ALB Forex

Extrait:ALB Forex, founded in 2014 and based in Turkey, offers a dynamic trading environment with access to various markets and instruments. Despite its lack of regulatory oversight, it presents a range of trading options, including currency pairs, precious metals, stocks, and indices, catering to diverse investment strategies. ALB Forex provides two main account types – VIP and Platinum – each tailored to different trader needs. The trading experience is further enhanced by the ALByatırım Mobile Application and MetaTrader 5 platform. While it offers comprehensive customer support and a suite of educational resources, potential clients must weigh the risks associated with its unregulated status.

| ALB Forex | Basic Information |

| Company Name | ALB Forex |

| Founded | 2014 |

| Headquarters | Turkey |

| Regulations | Not regulated |

| Tradable Assets | Currency pairs, precious metals, stocks, indices |

| Account Types | VIP, Platinum |

| Minimum Deposit | 50,000 Turkish Lira or equivalent in other currencies |

| Maximum Leverage | 1:10 |

| Spreads | Variable, depending on account type and market conditions |

| Commission | Not specified |

| Deposit Methods | EFT, Money Order |

| Trading Platforms | ALByatırım Mobile App, MetaTrader 5 |

| Customer Support | Phone, Email, Physical office in Istanbul |

| Education Resources | Training & Webinars, Blog, Glossary, Podcast, Stock/VIOP in 10 Questions |

| Bonus Offerings | None |

Overview of ALB Forex

ALB Forex is a Turkish-based forex broker established in 2014, offering a diverse range of financial instruments. It enables trading in over 70 currency pairs, various precious metals like gold and silver, stocks listed on the Borsa Istanbul, and several key indices. Despite providing these extensive services, ALB Forex operates without regulatory oversight, raising concerns about the safety and security of client funds and transparency in business practices. The broker offers two primary account types – VIP and Platinum – catering to different trading experiences. The VIP account is tailored for experienced traders with more competitive spreads, while the Platinum account serves as a mid-tier option. ALB Forexs trading experience is further facilitated by its user-friendly mobile application and the advanced MetaTrader 5 platform. Additionally, it provides educational resources like webinars and a blog, but potential clients should be cautious of the inherent risks involved in trading with an unregulated broker.

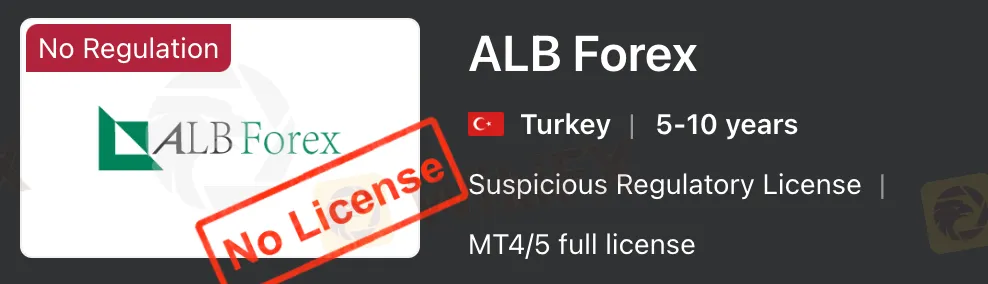

Is ALB Forex Legit?

ALB Forex is not regulated, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like ALB Forex, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

ALB Forex presents a mix of advantageous features and significant drawbacks. On the positive side, the platform offers a diverse range of trading instruments, including various currency pairs, precious metals, stocks, and indices. This diversity caters to traders with different investment preferences and strategies. Additionally, ALB Forex provides advanced and user-friendly trading platforms, such as the ALByatırım Mobile Application and MetaTrader 5, which enhance the overall trading experience. The broker also offers comprehensive educational resources, including webinars, blogs, and podcasts, which are beneficial for both novice and experienced traders in enhancing their market knowledge and trading skills. Furthermore, ALB Forex's customer support is readily accessible, offering assistance through multiple channels including phone, email, and a physical office.

However, a significant drawback of ALB Forex is its unregulated status, which raises concerns about the safety and security of client funds and the transparency of its business practices. The lack of regulatory oversight implies potential risks, particularly in terms of limited transparency and avenues for dispute resolution. This absence of regulation may deter some traders, especially those who prioritize security and regulatory compliance in their trading activities.

| Pros | Cons |

|

|

|

|

|

|

|

Trading Instruments

ALB Forex, operating under ALB Investment, offers a diverse range of trading instruments, catering to various investment styles and strategies.

Currency Pairs

ALB Forex provides traders with the opportunity to trade in more than 70 currency pairs. This extensive range includes major, minor, and exotic pairs, allowing traders to engage in the dynamic and potentially lucrative Forex market.

Precious Metals

Investors at ALB Forex can trade in precious metals, including gold and silver. These assets are often sought after as safe-haven investments and can be a crucial part of a diversified trading portfolio.

Stocks

ALB Forex offers its clients the chance to trade company stocks listed on Borsa Istanbul. This opens up opportunities for investors to participate in the equity market, diversifying their investment across various sectors.

BIST Indices

Traders can engage with various indices from the Borsa Istanbul, such as BIST100, BIST50, and BIST30. These indices provide a comprehensive overview of the Turkish stock market's performance, offering exposure to a broad market segment.

VIOP (Futures and Options Exchange)

ALB Forex allows investment in Futures (VIOP) and Options Exchange. This platform gives traders the chance to speculate on the future price movements of various instruments, including commodities and indices, and to use options strategies.

Options and Warrants

The platform also supports trading in options and warrants. These instruments enable traders to make investments based on their market predictions, turning risk into potential advantages. Warrants, in particular, offer profit opportunities whether the market is rising or falling.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | ALB Forex | RoboForex | FxPro | IC Markets |

| Forex | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| CFD | No | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | Yes |

| Options | Yes | No | Yes | No |

Account Types

ALB Forex offers two distinct account types tailored to different trader profiles: VIP and Platinum. Each account type comes with its own set of features and conditions, catering to the varying needs and strategies of traders.

VIP Account

The VIP account is designed for more experienced traders or those who intend to trade with larger volumes. This account type typically offers more competitive spreads and may include additional benefits such as lower transaction costs, personalized customer service, and access to more in-depth market analysis and tools. The VIP account is suitable for those who are looking for a more tailored trading experience with potentially lower trading costs, which can be crucial for high-volume trading.

Platinum Account

The Platinum account, on the other hand, is geared towards traders who are looking for an upgrade from the standard account offerings but may not yet be ready to commit to the volume typically associated with VIP accounts. The Platinum account usually offers better conditions than standard accounts, including tighter spreads than those available to average retail traders. It is a good middle-ground option for those seeking enhanced trading conditions without the commitment required for a VIP account.

How to Open an Account?

To open an account with ALB Forex, follow these steps.

Visit the ALB Forex website. Look for the “REGISTER” button on the homepage and click on it.

2. Sign up on websites registration page.

3.Receive your personal account login from an automated email

4.Log in

5.Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

ALB Forex offers its clients the flexibility to trade with varying degrees of leverage, including the option to engage in trading without using any leverage at all. This flexibility is particularly beneficial for traders with different risk appetites and trading strategies.

The platform allows traders to utilize leverage up to 1:10, meaning they can potentially control a large position with a relatively small amount of invested capital. This level of leverage can amplify both profits and losses, making it a powerful tool for traders who understand and can manage the associated risks.

Alternatively, ALB Forex also provides the option to trade without any leverage. This approach suits traders who prefer to limit their risk exposure and are more comfortable trading directly with their own capital without the amplification effect of leverage.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | ALB Forex | IG Group | VantageFX | RoboForex |

| Maximum Leverage | 1:10 | 1:30 | 1:500 | 1:2000 |

Spreads and Commissions

ALB Forex offers detailed spread and swap conditions for its trading instruments, tailored to meet the needs of various traders. The spread and swap values are specific to each currency pair and account type.

For example, the EURUSD pair has a spread of 13 for VIP accounts and 10 for Platinum accounts, with swap rates of -8.00 USD for long positions and 3.00 USD for short positions. Similarly, for the USDTRY pair, the spread is set at 6 for VIP and 5 for Platinum accounts, with the swap rates being -3,600.00 TRY for long positions and 700.00 TRY for short positions. The EURTRY pair follows the same spread structure as USDTRY, but with swap rates of -4,000.00 TRY for long positions and 900.00 TRY for short positions.

Other pairs like GBPUSD and USDJPY also have their distinct spread and swap values. For instance, the GBPUSD pair has a spread of 18 for VIP and 15 for Platinum accounts, with swap rates of -3.00 USD for long positions and 0.00 USD for short positions. The USDJPY pair offers a spread of 14 for VIP and 11 for Platinum, with swap rates of 1,000.00 JPY for long positions and -3,000.00 JPY for short positions.

Additionally, ALB Forex provides dynamic spreads for certain currency pairs, adjusting in real-time based on market conditions. This approach ensures that traders experience spread values that reflect the current market situation, particularly during times of volatility or major economic events.

Deposit & Withdrawal

ALB Forex provides its clients with efficient and reliable methods for depositing and withdrawing funds, primarily focusing on electronic fund transfers (EFT) and money order transactions.

EFT and Money Order Transfers

Clients can conduct their financial transactions, including deposits and withdrawals, through EFT and money order transfers. These services are available five days a week, aligning with standard business days. This provision ensures that traders can manage their funds effectively, with the flexibility to respond to market changes or personal liquidity needs promptly.

Minimum Deposit Requirement

For opening an account with ALB Forex, there is a minimum deposit requirement. The required minimum amount to open an account is 50,000 Turkish Lira (TRY) or its equivalent in other currencies. This threshold is set to ensure that clients are adequately capitalized to engage in trading activities, taking into consideration the risks and potential requirements of forex trading.

Trading Platforms

ALB Forex offers its clients a versatile and accessible trading experience through two main platforms: the ALByatırım Mobile Application and MetaTrader 5.

ALByatırım Mobile Application

The ALByatırım Mobile Application is designed to cater to traders who prefer the convenience and mobility of trading on their smartphones. This app is available for download from both the Apple iOS and Google Android markets, ensuring wide accessibility across various devices. The mobile platform emphasizes ease of use and allows traders to access and trade in all markets from a single, integrated platform. This approach aligns with the needs of modern traders who require the flexibility to manage their trading activities on the go.

MetaTrader 5

ALB Forex also provides its clients with access to MetaTrader 5 (MT5), a widely recognized and powerful trading platform in the forex and CFD trading community. MT5 is known for its advanced technical analysis tools, sophisticated charting capabilities, and the ability to automate trading strategies through Expert Advisors (EAs). The platform caters to both novice and experienced traders, offering a comprehensive suite of tools and features for detailed market analysis and effective trading execution.

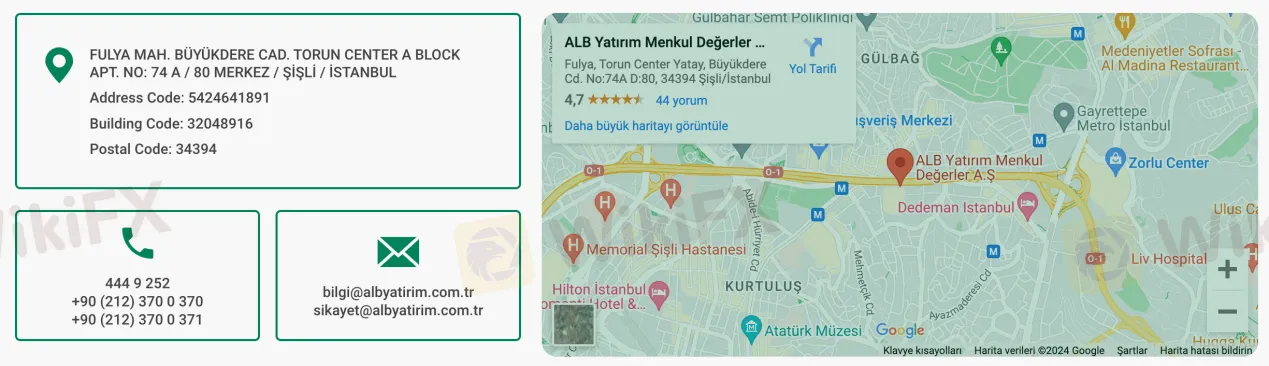

Customer Support

ALB Forex provides comprehensive customer support to address the queries and concerns of its clients. The support system is designed to be accessible and responsive, ensuring that traders receive timely assistance.

Physical Address

Clients have the option to visit ALB Forex's physical location for in-person assistance. The office is situated at Fulya Mah. Büyükdere Cad. Torun Center A Block Apt. No: 74 A / 80, Merkez / Şişli / İstanbul, Turkey. This presence provides a tangible point of contact for clients who prefer face-to-face interactions or have complex issues that might be better resolved in person.

Contact Numbers

ALB Forex offers multiple telephone lines for client support:

- A local Turkish number: 444 9 252

- Two additional lines: +90 (212) 370 0 370 and +90 (212) 370 0 371

These lines enable clients to reach out directly and discuss their queries or concerns with a representative.

Email Support

For clients who prefer digital communication or require written documentation of their interactions, ALB Forex provides two email addresses:

- General inquiries: bilgi@albyatirim.com.tr

- Complaints and issues: sikayet@albyatirim.com.tr

These email channels ensure that clients have a formal avenue for communication, be it for general information or specific concerns.

Educational Resources

ALB Forex provides a comprehensive range of educational resources designed to enhance the knowledge and skills of traders at all levels. These resources are aimed at offering both foundational and advanced insights into various aspects of trading and financial markets.

Training & Webinars

ALB Forex offers training sessions and webinars that cover a broad spectrum of topics. These sessions are likely to include introductions to trading basics, as well as more complex subjects like technical and fundamental analysis. The webinars provide an interactive platform for traders to learn from experts and get answers to their queries in real-time.

Blog

Their blog serves as a valuable educational tool, featuring articles on a wide range of topics relevant to trading. These posts may include market analyses, tips on trading strategies, and updates on financial news and trends, providing traders with regular insights into the trading world.

Glossary of Terms

Understanding the jargon of the financial markets is crucial for every trader. ALB Forex offers a glossary of terms, which is a handy resource for beginners to familiarize themselves with common trading terms and concepts, thereby enhancing their comprehension of market discussions and analyses.

Podcast

ALB Forex also provides educational content in the form of podcasts. These podcasts are likely to cover various aspects of trading and investment, offering traders the flexibility to learn on the go. Podcasts can be a great way to stay updated with market trends and learn from trading experts.

Stock/Viop in 10 Questions

This unique resource seems to offer concise answers to commonly asked questions about stock trading and VIOP (Futures and Options Exchange). It's an excellent way for traders to quickly grasp the essential aspects of these trading instruments.

Conclusion

ALB Forex, established in Turkey in 2014, offers a robust trading environment with a diverse range of instruments and advanced trading platforms like MetaTrader 5 and its mobile application. The broker caters to various trader needs with comprehensive educational resources and accessible customer support. However, its unregulated status casts a shadow over its offerings, raising concerns about fund safety, operational transparency, and dispute resolution. This lack of regulation is a critical factor for potential clients to consider, alongside the platform's diverse trading options and educational support.

FAQs

Q: Is ALB Forex regulated by any financial authority?

A: No, ALB Forex is not regulated by any recognized financial regulatory authority.

Q: What types of instruments can I trade with ALB Forex?

A: ALB Forex offers trading in currency pairs, precious metals, stocks, and indices.

Q: What is the minimum deposit required to open an account with ALB Forex?

A: The minimum deposit is 50,000 Turkish Lira or its equivalent in other currencies.

Q: What trading platforms does ALB Forex offer?

A: ALB Forex offers the ALByatırım Mobile Application and MetaTrader 5.

Q: What leverage does ALB Forex offer?

A: ALB Forex offers leverage up to 1:10.

Courtiers WikiFX

FBS

TMGM

AvaTrade

FXTM

Neex

FOREX.com

FBS

TMGM

AvaTrade

FXTM

Neex

FOREX.com

Courtiers WikiFX

FBS

TMGM

AvaTrade

FXTM

Neex

FOREX.com

FBS

TMGM

AvaTrade

FXTM

Neex

FOREX.com

Calcul du taux de change