2024-12-30 23:02

इंडस्ट्रीGLOBAL STORE MARKET

#Wherearethepost-holidayrallyopportunities?Michriches#

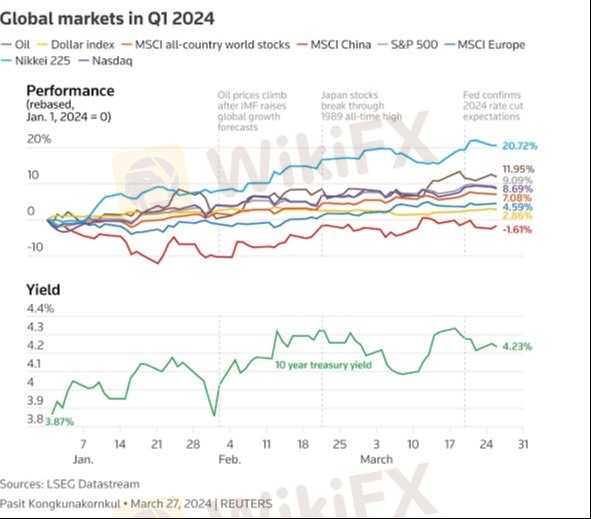

Global Stock Market Trends in Q1: Opportunities in Emerging Markets

The first quarter of each year (Q1) is a critical period for stock markets globally, often setting the tone for the rest of the year. During Q1, various factors such as economic data, corporate earnings reports, investor sentiment, and geopolitical events drive market trends. In this context, emerging markets (EMs) often present unique opportunities, but they also come with risks due to their higher volatility. Here’s a breakdown of global trends in Q1, with a focus on emerging market opportunities.

1. Global Stock Market Trends in Q1

a. Post-Holiday Optimism

• Renewed Sentiment: After the year-end slowdown and holiday season, Q1 often sees a surge in activity as investors return to the markets. Optimism around new year economic growth expectations, potential government stimulus packages, and corporate earnings drives equities higher in many regions.

• Earnings Reports: Corporate earnings in Q1 can be a major driver of stock movements. Companies that show strong growth or surpass analyst expectations tend to see their stocks perform well, which can influence broader market trends.

b. Economic Data Releases

• Q1 sees the release of GDP growth estimates, consumer spending, manufacturing data, and employment reports, which can all influence market sentiment, especially in developed markets like the U.S. and Europe.

• In emerging markets, key indicators like inflation rates, central bank policies, and commodity prices (particularly oil and metals) can have a larger-than-usual impact on stock market performance.

c. Central Bank Policies and Interest Rates

• Monetary Policy: Global central banks, including the Federal Reserve (U.S.), European Central Bank, and others in emerging markets, often make key policy announcements during Q1. Interest rate decisions, forward guidance, and asset purchases can influence investor sentiment in both developed and emerging markets.

• Rising interest rates in developed economies like the U.S. or Europe could lead to capital outflows from emerging markets, increasing their volatility.

• Easing monetary policy in emerging markets, especially from countries like China or India, can provide a boost to growth prospects, encouraging investment in EM equities.

d. Geopolitical Events and Global Risk Sentiment

• Geopolitical tensions, such as trade policy shifts, political instability, or military conflicts, can have an outsized impact in the first quarter, as investors position themselves for the year ahead. In Q1, emerging markets with strong commodity exports (like Brazil, Russia, and South Africa) may see heightened volatility due to global risk sentiment.

2. Emerging Market Opportunities in Q1

Emerging markets offer potential rewards in Q1, particularly for investors looking to capitalize on growth trends, lower valuations, and higher returns. However, these markets can be volatile, and factors such as local political risks, currency fluctuations, and global economic conditions must be taken into account. Here are the main opportunities in emerging markets during Q1:

a. Growth in China and Other Asian Markets

• China’s Economic Rebound: After the COVID-19 disruptions, China has been showing signs of recovery, particularly in manufacturing, technology, and consumer sectors. The Chinese government has taken steps to stimulate growth, including policy easing and support for the real estate market, which could create opportunities in Chinese equities.

• Technology and Consumer Sectors: Stocks in China’s technology sector (e.g., Alibaba, Tencent, or smaller fintech companies) can benefit from continued economic recovery and government-backed growth initiatives.

• Renewed Consumer Demand: As China’s middle class grows, sectors like retail, e-commerce, and consumer discretionary may continue to expand.

• India’s Expanding Economy: India’s large, young population and growing middle class position it as one of the fastest-growing emerging markets.

• Infrastructure and Digitalization: The government’s push toward infrastructure development and digitalization can provide a strong investment case in sectors like telecom, construction, and technology.

• Energy Transition: The Indian government is investing in renewable energy and electric vehicles, which could benefit companies in these sectors in Q1 and beyond.

b. Commodity-Driven Economies: Brazil, Russia, South Africa

• Commodity Price Surge: Many emerging markets depend on exports of raw materials like oil, metals, and agricultural products. In Q1, commodity prices often rise due to renewed global demand, especially from China.

• Brazil and Russia: These markets benefit from higher commodity prices, particularly oil and natural gas. If global economic conditions remain strong, oil-producing nations like Russia and Brazil can see their stock markets outperform in Q1

लाइक करें 0

OLUWAPELUMI

ट्रेडर

गर्म सामग्री

इंडस्ट्री

विदेशी मुद्रा कहानी Forex story

इंडस्ट्री

User Survey Questionnaire

इंडस्ट्री

User Survey Questionnaire

इंडस्ट्री

User Survey Questionnaire

इंडस्ट्री

User Survey Questionnaire

इंडस्ट्री

Participate in the survey and claim your contribution rewards!

फोरम केटेगरी

प्लेटफॉर्म

एक्सहिबिशन

एजेंट

भर्ती करना

EA

इंडस्ट्री

मार्केट

इंडेक्स

GLOBAL STORE MARKET

नाइजीरिया | 2024-12-30 23:02

नाइजीरिया | 2024-12-30 23:02#Wherearethepost-holidayrallyopportunities?Michriches#

Global Stock Market Trends in Q1: Opportunities in Emerging Markets

The first quarter of each year (Q1) is a critical period for stock markets globally, often setting the tone for the rest of the year. During Q1, various factors such as economic data, corporate earnings reports, investor sentiment, and geopolitical events drive market trends. In this context, emerging markets (EMs) often present unique opportunities, but they also come with risks due to their higher volatility. Here’s a breakdown of global trends in Q1, with a focus on emerging market opportunities.

1. Global Stock Market Trends in Q1

a. Post-Holiday Optimism

• Renewed Sentiment: After the year-end slowdown and holiday season, Q1 often sees a surge in activity as investors return to the markets. Optimism around new year economic growth expectations, potential government stimulus packages, and corporate earnings drives equities higher in many regions.

• Earnings Reports: Corporate earnings in Q1 can be a major driver of stock movements. Companies that show strong growth or surpass analyst expectations tend to see their stocks perform well, which can influence broader market trends.

b. Economic Data Releases

• Q1 sees the release of GDP growth estimates, consumer spending, manufacturing data, and employment reports, which can all influence market sentiment, especially in developed markets like the U.S. and Europe.

• In emerging markets, key indicators like inflation rates, central bank policies, and commodity prices (particularly oil and metals) can have a larger-than-usual impact on stock market performance.

c. Central Bank Policies and Interest Rates

• Monetary Policy: Global central banks, including the Federal Reserve (U.S.), European Central Bank, and others in emerging markets, often make key policy announcements during Q1. Interest rate decisions, forward guidance, and asset purchases can influence investor sentiment in both developed and emerging markets.

• Rising interest rates in developed economies like the U.S. or Europe could lead to capital outflows from emerging markets, increasing their volatility.

• Easing monetary policy in emerging markets, especially from countries like China or India, can provide a boost to growth prospects, encouraging investment in EM equities.

d. Geopolitical Events and Global Risk Sentiment

• Geopolitical tensions, such as trade policy shifts, political instability, or military conflicts, can have an outsized impact in the first quarter, as investors position themselves for the year ahead. In Q1, emerging markets with strong commodity exports (like Brazil, Russia, and South Africa) may see heightened volatility due to global risk sentiment.

2. Emerging Market Opportunities in Q1

Emerging markets offer potential rewards in Q1, particularly for investors looking to capitalize on growth trends, lower valuations, and higher returns. However, these markets can be volatile, and factors such as local political risks, currency fluctuations, and global economic conditions must be taken into account. Here are the main opportunities in emerging markets during Q1:

a. Growth in China and Other Asian Markets

• China’s Economic Rebound: After the COVID-19 disruptions, China has been showing signs of recovery, particularly in manufacturing, technology, and consumer sectors. The Chinese government has taken steps to stimulate growth, including policy easing and support for the real estate market, which could create opportunities in Chinese equities.

• Technology and Consumer Sectors: Stocks in China’s technology sector (e.g., Alibaba, Tencent, or smaller fintech companies) can benefit from continued economic recovery and government-backed growth initiatives.

• Renewed Consumer Demand: As China’s middle class grows, sectors like retail, e-commerce, and consumer discretionary may continue to expand.

• India’s Expanding Economy: India’s large, young population and growing middle class position it as one of the fastest-growing emerging markets.

• Infrastructure and Digitalization: The government’s push toward infrastructure development and digitalization can provide a strong investment case in sectors like telecom, construction, and technology.

• Energy Transition: The Indian government is investing in renewable energy and electric vehicles, which could benefit companies in these sectors in Q1 and beyond.

b. Commodity-Driven Economies: Brazil, Russia, South Africa

• Commodity Price Surge: Many emerging markets depend on exports of raw materials like oil, metals, and agricultural products. In Q1, commodity prices often rise due to renewed global demand, especially from China.

• Brazil and Russia: These markets benefit from higher commodity prices, particularly oil and natural gas. If global economic conditions remain strong, oil-producing nations like Russia and Brazil can see their stock markets outperform in Q1

लाइक करें 0

मैं भी टिप्पणियाँ करना चाहता हूँ

प्रस्तुत

0टिप्पणियाँ

अभी तक कोई टिप्पणी नहीं है। पहले एक बनाओ।

प्रस्तुत

अभी तक कोई टिप्पणी नहीं है। पहले एक बनाओ।