XTB Information Revealed

एब्स्ट्रैक्ट:XTB, operating under the name X-Trade Brokers, is a Belize-based company providing trading services across various financial markets. With a trading history of 1-2 years, XTB offers trading in forex, indices, commodities, stock CFDs, ETF CFDs, and cryptocurrencies CFDs. The company offers two main types of trading accounts: STANDARD and SWAP FREE, both featuring market execution and a range of instruments. XTB provides leverage up to 1:500 for different instruments, with spreads starting from 0.1 pips. The platform offers xStation 5 for web-based trading and xStation Mobile for mobile trading, with market news, price tables, and a market calendar as trading tools. Educational resources include a Knowledge Base covering trading topics, while customer support is accessible through various channels for international clients. Reviews for XTB on WikiFX are mixed, with concerns about customer service and scam allegations.

| Aspect | Information |

| Registered Country | Belize |

| Founded Year | 1-2 years |

| Company Name | X-Trade Brokers (XTB) |

| Regulation | Currently lacks proper regulation, operates without oversight |

| Minimum Deposit | No minimum deposit requirement |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0.1 pips |

| Trading Platforms | 1. xStation 5 (web-based) 2. xStation Mobile (mobile app) |

| Tradable Assets | 1. Forex (48 currency pairs) 2. Indices (20+ indices) 3. Commodities 4. Stock CFDs (2100+ equities) 5. ETF CFDs (60 ETFs) 6. Cryptocurrency CFDs (10+ cryptocurrencies) |

| Account Types | 1. STANDARD (max leverage 1:500) 2. SWAP FREE (max leverage 1:500) |

| Demo Account | Available for both account types |

| Islamic Account | Not mentioned |

| Customer Support | Phone, chat, and email support available in multiple languages |

| Payment Methods | Bank transfers, Credit card, E-wallets |

| Educational Tools | Knowledge Base with articles covering various trading topics |

Overview of XTB

XTB, or X-Trade Brokers, operates from Belize and provides a trading platform for various markets. While offering opportunities in forex, indices, commodities, stock CFDs, ETF CFDs, and cryptocurrency CFDs, a notable concern is its lack of proper regulation, posing potential risks due to the absence of oversight.

Traders can access 48 currency pairs with low spreads from 0.1 pips in the forex market, which operates 24/5, allowing for microlot trading. The platform extends to indices, commodities, and diverse equities, with low spreads and leverage of up to 500:1. Cryptocurrency enthusiasts can trade 10+ CFDs, including Bitcoin and Ethereum, in a market open 24/7.

Two main account types, STANDARD and SWAP FREE, cater to different preferences, offering market execution, leverage up to 1:500, and access to over 2200 instruments. The xStation 5 platform, available on web and mobile, provides trading tools like price tables and a market calendar. XTB's customer support is available in various languages, though mixed reviews raise concerns about response times and service quality.

In summary, XTB's platform offers a wide range of trading options, but its lack of regulation and mixed reviews warrant careful consideration before engaging in trading activities.

Pros and Cons

XTB presents a diverse array of trading instruments, featuring low spreads starting at 0.1 pips and leverage of up to 1:500. The platform offers comprehensive trading tools and supports the advanced xStation 5 platform. Traders can access these resources across various devices. Additionally, XTB provides educational materials through its Knowledge Base and offers a demo account for practice. However, the lack of proper regulation poses a risk, and there is limited customer support reported by some users. Deposit and withdrawal methods are also restricted, and coverage is limited in certain regions. There have been complaints of delayed responses leading to potential financial losses, and the range of account types is also limited.

| Pros | Cons |

| Diverse range of trading instruments | Lack of proper regulation poses risk |

| Low spreads from 0.1 pips | Limited customer support |

| Leverage up to 1:500 | Some users reported delayed responses |

| Comprehensive trading tools | Limited deposit and withdrawal methods |

| xStation 5 platform for advanced traders | Limited coverage in some regions |

| Trading platforms on various devices | Potential financial losses due to delays |

| Knowledge Base for educational resources | Limited types of accounts |

| Demo account available for practice |

Is XTB Legit?

XTB, unfortunately, lacks proper regulation at the moment, which means it operates without any valid oversight. This situation poses a significant risk for potential clients and investors.

Market Instruments

1. Forex: XTB offers a range of 48 currency pairs for trading. Traders can benefit from low spreads starting from 0.1 pips, with the market open 24 hours a day for five days a week. There is no minimum deposit requirement, and microlot trading is available, allowing for smaller position sizes. Examples of currency pairs include EUR/USD, EUR/GBP, EUR/JPY, and AUD/USD.

2. Indices: XTB provides low spreads for trading over 20 indices from various countries such as the USA, Germany, and China. Traders have the ability to go both short and long on these indices. Rollovers are visible directly on the chart, and leverage up to 500:1 is available. Examples of indices include UK100, DE30, US500, US2000, EU50, and FRA40.

3. Commodities: XTB allows traders to trade popular commodities like Gold, Silver, Oil, NATGAS, Cocoa, and Corn. The platform offers low spreads and rollovers visible on the chart. Leverage up to 500:1 is available, and trading is open 24 hours a day. The platform can be accessed on PC, Tablet, and Smartphone devices.

4. Stock CFDs: XTB offers CFDs on more than 2100 equities, providing leverage up to 1:10. Traders can go long or short on these equities without incurring any commission. The platform boasts ultra-fast execution and has received awards for its platform and services. Examples of equity CFDs include AAPL.US, AMZN.US, BARC.UK, BMW.DE, and DBK.DE.

5. ETF CFDs: With 60 ETF CFDs available, XTB allows traders to diversify their trading portfolio. These ETFs come with leverage up to 1:10 and offer negative balance protection. Like the Stock CFDs, there is no commission charged, and the execution is ultra-fast. Examples of ETF CFDs include SPY.US, URA.US, XLE.US, QQQ.US, and GDXJ.US.

6. Cryptocurrencies CFDs: XTB provides the opportunity to trade 10+ Crypto CFDs, including popular cryptocurrencies like Bitcoin, Ethereum, Stellar, and Dogecoin. The market is open 24/7, including weekends, and access to markets is available through mobile apps. Trading costs are low, with spreads starting from 0.22%. Examples of Crypto CFDs include BITCOIN, ETHEREUM, RIPPLE, and LITECOIN.

| Pros | Cons |

| Wide range of trading options | Limited information on trading platforms |

| Low spreads from 0.1 pips | Limited educational resources for traders |

| No minimum deposit requirement | Limited availability of advanced trading features |

Account Types

XTB offers two main types of trading accounts: STANDARD and SWAP FREE.

The STANDARD account operates with market execution and includes over 2200 instruments, such as Forex, Commodities, Indices, Cryptos, Stock CFDs, and ETF CFDs. The account provides a maximum leverage of 1:500, which can be adjusted dynamically. Traders can benefit from a minimum spread of 0.5 pips and access automated trading. Additionally, the account allows for segregated funds, has no commission on Forex, Indices, and Commodities, and provides a free setup and management process. The xStation trading platform is available for use on web, desktop, mobile, and tablet devices. A demo account is also available for practice.

On the other hand, the SWAP FREE account shares similar features with the STANDARD account, including market execution and access to the same range of instruments. The maximum leverage offered is also 1:500, adjustable dynamically, with a minimum spread of 0.7 pips. The SWAP FREE account, as the name suggests, provides a Swap Free feature. This means that there are no additional commissions for Forex, Indices, Commodities, Cryptocurrencies, Stock CFDs, and ETF CFDs. The account is also supported by the xStation platform and comes with a free setup and management process. A demo account is available to help traders familiarize themselves with the platform and practice their strategies before engaging in live trading.

| Pros | Cons |

| Demo account available | Limited types of accounts |

| Access to automated trading | Some commissions on specific instruments |

| No commissions on various assets | No Swap Free feature |

Leverage

XTB offers leverage of up to 1:500 for various instrument names, depending on the nominal portfolio value in EUR, allowing traders to potentially amplify their positions in the market.

Spreads

XTB offers spreads starting from as low as 0.1 pips for forex trading.

Fees & Commissions

XTB charges a monthly account fee of up to 10 EUR or none, a 30 USD withdrawal fee for transactions under 50 USD, and a 1.5% commission for credit card withdrawals. Withdrawals to Skrill and Neteller carry a 1% fee. Transaction fees for opening and closing PROFESSIONAL Accounts vary by instrument, starting at 3.5 USD per 1 Lot. Stock CFD and ETF CDF transactions have zero commission but include a spread markup and dividend-related fees. Notional transaction value fees range from 0.25 to 200 EUR based on transaction size. Exchange rate conversions are based on bid and ask rates. Additional fees might apply.

Bonus

XTB provides a Welcome Bonus exclusively to new non-EU, UK, and MENA clients. Residents in the UK, EU, and MENA (FCA, EU, DFSA Branches) cannot receive cash-based or any other incentives due to regulatory restrictions. However, non-UK, EU, and MENA residents (IFSC Belize regulated entity) can avail a Welcome Bonus of 50% of their first deposit if they trade a minimum amount of lots (15% of the first deposit) within 60 days of account opening. To apply for the Bonus, clients need to have a first deposit equivalent to at least 100 USD and contact the sales team. XTB does not offer a No Deposit Bonus.

Deposit & Withdrawal

Deposits & Withdrawals at XTB can be made through various methods. For bank transfers, XTB accepts USD with no fees, but the client's bank may charge a transfer fee. Credit card deposits in USD are also free of charge. However, using e-wallets incurs fees: 2% for Paysafe (formerly Skrill), 1.5% for SafetyPay, and 1% for Neteller. The processing times for deposits are generally instant, except for bank transfers, which take 1 working day for UK/EU and 2-5 days for other countries. There is no minimum deposit required, and XTB does not charge fees on bank transfers and credit/debit card deposits. However, for Skrill, there is a 2% fee for UK residents and non UK/EU residents, while there are no fees for PayPal deposits for EU residents. Withdrawals are processed in 1 business day, and for USD withdrawals, XTB covers the full cost charged by the sending bank, with withdrawals less than $50 incurring an additional $30 commission.

| Pros | Cons |

| Multiple deposit methods available | E-wallet deposits have fees |

| Instant processing for most deposits | Bank transfers may have external transfer fees |

| No minimum deposit requirement | Withdrawals under $50 incur $30 commission |

| Withdrawals processed in 1 business day |

Trading Platforms

1. xStation 5 is a web-based trading platform offered by XTB, providing access to advanced tools for experienced traders and an intuitive interface for beginners. It supports over 2200 instruments, including Forex, Indices, Commodities, Crypto, and real stocks & ETFs, all tradable from a single account. The platform offers comprehensive charts and is compatible with popular web browsers.

2. xStation Mobile is a mobile app by XTB, offering access to over 2200 CFD markets, including FX, cryptocurrencies, indices, commodities, stocks, and ETFs. The app features charts, real-time breaking news updates, and an easy-to-use interface for managing trades and risk.

| Pros | Cons |

| xStation 5 provides tools for all trader levels | Limited information on trading fees and spreads |

| Wide range of tradable instruments | Some advanced features may overwhelm beginners |

| User-friendly mobile app | Mobile app may lack certain advanced trading functionalities |

Trading Tools

1. Market News: XTB provides real-time market news on major companies like Apple and Caterpillar, along with updates on economic events like Fitch Agency's decision to lower the US credit rating. These news updates enable traders to stay informed and make timely decisions.

2. Price Tables: XTB offers comprehensive price tables for various instruments. Traders can access bid, ask, spread, and percentage change data, allowing them to monitor market fluctuations and execute trades.

3. Market Calendar: XTB's market calendar feature helps traders track important economic events and announcements, with the ability to filter events based on their impact. This enables traders to plan their strategies around key events and manage risks.

Educational Resources

XTB offers a Knowledge Base with articles covering a wide range of trading topics, including Forex, Commodities, Indices, and more. The content provides step-by-step guides on account application, activation, and funding. Users can learn about CFDs, Forex trading, commodities, and stock market indices without any promotional language.

Customer Support

XTB offers customer support through various channels. For account opening inquiries, customers can reach them at +357 257 25356. They provide 24/5 chat support at +48 222 739 976. Additionally, customers can contact XTB through specific email addresses for different regions: sales_int@xtb.com for international inquiries, and various region-specific email addresses for countries like Czech Republic, Hungary, Turkey, Italy, Latin America, Cyprus, Poland, Arabic-speaking countries, Germany, Portugal, Romania, Slovakia, France, Spain, United Kingdom, China, Thailand, Vietnam, and United Arab Emirates. The company has an extensive global presence, offering support in multiple languages to cater to their international client base.

Reviews

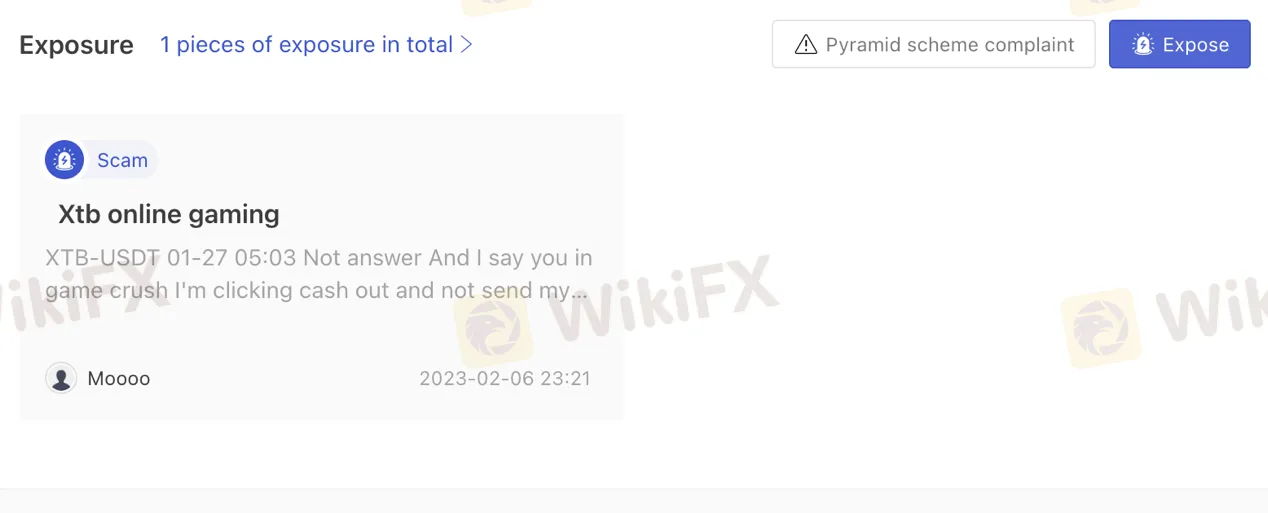

XTB's WikiFX reviews are a mixed bag, with a pyramid scheme complaint and exposure as a scam. Users have expressed frustration with delayed responses, resulting in financial losses. Concerns are raised about the lack of customer service permission for certain matters.

Conclusion

In summary, XTB, also known as X-Trade Brokers, offers a diverse range of trading opportunities spanning Forex, indices, commodities, stock CFDs, ETF CFDs, and cryptocurrency CFDs. The company presents two main account options, STANDARD and SWAP FREE, both featuring market execution and distinct benefits. Leverage of up to 1:500 is attainable, with associated spreads contingent upon the chosen account type. While XTB provides an array of trading tools through platforms like xStation 5 and xStation Mobile, offering market news, price tables, and a market calendar, some users have expressed concerns about customer service responsiveness, occasionally leading to financial setbacks. Aspirants should weigh both the appealing attributes and shortcomings of XTB judiciously when considering their participation in trading endeavors.

FAQs

Q: What is XTB and where is it located?

A: XTB, also known as X-Trade Brokers, is a company based in Belize that offers trading services.

Q: What markets can I trade with XTB?

A: XTB provides trading options in Forex, Indices, Commodities, Stock CFDs, ETF CFDs, and Cryptocurrencies.

Q: Is XTB regulated?

A: Currently, XTB lacks proper regulation, which poses a risk for potential clients and investors.

Q: What are the account types offered by XTB?

A: XTB offers STANDARD and SWAP FREE accounts, both with market execution and access to various instruments.

Q: What leverage does XTB offer?

A: XTB provides leverage of up to 1:500 for different instruments.

Q: What are the trading platforms available at XTB?

A: XTB offers xStation 5, a web-based platform, and xStation Mobile, a mobile app, for trading.

Q: Are there fees for deposits and withdrawals at XTB?

A: XTB charges varying fees for deposits and withdrawals depending on the method used.

Q: What educational resources does XTB offer?

A: XTB provides a Knowledge Base with articles covering trading topics and account-related information.

Q: How can I contact XTB's customer support?

A: You can reach XTB's customer support through phone, chat, and region-specific email addresses.

Q: What are some concerns raised about XTB?

A: Some users have expressed frustrations with delayed responses and customer service issues.

Q: Can I receive a Welcome Bonus from XTB?

A: XTB offers a Welcome Bonus for new non-EU, UK, and MENA clients, subject to certain conditions.

Q: What markets can I trade with XTB?

A: XTB offers trading in Forex, Indices, Commodities, Stock CFDs, ETF CFDs, and Cryptocurrencies.

Q: How can I access XTB's trading platforms?

A: XTB's xStation 5 platform is web-based, and xStation Mobile is a mobile app, both accessible for trading.

Q: Does XTB provide market news and tools?

A: Yes, XTB offers real-time market news, price tables, and a market calendar to assist traders.

Q: Are there fees for using e-wallets at XTB?

A: Yes, e-wallet deposits may incur fees, such as 2% for Paysafe (formerly Skrill).

Q: What types of accounts does XTB offer?

A: XTB offers STANDARD and SWAP FREE trading accounts, both with market execution and access to various instruments.

Q: Can residents from certain regions receive the Welcome Bonus?

A: The Welcome Bonus is available to non-EU, UK, and MENA residents, subject to specific conditions.

Q: What educational resources are available at XTB?

A: XTB offers a Knowledge Base with articles covering various trading topics and account-related information.

Q: How can I contact XTB's customer support?

A: You can reach XTB's customer support through phone, chat, and region-specific email addresses.

WikiFX ब्रोकर

रेट की गणना करना