SmartFX

एब्स्ट्रैक्ट: SmartFX, which was created in 1995 and is based in Vanuatu, claims to be a forex and CFD broker, but it is actually a shady clone that makes false claims about its regulatory status. It has more than 2,000 instruments on the MT5 platform and high leverage of up to 1:400. It also has competitive spreads and both live and demo accounts. However, traders should be careful because it is not clear what its regulatory status is.

| SmartFX Review Summary | |

| Founded | 1995 |

| Registered Region | Vanuatu |

| Regulation | CySEC/VFSC (Suspicious clone) |

| Market Instruments | Forex, Commodities, Indices, Stocks, Futures |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| EUR/USD Spread | 1.2 pips |

| Trading Platform | MetaTrader 5 (MT5) |

| Minimum Deposit | / |

| Customer Support | Live Chat |

| Phone: +971 4431 9003 | |

| Email: support@smartfx.com | |

SmartFX Information

SmartFX, which was created in 1995 and is based in Vanuatu, claims to be a forex and CFD broker, but it is actually a shady clone that makes false claims about its regulatory status. It has more than 2,000 instruments on the MT5 platform and high leverage of up to 1:400. It also has competitive spreads and both live and demo accounts. However, traders should be careful because it is not clear what its regulatory status is.

Pros and Cons

| Pros | Cons |

| Wide range of tradable instruments | Suspicious clone liscences |

| MT5 platform available | Minimum deposit unclear |

| Demo accounts available | |

| No deposit/withdrawal fees |

Is SmartFX Legit?

SmartFX is a suspicious clone broker using fake licenses. It falsely claims regulation under CySEC and VFSC, but the official CySEC license (No. 316/16) belongs to SSC Smart FX Ltd with a different website and contact details, and the VFSC license (No. 40491) belongs to SMART SECURITIES & COMMODITIES LIMITED, with no matching domain or company details.

| Regulated by | Licensed Institution | License Type | License Number | Regulatory Status |

| Cyprus Securities and Exchange Commission (CySEC) | SSC Smart FX Ltd | Straight Through Processing (STP) | 316/16 | Suspicious clone |

| Vanuatu Financial Services Commission (VFSC) | SMART SECURITIES & COMMODITIES LIMITED | Retail Forex License | 40491 | Suspicious clone |

What Can I Trade on SmartFX?

SmartFX provides an array of tradable products, such as forex, commodities, indices, equities, and futures, but does not offer cryptocurrency or ETFs.

| Tradable Instrument | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Equities | ✔ |

| Futures | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

SmartFX has a single live account type (Smart Account) and a demo account option. It makes no mention of offering Islamic accounts. The Smart Account is designed for both new and experienced traders, with competitive spreads, access to over 2,000 instruments, and leverage of up to 1:400.

Leverage

On its Smart Account, SmartFX gives you leverage of up to 1:400. High leverage can make potential returns bigger, but it also makes the chance of big losses much higher, especially in markets that change quickly. Traders should be careful when using it.

SmartFX Spreads

SmartFX's rates are generally in line with what other companies in the industry charge. For example, its primary Smart Account has low spreads and no extra commissions.

| Currency Pair | Spread |

| EUR/USD | 1.2 pips |

| GBP/USD | 2.2 pips |

| USD/CHF | 2 pips |

| EUR/GBP | 2.2 pips |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, iOS, Android | Experienced traders |

| MetaTrader 4 (MT4) | ❌ | / | Beginners |

Deposit and Withdrawal

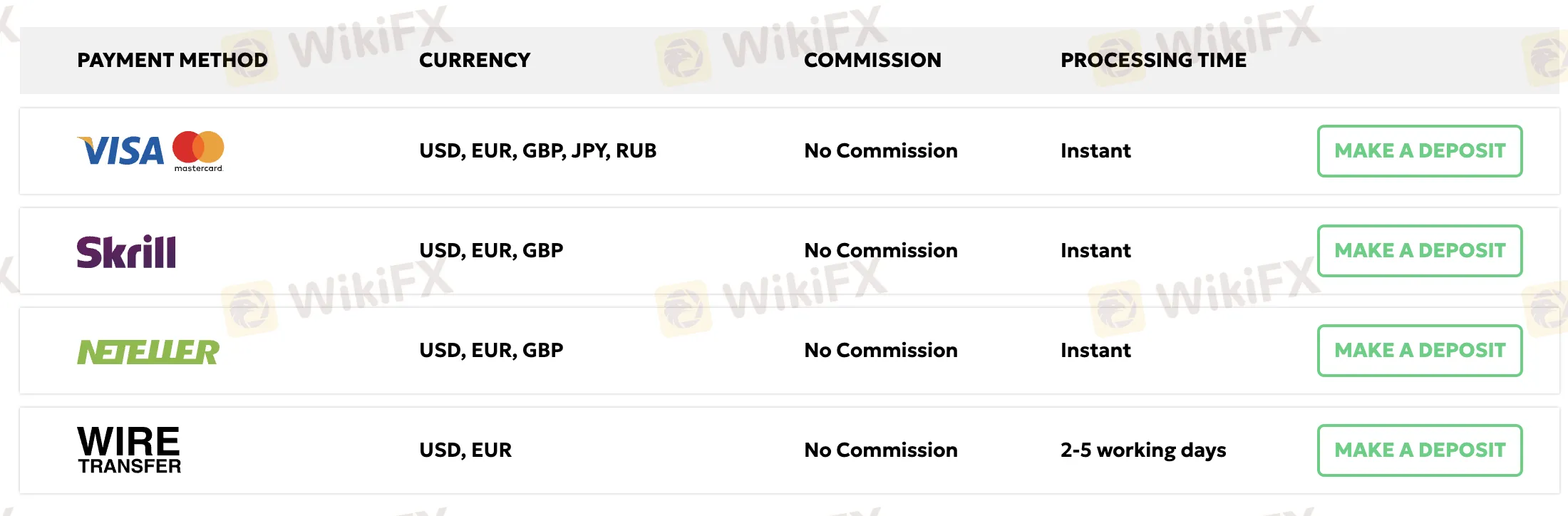

SmartFX doesn't impose fees for deposits or withdrawals, but international banks might. It's not clear what the minimum deposit is.

| Payment Method | Accpted Currencies | Fees | Deposit Processing Time | Withdrawal Processing Time |

| Credit Card | USD, EUR, GBP, JPY, RUB | 0 | Instant | 1–3 hours approval, transfer after approval |

| Skrill | USD, EUR, GBP | |||

| Neteller | ||||

| Wire Transfer | USD, EUR | 2–5 business days | 1–3 hours approval, 2–3 business days for transfer |

WikiFX ब्रोकर

रेट की गणना करना