Targo Bank

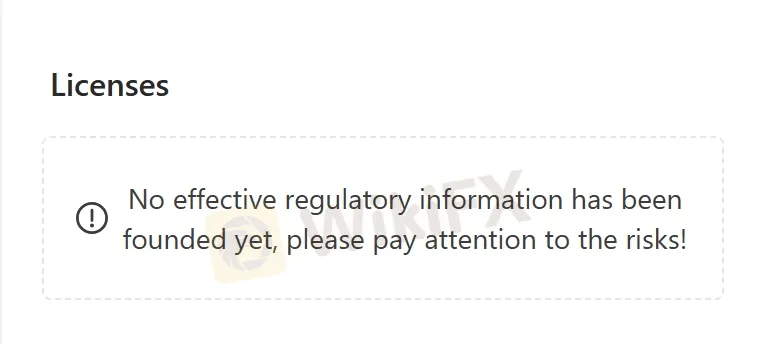

Ikhtisar:Targo Bank, a Germany-based bank, offers its traders a broad spectrum of banking services encompassing private, business and corporate segments. It currently operates under no valid regulations from any recognized bodies which raises concerns regarding its credibility.

| Targo Bank Review Summary in 6 Points | |

| Founded | 1999 |

| Registered Country/Region | Germany |

| Regulation | Unregulated |

| Financial Services | Private: Account & Cards, Savings & Investments, Custody account and securities, Credit, Installment loan, Insurance; |

| Business: Business Account, Business Credit, Business Credit Cards, Business call money account; | |

| Corporate: Factoring; Leasing & Investment Financing; Car Bench; Sales financing | |

| Trading platform | TARGOBANK BANKING APP |

| Customer Support | Phone, contact us form, social media |

What is Targo Bank?

Targo Bank, a Germany-based bank, offers its traders a broad spectrum of banking services encompassing private, business and corporate segments. It currently operates under no valid regulations from any recognized bodies which raises concerns regarding its credibility.

In the following article, we plan to review and evaluate the characteristics of this financial organization from multiple angles, presenting data in a precise and organized manner. If this information appeals to you, we invite you to keep reading. At the end of the article, we will offer a brief recap encapsulating the standout qualities of the bank, enabling you to grasp its salient features quickly.

Pros & Cons

| Pros | Cons |

| • Wide range of financial instruments and services | • Unregulated |

| • A large number of branches over Germany |

Targo Bank, spanning across Germany with a vast network of branches, offers an expansive range of banking and financial services catering to various customer needs. This extensive portfolio and their geographic reach stand as the primary advantages of banking with them.

However, a considerable drawback is their unregulated status, which could raise credibility concerns as regulatory oversight often provides a level of assurance to customers regarding operational safety and consumer rights protection.

Therefore, customers should tread with caution while dealing with unregulated institutions.

Is Targo Bank Safe or Scam?

When considering the safety of a bank like Targo Bank or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a bank:

Regulatory sight: Presently, Targo Bank is functioning without compliance to any valid regulations, raising substantial concerns about its operations, legality, and the level of safety it provides for its clients investments.

User feedback: To gain an in-depth perspective of the brokerage, it is recommended that traders delve into reviews and experiences shared by current users. These valuable insights, found on trustworthy websites and discussion forums, can provide a more encompassing view of the broker's operation.

Security measures: Targo Bank has implemented a privacy policy, serving as a protective measure to secure user data, thus promoting confidence among its worldwide client base.

In the end, the choice to engage in trade with Targo Bank is a deeply personal one. It's crucial to carefully balance the potential risks and advantages before coming to a decision.

Financial Services

Targo Bank offers a broad spectrum of financial services across different sectors:

Private Banking: This includes services such as Account and Cards, Savings and Investment Opportunities, Custody accounts and securities to help in safeguarding and growing one's wealth. The bank also provides credit facilities and installment loans for short-term financial needs, alongside a suite of insurance products for security.

Business Solutions: Tailored for business clients, the bank offers a specialized Business Account, Business Credit, Business Credit Cards, as well as a Business call money account to facilitate effective business management and development.

Corporate Services: To address the complex financial needs of corporations, the bank provides Factoring; Leasing & Investment Financing solutions; a Car Bench, and Sales financing services.

All these contribute to the smooth financial operation of any corporate entity.

Trading Platform

Targo Bank is committed to leveraging modern technology for their customer's convenience. They have introduced a web-based application, known as TargoBank banking app, broadening access to their variety of financial services.

This application remarkably simplifies banking operations and financial management for their customers, offering the comfort of carrying out transactions, checking balances, and more, irrespective of time or place.

Serving a wide range of banking functions, this app flaunts an easy-to-use interface that caters to the tech-savvy as well as the less digitally inclined customers.

With its availability on both iOS and Android platforms, it efficiently adapts to diverse customer preferences in digital tools.

Customer Service

For any inquiries or concerns, clients can contact Nurol Bank through several channels. They can reach out via the phone and contact us form. Email assistance is available utilizing the address.

Alternatively, clients can also visit or send mail to the Nurol Bank's physical location at its headquarter.

Address: Buyukdere Cad. Nurol Plaza No: 255 Kat: 15/1502 34485 Maslak Sarıyer, İstanbul.

Tel: +86 400-120-2008(Free for PRC)/+852 28330526

Fax: 852-28330558

Email: nurolbank@nurolbank.com.tr.

Phone: 0211 - 900 20 900(Monday to Fri 08:00 - 20:00).

For more details traders can visit: https://www.targobank.de/de/service/rufnummern.html.

Conclusion

Nurol Bank is a comprehensive financial institution offering a wide range of services targeted at private, business, and corporate clients and has over 300 branches over Germany. The bank leverages modern technology, such as the TargoBank banking app, to make banking simpler and more convenient. However, its operations currently abide by no official regulations, which raises concerns about its legitimacy and operational safety, as regulated institutions are generally obliged to follow industry norms.

Therefore, potential investors are fervently urged to conduct thorough investigations and engage directly with Targo Bank, to obtain the most recent and accurate information before they settle on any solid service or investment decisions. It's critical to fully grasp the potential risks and rewards associated with their financial services to make informed decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is Targo Bank regulated? |

| A 1: | No. It has been verified that this bank is currently under no valid regulations. |

| Q 2: | What kind of services does Targo Bank offer? |

| A 2: | Targo Bank is a Turkey-based bank offers private, business and corporate banking and financial services to traders. |

| Q 3: | Is Targo Bank a good bank for beginners? |

| A 3: | No. It is not a good choice for beginners because its not well regulated. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Broker yang bersangkutan

WikiFX Broker

Berita Terhangat

Ekspansi 2025 ! Broker Forex PU Prime Akuisisi Admirals AU PTY Ltd

PENGUMUMAN PENTING ! Kompetisi Demo Trading Mingguan Akan Dihentikan Sementara

Nilai Tukar