BOQ Review

Ikhtisar:BOQ, established in 1874 and regulated by ASIC, offers diverse financial services for individuals and businesses, including various bank accounts, home and personal loans, credit cards, insurance, and specialized business banking solutions. They are noted for having a zero minimum deposit requirement for some accounts.

| BOQ Review Summary | |

| Founded | 1874 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Financial Services | Bank accounts, home loans, credit cards, personal loans, insurance, business loans, business accounts, foreign exchange and trade services, merchant and payment products |

| Minimum Deposit | 0 |

| Customer Support | Tel: 1300 55 72 72 |

BOQ Information

BOQ, established in 1874 and regulated by ASIC, offers diverse financial services for individuals and businesses, including various bank accounts, home and personal loans, credit cards, insurance, and specialized business banking solutions. They are noted for having a zero minimum deposit requirement for some accounts.

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | Age restrictions on high-yield savings |

| Diverse account types | Limited channels for customer support |

| Zero minimum deposit | |

| Long operation time |

Is BOQ Legit?

BOQ has a Market Maker (MM) license regulated by the Australian Securities and Investments Commission (ASIC) in Australia with a license number of 000244616.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | Bank of Queensland Limited | Australia | Market Maker (MM) | 000244616 |

Financial Services

- For individuals, BOQ offers bank accounts (transaction, savings, term deposits), home loans (including refinancing and calculators), credit cards (with rewards), personal loans, and insurance (home/contents and car).

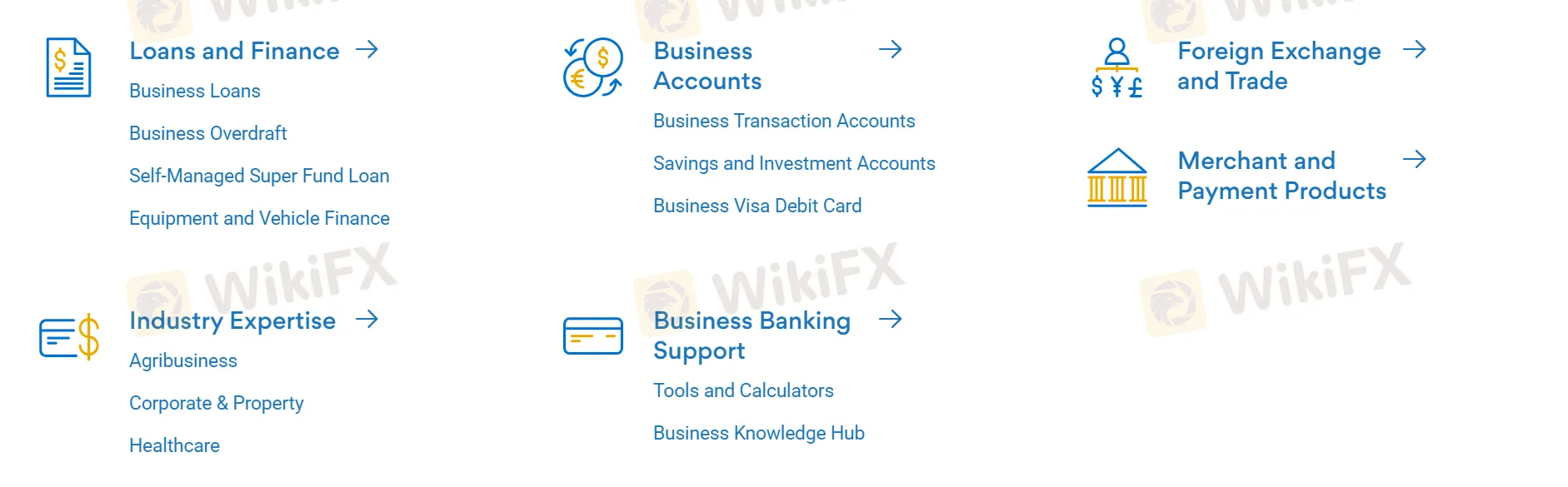

- For businesses, BOQ offers loans and finance (including business loans and overdraft), business accounts (transaction, savings, Visa debit card), foreign exchange and trade services, merchant and payment products, industry expertise (e.g., agribusiness, healthcare), and business banking support (tools, calculators, knowledge hub).

Account Type

Business bank account: BOQ offers various business bank accounts, including Business Transaction Accounts for daily operations and Savings and Investment Accounts to earn interest on business funds. They also provide Industry Specialist Accounts tailored for sectors like Solicitors, Real Estate Agents, and Not-for-Profits.

Personal account: BOQ offers two types of personal accounts, which are the Transaction Account and Savings Accounts.

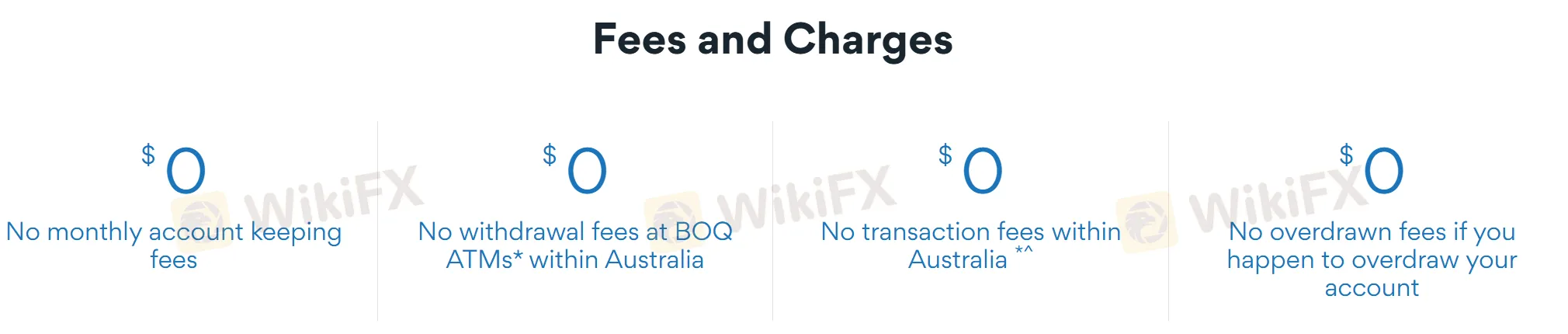

Transaction account: BOQ's transaction accounts generally feature no monthly account-keeping fees, no withdrawal fees at BOQ ATMs within Australia, and no transaction fees within Australia. They also state no overdrawn fees if you happen to overdraw your account.

Savings accounts:

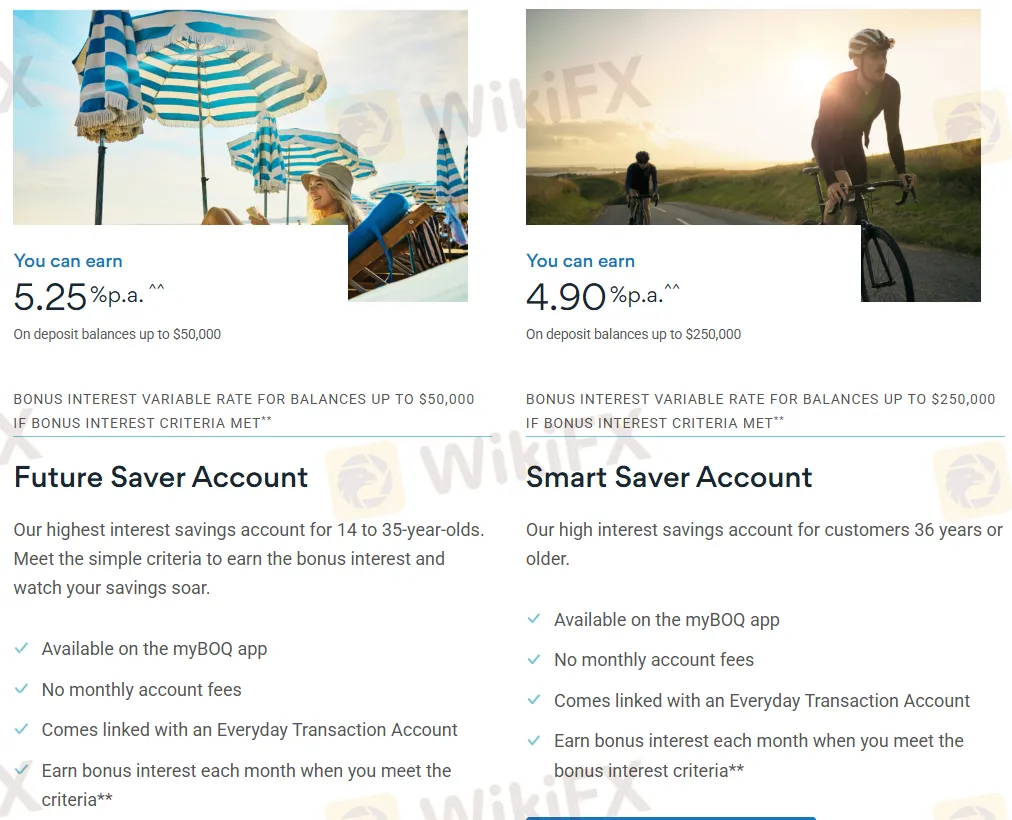

| Feature | Future Saver Account (14-35 years old) | Smart Saver Account (36 years or older) | Simple Saver Account | Term Deposits (Balances $5,000 - $249,999, Term 12-24 months) |

| Interest Rate | 5.25% p.a. on balances up to $50,000 | 4.90% p.a. on balances up to $250,000 | 4.55% p.a. on balances up to $5M | 4.00% P.A. |

| Bonus Interest | Variable rate up to $50,000 if criteria met | Variable rate up to $250,000 if criteria met | Get a great, ongoing interest rate | Fixed term interest rates and no account fees |

| Availability | Available on the myBOQ app | - | ||

| Monthly Account Fees | ❌ | ❌ | ❌ | ❌ |

| Minimum Deposit | - | - | 0 | $1,000 |

| Other Features | Earn bonus interest each month when criteria met | Simply sit back and watch your savings grow | Flexible terms from just 1 month, choose interest payment frequency | |

Broker yang bersangkutan

Baca lebih banyak

Jangan Sampai Salah, Ini 6 Tugas dan Tanggung Jawab Broker

Sebelum memutuskan bergabung penting bagi Anda mengetahui tugas dan tanggung jawab broker forex. Dunia investasi saham bisa dijadikan sebagai penghasilan tambahan yang sering dikatakan sebagai passive income.

Pembaruan Broker pada 1 Februari - 7 Februari

Squared Financial menambahkan GameStop dan lainnya dengan akses tidak terbatas. Pialang telah menambahkan semua saham populer, yang mengalami lonjakan permintaan besar-besaran.

Berita Mingguan Broker Per Tanggal 25/01 - 31/01

Organisasi Polisi Kriminal Internasional yang biasa dikenal sebagai INTERPOL mengeluarkan peringatan keras bahwa semakin sering penipu keuangan memburu korban baru di antara pengguna aplikasi kencan yang tidak sadar.

Berita Mingguan Broker Per Tanggal 18/01 - 24/01

Presiden Bank Sentral Eropa (ECB), Christine Lagarde telah menyatakan beberapa kekhawatiran tentang sifat anonim Bitcoin dan masa lalu cryptocurrency yang bermasalah - dalam kata-katanya, ini telah digunakan untuk beberapa "bisnis lucu".

WikiFX Broker

Berita Terhangat

Berhadiah USD ! Survey Online Singkat WikiFX Topik Kebiasaan Dan Kebutuhan Trader Forex di Indonesia

Apa Yang Terjadi Dengan Broker Forex NAGA ?! Review Revisi Proyeksi Pendapatan Jadi Menurun Di 2025

Nasib BURUK Trader WNI & Global: Dampak Penipuan Broker Forex LQH MARKETS Di Akhir 2025

Suara Juri WikiFX Golden Insight Award | Theo, Global Markets Director WeTrade

Hukuman 30 Tahun Dan Denda Triliunan: Konsekuensi Tindak Penipuan Broker Forex Banxso (Pty) Ltd

My Forex Funds Meraih Kendali atas Aset Kanada, Apakah Peluncuran Kembali Prop Trading Akan Terjadi?

BELASAN Keluhan Trader Indonesia! Emosi Para Korban Penipuan Broker Forex IUX Markets Ltd di 2025

Broker Robinhood EKSPANSI Ke Indonesia: Akusisi 2 Perusahaan, PT Buana Capital Sekuritas & Coinvest

Nilai Tukar