R.J. O’Brien

Extrait:R.J. O’Brien, founded in 1914 and headquartered in Canada, is a distinguished provider in the futures trading industry. As a regulated entity under the Canadian Investment Regulatory Organization, it offers a robust suite of financial products and services including futures, over-the-counter trading, and comprehensive brokerage solutions. The firm is known for its extensive array of trading platforms designed to cater to various trading preferences and its commitment to providing educational resources to enhance trading expertise. Despite its long-standing reputation, potential clients should consider all aspects of its offerings, especially its regulatory status and the breadth of its services.

| R.J.O‘Brien | Basic Information |

| Company Name | R.J.O’Brien |

| Founded | 1914 |

| Headquarters | Canada |

| Regulations | Regulated by the Canadian Investment Regulatory Organization |

| Products and Services | Futures brokerage, OTC trading, clearing services, management solutions |

| Trading Platforms | WebOE, CQG Trader, TT X_Trader, T4, CME ClearPort, ICE Platform |

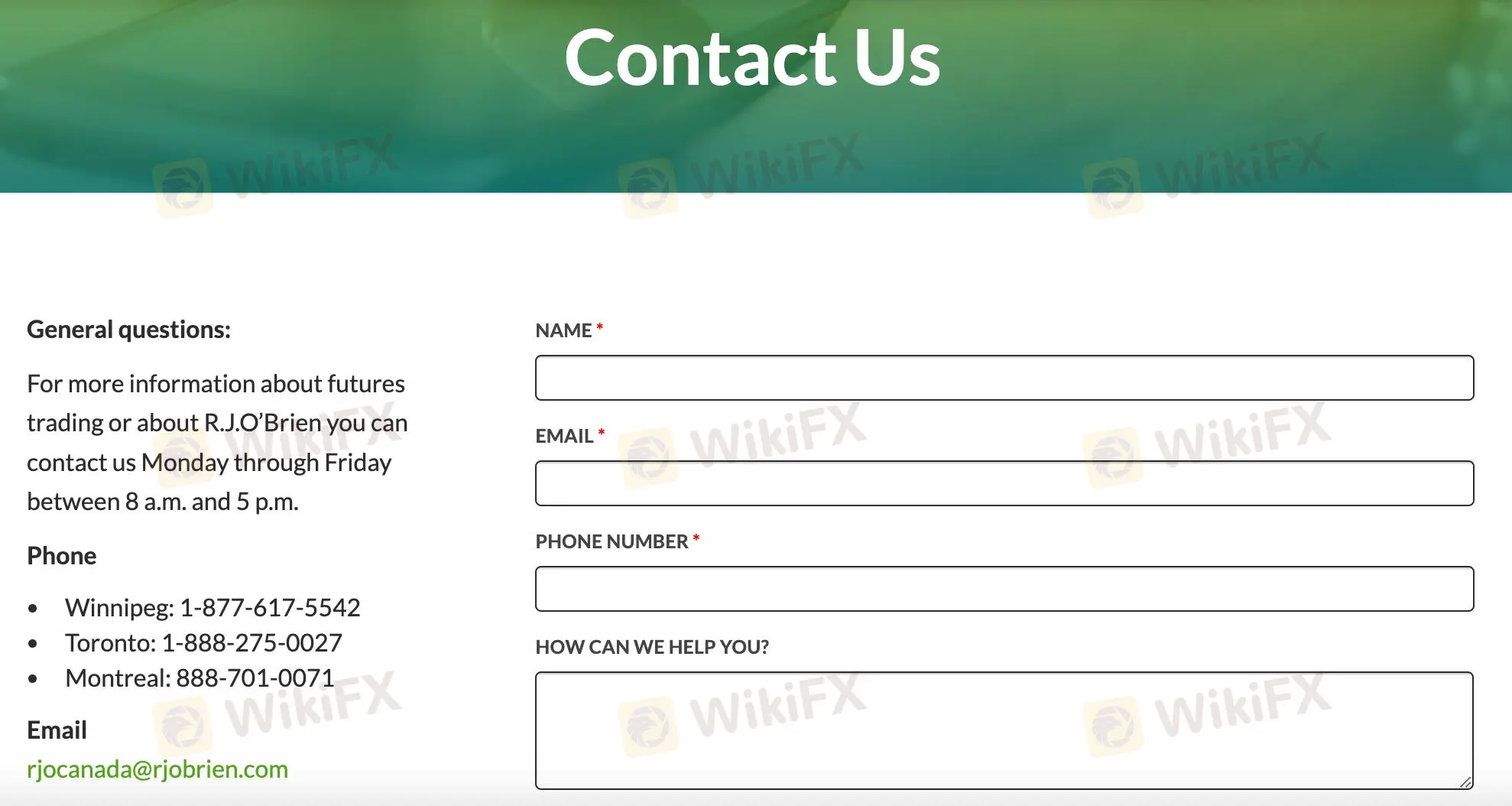

| Customer Support | Phone and email support(rjocanada@rjobrien.com); specific contacts for Winnipeg(1-877-617-5542), Toronto(1-888-275-0027), and Montreal(888-701-0071) |

| Education Resources | Real-time quotes, futures charts, symbols list, margin requirements, etc. |

Overview of R.J.OBrien

R.J. O‘Brien is a premier futures brokerage firm, leveraging over a century of experience to provide advanced trading solutions and extensive client support. It offers a comprehensive range of trading platforms, including WebOE, CQG Trader, and others, each designed to meet specific trader needs from casual to professional. Additionally, it enriches client engagement through a detailed suite of educational tools, focusing on futures and options trading. Regulated by Canadian authorities, R.J. O’Brien commits to high standards of compliance and operational integrity, offering a secure and reliable trading environment.

Is R.J.OBrien Legit?

R.J.O'Brien is regulated by the Canadian Investment Regulatory Organization as a Market Making (MM) entity in Canada. Although the specific license number has not been released, its status as a regulated firm ensures that it operates under the compliance guidelines set by Canadian regulatory authorities.

Pros and Cons

R.J. OBrien, with its established pedigree dating back to 1914 and robust regulation by Canadian authorities, presents a secure and authoritative platform for futures and OTC trading. The firm caters to a variety of trading preferences with an extensive array of specialized platforms like WebOE, CQG Trader, and TT X_Trader, each designed to enhance trading efficiency and effectiveness. Additionally, R.J. OBrien places a strong emphasis on trader education, offering a wealth of resources to aid clients in navigating complex market dynamics. However, the focus primarily on futures and OTC might limit options for those interested in other types of trading. Moreover, the variety of advanced trading platforms, while beneficial to experienced traders, could be daunting for newcomers to the trading scene.

| Pros | Cons |

|

|

|

|

|

|

Products and Services

R.J.OBrien offers a comprehensive range of products and services tailored for futures trading. These include futures brokerage services, efficient execution of trades, over-the-counter (OTC) trading options, and clearing services. Additionally, they provide facilities management and advanced trading technology solutions to support their clients' trading needs.

How to Open an Account

To open an account with R.J.OBrien, follow these steps.

Visit the R.J.OBrien website. Look for the “Open Account” button on the homepage and click on it.

Look for the “APPLY ONLINE” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

Trading Platforms

R.J. OBrien offers multiple trading platforms, each catering to different trader needs:

1. WebOE: A web-based application that connects traders to global futures markets without the need for software installation. It features a dynamic user interface, depth of market views, real-time quotes, and integrated risk management tools. It supports various markets including CME Group and ICE.

2. CQG Trader: Provides reliable market data and electronic trading primarily for quote and trading execution without technical analysis tools. It offers high-speed data, multiple chart styles, comprehensive risk management, and portfolio monitoring capabilities.

3. TT X_Trader: Targets serious traders, allowing simultaneous multi-market trading from one customizable screen. Features include single-click execution, MD Trader ladder, comprehensive order management, and integrated charting and analytics.

4. T4: Offers extensive customization for professional traders including real-time updates, a versatile charting package, multiple layout capabilities, and advanced order types. It also supports API for custom functionality.

5. CME ClearPort: Focuses on OTC transactions with features like risk mitigation through counterparty risk sharing, real-time trade confirmations, and efficient straight-through processing.

ICE Platform: An all-in-one solution for accessing both futures and OTC energy markets. Features include single-click trading, seamless Excel integration, real-time P&L tracking, and sophisticated spread implication engines.

Customer Support

R.J. OBrien offers customer support for general inquiries about futures trading and other services. Support is available Monday through Friday from 8 a.m. to 5 p.m. Customers can contact via phone with dedicated lines for Winnipeg (1-877-617-5542), Toronto (1-888-275-0027), and Montreal (888-701-0071). Emails can be sent to rjocanada@rjobrien.com.

Educational Resources

R.J. O‘Brien provides a comprehensive set of educational resources tailored for futures and options trading. These resources include real-time quotes, detailed futures charts, a complete symbols list, margin requirements, economic indicators, a futures calendar, a glossary of trading terms, exchange codes, and a learning center designed to enhance traders’ knowledge and trading skills.

Conclusion

R.J. O‘Brien stands out in the futures trading market with its comprehensive service offerings, multiple trading platforms tailored for diverse trading strategies, and a strong regulatory framework. While it provides significant advantages through its established history and educational resources, potential traders should consider their specific needs and compatibility with the platforms offered. The firm’s commitment to regulatory standards and client education underscores its dedication to maintaining a secure and enriching trading environment.

FAQs

Q: What regulatory body oversees R.J. O‘Brien’s operations?

A: R.J. OBrien is regulated by the Canadian Investment Regulatory Organization, ensuring compliance with the financial standards and practices mandated by Canadian authorities.

Q: What types of trading services does R.J. OBrien offer?

A: R.J. OBrien specializes in futures trading and offers related services including brokerage, OTC trading, and clearing solutions.

Q: How can I start trading with R.J. OBrien?

A: To begin trading, visit their website, register for an account online, and follow the steps to complete your registration and start trading.

Q: What educational resources does R.J. OBrien provide?

A: The firm offers a variety of educational materials including real-time market data, trading charts, and a comprehensive learning center focusing on futures and options.

Q: What are the trading platforms available at R.J. OBrien?

A: R.J. OBrien offers several platforms like WebOE, CQG Trader, and TT X_Trader, each designed to support different trading preferences and requirements.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.

Courtiers WikiFX

ATFX

GO MARKETS

TMGM

EC Markets

Pepperstone

Vantage

ATFX

GO MARKETS

TMGM

EC Markets

Pepperstone

Vantage

Courtiers WikiFX

ATFX

GO MARKETS

TMGM

EC Markets

Pepperstone

Vantage

ATFX

GO MARKETS

TMGM

EC Markets

Pepperstone

Vantage

Calcul du taux de change