EQFX-Some important Details about This Broker

एब्स्ट्रैक्ट:EQFX, is a financial corporation that has been operated for 5 years, besides, it was registered in Switzerland, however, all we know is that the corporation was founded in 2017 without regulatory and license, other than that, the broker does not provide any offices location info as well as the regulation details.

| Aspect | Information |

| Company Name | EQFX |

| Registered Country/Area | Switzerland |

| Founded Year | 2017 |

| Regulation | Unregulated |

| Minimum Deposit | Standard: $200, Raw Spread: $200, VIP: $5,000 |

| Maximum Leverage | Up to 1:20 |

| Spreads | Standard: From 0.1 pips, Raw Spread: From 0.0 pips |

| Trading Platforms | Web-based trading platform |

| Tradable Assets | Forex (Major, Minor, Exotic pairs) |

| Account Types | Standard, Raw Spread, VIP |

| Customer Support | Phone: 0203 897 0792, Email: info@eqfx.co.uk |

| Deposit & Withdrawal | Credit/debit cards, Bank transfers |

| Educational Resources | Unavailable |

Overview of EQFX

EQFX, founded in Switzerland in 2017, operates as a forex-only trading platform, specializing in currency pair transactions. Despite offering diverse forex trading options, EQFX operates without regulatory oversight, introducing potential risks for traders. The absence of a regulatory license raises concerns about client protection and adherence to industry standards. While the platform facilitates forex trading, the lack of regulatory backing may affect transparency and dispute resolution. Traders are advised to exercise caution and thoroughly assess associated risks before engaging with EQFX, given its unregulated status.

Is EQFX legit or a scam?

EQFX operates without regulatory oversight, posing potential risks for traders. The absence of regulation means there is no external authority ensuring fair practices, transparency, or adherence to industry standards. This lack of oversight exposes traders to inherent dangers, as they may face challenges in seeking recourse for disputes, and the platform may not be held to the stringent standards enforced by regulatory bodies. Traders should exercise caution and carefully consider the potential risks associated with using an unregulated platform like EQFX, as the absence of regulatory safeguards can impact the overall security and integrity of financial transactions.

Pros and Cons

| Pros | Cons |

| Diverse Range of Currency Pairs | Unregulated |

| Various Account Types | Limited Educational Resources |

| Competitive Spreads and Commission | Official Website Not Currently Available |

| Various Payment Methods | |

| Various Customer Support Channels |

Pros:

Diverse Range of Currency Pairs:

EQFX offers a broad selection of currency pairs, including major, minor, and exotic options. This diversity allows traders to engage in various combinations, catering to different risk appetites and trading strategies.

2. Various Account Types:

EQFX provides three distinct account types – Standard, Raw Spread, and VIP, accommodating diverse trader needs. Each account type comes with varied minimum deposits and exclusive benefits, offering flexibility for traders with different preferences.

3. Competitive Spreads and Commission:

EQFX offers competitive spreads and commission structures across its account types. The Standard Account features spreads starting from 0.1 pips with no commission charges, providing a cost-effective option.

4. Various Payment Methods:

EQFX accepts a variety of payment methods, including credit/debit cards (Visa, Mastercard, Maestro) and bank transfers (wire transfers, ACH transfers). This diversity in payment options enhances convenience for traders with different preferences.

5. Various Customer Support Channels:

EQFX provides customer support through multiple channels, including phone (0203 897 0792) and email (info@eqfx.co.uk). The platform maintains an active presence on social media platforms, including Twitter (https://twitter.com/hashtag/EQTraders) and Facebook (https://www.facebook.com/eqtraders/), ensuring accessibility and engagement for users seeking assistance or information.

Cons:

Unregulated:

EQFX operates without regulatory oversight, exposing traders to potential risks. The absence of regulation means there is no external authority ensuring fair practices, transparency, or adherence to industry standards.

2. Limited Educational Resources:

The current unavailability of EQFX's official website restricts access to educational materials. This limitation may impact traders and investors seeking valuable insights and learning resources to enhance their understanding of the financial markets.

3. Official Website Not Currently Available:

The official EQFX website is not currently accessible. The unavailability of the website may inconvenience users seeking essential information and updates related to EQFX's services and offerings.

Market Instruments

EQFX operates as a forex broker, offering a range of currency pairs categorized into major, minor, and exotic, including:

Major Currency Pairs:

EUR/USD (Euro/US Dollar)

USD/JPY (US Dollar/Japanese Yen)

GBP/USD (British Pound/US Dollar)

USD/CHF (US Dollar/Swiss Franc)

Minor Currency Pairs:

EUR/AUD (Euro/Australian Dollar)

GBP/CAD (British Pound/Canadian Dollar)

NZD/JPY (New Zealand Dollar/Japanese Yen)

AUD/CHF (Australian Dollar/Swiss Franc)

Exotic Currency Pairs:

USD/SGD (US Dollar/Singapore Dollar)

EUR/TRY (Euro/Turkish Lira)

GBP/SEK (British Pound/Swedish Krona)

USD/THB (US Dollar/Thai Baht)

This diversity allows traders to engage in various combinations, catering to different risk appetites and trading strategies.

Account Types

EQFX offers three distinct account types – Standard Account, Raw Spread Account, and VIP Account – each tailored to meet the diverse needs of traders. Here's a detailed breakdown of the features:

The Standard Account requires a minimum deposit of $200, offering competitive spreads from 0.1 pips and no commission charges.

Traders opting for the Raw Spread Account experience tighter spreads from 0.0 pips, with a commission of $2 per lot round turn.

The VIP Account, requiring a minimum deposit of $5,000, boasts spreads from 0.0 pips with no commission.

All accounts utilize the user-friendly web-based trading platform. Additionally, VIP Account holders enjoy exclusive access to trading signals. These options cater to traders with varying strategies and preferences, providing flexibility and choice in their trading journey.

| Feature | Standard Account | Raw Spread Account | VIP Account |

| Minimum deposit | $200 | $200 | $5,000 |

| Leverage | Up to 1:20 | Up to 1:20 | Up to 1:20 |

| Spreads | From 0.1 pips | From 0.0 pips | From 0.0 pips |

| Commission | $0 | $2 per lot round turn | $0 |

| Trading tool | Web-based trading platform | Web-based trading platform | Web-based trading platform |

| Additional benefits | None | None | Access to exclusive trading signals |

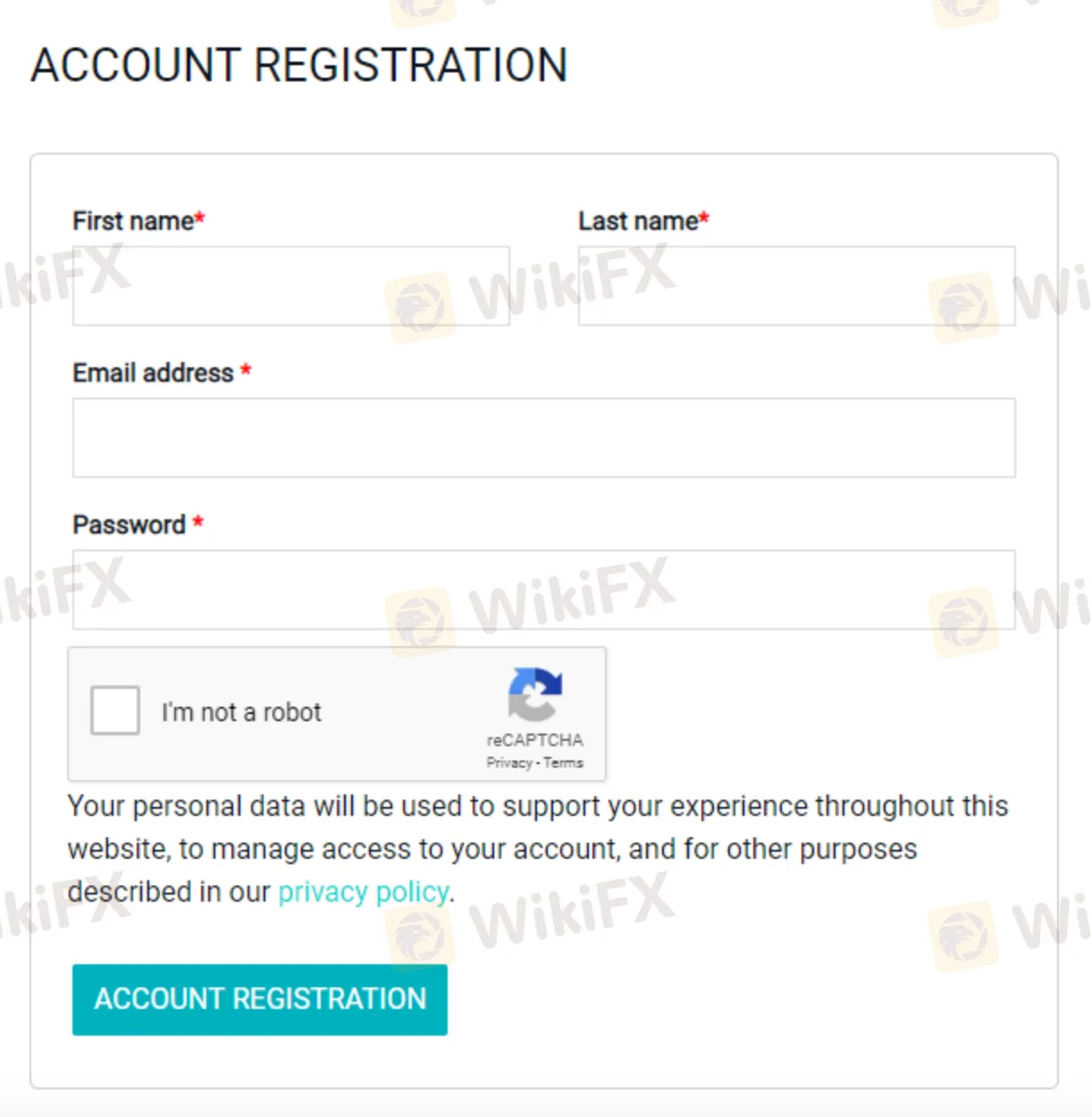

How to Open an Account?

Here's a step-by-step guide on how to open an account with EQFX:

Visit the Official Website:

Start by accessing the official website of EQFX using your web browser.

2. Account Type Selection:

Explore the available account types (e.g., Standard, Raw Spread, VIP) and choose the one that suits your trading preferences and needs.

3. Online Application Form:

Complete the online application form provided on the website. Input accurate personal details including your full name, contact information, residential address, and financial information.

4. Read and Accept Terms:

Carefully read through the terms and conditions associated with account opening. Ensure you understand and agree to the terms before proceeding.

5. Document Submission:

As part of the account verification process, be prepared to submit necessary identification documents. This often includes a copy of your passport, proof of address (utility bill or bank statement), and any additional documents requested.

6. Deposit Funds:

After your account is approved, fund it with the minimum deposit required. EQFX may specify different deposit amounts based on the chosen account type.

7. Explore Trading Platform:

Once funded, you can explore EQFX's web-based trading platform. Familiarize yourself with its features, tools, and functionalities to optimize your trading experience.

Always ensure that you follow security measures, review the provided information, and contact EQFX's customer support if you encounter any issues or have questions during the account opening process.

Leverage

EQFX provides leverage of up to 1:20 across all its account types, including the Standard Account, Raw Spread Account, and VIP Account. This leverage allows traders to potentially amplify their market exposure, enabling them to make more significant trades and potentially increase their profits or losses.

Spreads & Commissions

EQFX offers competitive spreads across its account types. The Standard Account features spreads starting from 0.1 pips, ensuring cost-effective trading. For traders seeking even tighter spreads, the Raw Spread Account provides options starting from 0.0 pips. The VIP Account extends this benefit, offering competitive spreads with no commission charges.

Trading Platform

EQFX is non MT4/MT5 provider, opting for a web-based trading platform. While it may not match the renown of MetaTrader platforms, this alternative offers traders versatility.

The platform allows users to explore various time frames, providing flexibility in analyzing market trends and making informed decisions. Traders can access charts displaying historical price movements, essential for comprehensive technical analysis.

Furthermore, EQFX's platform incorporates popular drawing tools, empowering users to visually represent market patterns and trends. Price indicators, a fundamental aspect of technical analysis, are also embedded, enhancing the platform's functionality.

Despite not adopting the industry-standard MT4/MT5, EQFX's web-based platform strives to provide traders with essential tools and features for effective decision-making in the financial markets.

Deposit & Withdrawal

EQFX accepts a variety of payment methods, including:

Credit/debit cards: Visa, Mastercard, Maestro

Bank transfers: Wire transfers, ACH transfers

The minimum deposit for an EQFX account depends on the account type you choose. The minimum deposits are:

Standard: $200

Raw Spread: $200

VIP: $5,000

Deposits are processed instantly for credit/debit cards. Bank transfers may take 1-3 business days to process. Withdrawals are processed within 24 hours.

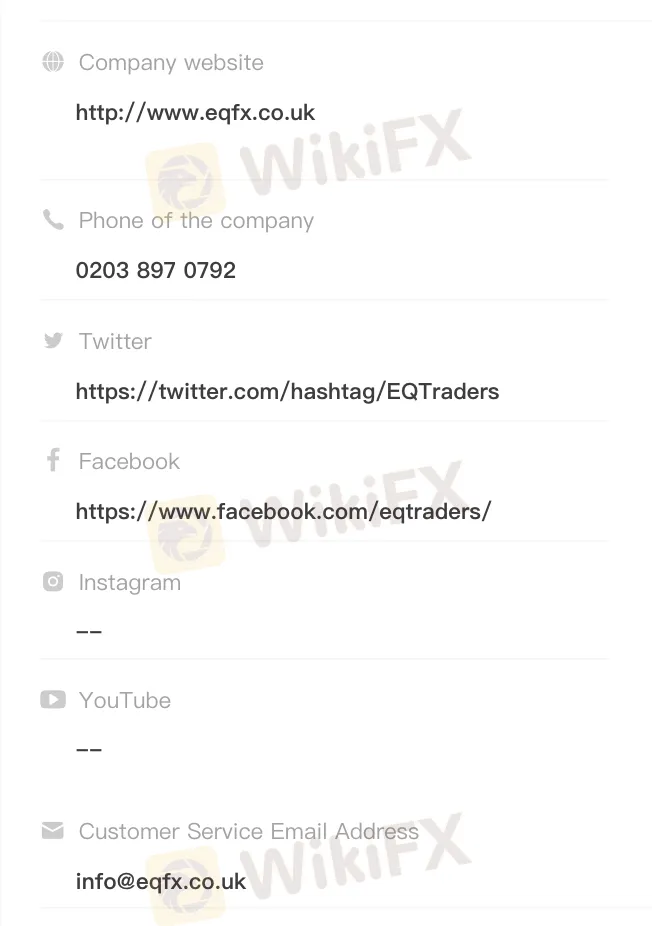

Customer Support

EQFX provides customer support through various channels, demonstrating a commitment to responsive assistance.

Traders can contact the company via phone at 0203 897 0792 or through the customer service email address info@eqfx.co.uk.

The platform maintains an active presence on social media platforms, including Twitter (https://twitter.com/hashtag/EQTraders) and Facebook (https://www.facebook.com/eqtraders/), keeping users informed and engaged.

The availability of multiple communication options indicates a client-centric approach, ensuring accessibility and support for users seeking assistance or information related to EQFX services.

Educational Resources

EQFX's current official website is not accessible, and there is a lack of available educational resources. This limitation may impact traders and investors seeking valuable insights and learning materials to enhance their understanding of the financial markets. Access to comprehensive educational content is crucial for individuals looking to make informed decisions and navigate the complexities of trading successfully.

Conclusion

In conclusion, EQFX, established in Switzerland in 2017, serves as a forex-only trading platform, emphasizing currency pair transactions. Operating without regulatory oversight, the platform carries inherent risks for traders, particularly concerning client protection and adherence to industry standards. While offering diverse forex trading options, the absence of regulatory backing may impact transparency and dispute resolution. Traders should approach EQFX with caution, carefully evaluating the associated risks due to its unregulated status. The platform's foundation in 2017 without regulatory licensing underscores the importance of thorough consideration before engaging in financial transactions on the EQFX platform.

FAQs

Q: Is EQFX regulated?

A: No, EQFX operates without regulatory oversight.

Q: What trading instruments does EQFX offer?

A: EQFX exclusively offers forex trading with a variety of currency pairs.

Q: How many account types does EQFX provide?

A: EQFX offers three account types: Standard, Raw Spread, and VIP.

Q: What is the minimum deposit for the Standard account?

A: The minimum deposit for the Standard account is $200.

Q: Does EQFX have educational resources?

A: Currently, EQFX's official website is not accessible, limiting access to educational materials.

Q: What is EQFX's customer support email?

A: EQFX's customer support email is info@eqfx.co.uk.

WikiFX ब्रोकर

रेट की गणना करना