Gapstock

एब्स्ट्रैक्ट:Gapstock is an offshore broker registered in Australia. It offers account with a minimum deposit of $250. However, since its website is currently inaccessible, details about market instruments and trading fees are currently inaccessible. And most importantly, the broker lacks legal regulation from any official regulatory institution.

Note: Gapstock's official website: https://gapstock.com/ is currently inaccessible normally.

| Gapstock Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Australia |

| Regulation | Not regulated |

| Market Instruments | / |

| Demo Account | ❌ |

| Leverage | 1:200 |

| Spreads | From 3 pipis |

| Trading Platform | Web-based platform |

| Min Deposit | $250 |

| Customer Support | Email: support@gapstock.com |

| Phone: +44 2080976219 | |

Gapstock is an offshore broker registered in Australia. It offers account with a minimum deposit of $250. However, since its website is currently inaccessible, details about market instruments and trading fees are currently inaccessible. And most importantly, the broker lacks legal regulation from any official regulatory institution.

Pros and Cons

| Pros | Cons |

| None | No Legal regulation |

| Limited info on trading fees | |

| Unavailable website | |

| Lack of transparency | |

| No demo accounts | |

| High minimum deposit |

Is Gapstock Legit?

Gapstock holds no legal license. It also fails to specify its physical location. Such a broker, unable to provide an address, will not obtain a license in most regulatory institutions. In addition, the domain of this broker was registered on August 29, 2023, and expired on August 29, 2024.

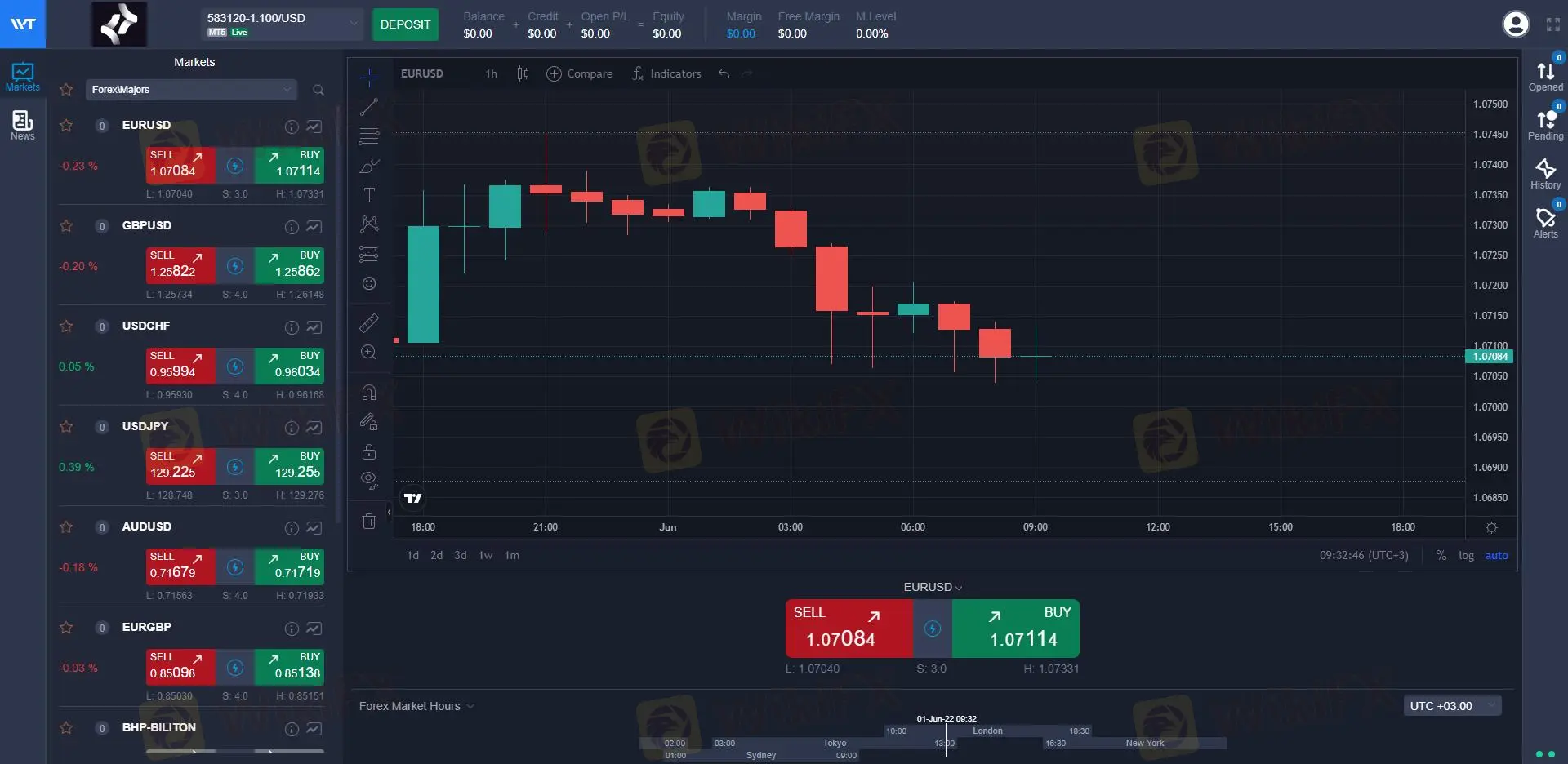

Trading Platform

GapStock provides a web-based trading software with almost no charting and analysis capabilities, and offers fewer additional tools. Therefore, we suggest that you choose brokers that offer the most advanced trading platforms such as MT4/5. This not only ensures the safety of funds, but also provides a smooth trading experience.

Deposit and withdrawl

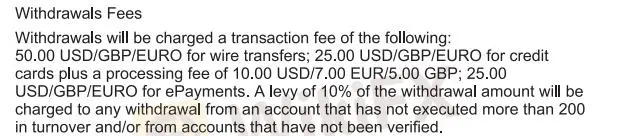

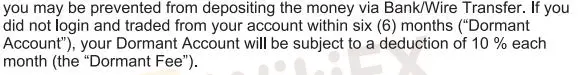

Gapstock claims to accept deposits via Visa or MasterCard cards or wire transfers. But the withdrawal fee is quite high, requiring a minimum payment of $35. Additionally, it imposes a 10% fee on all accounts that have not achieved a turnover rate of 200 times, which actually applies to all accounts. Finally, it also imposes a huge fee of 10% on inactive accounts.

WikiFX ब्रोकर

रेट की गणना करना