ARROW FORTUNE

एब्स्ट्रैक्ट:ARROW FORTUNE, headquartered in the United Kingdom, is a trading platform offering four account types: Basic, Intermediate, Advanced, and Expert. The company operates without regulatory oversight, providing a range of trading options to cater to different levels of experience and investment capacity.

| ARROW FORTUNE | Basic Information |

| Company Name | ARROW FORTUNE |

| Headquarters | United Kingdom |

| Regulations | Not regulated |

| Account Types | Basic,Intermediate,Advanced,Expert |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:300 |

| Customer Support | Telephone number(+1 2046900625)Email (info@arrowfortune.com) |

Overview of ARROW FORTUNE

ARROW FORTUNE, headquartered in the United Kingdom, is a trading platform offering four account types: Basic, Intermediate, Advanced, and Expert. The company operates without regulatory oversight, providing a range of trading options to cater to different levels of experience and investment capacity.

Is ARROW FORTUNE Legit?

ARROW FORTUNE operates without regulatory supervision. This means the company's activities are not monitored or controlled by any financial regulatory body. Traders should be aware that this lack of regulation may impact the level of protection and oversight typically associated with regulated financial entities.

Pros and Cons

ARROW FORTUNE presents a mixed profile of advantages and potential drawbacks. The platform offers multi-user support, which can be beneficial for collaborative trading or account management. It also claims to provide openness and transparency of information. However, the lack of regulatory oversight poses potential risks to traders, as there's no external authority ensuring compliance with industry standards.

| Pros | Cons |

|

|

|

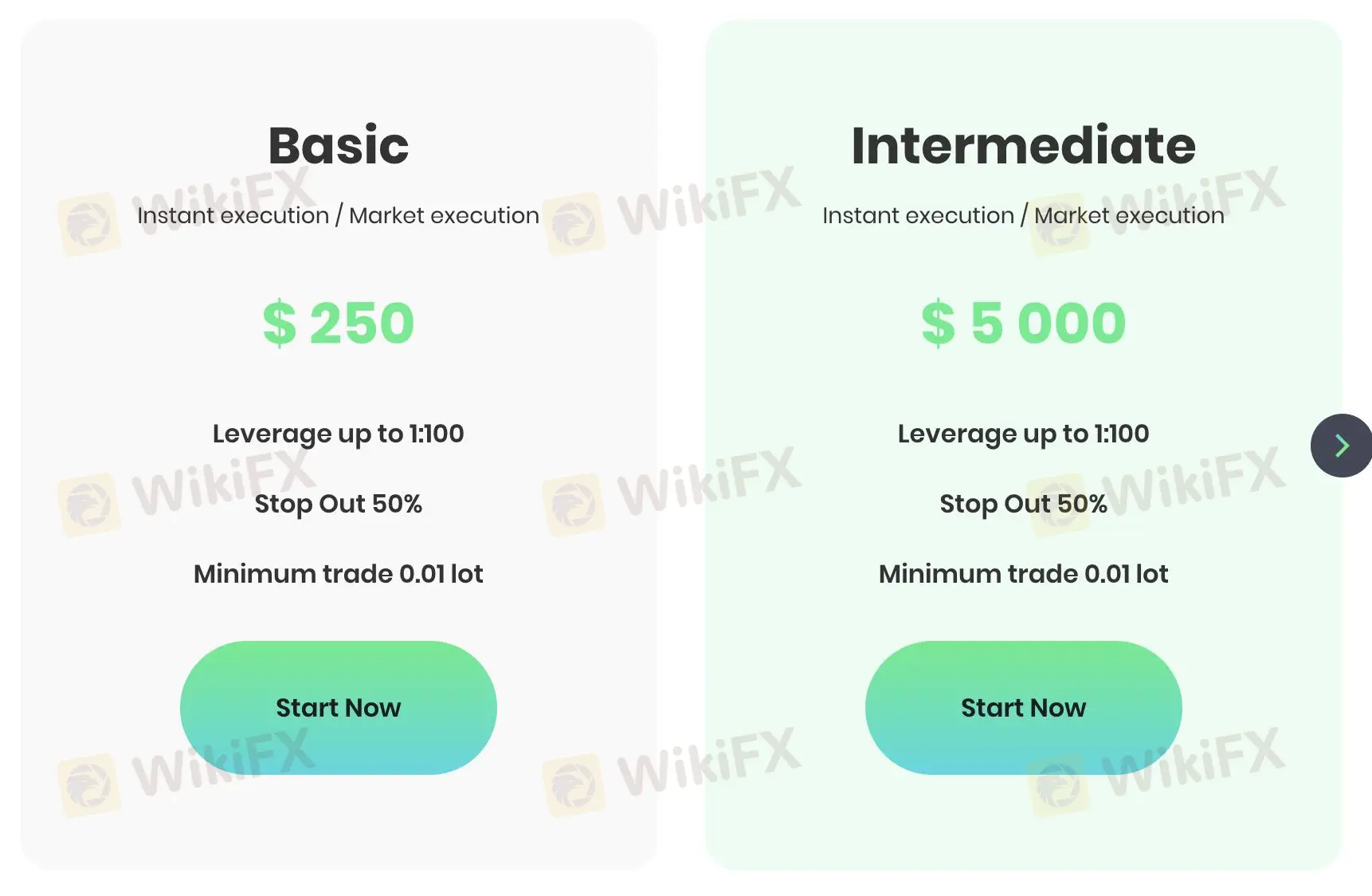

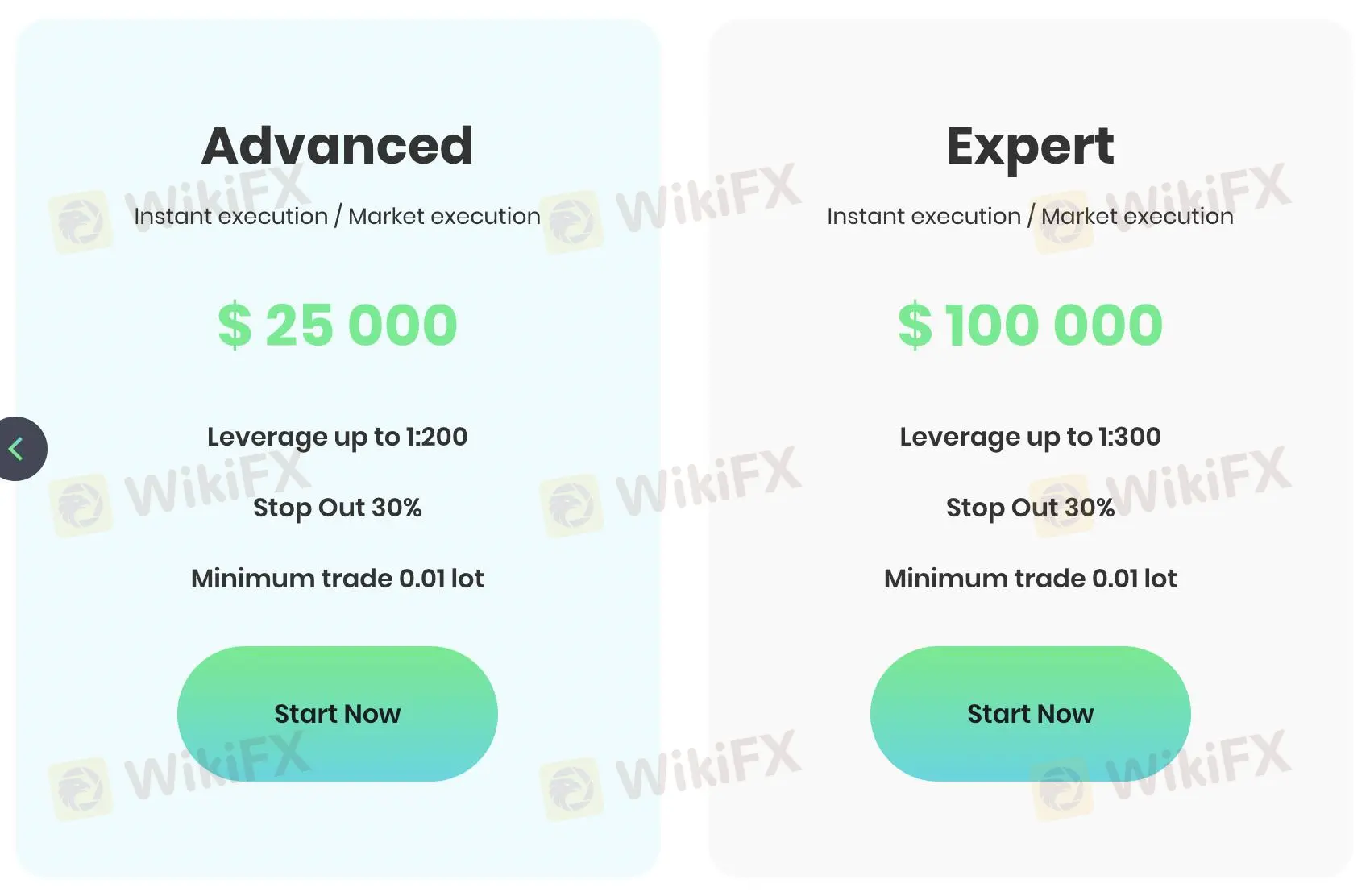

Account Types

ARROW FORTUNE offers four account types with varying minimum deposits. The Basic account has the lowest entry point at $250, followed by the Intermediate at $5000, Advanced at $25000, and Expert at $100000. This tiered structure allows traders to choose an account type that aligns with their investment capital and trading experience.

| Account Type | Basic | Intermediate | Advanced | Expert |

| Minimum Deposit | $250 | $5000 | $25000 | $100000 |

Leverage

ARROW FORTUNE provides different leverage options across its account types. The Basic and Intermediate accounts offer a maximum leverage of 1:100. The Advanced account increases this to 1:200, while the Expert account provides the highest leverage at 1:300. These options allow traders to select a leverage level that suits their risk tolerance and trading strategy.

| Account Type | Basic | Intermediate | Advanced | Expert |

| Maximum Leverage | 1:100 | 1:100 | 1:200 | 1:300 |

Customer Support

For customer support, ARROW FORTUNE provides both a telephone number (+1 2046900625) and an email address (info@arrowfortune.com). These contact options allow clients to reach out for assistance with their trading accounts or general inquiries about the platform's services.

Conclusion

In conclusion, ARROW FORTUNE offers a range of account types with varying deposit requirements and leverage options. While it provides multi-user support and claims transparency, the lack of regulation warrants careful consideration by potential traders.

FAQs

- What account types does ARROW FORTUNE offer?

ARROW FORTUNE offers Basic, Intermediate, Advanced, and Expert account types.

- Is ARROW FORTUNE regulated?

No, ARROW FORTUNE is not currently regulated by any financial authority.

- How can I contact ARROW FORTUNE's customer support?

You can reach ARROW FORTUNE's customer support via phone at +1 2046900625 or by email at info@arrowfortune.com.

Review

ARROW FORTUNE seems to be aiming for a broad audience with its four-tier account system. They're covering the spectrum from newbies to high rollers, with minimum deposits ranging from a modest $250 to a hefty $100,000. The leverage options are pretty interesting too, ramping up as you climb the account ladder. The multi-user support could be a nice touch for those who like to trade as a team. They're talking a big game about transparency, which is always good to hear. But here's the kicker - they're flying solo without any regulatory backup. It's a mixed bag, really. It could be exciting for some, but you'd want to keep your wits about you.

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

WikiFX ब्रोकर

रेट की गणना करना