Elviva

एब्स्ट्रैक्ट: Elviva Invest, registered in Elviva and founded in 2023, emerges as a highly questionable and potentially unreliable trading platform. It operates without regulatory oversight, a significant red flag indicating a lack of standard protections for its users. The platform demands a minimum deposit of $250 for its lowest Silver Tier, but this is overshadowed by its extremely high spreads, notably 27 pips for EUR/USD, which is exorbitantly high compared to industry norms. The trading platform itself is basic and rudimentary, lacking the advanced features that are standard in more reputable platforms like MT4 and MT5. While Elviva Invest offers a range of tradable assets, including Forex, Bullion, and Cryptocurrency, these offerings are marred by the platform's overall lack of sophistication and transparency. The account types, though varied, come with a maximum leverage of 1:200, which is excessively risky, especially for inexperienced traders. Customer support is limited to email and is

| Aspect | Details |

| Registered Country/Area | Elviva |

| Founded Year | 2023 |

| Company Name | Elviva Invest |

| Regulation | Not regulated |

| Minimum Deposit | $250 (Silver Tier) |

| Maximum Leverage | 1:200 |

| Spreads | Extremely high (e.g., 27 pips for EUR/USD) |

| Trading Platforms | Basic and simplistic, lacks advanced features |

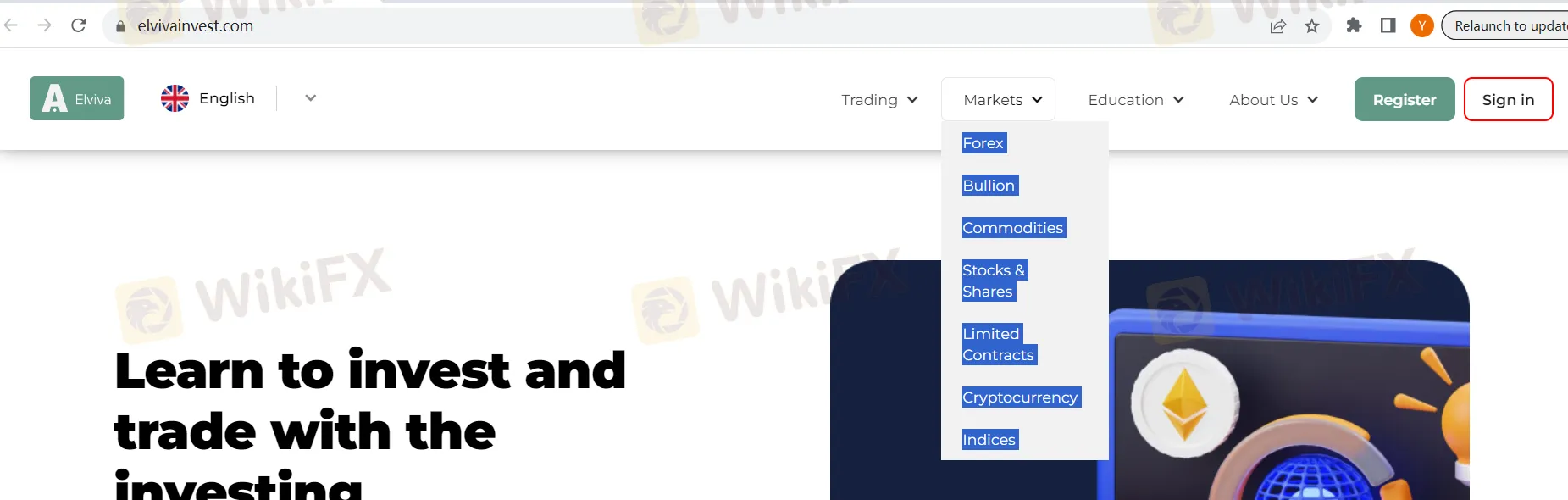

| Tradable Assets | Forex, Bullion, Commodities, Stocks & Shares, Limited Contracts, Cryptocurrency, Indices |

| Account Types | Silver Tier, Gold Tier, Platinum Tier |

| Customer Support | Limited to email, often unresponsive |

| Payment Methods | Not specified, lacks transparency |

| Educational Tools | Non-functional link, essentially inaccessible |

| Reputation | Questionable, with indications of being a scam |

Overview

Elviva Invest, registered in Elviva and founded in 2023, emerges as a highly questionable and potentially unreliable trading platform. It operates without regulatory oversight, a significant red flag indicating a lack of standard protections for its users. The platform demands a minimum deposit of $250 for its lowest Silver Tier, but this is overshadowed by its extremely high spreads, notably 27 pips for EUR/USD, which is exorbitantly high compared to industry norms.

The trading platform itself is basic and rudimentary, lacking the advanced features that are standard in more reputable platforms like MT4 and MT5. While Elviva Invest offers a range of tradable assets, including Forex, Bullion, and Cryptocurrency, these offerings are marred by the platform's overall lack of sophistication and transparency.

The account types, though varied, come with a maximum leverage of 1:200, which is excessively risky, especially for inexperienced traders. Customer support is limited to email and is often unresponsive, adding to the frustration of users seeking assistance. The lack of clarity regarding payment methods and the inaccessibility of educational tools due to a non-functional website link further degrade the platform's credibility.

Elviva Invest's overall reputation is deeply tarnished by indications that it might be a scam, coupled with its numerous operational deficiencies. This, combined with its non-transparent practices, makes Elviva Invest a platform that potential investors should approach with extreme caution, if not outright avoid.

Regulation

Elviva is not classified as a broker, and therefore, it operates outside the regulatory scope typically applied to brokerage firms. This distinction means that Elviva does not adhere to the same rules and oversight that govern traditional brokerage entities. Consequently, users engaging with Elviva's services may not have the same protections and assurances that are standard in regulated brokerage operations. It is important for individuals to be aware of this difference and consider the potential implications when utilizing Elviva's offerings.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

This summary and table highlight the imbalances in Elviva Invest's offerings, with the cons significantly outweighing the pros, suggesting a trading environment that is unfavorable and risky for investors.

Market Instruments

Elviva offers a diverse range of market instruments that cater to various investment preferences and strategies. Here's a breakdown of each type:

Forex: Elviva provides access to the foreign exchange market, allowing traders to buy, sell, and speculate on currencies from around the world. This market is known for its high liquidity and operates 24/5, offering opportunities for both short-term and long-term traders.

Bullion: This involves trading in precious metals, primarily gold and silver. Bullion trading with Elviva is often considered a hedge against inflation and currency devaluation, and it attracts investors looking for a safe haven or long-term store of value.

Commodities: Elviva's commodity trading includes a range of products such as oil, natural gas, agricultural products (like wheat, corn, and soybeans), and other raw materials. These markets can be influenced by a variety of factors, including geopolitical events, weather patterns, and changes in supply and demand.

Stocks & Shares: This category allows investors to buy shares in publicly traded companies. Trading stocks and shares through Elviva can range from blue-chip stocks to emerging market equities, catering to a wide spectrum of risk appetites and investment strategies.

Limited Contracts: These are likely contract-based investments with a fixed duration and predetermined conditions. They might include instruments like options, futures, or fixed-term bonds, offering a blend of risk and reward based on the contract terms.

Cryptocurrency: Elviva provides a platform for trading various cryptocurrencies. This relatively new asset class includes digital currencies like Bitcoin, Ethereum, and many others. Crypto trading is known for its high volatility and is popular among traders looking for rapid price movements.

Indices: Trading in indices with Elviva allows investors to speculate on the overall movement of specific market segments or the entire market. Indices are often used to gauge the performance of a market or a sector and can include major indices like the S&P 500, NASDAQ, or other global market indices.

Each of these market instruments has its own characteristics, risk profiles, and potential returns, making Elviva's offerings diverse and suitable for a wide range of investment strategies.

Account Types

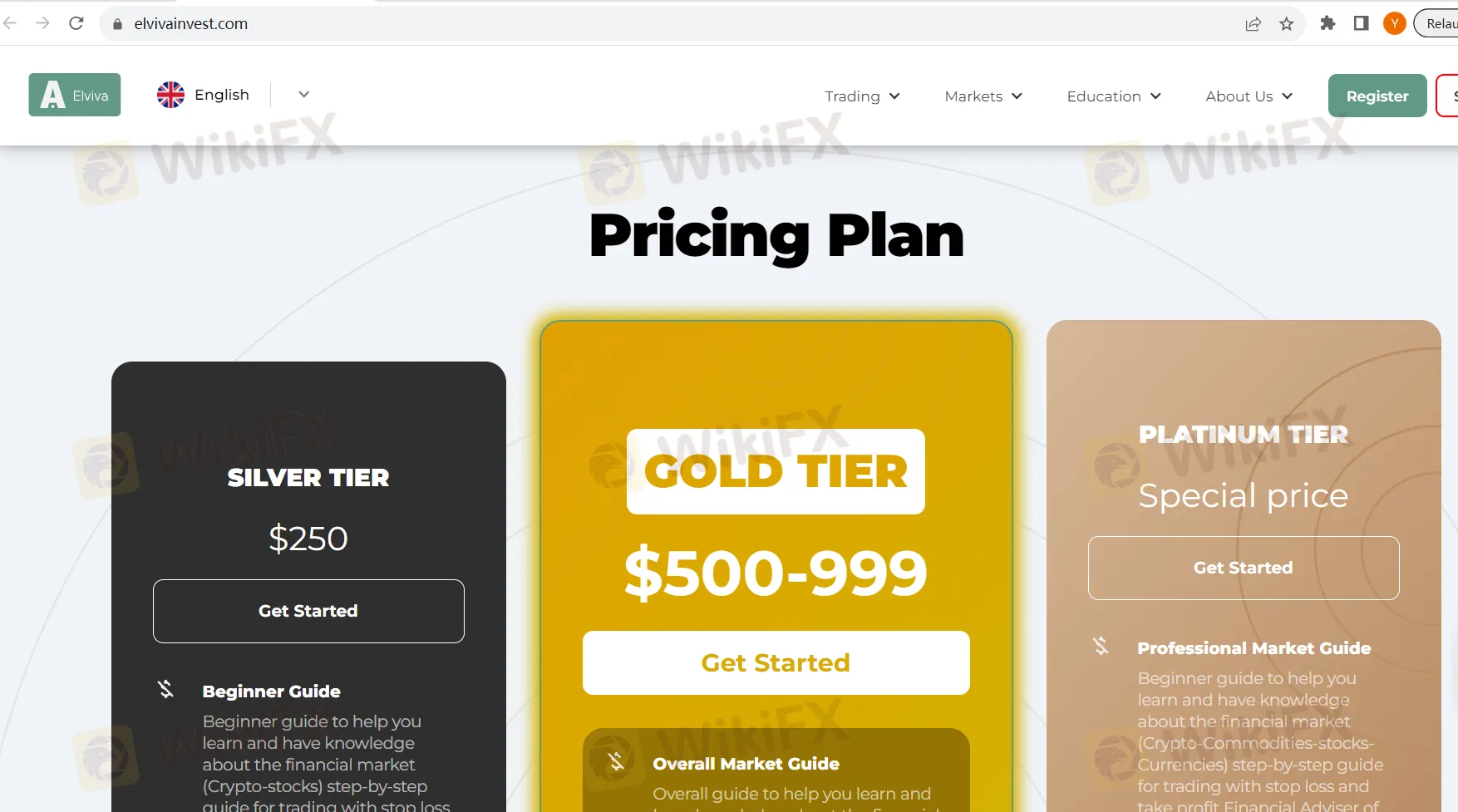

Elviva offers three distinct pricing tiers for its clients, each with unique features and benefits suited to different levels of trading experience and investment capacity. Here's a detailed overview of each plan:

Silver Tier ($250):

Beginner Guide: This plan offers a beginner's guide to the financial markets, focusing on cryptocurrencies and stocks. It includes a step-by-step guide for trading with essential tools like stop loss and take profit.

Financial Adviser: Clients receive advice from a financial adviser with over 5 years of experience, specialized and legalized in the trading field.

Fees: The fee structure is based on the strategies and follow-ups provided to the client, charging up to 30% on the daily or monthly income.

Trading: The trading limitation under this plan is 5 trades per day, including a restriction of 1 daily night trade with a Trading Bot.

Overall Market Guide: This includes a more comprehensive guide covering cryptocurrencies, commodities, and stocks. It comes with a professional trading guide and step-by-step instructions for effective trading.

Financial Adviser: Access to a financial adviser with at least 8 years of experience in the trading field.

Fees: Fees are calculated similarly to the Silver Tier but are reduced to up to 20% on the daily or monthly income.

Trading: Clients can make up to 8 trades per day without any amount limitations. This tier includes a 7-hour night shift with a Trading Bot, allowing up to 5 trades.

Professional Market Guide: This tier provides an advanced guide covering a broader range of markets, including cryptocurrencies, commodities, stocks, and currencies. It aims to cater to more experienced traders.

Financial Adviser: The financial adviser in this tier boasts over 15 years of experience and offers opportunities to join whale movements in trading.

Fees: The fee structure is the most favorable in this tier, with fees under 11% based on the client's strategies, follow-ups, and income.

Trading: This plan offers unlimited trading, a 24/7 Trading Bot, VIP signals for instant trade, whale movement insights, access to rare cryptocurrency contracts, daily follow-up paperwork, and a competitive environment to be listed in the top trader list.

Gold Tier ($500-999):

Platinum Tier (Special Price):

Each tier is designed to cater to different levels of expertise and investment strategies, from beginners to seasoned traders, with progressively more advanced tools, guidance, and lower fee percentages as you move up the tiers.

Leverage

Elviva offers a maximum trading leverage of 1:200. This means that for every $1 of a trader's capital, they can control a position worth up to $200. While this high leverage can significantly amplify potential profits on successful trades, it also increases the risk of substantial losses if the market moves unfavorably. Effective risk management, including the use of stop-loss orders, is crucial when trading with such high leverage. It's a powerful tool for experienced traders but can be risky for novices.

Spreads and Commissions

The lack of crucial cost information on Elviva's website further compounds the problem. Withholding such vital details about trading costs is not just non-transparent, but it can also be misleading for traders, especially those less experienced. This omission of cost information could be seen as a deliberate attempt to obscure the true expense of trading with them.

Moreover, the starting spread for a major pair like EUR/USD being set at an extraordinary 27 pips is alarmingly high. In the trading world, such a spread is considered excessively large and can significantly hinder the profitability of trades. This is especially true for short-term traders who rely on small fluctuations in currency prices.

Deposit & Withdrawal

The deposit and withdrawal processes at Elviva Invest are fraught with difficulties, marked by a troubling lack of transparency and convenience. Critical information about payouts is conspicuously absent from their site and legal documents, creating an air of secrecy. Clients are forced to rely heavily on account managers or support for basic transaction instructions, adding unnecessary complexity. Moreover, the ambiguity around transaction channels and associated fees further complicates and potentially adds unforeseen costs to the process. This overall lack of clarity and user-friendliness in handling transactions strongly suggests deceptive practices and a disregard for client experience.

Trading Platforms

Elviva Invest's trading platform is starkly underwhelming and inadequate, especially when compared to the industry standards set by leading platforms like MT4 and MT5. It is overly simplistic, lacking in advanced tools, add-ons, and functionalities that are essential for effective and sophisticated trading. This deficiency not only limits traders' abilities to analyze markets and execute strategies but also raises suspicions about the platform's integrity. There's a concern that the broker might be manipulating this subpar software to create an illusion of trading opportunities, potentially enticing traders to invest more while unknowingly participating in unrealistic or manipulated trades. Such practices, if true, would be unethical and detrimental to traders, suggesting a significant risk associated with using Elviva Invest's platform.

Customer Support

Elviva Invest's customer support is severely lacking and does not live up to its promise of dedicated 24/7 assistance. The support system is disappointingly limited to just one communication channel – email – which greatly undermines its effectiveness. Furthermore, inquiries sent via this sole channel often go unanswered, highlighting a significant failure in responsiveness. This lack of timely and diverse support options, especially in urgent situations, reveals a stark contrast between their claims and the actual level of service, casting doubt on their reliability as a trading platform provider.

Educational Resources

Elviva Invest's website features an education section, which, in theory, should be a valuable resource for traders. However, the functionality of this section is severely compromised as the link to access it is non-functional. This broken link not only represents a technical oversight but also reflects a broader issue of neglect and lack of attention to detail. For traders, especially beginners, educational resources are crucial for developing trading skills and making informed decisions. The inaccessibility of this section not only deprives users of potentially helpful information but also raises questions about the overall quality and reliability of Elviva Invest's services. Such a basic yet critical flaw can significantly undermine trust in the platform and its commitment to supporting its users' trading education.

Conclusion

Elviva Invest's operations are fraught with numerous red flags and shortcomings, casting serious doubts on its legitimacy and reliability as a trading platform. The lack of regulatory oversight means it doesn't adhere to the stringent standards and protections typically required for brokers, leaving users vulnerable. Its market instruments, while varied, are overshadowed by highly concerning practices in other areas. The platform offers unreasonably high leverage of 1:200, which, coupled with astronomical spreads like 27 pips on major pairs, creates an environment ripe for substantial financial risks and losses. The trading platform itself is rudimentary and lacks advanced features found in industry-standard platforms like MT4 and MT5, raising suspicions of manipulation and deceit.

Furthermore, Elviva's approach to client transactions is alarmingly opaque, with essential details on deposits, withdrawals, and fees either hidden or unavailable. This lack of transparency extends to their customer support, which is both limited in communication channels and unresponsive, failing to live up to its 24/7 support claim. Additionally, the non-functional educational resources section on their website further demonstrates a lack of commitment to client support and education.

All these issues, combined with the platform being labeled as a scam by some, paint a picture of a trading platform that is not only unreliable but potentially exploitative. Elviva Invest appears to prioritize its own interests at the expense of its clients, employing practices that are misleading, unprofessional, and detrimental to traders. The cumulative effect of these practices is a trading environment that is highly unfavorable and risky for investors.

FAQs

Q1: Is Elviva Invest regulated by any financial authority?

A1: No, Elviva Invest is not classified as a broker and operates outside the regulatory scope typically applied to brokerage firms. This means they don't adhere to the rules and oversight that govern regulated brokerage entities.

Q2: What are the spreads for major currency pairs like EUR/USD with Elviva Invest?

A2: Elviva Invest offers extremely high spreads, with the starting spread for EUR/USD being an unusually high 27 pips. This is considerably higher than the industry average and can significantly impact trade profitability.

Q3: What types of customer support does Elviva Invest offer?

A3: Elviva Invest's customer support is primarily via email, and they claim to offer 24/7 support. However, this claim is questionable as their responsiveness and availability of support channels are significantly lacking.

Q4: Can I access educational resources on Elviva Invest's website?

A4: While Elviva Invest's website features an education section, the link to this resource is non-functional, making it inaccessible and questioning the platform's commitment to trader education.

Q5: What are the risks associated with the high leverage offered by Elviva Invest?

A5: Elviva Invest offers a high leverage of 1:200, which can significantly amplify potential profits but also increases the risk of substantial losses. This high leverage, especially without adequate regulatory oversight, poses a high risk for traders, particularly for novices.

WikiFX ब्रोकर

रेट की गणना करना