Huajin Futures

एब्स्ट्रैक्ट:Huajin Futures, established in 1995 in China, is a regulated futures brokerage firm overseen by CFFEX.The company offers a range of market instruments including Commodity Futures Brokerage, Financial Futures Brokerage, Asset Management, and Futures Investment Consulting. Huajin Futures caters to both individual and professional clients, providing a commission-free trading environment. The firm operates through its proprietary Huajin Futures App and offers a demo account for practice trading. Clients can contact customer support via phone at 400-9955-889. Additionally, Huajin Futures emphasizes investor education and awareness of resources on investor protection and anti-money laundering.

| Aspect | Information |

| Company Name | Huajin Futures |

| Registered Country/Area | China |

| Founded Year | 1995 |

| Regulation | CFFEX |

| Market Instruments | Commodity Futures Brokerage,Financial Futures Brokerage,Asset Management,Futures Investment Consulting |

| Trading Platforms | Huajin Futures App,Hangseng UF 2.0,CTP-See,Yi Sheng-See |

| Demo Account | Available |

| Customer Support | Phone:400-9955-889 |

| Deposit & Withdrawal | Bank transfer,credit/debit card,third-party payment |

| Educational Resource | Investor protection,Anti-Money Laundering Column |

Overview of Huajin Futures

Huajin Futures, established in 1995 in China, is a regulated futures brokerage firm overseen by CFFEX.The company offers a range of market instruments including Commodity Futures Brokerage, Financial Futures Brokerage, Asset Management, and Futures Investment Consulting.

Huajin Futures caters to both individual and professional clients, providing a commission-free trading environment. The firm operates through its proprietary Huajin Futures App and offers a demo account for practice trading. Clients can contact customer support via phone at 400-9955-889.

Additionally, Huajin Futures emphasizes investor education and awareness of resources on investor protection and anti-money laundering.

Is Huajin Futures Limited Legit or a Scam?

The China Financial Futures Exchange regulates Huajin Futures Co., Ltd. under the Futures License category. The firm holds a valid license with the number 0322, indicating its status as a regulated entity within China's financial sector.

This license specifically enables Huajin Futures to operate in the futures market, adhering to the rules and standards set forth by the regulatory body.

Pros and Cons

| Pros | Cons |

| Various Trading Platforms | Complexity for Beginners |

| Variety of Market Instruments | Geographical Focus |

| Demo Account Availability | Market Risk |

| Educational Resources | Regulatory Restrictions |

| Regulatory Compliance | Digital Platform Reliability |

Pros of Huajin Futures:

Various Trading Platforms: Offering platforms like Huajin Futures App, Hangseng UF 2.0, CTP-See, and Yi Sheng-See, Huajin Futures provides a range of options catering to different trading preferences and needs.

Variety of Market Instruments: Huajin Futures offers a wide range of services including Commodity Futures Brokerage, Financial Futures Brokerage, Asset Management, and Futures Investment Consulting, appealing to a broad spectrum of investors.

Demo Account Availability: The availability of a demo account allows new traders to practice and learn trading strategies without risking real money, which is crucial for building confidence and skills.

Educational Resources: With educational resources focused on investor protection and anti-money laundering, Huajin Futures demonstrates a commitment to client education and ethical trading practices.

Regulatory Compliance: Being regulated by CFFEX ensures that Huajin Futures adheres to industry standards and regulatory requirements, providing a secure environment for traders.

Cons of Huajin Futures:

Complexity for Beginners: The variety of trading platforms and advanced market instruments might be overwhelming for beginners, making the initial learning curve steep.

Geographical Focus: As a China-registered company, its services and offerings might be more tailored to the Chinese market, which could be a limitation for international traders.

Market Risk: Trading in futures and financial instruments involves inherent market risks, including volatility and unpredictability, which can lead to significant financial losses.

Regulatory Restrictions: Being under the strict regulation of CFFEX might limit some of the offerings and flexibility in trading options that may be available in less regulated markets.

Digital Platform Reliability: Dependence on digital trading platforms requires robust technology infrastructure; any technical issues or downtimes can impact trading efficiency and client experience.

Market Instruments

Huajin Futures offers a variety of market instruments, which include:

Commodity Futures Brokerage: This service involves the trading and brokerage of futures contracts on physical commodities like metals, energy, and agricultural products. It caters to clients looking to hedge against price fluctuations in the commodity markets or speculate for profit.

Financial Futures Brokerage: This focuses on the trading of futures contracts based on financial instruments, such as indices, bonds, and currencies. It's suitable for investors interested in hedging against or speculating on changes in financial market indices and rates.

Asset Management: Huajin Futures provides asset management services, likely involving the management of investments in futures and other financial instruments on behalf of clients. This can include portfolio management, investment strategy formulation, and risk management.

Futures Investment Consulting: This service offers expert advice and insights on futures investment strategies. It's aimed at guiding clients through the complexities of futures markets, helping them make informed decisions about their investment choices.

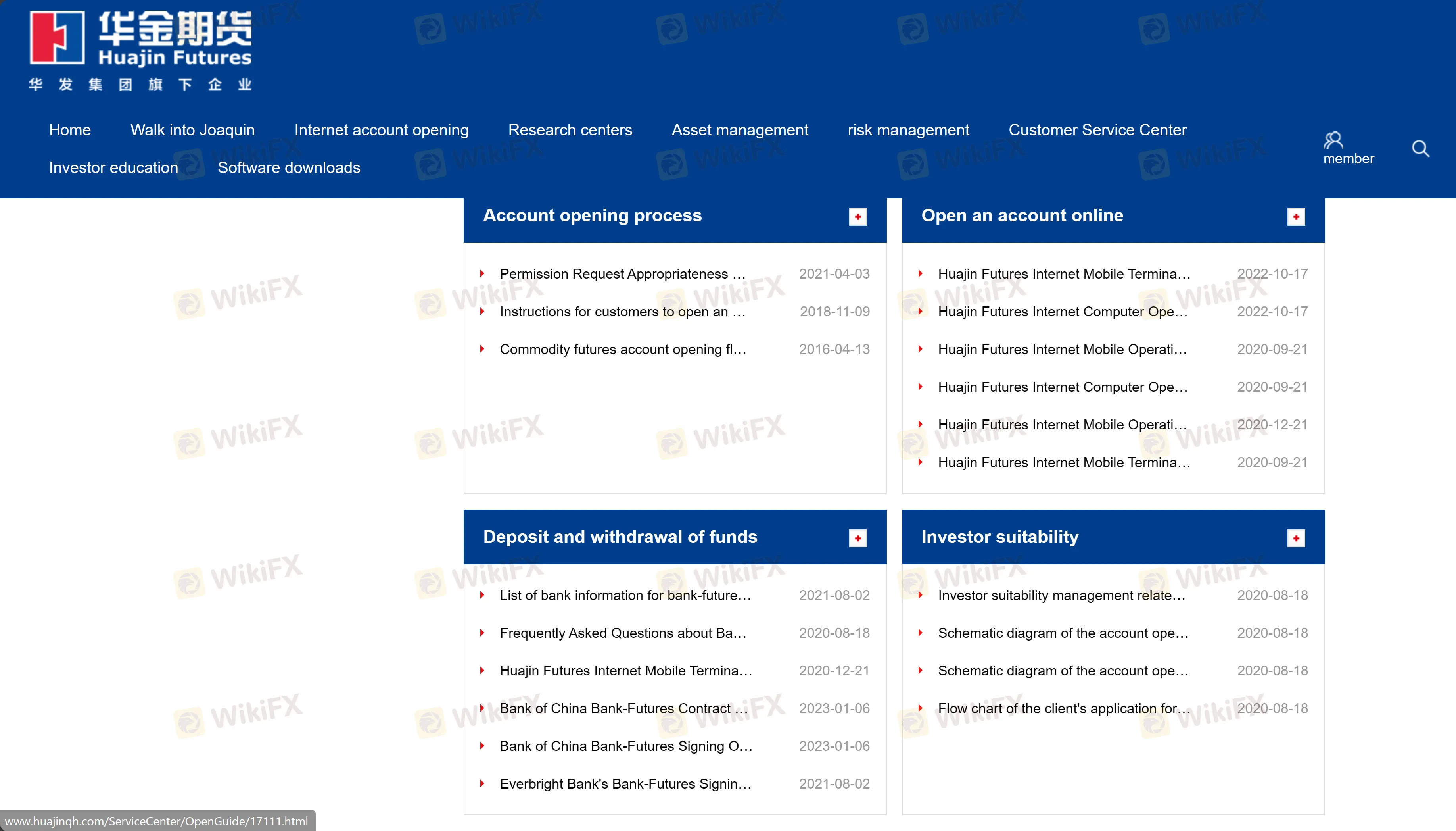

How to Open an Account?

Opening an account with Huajin Futures can typically be done in a few straightforward steps. Here's a general guide on how to proceed:

Step 1: Choose the Account Type

Decide on the Account Type: Based on your trading experience and needs, choose between an individual account and a professional account. Individual accounts are generally for personal traders, while professional accounts are suited for experienced or institutional traders.

Step 2: Complete the Application Form

Fill Out the Application Form: Visit the Huajin Futures website or use their mobile app to access the account application form. Provide all the required personal and financial information accurately. This may include your name, contact details, identification information, and financial background.

Step 3: Submit Required Documentation

Provide Necessary Documents: You will likely need to submit various documents for identity and residency verification. This typically includes a government-issued ID (like a passport or national ID card), proof of residence (such as a utility bill or bank statement), and possibly financial statements.

Step 4: Fund Your Account

Deposit Funds: After your account is approved, deposit funds to start trading. Check the minimum deposit requirement (100 yuan for Huajin Futures). You can use one of the accepted deposit methods such as bank transfer, credit/debit card, or third-party payment services.

Trading Platform

Huajin Futures offers four types of main mobile trading platforms.

Hengsheng UF2.0 and CTP-Transparent Style : This trading platform, Hengsheng UF2.0, coupled with CTP's transparent style, seems to provide a sophisticated trading environment. It likely offers advanced features for transparency and efficiency in trading activities.

Yi Sheng-Transparent Style : The Yi Sheng platform, with its transparent style, appears to be tailored for traders who prioritize clarity and direct access to market information. This platform offera tools that facilitate real-time market analysis and direct execution of trades, making it suitable for active traders who need quick and clear market insights.

Hua Jin Futures Mobile APP and Da Zhi Hui APP: These mobile applications offer on-the-go trading capabilities, essential for modern traders who need to execute trades and monitor markets from anywhere.

Quick Period Small Q - Quick Period Mobile APP Trading Software: This software seems to be focused on providing a fast and efficient trading experience. Quick Period Small Q is probably designed for speed and ease of use, enabling rapid execution of trades and access to essential market information in a streamlined, mobile-friendly format.

Deposit & Withdrawal

Huajin Futures provides various options for deposit and withdrawal, ensuring convenience and flexibility for its clients.

Deposit & Withdrawal Methods

Bank Transfer: Clients can deposit and withdraw funds through direct bank transfers. This method is typically secure and can be convenient for those who prefer traditional banking methods.

Credit/Debit Card: The use of credit and debit cards for transactions is supported. This method offers quick and easy transfers, allowing clients to manage their funds efficiently.

Third-Party Payment: Huajin Futures also accepts deposits and withdrawals via third-party payment services. These services often provide an additional layer of convenience, especially for clients who prefer online payment solutions.

These varied methods of deposit and withdrawal cater to different preferences and needs, providing clients with multiple options to manage their funds.

Customer Support

Huajin Futures offers comprehensive customer support to assist its clients with various inquiries and issues. Clients can reach out to their service hotline at 400-9955-889 for immediate assistance on a range of topics, from account management to trading queries.

Additionally, for more direct communication, there's a contact phone number available at 022-83211666. The company also has a dedicated fax number, 022-83211667, for clients who need to send documents or written communication.

For those who prefer or require in-person assistance or wish to visit the company's office, Huajin Futures is located at 22nd Floor, Century Metropolis Commercial Mansion Office Building, 183 Nanjing Road, Heping District, Tianjin City.

Educational Resource

Huajin Futures emphasizes investor education with a range of resources, particularly highlighted during the “World Investor Week.” They offer sessions under the “Futures Academy” series, addressing key topics such as the intricacies of futures contracts, risk management in trading, and strategies for effective hedging.

These educational programs cover practical aspects like adjusting hedge ratios, understanding the impact on hedge effectiveness, and distinguishing between hedging and basis trading. Additionally, they provide insights on common challenges in futures trading consultancy and risk management.

This focus on investor education showcases Huajin Futures' dedication to equipping investors with essential knowledge for successful trading in the futures market.

Conclusion

In conclusion, Huajin Futures stands out as a comprehensive and client-focused futures brokerage firm. Established in 1995 in China and regulated by the China Financial Futures Exchange, it offers a range of services including Commodity and Financial Futures Brokerage, Asset Management, and Investment Consulting.

With a low minimum deposit requirement and a commission-free trading policy, Huajin Futures makes futures trading accessible to a wide array of investors. The firm supports this with diverse and user-friendly trading platforms, multiple deposit and withdrawal options, and robust customer support.

Moreover, its strong commitment to investor education, particularly highlighted through various initiatives like the “Futures Academy,” reinforces its dedication to empowering clients with knowledge and skills for effective trading. Huajin Futures thus represents a blend of accessibility, reliability, and educational support, catering to both novice and experienced traders in the futures market.

FAQs

Q: What types of market instruments does Huajin Futures offer?

A: Huajin Futures specializes in Commodity Futures Brokerage, Financial Futures Brokerage, Asset Management, and Futures Investment Consulting, providing a range of services for diverse trading needs.

Q: Does Huajin Futures provide any digital trading platforms?

A: Yes, Huajin Futures offers 4 types of trding platform,including Huajin Futures App,Hangseng UF 2.0,CTP-See,Yi Sheng-See.

Q: Is there a demo account option available for new traders at Huajin Futures?

A: Yes, Huajin Futures provides a demo account, enabling new traders to practice and familiarize themselves with trading activities without financial risk.

Q: How can I contact customer support at Huajin Futures?

A: Huajin Futures offers customer support through their phone line at 400-9955-889, where clients can get assistance regarding their trading queries and issues.

Q: What are the options for depositing and withdrawing funds with Huajin Futures?

A: Clients can deposit and withdraw funds using various methods, including bank transfers, credit/debit cards, and third-party payment systems.

Q: Does Huajin Futures offer any educational resources for investors?

A: Yes, Huajin Futures provides educational resources focusing on investor protection and an Anti-Money Laundering Column, aimed at educating clients about safe trading practices and compliance.

WikiFX ब्रोकर

रेट की गणना करना