Sunton Capital

एब्स्ट्रैक्ट:Sunton Capital is a forex broker that claims to be registered in China. Founded within the last 2-5 years, the company operates as an unregulated entity. It offers a trading platform powered by MetaTrader5, providing access to a wide range of financial instruments including forex currency pairs, metals, indices, commodities, and shares. The minimum deposit required to start trading with Sunton Capital is $100, and the maximum leverage offered is 1:100. While specific details about account types, demo accounts, customer support, and educational resources are not provided, the broker supports various deposit and withdrawal methods, including credit cards, debit cards, wire transfers, and cryptocurrency options. It is important to note that the unregulated status of Sunton Capital raises concerns about the credibility and legitimacy of the broker. Traders should exercise caution and consider regulated alternatives to ensure a safe and reliable trading experience.

| Aspect | Information |

| Company Name | Sunton Capital |

| Registered Country/Area | China |

| Founded Year | 2-5 years |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

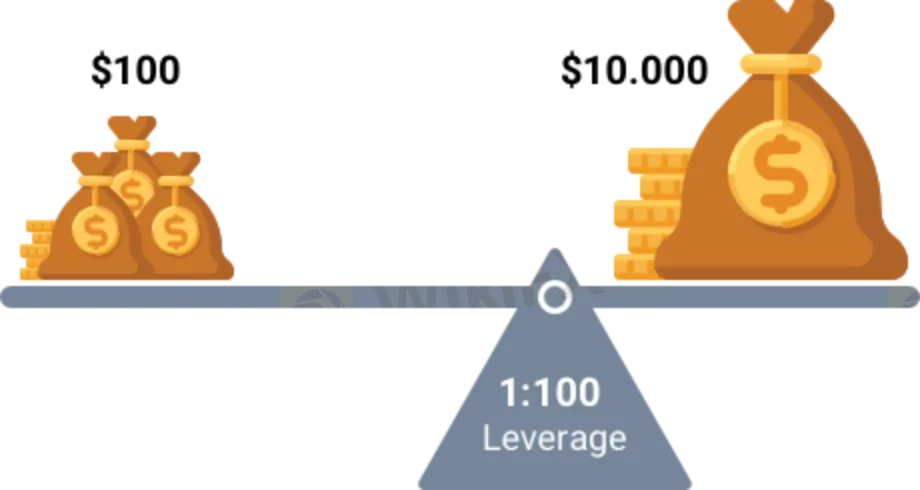

| Maximum Leverage | 1:100 |

| Trading Platforms | MetaTrader5 |

| Tradable Assets | Forex currency pairs, metals, indices, commodities, shares |

| Account Types | Not specified |

| Demo Account | Not specified |

| Customer Support | Not specified |

| Deposit & Withdrawal | Credit cards, debit cards, wire transfers, crypto methods |

| Educational Resources | Not specified |

Overview of Sunton Capital

Sunton Capital is a forex broker that claims to be registered in China. Founded within the last 2-5 years, the company operates as an unregulated entity. It offers a trading platform powered by MetaTrader5, providing access to a wide range of financial instruments including forex currency pairs, metals, indices, commodities, and shares. The minimum deposit required to start trading with Sunton Capital is $100, and the maximum leverage offered is 1:100. While specific details about account types, demo accounts, customer support, and educational resources are not provided, the broker supports various deposit and withdrawal methods, including credit cards, debit cards, wire transfers, and cryptocurrency options. It is important to note that the unregulated status of Sunton Capital raises concerns about the credibility and legitimacy of the broker. Traders should exercise caution and consider regulated alternatives to ensure a safe and reliable trading experience.

Is Sunton Capital legit or a scam?

However, there is limited information available about its founding time, actual office address, and the company behind it. This lack of transparency raises concerns about the credibility and legitimacy of Sunton Capital. Trading with an unregulated broker like Sunton Capital can pose several risks and disadvantages.

Here are some detailed explanations of the drawbacks of trading with an unregulated broker:

1. Lack of Investor Protection: Regulated brokers are required to adhere to strict financial and operational standards imposed by regulatory authorities. These regulations aim to safeguard the interests of investors, including measures such as segregated client accounts and compensation schemes.

2. Potential for Fraudulent Activities: Unregulated brokers operate without the oversight and scrutiny of regulatory authorities. This lack of regulation opens the door for potential fraudulent activities, such as market manipulation, unfair trading practices, and misleading information.

3. Lack of Transparency: Regulated brokers are required to provide transparent and accurate information about their operations, trading conditions, and fees. On the other hand, unregulated brokers may not be obliged to disclose crucial information, such as their ownership structure, financial stability, or conflicts of interest.

4. Limited Legal Recourse: When trading with an unregulated broker, the legal options available to clients in case of disputes or financial losses are often limited. However, with unregulated brokers, the absence of a regulatory authority means there may be fewer options for seeking legal recourse or resolving conflicts.

5. Higher Risk of Financial Losses: Due to the lack of regulation, unregulated brokers may not adhere to best practices or industry standards. This can result in higher trading risks, including execution issues, slippage, requotes, or sudden changes in trading conditions.

Traders should exercise caution when dealing with brokers that have undisclosed information, as it may indicate potential risks and an increased likelihood of fraudulent activities. It is crucial to choose brokers with established reputations and proper regulatory oversight to ensure the safety of your funds and trading experience.

Pros and Cons

Sunton Capital offers a wide range of tradable instruments, providing traders with options to diversify their portfolios and explore different market opportunities. The minimum deposit requirement at Sunton Capital is reasonable, making it accessible for traders with varying budgets to start trading. The availability of the MetaTrade5 trading platform allows traders to access a reliable and robust platform with various features and tools to support their trading decisions. Sunton Capital supports multiple payment methods, providing convenience and flexibility for depositing and withdrawing funds.

Sunton Capital lacks transparency and undisclosed information, raising concerns about the credibility and legitimacy of the broker. Traders should exercise caution when dealing with brokers that have undisclosed information, as it may indicate potential risks and increased likelihood of fraudulent activities. Being an unregulated broker, Sunton Capital operates without the oversight and scrutiny of regulatory authorities, which poses potential risks and disadvantages for traders. This may not suit traders who prefer alternative platforms or have specific platform preferences. The website of Sunton Capital is inaccessible, which can be a major drawback as traders rely on easy access to information and services online.

| Pros | Cons |

| Wide Range of Tradable Instruments | Lack of Transparency and Undisclosed Information |

| Reasonable Minimum Deposit Requirement | Unregulated Status and Potential Risks |

| Availability of MetaTrade 5 Trading Platform | Limited Platform Options |

| Moderate Leverage Offered | Inaccessible website |

| Multiple Payment Methods | Withdrawal Processing Time and Fees Not Clearly Stated |

Market Instruments

At Sunton Capital, traders have the opportunity to trade a variety of financial instruments, including forex currency pairs, metals, indices, commodities, and shares. This wide range of tradable assets allows traders to diversify their portfolios and explore different market opportunities. However, it's important to note that due to the lack of transparency and undisclosed information about Sunton Capital, caution should be exercised when considering trading with this broker. Traders should thoroughly research and evaluate the credibility and regulatory status of any broker before engaging in trading activities to ensure a secure and reliable trading experience.

Minimum Deposit

The minimum deposit required for opening a basic account at Sunton Capital is $100 or equivalent. While this minimum deposit requirement may seem reasonable, it is important to note that Sunton Capital operates as an unregulated broker. As a result, it is strongly advised that traders exercise caution and refrain from registering real trading accounts with Sunton Capital. The lack of regulatory oversight poses potential risks for traders, and it is essential to prioritize the safety and security of your funds when choosing a broker. It is recommended to consider regulated and reputable brokers that offer transparent services and adhere to established industry standards to ensure a trustworthy trading environment.

Leverage

Sunton Capital offers a maximum leverage level of 1:100, which is relatively moderate compared to some other brokers in the industry. It is important to note that leverage can magnify both profits and losses in trading. While higher leverage may seem attractive for potential gains, inexperienced traders are strongly advised against using high leverage due to the increased risk involved.

Using high leverage without sufficient knowledge and experience can lead to significant losses, as even small market movements can have a substantial impact on trading accounts. It is crucial for traders, especially those new to the market, to exercise caution and consider their risk tolerance before utilizing leverage. It is recommended to thoroughly educate oneself about leverage, risk management strategies, and the potential consequences of using leverage before engaging in trading activities.

Traders should carefully assess their trading objectives, financial situation, and risk appetite to determine an appropriate leverage level that aligns with their individual circumstances. It is always advisable to start with lower leverage and gradually increase it as trading proficiency and understanding of the market improve. Additionally, seeking guidance from professional advisors or engaging in educational resources can further enhance one's trading skills and decision-making abilities.

Spreads & Commissions

While Sunton Capital mentions that it offers low spreads, the broker does not provide detailed information about spreads on specific instruments. This lack of transparency regarding spread details can be concerning for traders who rely on accurate and specific information to make informed trading decisions. It is important for traders to have a clear understanding of the spreads associated with the instruments they wish to trade, as spreads directly impact trading costs and potential profitability. In order to make well-informed decisions, it is recommended to choose brokers that provide comprehensive and transparent information about their spreads across various trading instruments. This transparency enables traders to evaluate and compare the cost of trading with different brokers, ultimately selecting the most suitable option for their trading strategies and objectives.

Trading Platform

At Sunton Capital, the available trading platform is limited to the web version of MetaTrader 5 (MT5). MT5 is a popular and widely used trading platform that offers a range of features and tools for traders. It provides access to various financial markets, including forex, commodities, indices, and more. With MT5, traders can analyze price charts, execute trades, set up automated trading strategies, and access a wide range of technical indicators and analytical tools to support their trading decisions.

While MT5 is a reliable and robust platform, it is worth noting that the availability of only one trading platform may limit the options for traders who prefer alternative platforms or have specific platform preferences. Traders should consider their individual trading needs and preferences when evaluating the suitability of a broker's trading platform. Additionally, it is important to ensure that the web version of MT5 offered by Sunton Capital is reliable, user-friendly, and provides access to the necessary features and functionalities required for efficient trading.

Deposit & Withdrawal

Payment methods used by Sunton Capital are around credit cards, debit cards, wire transfers, crypto methods, and at times, some alternative payment gateways. Withdrawals use the same methods, although with withdrawals users have to look out for fees! The typical withdrawal processing time is between 2 and 5 days.

By the time the user reaches the bottom of the home page, she will notice a couple of payment services icons: VISA, Mastro, MasterCard, and Skrill. Then these must be the payment methods, although we have absolutely no proof.

Other than this vague reference to the payment methods, the home page (a.k.a the entire broker) has no other payment details.

Its all the same to us. Sunton Capital is not licensed, and is a risk to all investments! It is also a scam!

What to Do if Scammed?

If you have been scammed or encountered fraudulent activities, here are some actions to consider:

1. Credit card or debit card chargeback: If you made the payment using a credit or debit card, initiating a chargeback is often the safest option. Major card providers like MasterCard and VISA typically offer a chargeback period of 540 days, during which you can dispute the transaction and potentially recover your funds.

2. Bank transfer funds: Recovering funds from bank transfers can be more challenging but not impossible. Start by changing your bank account username and password to prevent further unauthorized access. Then, contact your bank directly to report the issue and work together to find a solution for recovering the stolen funds.

3. Crypto deposits: Unfortunately, if you made deposits using cryptocurrencies, the chances of recovering those funds are slim. The only hope would be if the scammers unexpectedly decide to return the funds, but this is rare and unlikely to happen.

4. Avoid recovery agents or agencies: Be cautious of recovery agents or agencies claiming to offer assistance in retrieving lost funds. These individuals or organizations are often scammers themselves and may ask for a service fee upfront. In reality, they have no intention or ability to recover your money, and you may end up losing more.

Conclusion

Overall, while Sunton Capital offers a wide range of tradable instruments and supports multiple payment methods, the lack of transparency, unregulated status, limited platform options, and inaccessible website raise concerns and potential risks for traders. It is recommended to prioritize regulated and reputable brokers that provide transparent information and proper oversight for a secure and reliable trading experience.

FAQs

Q: Is Sunton Capital a legitimate broker or a scam?

A: Trading with an unregulated broker like Sunton Capital can be risky and disadvantageous.

Q: What leverage does Sunton Capital offer?

A: Sunton Capital offers a maximum leverage level of 1:100, which is moderate compared to some other brokers in the industry.

Q: Does Sunton Capital provide detailed information about spreads on specific instruments?

A: Sunton Capital mentions low spreads but does not provide detailed information about spreads on specific instruments.

Q: What trading platform does Sunton Capital offer?

A: Sunton Capital offers the web version of MetaTrader5 (MT5) as its trading platform.

Q: What payment methods are available for deposits and withdrawals at Sunton Capital?

A: Sunton Capital accepts payment methods such as credit cards, debit cards, wire transfers, and crypto methods for both deposits and withdrawals.

Q: What should I do if I have been scammed by Sunton Capital?

A: If you have been scammed by Sunton Capital, the safest option is to initiate a charge back with your credit card or debit card company within the charge back period.

WikiFX ब्रोकर

WikiFX ब्रोकर

रेट की गणना करना