EMPIRE TRADING-Some important Details about This Broker

Ikhtisar:EMPIRE TRADING is a broker registered in the United Kingdom, specializing in stocks trading. They provide a demo account, leverage up to 1:500, and tight spreads of 0.1 pips for EUR/USD. Featuring in education, EMPIRE TRADING promotes strategies like PMHL STRATEGY, 3'ORB STRATEGY, and BAR STRATEGY. However, it operates without any regulation. Additionally, the information about trading and operation is limited.

| EMPIRE TRADING Review Summary | |

| Registered Country/Region | United Kingdom |

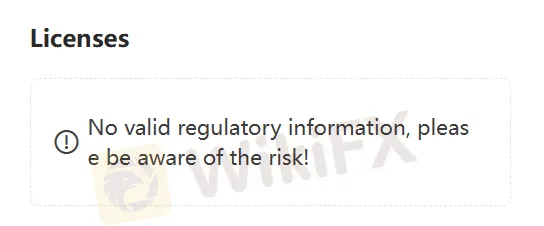

| Regulation | No Regulation |

| Market Instruments | Stocks |

| Demo Account | Availbale |

| Leverage | Up to 1:500 |

| Spread | 0.1 pips (for EUR/USD in a demo account) |

| Trading Platforms | MetaTrader5 |

| Minimum Deposit | 1000 EUR/USD |

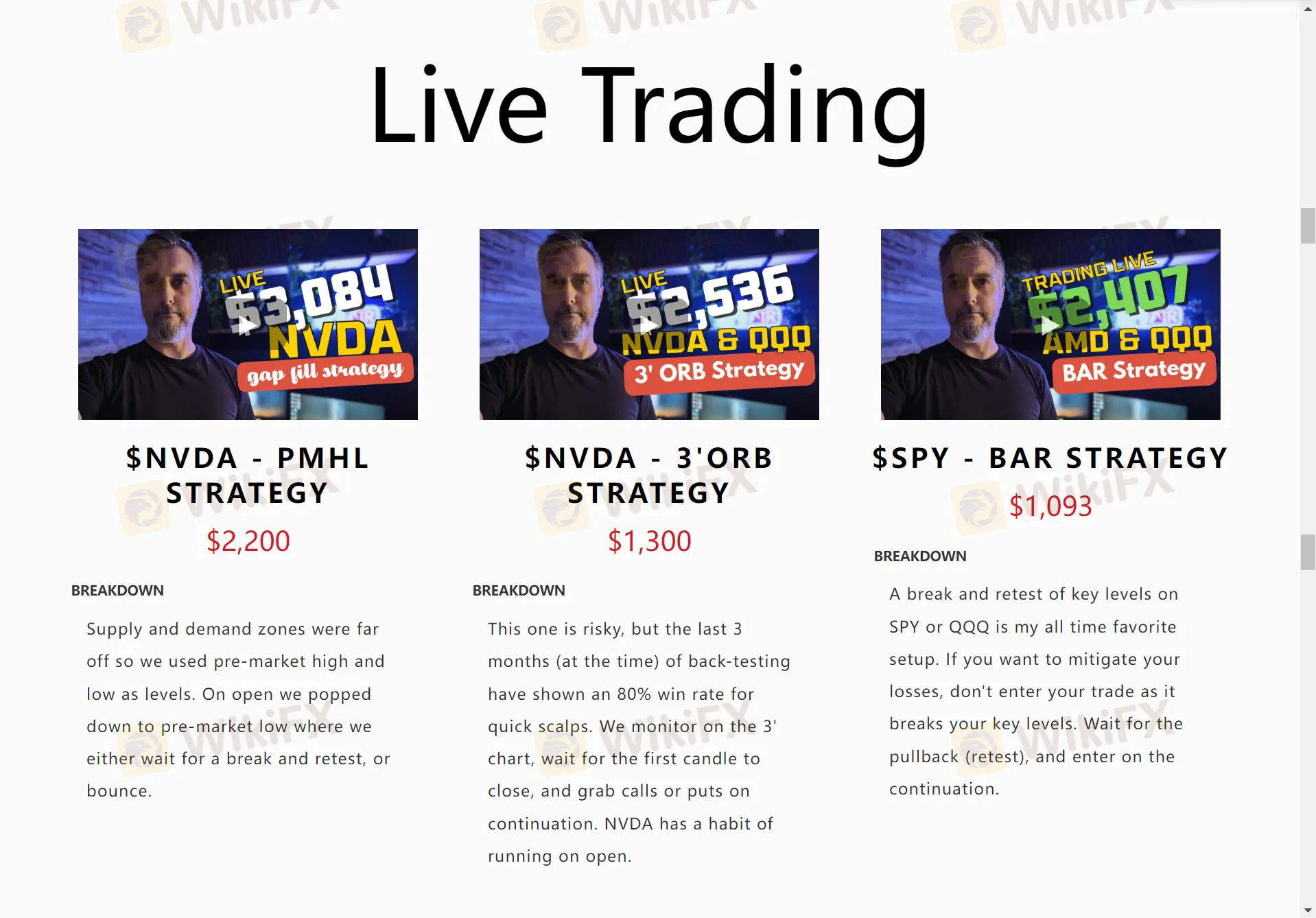

| Educational Resources | $NVDA - PMHL STRATEGY, $NVDA - 3'ORB STRATEGY, and $SPY - BAR STRATEGY |

| Customer Support | Tel: 1.929.552.8269 |

| Email: support@empiretrading.net | |

| Contact Form | |

| Twitter, Instagram, YouTube, and Tiktok | |

What is EMPIRE TRADING?

EMPIRE TRADING is a broker registered in the United Kingdom, specializing in stocks trading. They provide a demo account, leverage up to 1:500, and tight spreads of 0.1 pips for EUR/USD. Featuring in education, EMPIRE TRADING promotes strategies like PMHL STRATEGY, 3'ORB STRATEGY, and BAR STRATEGY. However, it operates without any regulation. Additionally, the information about trading and operation is limited.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

Demo Account Availability: Allows traders to practice and familiarize themselves with the platform and trading strategies without risking real money.

Education of Various Trading Strategies: Offers resources or guidance on different trading strategies like PMHL STRATEGY, 3'ORB STRATEGY, and BAR STRATEGY, which can help traders make more informed decisions.

Cons:

Not Regulated: Empire Trading is not regulated by any reputable financial authority. This is a major concern as it offers no protection for your funds in case of fraud or mismanagement.

High Minimum Deposit (1,000 EUR/USD): This is a relatively high minimum deposit compared to some brokers who offer lower entry points.

Limited Information: There is no any information on commissions, account maintenance fees, or withdrawal fees. These are crucial factors to consider when choosing a broker.

Is EMPIRE TRADING Safe or Scam?

Empire Trading is a high-risk option and could be a scam.

The biggest red flag is the lack of regulation by any reputable financial authority. This means your funds are not protected in case of fraud or mismanagement.and hold client funds in segregated accounts. Offering leverage up to 1:500 can be very risky, especially for beginners. High leverage can amplify losses significantly. Reputable brokers often offer lower leverage ratios for investor protection. 1,000 EUR/USD is a relatively high minimum deposit compared to some brokers who allow you to start with less.

Market Instruments

EMPIRE TRADING offers trading in stocks as its primary market instrument. This means that clients can trade shares of publicly listed companies on various stock exchanges.The supporting list includes SPY, QQQ, NVDA, AMD, APPL, AMZN, GOOG, TSLA, and other similar stocks. However, the focus on stocks also limits trading options.

Account Types

EMPIRE TRADING offers two account types: STD Account and ECN Account, both requiring a minimum deposit of 1000 EUR/USD.

STD Account: This account type is designed for traders who prefer standard and simple trading experience.

ECN Account: The ECN Account is geared towards traders who prefer a more direct market access trading environment.

Leverage

Both of the two accounts support leverage of up to 1:500. Leverage is a key feature in trading that allows traders to control larger positions with a relatively small amount of capital. However, while leverage can amplify profits, it also increases the risk of significant losses.

Spreads & Commissions

There is no detailed information about spreads and commissions. We just know that the spread for EUR/USD in a demo account is 0.1 pips.

Trading Platform

Empire Trading uses MetaTrader5 (MT5) platform. The MT5 is a reliable and technologically advanced trading platform. It has intuitive trading interface, top-notch charting with useful market analysis tools, and supports automated trading via Expert Advisors (EAs), and copy trading.

Deposits & Withdrawals

The minimum deposit required by Empire Trading is relatively high at $1000, which is a barrier for some traders. Empire Trading offers payment methods including bank wire and various cryptocurrencies. However, it does not offer refunds, which is an important consideration for traders looking for risk management in their trading activities.

Educational Resources

Empire Trading provides educational resources on various trading strategies such as PMHL STRATEGY, 3'ORB STRATEGY, and BAR STRATEGY.

$NVDA - PMHL STRATEGY: Used pre-market high and low levels, waited for the price to drop to the pre-market low and then either waited for a break and retest or a bounce to enter the trade.

$NVDA - 3'ORB STRATEGY: This strategy showed an 80% win rate in back-testing. Monitored the 3-minute chart, waited for the first candle to close, and entered calls or puts on continuation. NVDA tends to run on open.

$SPY - BAR STRATEGY: Favorite setup involves a break and retest of key levels on SPY or QQQ. Advised not to enter the trade as it breaks key levels but to wait for the pullback (retest) and enter on the continuation to mitigate losses.

Customer Service

Empire Trading offers several customer support options:

Telephone: You can reach them at +1 929-552-8269.

Email: For inquiries or assistance, you can email them at support@empiretrading.net.

Contact Form: They provide a contact form on their website for easy communication.

Social Media: Empire Trading is also active on social media platforms such as Twitter, Instagram, YouTube, and TikTok, where you can follow them for updates and possibly reach out for support.

Conclusion

In conclusion, Empire Trading presents a high-risk option for stock trading. The lack of regulation exposes your funds to potential fraud or mismanagement. High leverage and a minimum deposit of $1,000 can lead to significant losses, especially for beginners. While educational resources are offered, their effectiveness and suitability are uncertain.

We strongly advise you to prioritize safety and choose a reputable broker to minimize risks and maximize your chances of success.

Frequently Asked Questions (FAQs)

Q: Is EMPIRE TRADING regulated?

A: No, EMPIRE TRADING operates without any regulation.

Q: What is the minimum deposit required to open an account with EMPIRE TRADING?

A: The minimum deposit required by EMPIRE TRADING is 1000 EUR/USD.

Q: What trading instruments are available on EMPIRE TRADING?

A: EMPIRE TRADING specializes in stock trading.

Q: What trading platforms does EMPIRE TRADING offer?

A: EMPIRE TRADING uses the MetaTrader 5 (MT5) platform.

Q: Does EMPIRE TRADING offer a demo account?

A: Yes, EMPIRE TRADING offers a demo account.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Broker yang bersangkutan

WikiFX Broker

Berita Terhangat

KEKAISARAN Penipuan Trading & Investasi Online Terpusat Di Israel & Georgia

Nilai Tukar