Da Fu Gold

एब्स्ट्रैक्ट:Da Fu Gold, founded in 2010 and based in New Zealand, is a trading platform that specializes in futures trading. It offers two account types, the Standard Account with a minimum deposit of $100 and the ECN Account with a $5,000 minimum deposit. While the platform boasts user-friendly features and utilizes the well-known MetaTrader 4 (MT4) trading platform, it operates without any regulatory oversight. This lack of regulatory supervision will raise issues for traders regarding transparency and investor protections. Nevertheless, its expertise in futures trading provides an advantage for traders interested in this specific asset class, making it an option worth considering for experienced traders who prioritize futures trading.

| Aspect | Information |

| Company Name | Da Fu Gold |

| Registered Country/Area | New Zealand |

| Founded Year | 2010 |

| Regulation | No regulatory oversight |

| Market Instruments | Specializes in futures trading |

| Account Types | Standard Account, ECN Account |

| Minimum Deposit | $100 |

| Spreads | 0.20% |

| Trading Platforms | MetaTrader 4 (MT4) |

| Customer Support | Email support at jyzq002@gmail.com |

Overview of Da Fu Gold

Da Fu Gold, founded in 2010 and based in New Zealand, is a trading platform that specializes in futures trading. It offers two account types, the Standard Account with a minimum deposit of $100 and the ECN Account with a $5,000 minimum deposit. While the platform boasts user-friendly features and utilizes the well-known MetaTrader 4 (MT4) trading platform, it operates without any regulatory oversight. This lack of regulatory supervision will raise issues for traders regarding transparency and investor protections. Nevertheless, its expertise in futures trading provides an advantage for traders interested in this specific asset class, making it an option worth considering for experienced traders who prioritize futures trading.

Is Da Fu Gold legit or a scam?

Da Fu Gold operates without any regulatory oversight, which can give rise to apprehensions regarding the exchange's transparency and supervision. Unregulated exchanges are devoid of the vigilant scrutiny and legal safeguards offered by regulatory bodies. Consequently, they are more susceptible to fraudulent activities, market manipulation, and security breaches. In the absence of adequate regulation, users will encounter difficulties in pursuing remedies or settling disputes. Moreover, the absence of regulatory supervision can contribute to a lack of transparency in the trading environment, rendering it challenging for users to ascertain the legitimacy and dependability of the exchange.

Pros and Cons

| Pros | Cons |

| Expertise in futures | Lack of regulatory oversight |

| User-friendly platform | Limited customer support channels |

| Limited educational resource | |

| Not available in some countries or regions |

Pros:

Expertise in Futures:

Da Fu Gold demonstrates proficiency in the futures trading domain, which can be advantageous for traders interested in this asset class. Their experience and focus on futures provide valuable insights and opportunities for futures traders.

User-Friendly Platform:

The platform offered by Da Fu Gold is user-friendly, making it accessible to traders of various skill levels. An intuitive interface and easy navigation can help traders efficiently execute their trades and manage their accounts.

Cons:

Lack of Regulatory Oversight:

Da Fu Gold operates without oversight from regulatory authorities, which can potentially expose traders to increased risks. The absence of regulatory supervision means there is limited investor protections, potentially leading to worry about transparency and accountability.

Limited Customer Support Channels:

Da Fu Gold offers a limited range of customer support channels, primarily relying on email communication. This can lead to longer response times and less immediate assistance compared to platforms with more customer support options like live chat or phone support.

Limited Educational Resources:

Da Fu Gold does not provide comprehensive educational resources or materials for traders looking to enhance their trading knowledge. Traders seeking educational support and guidance will find the platform lacking in this regard.

Not Available in Some Countries or Regions:

Da Fu Gold's services are restricted or unavailable in certain countries or regions due to regulatory restrictions or other factors. Potential users should check whether the platform is accessible in their specific location before considering it for trading purposes.

Market Instruments

Da Fu Gold offers a range of trading assets, with a primary focus on futures trading. These trading assets include various futures contracts spanning different commodities, indices, and financial instruments. The platform provides opportunities for traders to speculate on the price movements of these assets, enabling them to potentially profit from price fluctuations.

It's important to note that Da Fu Gold's product offerings are primarily centered around futures trading, and the variety of assets available for trading depend on market conditions and the exchange's current offerings. Traders interested in using the platform should conduct thorough research and due diligence to ensure they have a clear understanding of the specific assets available for trading at any given time.

Account Types

Da Fu Gold offers two distinct account types for different trading preferences and needs.

Standard Account:

The Standard account type is for traders seeking simplicity and accessibility. It features a fixed spread of 0.2% with no commission charges, making it suitable for those who prefer straightforward fee structures. With a relatively low minimum deposit requirement of $100, this account type is accessible to both novice and experienced traders. Withdrawals are free, and traders can take advantage of a demo account to practice their strategies.ECN Account:The ECN (Electronic Communication Network) account is tailored for more experienced traders who prioritize market depth and transparency. It offers raw spreads, providing traders with direct access to market pricing. However, there is a commission of $5 per lot traded. With a higher minimum deposit requirement of $5,000, the ECN account type is better suited for traders with a more substantial trading capital. Similar to the Standard account, ECN account holders enjoy free withdrawals and access to a demo account.

How to Open an Account?

Opening an account with Da Fu Gold is a straightforward process, consisting of six clear steps:

Visit Da Fu Gold Website:

Start by visiting the official Da Fu Gold website. Ensure that you are on the official platform to guarantee the security of your account registration.

Select “Open an Account”:

On the website's homepage, you should find an option that says “Open an Account” or something similar. Click on this button to initiate the account creation process.

Complete the Registration Form:

You will be directed to a registration form where you'll need to provide personal information. This typically includes your full name, contact details, and a valid email address.

Choose Account Type:

During the registration process, you will be asked to select your preferred account type. Da Fu Gold typically offers Standard and ECN account options. Make your selection based on your trading preferences.

Submit Verification Documents:

Da Fu Gold requires you to submit identity verification documents to comply with regulatory requirements. This usually involves uploading a government-issued ID (such as a passport or driver's license) and proof of address (like a utility bill).

Fund Your Account:

Once your account is approved and verified, you can fund it by depositing the minimum required amount. Da Fu Gold provides various deposit methods for your convenience, including bank transfers and online payment processors.

Spreads & Commissions

Da Fu Gold offers varying spreads and commissions for its two different account types, the Standard and ECN accounts.

The Standard Account features a fixed spread of 0.2% with no commission charges. This fee structure is relatively straightforward and appeals to traders who prefer a clear understanding of their trading costs. With a minimum deposit requirement of $100, it serves a broad spectrum of traders, including beginners and those with limited capital. The absence of a commission makes it particularly suitable for those who want to avoid transaction-based fees.

In contrast, the ECN Account offers raw spreads but comes with a $5 commission per lot traded. While the spreads vary depending on market conditions, the presence of a commission means that traders using the ECN account will incur a transaction-based fee. To open an ECN account, a higher minimum deposit of $5,000 is required. This account type is better suited for experienced traders with a more substantial trading capital who prioritize market depth and transparency over a fixed spread.

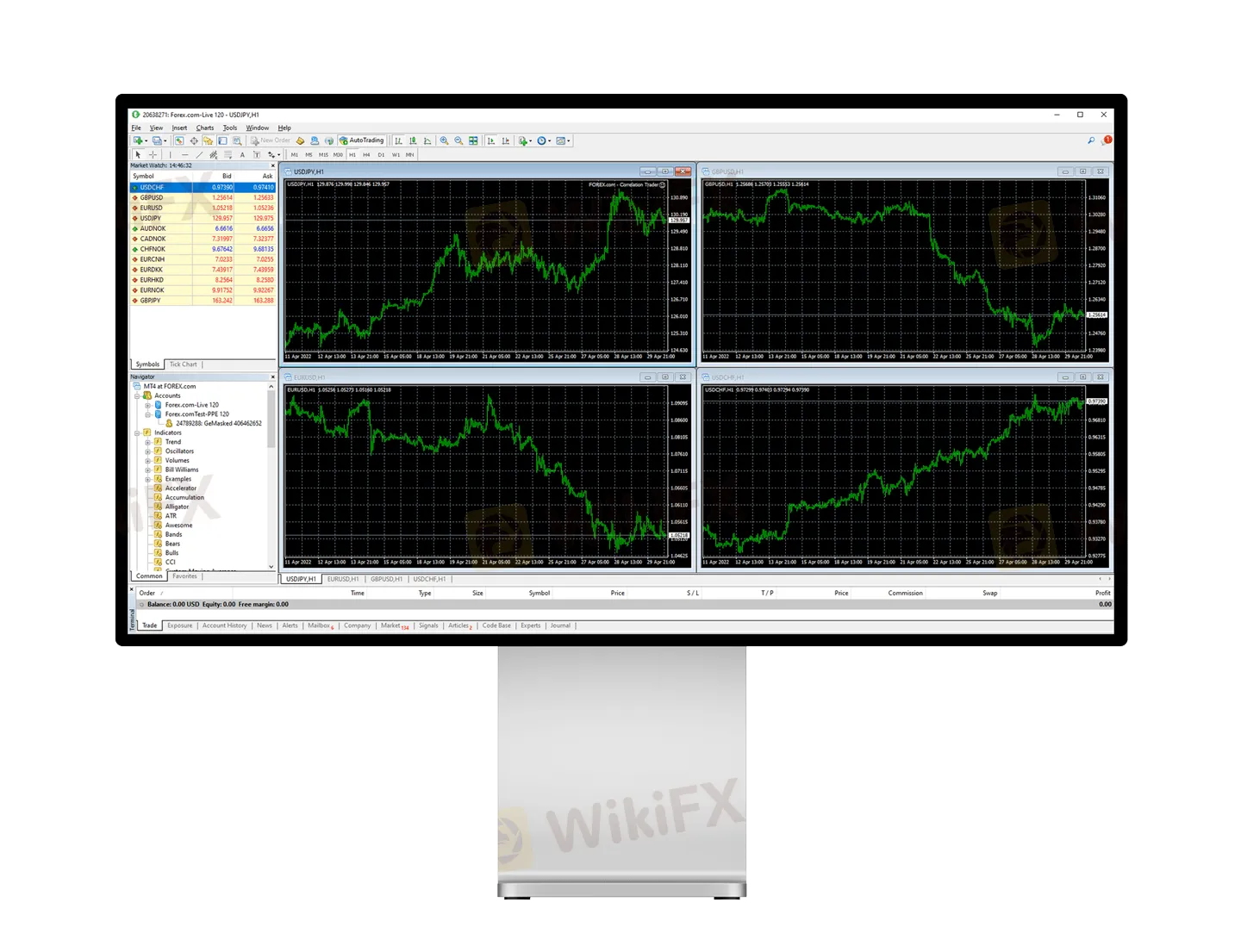

Trading Platform

Da Fu Gold operates its trading platform primarily on MetaTrader 4 (MT4). MetaTrader 4 is a widely recognized and established trading platform in the industry, known for its user-friendly interface and robust features. Traders using Da Fu Gold's platform on MT4 can access a range of tools and resources for analysis and execution of trades.

MetaTrader 4 offers charting capabilities, a variety of technical indicators, and customizable trading strategies through Expert Advisors (EAs). It supports various order types, including market orders, limit orders, and stop orders, providing flexibility for traders' execution preferences.

Moreover, the platform allows for algorithmic trading and automated trading strategies, enhancing efficiency for traders who utilize such methods. Additionally, MT4 provides access to historical data, real-time quotes, and news feeds to aid traders in making informed decisions.

While Da Fu Gold's use of MT4 offers a familiar and well-regarded trading experience, it's important for traders to consider their specific needs and preferences when evaluating the platform.

Customer Support

Da Fu Gold provides customer support primarily through email communication. The designated email address for customer inquiries isjyzq002@gmail.com. While email support allows users to submit their questions, it's important to note that this contact method does not provide immediate responses compared to live chat or phone support. The availability and responsiveness of customer service representatives will vary, and users should consider this when seeking assistance. It's advisable for traders to carefully evaluate their preferred communication channels and response times when assessing Da Fu Gold's customer support offerings.

Conclusion

In conclusion, Da Fu Gold presents a trading platform that specializes in futures, which can be an advantage for traders interested in this specific asset class. Their expertise in the futures market provides valuable insights and opportunities for those seeking to trade in futures. Additionally, the platform is user-friendly, making it accessible to traders of different skill levels. Its intuitive interface and ease of navigation contribute to efficient trade execution and account management.

However, there are notable drawbacks to consider. Da Fu Gold operates without regulatory oversight, which means there are limited investor protections and transparency. This lack of regulation can be a cause for issue, particularly for traders who prioritize safety and accountability in their trading activities. Furthermore, the platform offers limited customer support channels, primarily relying on email communication. This can result in longer response times and less immediate assistance compared to platforms with more customer support options. Additionally, the absence of comprehensive educational resources are a disadvantage for traders looking to expand their knowledge and improve their trading skills.

FAQs

Q: What is Da Fu Gold's minimum deposit requirement?

A: The minimum deposit for a Standard account is $100, while the ECN account requires a minimum deposit of $5,000.

Q: Does Da Fu Gold offer a demo account for practice?

A: Yes, Da Fu Gold provides a demo account for users to practice trading without risking real funds.

Q: What trading platforms are available on Da Fu Gold?

A: Da Fu Gold offers MetaTrader 4 and 5 as its primary trading platforms.

Q: Are there any commissions on the Standard account?

A: No, the Standard account does not have any commission charges.

Q: Is Da Fu Gold regulated by any regulatory authority?

A: No, Da Fu Gold operates without regulatory oversight.

Q: Does Da Fu Gold offer educational resources for traders?

A: Da Fu Gold has limited educational resources, so traders seeking extensive educational materials should consider this.

WikiFX ब्रोकर

रेट की गणना करना