China Merchants Bank

एब्स्ट्रैक्ट:In 1987, China Merchants Bank (CMB) was founded in Shenzhen by China Merchants Group. CMB provides a wide range of financial services, including deposits, loans, insurance, wealth management, and more. It now offers advanced Digital Bank services via the internet. However, CMB faces questions about its regulatory status.

| CMB Summary | |

| Founded | 1987 |

| Registered Country/Region | Hong Kong |

| Regulation | Unregulated |

| Services | Commercial banking, financial leasing, fund management, life insurance, overseas investment banking, consumer finance, and wealth management subsidiary... |

| Customer Support | 24/7 support |

| Tel: +86-95555; +86-755-84391000 (Overseas) | |

| Email: support@cryptoadviseruk.com | |

| Physical address: 19/F, China Merchants Bank Building, 7088 Shennan Avenue, Shenzhen, 518040 | |

In 1987, China Merchants Bank (CMB) was founded in Shenzhen by China Merchants Group. CMB provides a wide range of financial services, including deposits, loans, insurance, wealth management, and more. It now offers advanced Digital Bank services via the internet. However, CMB faces questions about its regulatory status.

Pros and Cons

| Pros | Cons |

| Global presence | No regulation |

| Various financial services | |

| User-friendly electronic banking | |

| 24/7 support |

Is CMB Legit?

No, CMB operates in an unregulated environment, with no specific details available concerning regulatory oversight. The lack of regulated licenses gives rise to concerns regarding the level of asset protection and transparency within the institution.

Services

| Personal clients | Private Banking | / |

| All in one Card | / | |

| Electronic Banking | / | |

| Loan | Personal commercial real estate loan, Loan for study abroad, Personal consumption loan, Personal housing loan, Micro-business loan, Personal car loan | |

| Invest | Insurance, Gold Trading,Open-ended Fund, Forex Express Trading, Wealth Management Products, and Saving services | |

| Saving | Overseas remittance, Domestic remittance, Intra-city Transfer, Personal Exchange Sale/Purchase, Personal Check, Demand Deposit, Time deposits, Personal Call Deposit | |

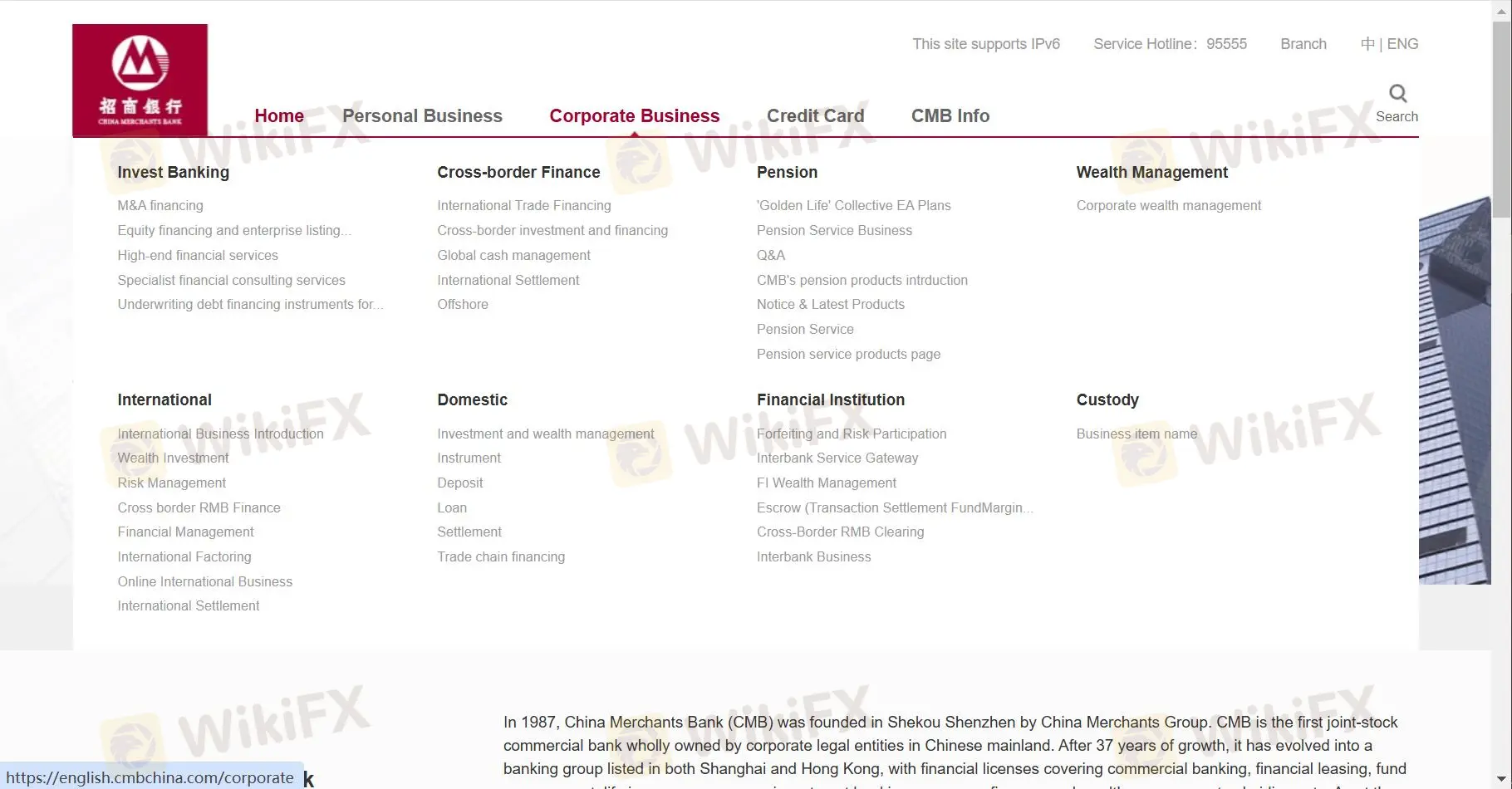

| Corporate clients | Invest Banking | M&A financing, Equity financing and enterprise listing services, High-end financial services, Specialist financial consulting services, Underwriting debt financing instruments |

| Cross-border FinancePension | International Trade Financing, Cross-border investment and financing, Global cash management, International Settlement, Offshore baking service | |

| Pension | 'Golden Life' Collective EA Plans, Pension Service Business, Pension Service | |

| Wealth Management | / |

Account Type

CMB offers a Sunflower VIP card to clients whose assets in personal accounts at the same branch total RMB 500,000, including RMB current, time, and third-party deposit accounts; funds and entrusted financial products; and certificated bonds. Sunflower VIPs are end to enjoy some extra services, such as professional wealth management advisors, a full portfolio of financial products, unique superior loan services, and more.

Platform

CMB offers two online platforms for you to manage your assets: web banking and app banking.

- Web Banking

With Web Banking, you can manage all your CMB bank cards around the clock. Simply open your computer to access complete account information. You don't even need to pre-designate a remittance account, as you can enjoy fast and convenient transfer services, especially for online shopping.

- Mobile Banking

You can also log in to the mobile banking system on Android or Apple devices to check balances, transfer funds, make repayments, pay bills (including phone bills and household expenses), subscribe to or redeem funds, and utilize financial products, etc.

WikiFX ब्रोकर

रेट की गणना करना