Snap-Zed Futures-Overview of Minimum Deposit, Leverage, Spreads

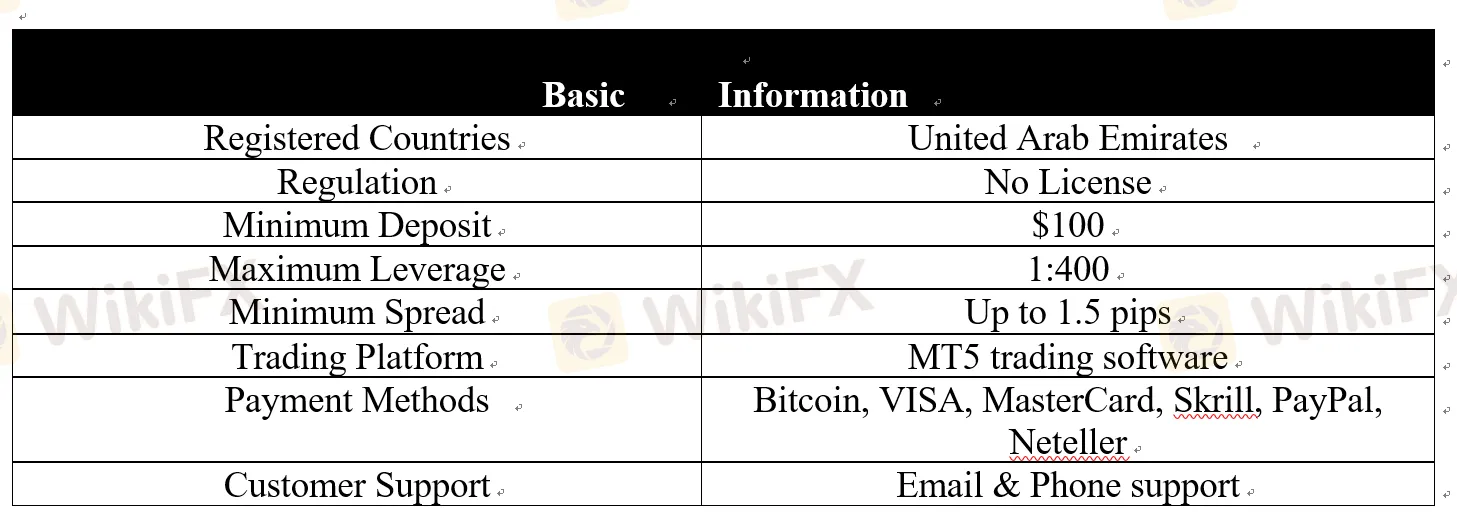

एब्स्ट्रैक्ट:Registered in the United Arab Emirates, Snap-Zed Futures is an online forex broker offering a series of trading instruments for both retail and professional traders, such as Forex, Stocks & Indices. Snap-Zed Futures hypes that it offers tight spread from 0.1 pips with small commission charged.

Snap-Zed Futures 4029310755

General Information

Registered in the United Arab Emirates, Snap-Zed Futures is an online forex broker offering a series of trading instruments for both retail and professional traders, such as Forex, Stocks & Indices. Snap-Zed Futures hypes that it offers tight spread from 0.1 pips with small commission charged.

Is Snap-Zed Futures safe to trade with?

Obviously, Snap-Zed Futures has let us down when it comes to enforcing rules and regulations. This broker has been confirmed to be outside of the purview of any regulatory bodies. Thats why its regulatory status on WikiFX has been classified as “No License” and it receives a low scoreof 1.13/10.

Please be aware of the considerable risk associated with trading with an offshore, unregulated forex broker.

Market Instruments

Snap-Zed Futures claims that it offers over 175 trading instruments. Four classes of trading assets can be traded, which include Foreign Exchange, Futures, Indices, Bonds.

Account Types

A total of four trading accounts are available with the Snap-Zed Futures platform, namely the Micro, Standard, Professional and Swap-free accounts.

The Micro account is suitable for beginners, asking for an initial deposit of 100 USD, much higher than its peers requirements. The Standard account is said to be the most popular one, suitable for all types of traders, yet requiring an insanely high deposit of $5,000.

The Professional account is designed for professional and active traders with large trade volumes. To open this account, you need to fund at least $25,000.

Spreads & Commissions

The spreads offered by three trading account are up to 1.5 pips, with commission charged varying depending on trading accounts, 15 USD per lot on the Micro account, 10 USD per lot on the Standard account, and 7 USD per lot on the Professional account.

Leverage

When it comes to leverage, a key red flag with Snap-Zed Futures is that it permits traders to use leverage of up to 1:400, which is significantly higher than the levels regarded appropriate by many regulators. This is a common practice for offshore companies, and Nation FX just engages in it to increase its client base.

Trading Platform

Snap-Zed Futures offers its clients the access to popular MT5 trading platform that can be available for Desktop, Mobile and Web terminals.

Traders can quickly analyze market activity, place trades, and integrate automated systems thanks to this powerful platform's convenient workspace (Expert Advisors). Everything you need to begin trading on the financial markets, including all of the above features, is available in a single, convenient interface.

Trading Tools

Aside from the MT5 trading platform, Snap-Zed Futures also offers some trading tools, including Economic Calendar, Pip Calculator, Position Size Calculator, Margin Calculator.

Payment Methods

The minimum deposit is $100. And Snap-Zed Futures allows its clients to make a deposit and withdrawal through the following payment options:

Bitcoin

VISA

MasterCard

Skrill

PayPal

Neteller

However, further details about withdrawals and processing time are not disclosed.

Customer Support

Snap-Zed Futures says it works 24/5 days a week. Clients can reach out to Snap-Zed Futures about any questions or concerns they may have about their accounts or their trading only through the email: support@snapzfx.org.

Registered Company Address: Kemp House, 160 City Road, London, EC1V 2NX, United Kingdom

Or you can also keep up with this brokerage platform on some popular social media platforms, such as Facebook, Twitter, Youtube, Instagram, and Telegram.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

WikiFX ब्रोकर

रेट की गणना करना