HengChang

Extrait:HengChang, founded 2016, is a brokerage firm that offers a wide range of tradable CFD instruments. As New Zealand's first HengChangTrader broker, they have expanded their trading platform suite to include iEx PRO, mobile trading, and a web-based version to cater to their clients' needs. However, it's important to note that HengChang currently operates without valid regulation or oversight from a government or financial authority. This lack of regulation carries inherent risks for investors.

| HengChang Review Summary | |

| Founded | 2016 |

| Registered Country/Region | New Zealand |

| Regulation | Unregulated |

| Market Instruments | Forex CFD, index CFD and so on |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/ USD Spreads | 1.0 pips (Std) |

| Trading Platforms | HengChangTrader, iEx PRO, and Mobile Trading |

| Minimum Deposit | Free |

| Customer Support | 24/5 phone, QQ, email |

What is HengChang?

HengChang, founded 2016, is a brokerage firm that offers a wide range of tradable CFD instruments. As New Zealand's first HengChangTrader broker, they have expanded their trading platform suite to include iEx PRO, mobile trading, and a web-based version to cater to their clients' needs. However, it's important to note that HengChang currently operates without valid regulation or oversight from a government or financial authority. This lack of regulation carries inherent risks for investors.

In this article, we will examine the broker's characteristics from different angles and present the information in a clear and organized manner. If you are interested, please continue reading. Towards the end of the article, we will summarize the key points so you can quickly understand the broker's characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

Pros:

- Range of Trading Instruments: HengChang offers a diverse selection of trading instruments, including Forex, Shares, Metals, Indices, and Commodities. This provides traders with various options to diversify their portfolios.

- Demo Accounts Available: HengChang offers demo accounts, allowing traders to practice their strategies and test the platform's features before committing real funds. This can be beneficial for both novice and experienced traders to gain familiarity with the platform.

- No Minimum Deposit Requirement: HengChang does not impose a minimum deposit requirement. This can be advantageous for traders who have limited initial capital or prefer to start with smaller investments.

Cons:

- Not Regulated: HengChang currently operates without valid regulation or oversight from a government or financial authority. This lack of regulation poses risks for investors, as there is no external entity monitoring the company's operations to ensure fairness and transparency.

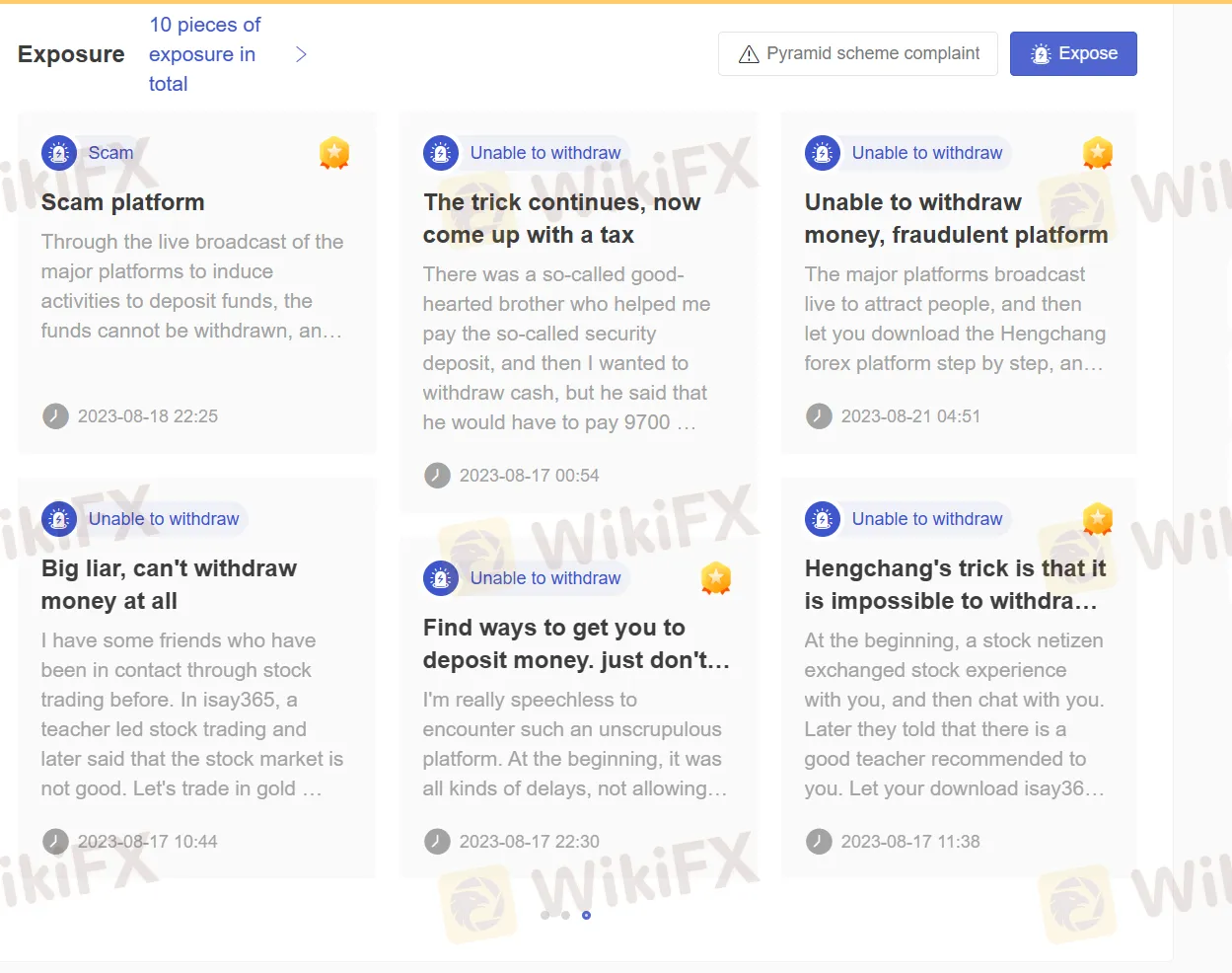

- Reports of Scam and Withdrawal Issues: There have been reports of difficulties in withdrawing funds and allegations of scams associated with HengChang. These reports raise concerns about the reliability and trustworthiness of the company.

- Not MT4 Supported: HengChang does not support the widely popular MetaTrader 4 (MT4) platform. This may be a drawback for traders who are accustomed to using MT4 or prefer its advanced features, extensive charting capabilities, and vast library of third-party plugins and indicators.

Is HengChang Safe or Scam?

Presently, HengChang operates without proper regulation, indicating the absence of government or financial authority supervision over their activities. This lack of oversight poses inherent risks when considering investing with them.

If you are contemplating an investment with HengChang, it is crucial to conduct comprehensive research and carefully evaluate the potential risks compared to the potential rewards before reaching a decision. In general, it is advisable to opt for brokers that are well-regulated to ensure the safety and protection of your funds.

Market Instruments

HengChang offers over 600 trading instruments across various asset classes. These instruments include:

- Forex CFDs: HengChang also offers Forex CFDs, which are derivative contracts that allow traders to speculate on the price movements of currency pairs without owning the underlying assets.

- Share CFDs: HengChang provides Share CFDs, which enable traders to speculate on the price movements of individual company shares. This allows traders to take advantage of both rising and falling markets.

- Indices CFDs: Similar to Share CFDs, HengChang allows traders to trade CFDs based on various indices. This means traders can speculate on the price movements of indices without owning the underlying assets.

- Metal CFDs: HengChang also offers Metal CFDs, allowing traders to trade derivative contracts based on the value of metals. This provides flexibility and accessibility to metal trading.

- Commodities: HengChang gives traders access to various commodities, such as oil, natural gas, and agricultural products. Traders can take advantage of price movements in these markets.

Account Types

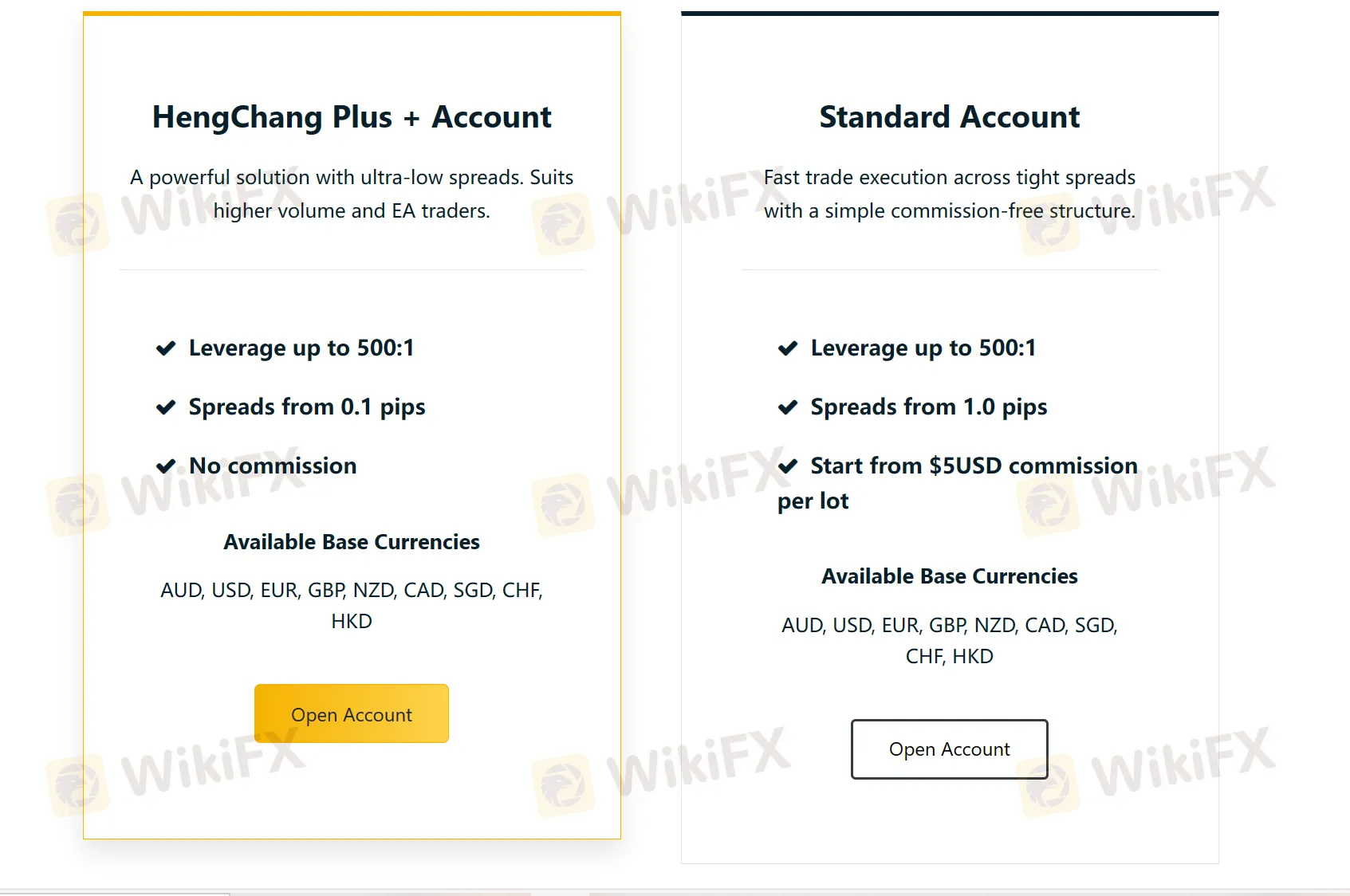

The table provides a comparison between two types of trading accounts offered by HengChang: the HengChang Plus+ Account and the Standard Account.

The HengChang Plus+ Account:

The HengChang Plus+ Account is designed for traders who require powerful solutions and offers ultra-low spreads. It is particularly suitable for higher volume traders and those who utilize Expert Advisors (EAs) in their trading strategies.

The Standard Account:

On the other hand, the Standard Account is designed to provide fast trade execution coupled with tight spreads.

HengChang also provides demo accounts for traders who want to familiarize themselves with the platform before trading with real funds. Demo accounts simulate real market conditions, which allows traders to execute trades using virtual funds.

Leverage

HengChang offers a maximum leverage of 1:500 to its traders. With a leverage, traders can potentially control a larger position in the market compared to their available capital.

High leverage ratios, such as 1:500, can offer the opportunity to make significant profits with a relatively small initial investment. For example, with a leverage of 1:500, a trader with $1,000 in their account can control positions worth up to $500,000. This amplification of trading power can be appealing to traders who aim to maximize their potential returns.

However, it is important to note that high leverage also comes with a higher level of risk. While it can increase potential profits, it can also amplify losses. If not managed properly, trading with high leverage can result in significant losses and even the complete loss of the invested capital.

Spreads & Commissions

| Account Type | HengChang Plus+ Account | Standard Account |

| Spreads | From 0.1 pips | From 1.0 pips |

| Commission | No commission | Starting from $5 USD per lot |

| Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

Trading Platforms

HengChang offers three trading platforms to cater to the varying needs of its clients: HengChangTrader, iEx PRO, and Mobile Trading.

HengChangTrader

HengChangTrader is a popular platform that has been enhanced to provide a world-class solution. It is designed to be user-friendly, catering to both new and experienced traders. The platform offers fast execution, allowing traders to seize opportunities swiftly. Advanced charting options are also available, providing in-depth analysis of market trends. Additionally, HengChangTrader supports Expert Advisors (EAs) and offers Virtual Private Server (VPS) options, providing more flexibility and automation in trading strategies.

iEx PRO

iEx PRO is a robust and intuitive platform that enables trading across multiple asset classes. It offers precise management tools through extensive price analysis capabilities. Traders can benefit from professional technical analysis tools to make informed trading decisions. Furthermore, iEx PRO supports algorithmic trading, allowing traders to automate their strategies and execute trades based on predefined rules.

Mobile Trading App

For traders who prefer to trade on the go, HengChang also offers a mobile trading app. This app provides access to the same tools, features, and fast execution as the desktop platforms - HengChangTrader and iEx PRO. It allows traders to stay connected to the markets and take advantage of trading opportunities anytime and anywhere.

User Exposure on WikiFX

Our website provides information regarding reports of difficulties in withdrawing funds and potential scams. We advise traders to thoroughly review the available information and carefully consider the risks associated with trading on an unregulated platform. Prior to engaging in any trading activities, we recommend visiting our platform to obtain relevant information. If you have come across fraudulent brokers or have personally experienced deceptive practices, please notify us in the Exposure section. Our team of experts will be grateful for your input and will make every effort to address the issue on your behalf.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +852 55076650

QQ: 1517107553

Email: service@hcangfoeffx.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram and YouTube.

Furthermore, HengChang offers a dedicated section on their website called the Frequently Asked Questions (FAQ), which aims to support their clients by addressing commonly asked questions and providing pertinent information. The FAQ section aims to cover a range of topics, including the company's services, operational processes, and available investment opportunities. By providing this resource, HengChang strives to promote transparency and provide clarity to their clients, empowering them to make well-informed decisions.

Conclusion

In conclusion, HengChang is a brokerage firm that offers a range of trading instruments and platforms to its clients. However, it is important to note that HengChang currently operates without valid regulation or oversight from a government or financial authority. This lack of regulation raises potential risks for investors, as there is no external entity monitoring and ensuring the fairness and transparency of their operations.

Frequently Asked Questions (FAQs)

| Q 1: | Is HengChang regulated? |

| A 1: | No. HengChang currently has no valid regulation. |

| Q 2: | How can traders contact the customer support team at HengChang? |

| A 2: | They can contact via telephone: +852 55076650, QQ: 1517107553 and email: service@hcangfoeffx.com. |

| Q 3: | Does HengChang offer demo accounts? |

| A 3: | Yes. |

| Q 4: | What platforms does HengChang offer? |

| A 4: | It offers HengChangTrader, iEx PRO, and Mobile Trading. |

| Q 5: | What is the minimum deposit for HengChang? |

| A 5: | It does not require minimum deposit. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Courtiers WikiFX

FXTM

ATFX

FOREX.com

FBS

HFM

FP Markets

FXTM

ATFX

FOREX.com

FBS

HFM

FP Markets

Courtiers WikiFX

FXTM

ATFX

FOREX.com

FBS

HFM

FP Markets

FXTM

ATFX

FOREX.com

FBS

HFM

FP Markets

Calcul du taux de change