GOFX-Overview of Minimum Deposit, Leverage, Spreads

Ikhtisar:Founded in 2020, GOFX is a forex broker registered in the Saint Vincent and the Grenadines, offering its clients access to a wide range of trading instruments through the MT4 platform. However, WikiFX shows that this brokerage is not subject to any regulation. Please be aware of the risk.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| GOFX Review Summary in 10 Points | |

| Founded | 2020 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No license |

| Market Instruments | Forex, precious metals CFDs, index CFDs, share CFD, energy CFDs, CFD cryptocurrency |

| Demo Account | N/A |

| Leverage | 1:3000 |

| EUR/USD Spread | 1 pip (Std) |

| Trading Platforms | MT4 |

| Minimum Deposit | $5 |

| Customer Support | 24/7 live chat, phone, email |

What is GOFX?

Founded in 2020, GOFX is a forex broker registered in the Saint Vincent and the Grenadines, offering its clients access to a wide range of trading instruments through the MT4 platform. However, WikiFX shows that this brokerage is not subject to any regulation. Please be aware of the risk.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments | • No valid regulation |

| • Multiple account types | • Reports of unable to withdraw |

| • Swap-free accounts offered | • Clients from USA, Mauritius, Japan, Canada, Haiti, Suriname, the Democratic Republic of Korea, Puerto Rico, Brazil, the Occupied Area of Cyprus and Hong Kong are excluded |

| • Low minimum deposit | • No info on deposit/withdrawal |

| • Flexible leverage ratios | • No educational resources |

| • Tight spreads | |

| • Commission-free accounts offered | |

| • MT4 supported | |

| • 24/7 multi-channel support |

Is GOFX Safe or Scam?

GOFX currently has no valid regulation, it raises concerns about the safety and legitimacy of the broker. Regulation plays a crucial role in ensuring the transparency, security, and accountability of financial service providers. Without proper regulation, there may be a higher risk of scams or unethical practices. Given the lack of valid regulation, it is advisable to exercise caution when considering GOFX as a trading platform and explore alternative brokers that are properly regulated and have a track record of reliable and transparent operations.

GOFX Alternative Brokers

FXPro - a reputable broker with a wide range of trading instruments and competitive trading conditions, making it a popular choice among traders.

SBI FXTRADE - offers a reliable and regulated trading environment, backed by the reputation and financial strength of the SBI Group, making it a trusted option for Forex trading.

LIGHT FX - provides traders with a user-friendly platform, competitive spreads, and a range of trading tools, making it a suitable choice for both beginner and experienced traders.

There are many alternative brokers to GOFX depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Market Instruments

GOFX provides a range of market instruments to cater to the diverse trading needs of its clients. Traders have the opportunity to engage in Forex trading, which involves the buying and selling of currency pairs. This allows traders to speculate on the fluctuations in exchange rates between different currencies, such as the EUR/USD or GBP/JPY.

In addition to Forex, GOFX offers precious metals CFDs, allowing traders to trade contracts based on the price movements of commodities like gold, silver, platinum, and palladium. These CFDs provide traders with exposure to the precious metals market without needing to physically own the underlying assets.

GOFX also provides index CFDs, which enable traders to speculate on the performance of global stock market indices, such as the S&P 500, FTSE 100, or Nikkei 225. Traders can take positions on whether an index will rise or fall, based on their market analysis and trading strategies.

Furthermore, GOFX offers share CFDs, allowing traders to speculate on the price movements of individual company shares. With share CFDs, traders can take advantage of both rising and falling prices, potentially profiting from the market movements of popular stocks without needing to own the shares outright.

Energy CFDs are another market instrument offered by GOFX, enabling traders to participate in the energy markets. This includes contracts based on the price movements of commodities like oil, natural gas, and heating oil. Traders can capitalize on changes in energy prices, which are influenced by various factors such as supply and demand dynamics, geopolitical events, and economic trends.

Lastly, GOFX providesCFDs on cryptocurrencies, allowing traders to access the rapidly evolving and volatile cryptocurrency markets. This includes popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more. Traders can speculate on the price movements of these digital assets without needing to own them physically.

Accounts

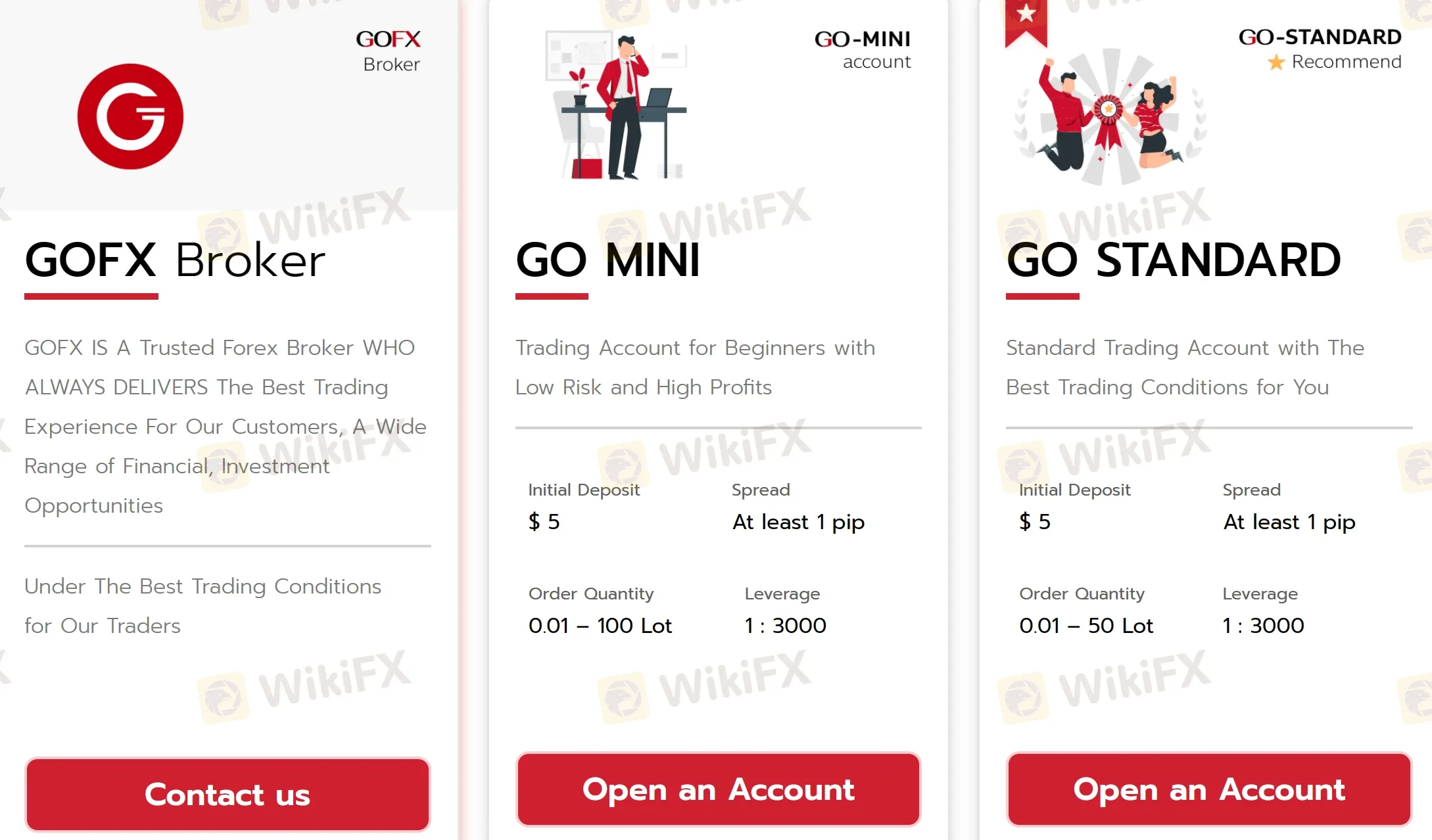

Five trading accounts are offered by GOFX to suit different traders trading needs, which include Go-Mini, Go-Standard, Go-Low Spread, Go-Pro and Go-Inter. The minimum initial deposit to open all these five trading accounts is $5.

The Go-Mini account is designed for beginners or those who prefer to start with a smaller initial deposit. The Go-Standard account is a more intermediate-level account, suitable for traders who have gained some experience in the financial markets.

For traders who value tight spreads, the Go-Low Spread account is available. This account is designed to offer competitive spreads on various financial instruments, allowing traders to potentially reduce their trading costs and improve their overall profitability.The Go-Pro account is tailored for more experienced and professional traders who require advanced trading features and tools.

Lastly, GOFX offers the Go-Inter account, which is designed for institutional or corporate clients. This account type may have specific requirements, benefits, and features tailored to the needs of institutional traders, such as access to liquidity providers, custom trading conditions, and dedicated support.

GOFX also offers swap-free accounts, also known as Islamic accounts, which comply with Shariah principles. These accounts are designed to cater to traders who follow Islamic finance principles and do not involve interest payments or charges for holding positions overnight.

| Account Type | Go-Mini | Go-Standard | Go-Low Spread | Go-Pro | Go-Inter |

| Minimum Deposit | $5 | ||||

| Stop Out | Yes | ||||

| Minimum Trading | 0.01 Lot | ||||

| Maximum Trading | 100 Lot | 50 Lot | |||

| Maximum Orders | 1,000 positions | ||||

| Service Fee | No | Yes | No | ||

| Hedging is Allowed | No | ||||

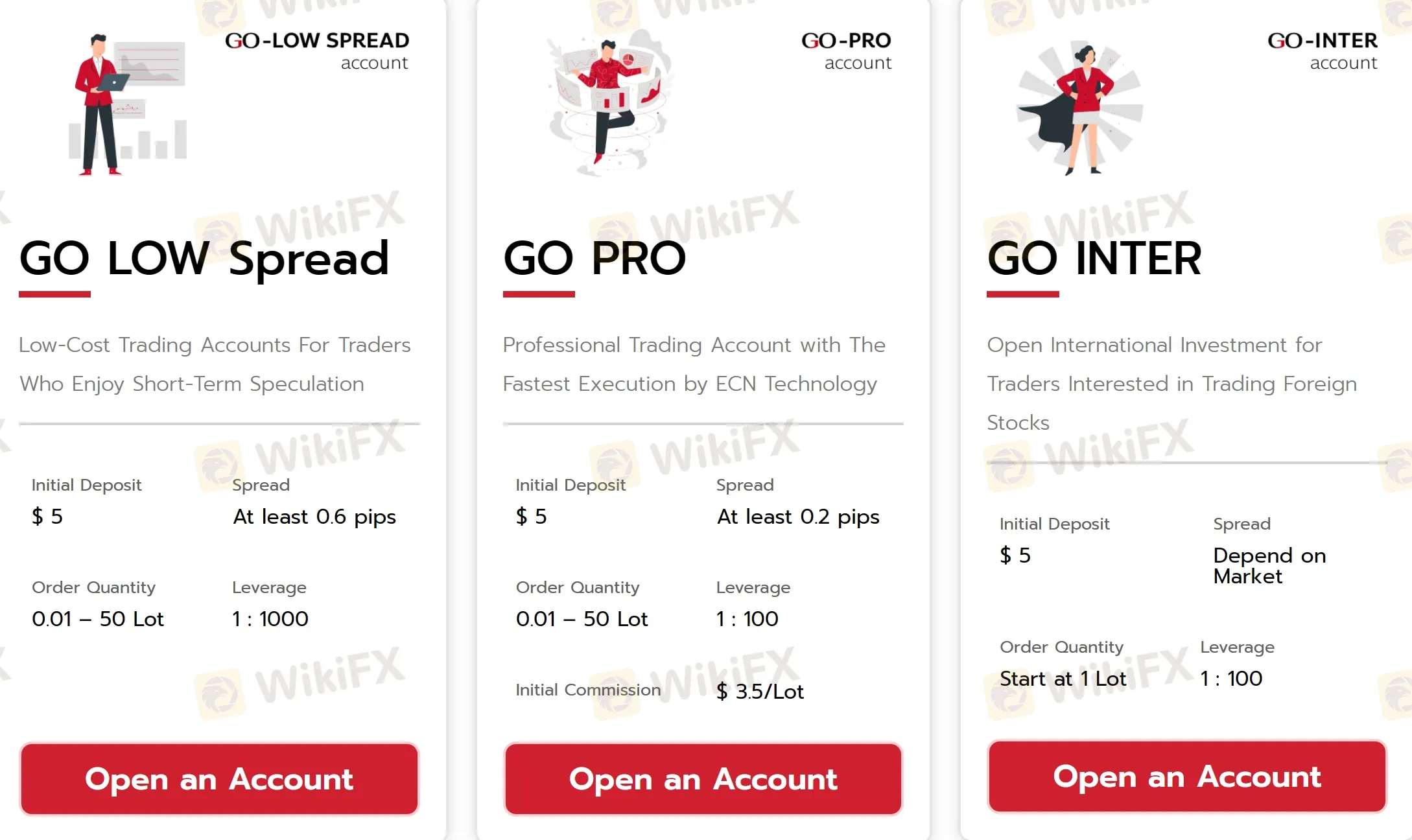

Leverage

GOFX provides traders with different leverage options across its various trading accounts. Leverage is a tool that allows traders to amplify their trading positions and potentially increase their potential profits. However, it's important to note that leverage also magnifies the risks involved in trading.

For the Go-Mini and Go-Standard accounts, GOFX offers a maximum leverage of 1:3000. This high leverage option allows traders to control a significantly larger position size relative to their invested capital. It provides an opportunity to potentially maximize returns on successful trades. However, traders should exercise caution and consider the increased risk exposure associated with such high leverage.

The Go-Low Spread account offers a maximum leverage of 1:1000. Although slightly lower than the Go-Mini and Go-Standard accounts, it still provides traders with substantial leverage to trade a larger position size.

On the other hand, the Go-Pro and Go-Inter accounts have a maximum leverage of 1:100. This lower leverage option may be more suitable for experienced traders who prefer a more conservative approach to risk management. While the leverage is comparatively lower, it still allows traders to magnify their positions to a certain extent.

| Account Type | Go-Mini | Go-Standard | Go-Low Spread | Go-Pro | Go-Inter |

| Maximum Leverage | 1:3000 | 1:3000 | 1:1000 | 1:100 | 1:100 |

It's crucial for traders to fully understand the implications of using leverage and to carefully manage their risk. Higher leverage levels can lead to greater potential profits but also increase the potential losses. Traders should consider their trading strategy, risk tolerance, and available capital when deciding on the appropriate leverage level for their trading activities.

It's recommended that traders educate themselves about leverage and its associated risks before utilizing it in their trading. Implementing appropriate risk management strategies, such as setting stop-loss orders and using proper position sizing, can help mitigate the potential downsides of trading with leverage.

Spreads & Commissions

GOFX offers competitive spreads and commissions across its different trading accounts. The spreads refer to the difference between the buying and selling prices of a financial instrument, and they play a significant role in determining the trading costs for traders.

| Account Type | Go-Mini | Go-Standard | Go-Low Spread | Go-Pro | Go-Inter |

| Spread from | 1 pip | 0.6 pips | 0.2 pips | depend on market | |

| Commission | / | $3.5/Lot | / | ||

For the Go-Mini and Go-Standard accounts, GOFX provides spreads starting from at least 1 pip. This means that the minimum difference between the buying and selling prices of a currency pair or other tradable instruments is 1 pip. While the spreads may vary depending on market conditions and liquidity, this account type offers relatively competitive spreads for traders.

The Go-Low Spread account, on the other hand, offers tighter spreads starting from 0.6 pips. This account type is designed for traders who prioritize obtaining the most favorable pricing conditions and minimizing their trading costs. The tighter spreads can potentially result in reduced transaction costs and improved profitability.

For the Go-Pro account, GOFX charges a commission of $3.5 per Lot traded. This commission structure is separate from the spreads. While the spreads for the Go-Pro account may start from as low as 0.2 pips, traders need to consider the additional commission cost per Lot when evaluating their overall trading expenses.

Lastly, the Go-Inter account's spreads depend on the market and may vary accordingly. As the spreads depend on the market, traders should consult with GOFX to obtain accurate information regarding the spreads for the Go-Inter account.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commission (per lot) |

| GOFX | 1.0 (Std) | $0 (Std) |

| FXPro | 0.6 | $7 |

| SBI FXTRADE | 0.3 | Varies |

| LIGHT FX | 1.2 | $4 |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

GOFX provides its clients with access to the popular MetaTrader 4 (MT4) trading platform, which is available for Windows, iOS, and Android devices. MT4 is widely recognized in the industry for its robust features, user-friendly interface, and advanced trading capabilities.

The MT4 platform offers a comprehensive set of tools and features that cater to the needs of both beginner and experienced traders. It provides real-time market quotes, interactive charts, technical analysis indicators, and a wide range of order types to execute trades. Traders can customize their charts, set up price alerts, and access historical data for in-depth analysis.

One of the notable advantages of using the MT4 platform is its support for automated trading. Traders can develop and implement their own trading strategies using the platform's built-in programming language, MetaQuotes Language 4 (MQL4). This enables the creation of custom indicators, expert advisors (EAs), and automated trading systems that can execute trades on behalf of the trader based on predefined criteria.

Additionally, MT4 supports mobile trading, allowing clients to monitor the markets and manage their trades on the go. The mobile versions of MT4 for iOS and Android devices provide a seamless trading experience, enabling traders to access their accounts, view real-time prices, execute trades, and manage their positions from anywhere with an internet connection.

Overall, the MT4 trading platform offered by GOFX is a reliable and versatile tool for traders to analyze the markets, execute trades, and implement automated strategies. Its user-friendly interface, extensive charting capabilities, and support for mobile trading make it a popular choice among traders of all levels of experience.

See the trading platform comparison table below:

| Broker | Trading Platform |

| GOFX | MetaTrader 4 (MT4) |

| FXPro | MetaTrader 4 (MT4) |

| SBI FXTRADE | SBI FXTRADE Platform |

| LIGHT FX | MetaTrader 4 (MT4) |

Customer Service

24/7 live chat

Telephone: 02-026-6559

Email: support@gofx.com

For any inquiries or traders, you can get in touch with this broker through the following contact channels:

Registered Address: Beachmont Business Center , 330 , Kingstown , Saint Vincent and the Grenadines.

Physical address: Telepeniou 3A, Office No.002 2235, Latsia, Cyprus +357 22010591.

In addition to these contact options, GOFX maintains a presence on various social media platforms, including Twitter, Facebook, Instagram, YouTube, and Line. This enables clients to stay updated with the latest news, announcements, and educational content provided by the broker. It also provides an additional avenue for clients to connect with GOFX and engage in discussions or ask questions.

Overall, GOFX's customer service aims to provide prompt and comprehensive support to its clients through various communication channels. However, clients should always consider the company's regulatory status and jurisdictional information when assessing the overall reliability and credibility of the customer service provided.

| Pros | Cons |

| • 24/7 customer service availability | • No dedicated FAQ or knowledge base |

| • Live chat support for immediate assistance | |

| • Multiple social media platforms for engagement | |

| • Physical address provided |

Note: These pros and cons are subjective and may vary depending on the individual's experience with GOFX's customer service.

User Exposure at WikiFX

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

Based on the limited information provided, GOFX currently lacks valid regulation. This raises concerns about the safety and reliability of the platform. Additionally, reports of withdrawal issues have been observed, further highlighting potential risks associated with trading on an unregulated platform. Traders are advised to exercise caution and thoroughly review all available information before engaging with GOFX or any unregulated broker. It is essential to consider the potential risks involved and explore alternative options that offer a higher level of regulation and transparency.

Frequently Asked Questions (FAQs)

| Q 1: | Is GOFX regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At GOFX, are there any regional restrictions for traders? |

| A 2: | Yes. GOFX does not provide services to residents of the USA, Mauritius, Japan, Canada, Haiti, Suriname, the Democratic Republic of Korea, Puerto Rico, Brazil, the Occupied Area of Cyprus and Hong Kong. |

| Q 3: | Does GOFX offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT4. |

| Q 4: | What is the minimum deposit for GOFX? |

| A 4: | The minimum initial deposit to open an account is only $5. |

| Q 5: | Is GOFX a good broker for beginners? |

| A 5: | No. It is not a good choice for beginners. Though it advertises well, it lacks valid regulation. |

Baca lebih banyak

Jangan Sampai Salah, Ini 6 Tugas dan Tanggung Jawab Broker

Sebelum memutuskan bergabung penting bagi Anda mengetahui tugas dan tanggung jawab broker forex. Dunia investasi saham bisa dijadikan sebagai penghasilan tambahan yang sering dikatakan sebagai passive income.

Pembaruan Broker pada 1 Februari - 7 Februari

Squared Financial menambahkan GameStop dan lainnya dengan akses tidak terbatas. Pialang telah menambahkan semua saham populer, yang mengalami lonjakan permintaan besar-besaran.

Berita Mingguan Broker Per Tanggal 25/01 - 31/01

Organisasi Polisi Kriminal Internasional yang biasa dikenal sebagai INTERPOL mengeluarkan peringatan keras bahwa semakin sering penipu keuangan memburu korban baru di antara pengguna aplikasi kencan yang tidak sadar.

Berita Mingguan Broker Per Tanggal 18/01 - 24/01

Presiden Bank Sentral Eropa (ECB), Christine Lagarde telah menyatakan beberapa kekhawatiran tentang sifat anonim Bitcoin dan masa lalu cryptocurrency yang bermasalah - dalam kata-katanya, ini telah digunakan untuk beberapa "bisnis lucu".

WikiFX Broker

Berita Terhangat

Ada Indikasi WNI Ikut TERLIBAT ? Penipuan Broker VGM Terhadap Trader Indonesia

Tidak Perlu PANIK? Terkait Kenaikan Biaya Platform MetaTrader Di 2025

Broker CFI Group Catat Rekor Volume Perdagangan US$ 1,12 Triliun

Program INOVASI Broker Lirunex 2025 Proteksi Klien Hingga €20.000

WAH.. Kenapa Lagi ?! Broker Sway Markets Pty Ltd Berhenti Beroperasi

WikiEXPO Menjadi Mitra Pemerintah Liberland, Inovasi dan Pembangunan Transaksi Keuangan Global

Nilai Tukar