 9.5, among others. Each of these software applications comes with their unique features designed for a specific trading operation, making them suitable for both new and experienced traders. They all also support IPV6 and have gone through penetration supervision to ensure maximum security during trades.

The BoYi Master software has explicit support for penetration supervision and supports IPV6. The Esunny Polaris 9.3 and 9.5 are professional market trading software that cover multiple backends and operations. They are designed to place orders quickly and support local arbitrage along with stop-loss and profit-stop functions. The Fast V2 system is specifically designed for manual high-frequency trading, capable of ordering dozens of times per second. Moreover, there are also platforms such as the golden point hand of Golden Shida and the exclusive IPV6 purpose software Fast V3 system.

Deposit & Withdrawal

Herong Futures maintains flexible policies regarding deposit and withdrawal for the convenience of their clients. As for deposit, there is no limitation, clients are free to deposit any amount into their trading account based on their investment plans and strategies. However, withdrawal policies are set in a way that contributes to secure and efficient management of funds. Clients can make a maximum of three withdrawals a day, with the maximum amount being 5.5 million yuan each time, and the total daily withdrawal amount capped at 50,000 yuan.

If clients wish to withdraw more than the given limits, they can apply for authorization by contacting the customer service at 022-23330983/23330986. Furthermore, the system by default maintains a minimum balance in the account. If clients wish to withdraw the entire amount in one day without making a trade, they need to apply for authorization by contacting the same number.

Customer Support

Herong Futures offers robust and reliable customer support to ensure all queries, concerns are addressed efficiently and effectively. Their services are available during trading days from 20:30 till 2:30 am. Clients can reach out to the support team through telephone at 022-59780722/59780725. Moreover, for those who prefer to communicate through written correspondence, they can send an email to hrqhgs@hrqh.com. This ensures that all inquiries are taken care of swiftly, providing optimal customer experience. For face-to-face assistance, clients can visit their officies located in Tianjin, at No. 18, Zhengzhou Road, Heping District. The specific rooms are 103, 201-1, 201-2, 302-1, and 302-2 in the Hong Kong and Macao Building.

Brokers Comparison

| Features | HERONG Futures | IronFX | OctaFX |

| Market Instruments | Multiple | Multiple | Multiple |

| Leverage | Not disclosed | Up to 1:500 | Up to 1:500 |

| Spreads | Not disclosed | From 0.7 pips | From 0.4 pips |

| Customer Support | Limited Hours | Hours 5/24 | Hours 7/24 |

Educational Resources

Herong Futures highly values investor education and provides a wealth of educational resources designed to empower and enlighten its clients. The resources include special investment education topics, animated propagandist videos, a dedicated section for anti-money laundering, extensive knowledge material on futures, legal regulations, and frequent questions. These resources aim to educate investors on investment technicalities, legalities and best practices. They also provide comprehensive insights into the futures market, aiming to equip clients with the necessary knowledge to make informed investment decisions. It is noteworthy that Herong Futures goes a step further to tackle subjects such as money laundering, projecting its commitment to ethical investment practices.

Conclusion

HERONG Futures presents as a reputable and well-backed futures brokerage firm with an extensive range of market offerings and technology platforms. It appears to be geared towards both the domestic Chinese market as well as the larger Asian financial market. However, the company does have some drawbacks, such as limited customer support hours and lack of transparency in areas like account types, leverage, and fees.

FAQs

Q: What is the maximum leverage HERONG Futures offers?

A: HERONG Futures offers leverage up to 1:500, although the actual leverage provided will depend on your account type and trading experience.

Q: What is the average spread for EUR/USD?

A: The average spread for trading the EUR/USD currency pair at HERONG Futures is 0.7 pips.

Q: How can I open an account with HERONG Futures?

A: You can open an account by either using the mobile app, HeRong Mobile Assistant, or by visiting their official website. The account opening process involves document submission, risk assessment, and verification steps.

Q: What types of market instruments does HERONG Futures offer?

A: HERONG Futures offers a broad range of market instruments including stock indices like Dow Jones and Nasdaq, commodities, and foreign exchange markets.

Q: Is customer support available 24/7?

A: No, customer support is available only during specific trading hours, from 20:30 to 2:30 am.

Q: How many withdrawals can I make in a day?

A: Clients are allowed a maximum of three withdrawals per day, with a maximum amount of 5.5 million yuan each time, and a total daily cap of 50,000 yuan.

Q: What kind of educational resources does HERONG Futures offer?

A: The firm provides a comprehensive range of educational resources, including investment education topics, videos, a section for anti-money laundering, and extensive material on futures and legal regulations.

Courtiers concernés

Courtiers WikiFX

XM

OANDA

Neex

STARTRADER

EC Markets

HFM

XM

OANDA

Neex

STARTRADER

EC Markets

HFM

Courtiers WikiFX

XM

OANDA

Neex

STARTRADER

EC Markets

HFM

XM

OANDA

Neex

STARTRADER

EC Markets

HFM

Calcul du taux de change