ED&F Man Capital Markets

एब्स्ट्रैक्ट: ED&F Man, founded in 1783 and headquartered in the United Kingdom, is a global commodity broker and service provider. Although it has provided a wide range of services and held licenses in several countries, many of its regulatory permits have been canceled or are unlawful, raising concerns among clients.

| ED&F Man Review Summary | |

| Founded | 1783 |

| Registered Country/Region | United Kingdom |

| Regulation | SFC/FCA/DFSA (Revoked), NFA (Unauthorized) |

| Trading Products | Agricultural, metals, energy |

| Demo Account | / |

| Trading Platform | Neon by Marex, Connectivity (API, FIX), Nanolytics, Marex FX, Agile |

| Minimum Deposit | / |

| Customer Support | Tel: +44 (0) 20 7655 6000 |

ED&F Man Information

ED&F Man, founded in 1783 and headquartered in the United Kingdom, is a global commodity broker and service provider. Although it has provided a wide range of services and held licenses in several countries, many of its regulatory permits have been canceled or are unlawful, raising concerns among clients.

Pros and Cons

| Pros | Cons |

| Long-established (founded in 1783) with historical global presence | Regulatory licenses revoked or unauthorized |

| Wide range of services offered | No demo accounts |

| Access to diverse markets | Lack of information on fees |

Is ED&F Man Legit?

ED&F Man has held several licenses in Hong Kong, the United Kingdom, the United States, and the United Arab Emirates, however, many of them are either revoked or unauthorized.

| Licensed Entity | Regulated by | Regulatory Authority | License Type | License No. | Status |

| Marex HK Asia Limited | Hong Kong, China | Securities and Futures Commission of Hong Kong (SFC) | Dealing in futures contracts | BBD066 | Revoked |

| MCML Limited | UK | Financial Conduct Authority (FCA) | Institution Forex License | 194926 | Revoked |

| ED&F Man Capital Markets Limited | USA | National Futures Association (NFA) | Common Financial Service License | 354008 | Unauthorized |

| ED&F Man Capital Markets Limited | UAE | Dubai Financial Services Authority (DFSA) | Common Financial Service License | F002947 | Revoked |

Products and Services

Marex provides a wide range of services, including clearing, execution, market making, and customized hedging solutions, with market access in agricultural, metals, energy, environmental products, and capital markets.

| Category | Details |

| Services | Clearing, Agency and Execution, Market Making, Hedging and Investment Solutions |

| Markets | Agriculture, Metals, Energy, Environmental, Capital Markets |

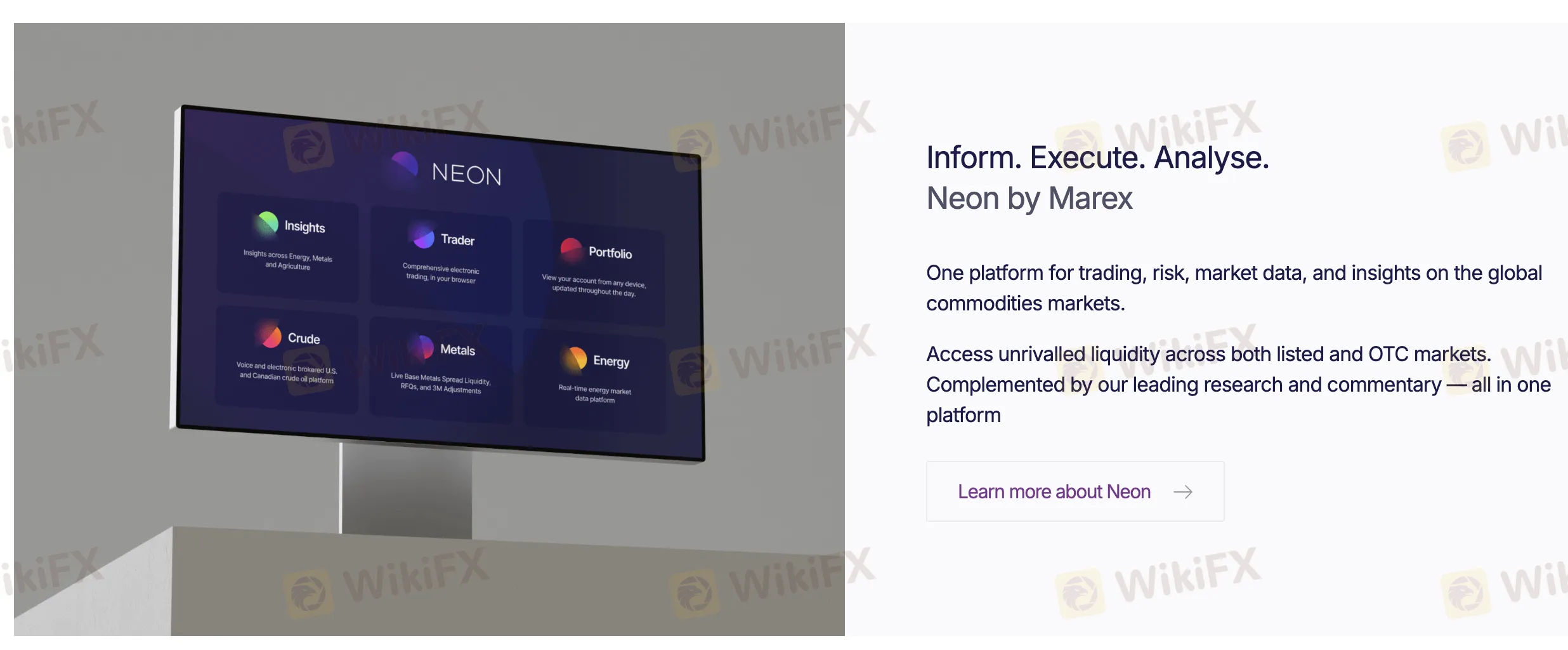

Trading Platform

| Trading Platform | Supported | Available Devices |

| Neon by Marex | ✔ | Desktop, Mobile (iOS, Android) |

| Connectivity (API, FIX) | ✔ | Integrated into user systems (software connectivity) |

| Nanolytics | ✔ | Desktop, secure delivery |

| Marex FX | ✔ | Mobile |

| Agile | ✔ | Web-based, Mobile |

WikiFX ब्रोकर

रेट की गणना करना