SquaredFinancial

Extrait:SquaredFinancial is a globally-oriented brokerage based in Cyprus, offering a range of financial instruments and services such as Cryptocurrencies, futures, foreign exchange, energy, metal, index, Share CFDs. Despite these diverse offerings, it is critical to highlight that SquaredFinancial operates without the oversight of any acknowledged regulatory bodies.

| SquaredFinancial Review Summary in 10 Points | |

| Founded | 2023 |

| Registered Country/Region | Cyprus |

| Regulation | Unregulated |

| Market Instruments | Cryptocurrencies, futures, foreign exchange, energy, metal, index, Share CFDs |

| Demo Account | Available |

| Leverage | Dynamic leverage up to 1:500 |

| Spread | Start from 0.0 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Squared WebTrader |

| Minimum Deposit | Not disclosed |

| Customer Support | Phone, email, contact us form |

What is SquaredFinancial?

SquaredFinancial is a globally-oriented brokerage based in Cyprus, offering a range of financial instruments and services such as Cryptocurrencies, futures, foreign exchange, energy, metal, index, Share CFDs. Despite these diverse offerings, it is critical to highlight that SquaredFinancial operates without the oversight of any acknowledged regulatory bodies.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Diversified instruments | • Unregulated |

| • Demo account available | • Lack of transparency on commissions |

| • MT4/5 trading platform | • Negative reports from their client |

| • Low starting spread |

Pros:

Diversified instruments: SquaredFinancial offers a wide range of trading instruments including cryptocurrencies, futures, forex, energy, metals, indices, and share CFDs. This breadth of services allows traders to diversify their portfolios.

Demo account available: The availability of a demo account offers a risk-free environment for traders who are beginners or those who want to test their strategies before going live. It also helps users to familiarize themselves with the platforms.

MT4/5 trading platform: Having MetaTrader 4 and 5 interfaces demonstrates SquaredFinancials commitment to providing reputable and efficient trading platforms. These platforms come with superior execution capabilities and comprehensive analytical tools.

Low starting spread: Offering low spreads starting from 0.0 pips provides competitive pricing, giving traders the opportunity to potentially make more profit.

Cons:

Unregulated: The significant lack of regulatory supervision casts doubt on the brokers commitments to protecting its clients and upholding regulatory standards.

Lack of transparency on commissions: The absence of clear commission details makes it challenging for traders to calculate the true cost of their trades.

Negative reports from clients: There have been negative reports from clients. This sends a warning signal to clients about possible dissatisfaction with the broker's services.

Is SquaredFinancial Safe or Scam?

When considering the safety of a brokerage like SquaredFinancial or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Given SquaredFinancial's broad operational scope, the lack of supervision from established regulatory authorities raises significant concerns. The absence of regulatory oversight calls into question the broker's legal status and accountability.

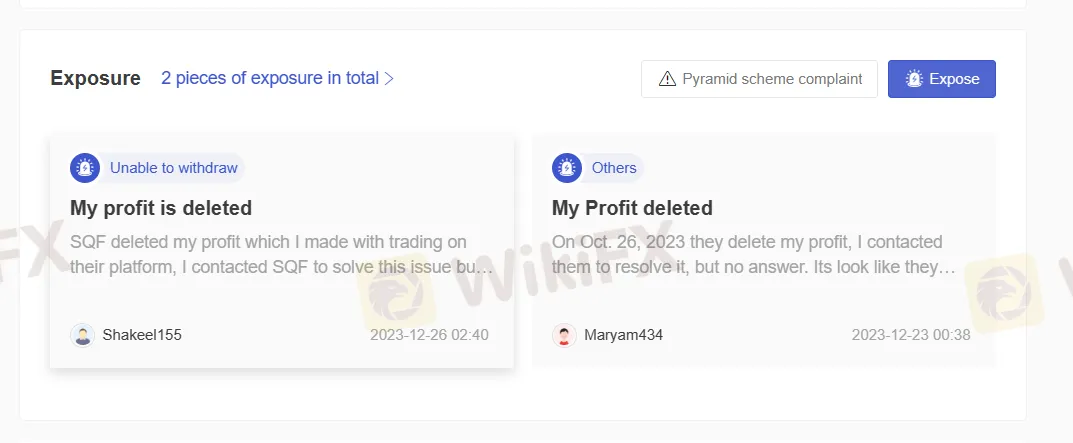

User feedback: Two reports regarding withdrawal issue and profit missing found on WikiFX raises questions about the company's operational dependability and liability which should be a red fag to interested traders.

Security measures: SquaredFinancial prioritizes client security, providing coverage in case of insolvency or bankruptcy through its London Lloyds insurance policy. It ensures full return of customer funds and offers compensation up to $1 million per client. Additionally, customer funds are securely segregated from the company's operational funds, further enhancing security.

Ultimately, the decision to trade with SquaredFinancial rests with the individual. It's important to carefully weigh the potential risks and returns before initiating any trading activities.

Market Instruments

SquaredFinancial offers its clients an extensive range of financial instruments. This includes trading in cryptocurrencies, which provide a dynamic, fluid market with immense growth potential. They also offer futures trading, a form of derivative trading that allows traders to bet on the price movements of underlying commodities. Other offerings include foreign exchange, one of the world's largest markets; energy, metal, and index CFDs for those interested in commodities and global market indices; and Share CFDs for investors willing to make predictions on individual company performance.

Accounts

SquaredFinancial offers two types of accounts to its clients. The first is a free demo account, perfect for those looking to practice their trading strategies or new traders who want to familiarize themselves with the platform. This demo account is furnished with $50,000 of virtual money, offering users a risk-free environment to explore and learn.

The second type is a live trading account, suitable for beginners through to advanced traders. The live account allows users to trade in real-time with real capital, adding a realistic dimension to the trading experience. Yet more details such as minimum deposit requirements are not available, you can contact with the broker's customer service for direct guidance and clarification.

How to Open an Account?

Visit the SquaredFinancial website.

Click the “Sign up for an account” button located on the homepage.

You will then be required to fill in certain information such as personal details and password.

You will also be required to submit identification documents for verification according to KYC (Know Your Customer) regulations.

Once the broker has verified your details, you'll be able to deposit funds and start trading.

Leverage

SquaredFinancial employs a dynamic leverage model that varies based on the financial instrument being traded and the size of the open positions.

For cryptocurrencies, leverage can go up to 1:2.

With Forex trades, leverage ranges from a maximum of 1:500 for 0 to 25 opened positions and goes down to 1:20 for over 100 positions. Depending on the number of positions, leverage for new Forex options goes from 1:100 to 1:20, while energy futures also have a dynamic leverage with a maximum of 1:100.

For precious metals, maximum leverage reduces from 1:200 to 1:50 as open positions increase.

Indices and futures follow a similar pattern with maximum leverage decreasing as position sizes increase.

For more details you can visit https://www.sqfinfx.com/?pages_15/.

Spread & Commission

SquaredFinancial offers incredibly low spreads starting from 0.0 pips, a feature that provides competitive pricing for their trading services.

However, information regarding trading commissions isn't readily available on the platform. This lack of transparency could be a drawback for some traders since the absence of clear commission details makes it challenging for them to calculate the true cost of their trades. If you are interested with this broker, contact with them directly to before commiting any

Trading Platform

SquaredFinancial offer both MetaTrader 4 and MetaTrader 5, accessible on various operating systems including iOS, Android, and Windows. They arerecognized as some of the most reputable and efficient trading platforms in the industry. These platforms come with a plethora of benefits, such as an extensive range of advanced features, superior execution capabilities and comprehensive analytical tools. They have been engineered with an emphasis on user-friendliness to enable seamless navigation and operation, significantly enhancing the trading experience.

In addition to these, SquaredFinancial offers the web-based Squared WebTrader. This proprietary platform is designed for user convenience as it requires no downloads and can be accessed from any internet-enabled device. Users can carry their trading environment with them, uninterrupted, no matter where they are. .

Deposit & Withdrawal

SquaredFinancial offers a variety of payment methods for their clients. For traditional banking lovers, bank transfer is available. This is a secure and robust method, although it usually takes more processing time.

For those who prefer card payments, they accept both Visa and Mastercard, offering a quick and efficient way to deposit or withdraw funds.

For digital enthusiasts, SquaredFinancial also accommodates crypto payments, which can be ideal considering the increasing popularity and usage of cryptocurrencies.

Lastly, for instant transfers, the broker has an Insta Transfer option, which allows for real-time transaction processing.

User Exposure

Two report on WikiFX regarding withdrawal issue and profit loss calls for traders' vigilance. Before deciding to trade with the company, we highly suggest you conduct a thorough investigation of all the pertinent information. Our platform tries to support your trading endeavors effectively. If you stumble upon dishonest brokers or have been a victim of such fraudulent, we strongly encourage you to report through our “Exposure” section. Your input is essential to our pursuit of transparency, and our skilled team will endeavor to address your reports swiftly.

Customer Service

SquaredFinancial provides multiple channels for customer support. These include email for detailed queries, phone for immediate support, a contact us form on their website that users send their request then the broker's customer service will contact the user directly.

Email: support@squaredfinancial.sc.

Phone: 002484671943.

Conclusion

In conclusion, SquaredFinancial is an international online brokerage, headquartered in Cyprus, providing a broad spectrum of trading instruments including Cryptocurrencies, futures, foreign exchange, energy, metal, indices and Share CFDs. However, given its significant lack of regulatory supervision, interested investors are strongly encouraged to proceed with great caution since the absence of regulatory oversight casts doubt on the broker's dedication to uphold regulatory standards and the security of its clients.

As a result, we recommend you to explore other brokerages that prioritize transparency, strict adherence to regulatory guidelines, and a high degree of professionalism.

Frequently Asked Questions (FAQs)

| Q 1: | Is SquaredFinancial regulated? |

| A 1: | No. The broker is currently under no valid regulations. |

| Q 2: | Is SquaredFinancial a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners because its unregulated by any recognized bodies. |

| Q 3: | Does SquaredFinancial provide the industry leading MT4/5? |

| A 3: | Yes, the broker offers both MT4 and MT5 on Window, iOS and Android devices. |

| Q 4: | Does SquaredFinancial offer a demo account? |

| A 4: | Yes. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Courtiers WikiFX

Pepperstone

Vantage

FBS

STARTRADER

IC Markets Global

ATFX

Pepperstone

Vantage

FBS

STARTRADER

IC Markets Global

ATFX

Courtiers WikiFX

Pepperstone

Vantage

FBS

STARTRADER

IC Markets Global

ATFX

Pepperstone

Vantage

FBS

STARTRADER

IC Markets Global

ATFX

Calcul du taux de change