Cawada

Ikhtisar:Cawada is an ECN forex broker founded in 2017 and registered in Belize. It claims to provide its clients with leverage up to 1:100 and spreads from 3 pips. They provide MT4 platform catering to trading needs. The company currently has no valid regulation.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| Cawada Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Belize |

| Regulation | Unregulated |

| Market Instruments | Forex, etc. |

| Demo Account | Available |

| Leverage | 1:100 |

| EUR/USD Spread | From 3 pips |

| Trading Platforms | MT4 |

| Minimum Deposit | $100 |

| Customer Support | Email: support@cawada.com |

| Phone: +1 917 267 8536 | |

| Social networks: Twitter, Facebook, LinkedIn, and Skype | |

| Address: 123 Barack Road, Belize City, Belize | |

What is Cawada?

Cawada is an ECN forex broker founded in 2017 and registered in Belize. It claims to provide its clients with leverage up to 1:100 and spreads from 3 pips. They provide MT4 platform catering to trading needs. The company currently has no valid regulation.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

Pros & Cons

| Pros | Cons |

| • MT4 trading platform | • No regulation |

| • Demo account available | • Only offers one asset class |

| • Social Media available | |

| • Accepts numerous means of payment |

Cawada Alternative Brokers

There are many alternative brokers to Cawada depending on the specific needs and preferences of the trader. Some popular options include:

• FBS - The company has a wide range of account types, which cater to traders of all levels and preferences. Whether you're a beginner or an experienced trader, FBS has an account that will suit your needs. The broker also offers an impressive range of trading instruments, including over 40 currency pairs, precious metals, CFDs on stocks, and cryptocurrencies.

• IG - IG was founded in 1974 in London, U.K. is the world's first broker to actually built the concept of financial spread betting that introduced online dealing as early as in 1998. IG claims that it offers a wide range of tradable financial instruments for global investors, over 18,000 instruments, including Forex, indices, CFDs on stocks, digital cryptocurrencies, and options trading for investors to choose from.

• Admiral Markets - The company is a global online trading provider offering trading services in various financial instruments, including forex, stocks, commodities, and indices. The company offers a range of trading platforms, account types, and educational resources to its clients.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Cawada Safe or Scam?

Cawada is a forex broker that is not regulated by any major financial regulator. This means that there is no governing body that oversees its activities or protects its customers. As a result, there is a high risk that Cawada could be a scam.

If you are considering doing business with Cawada, I would strongly advise against it. Many other regulated forex brokers offer a safe and secure trading environment.

Market Instruments

Cawada advertises that it is a forex broker that mainly offers forex trading.

• Forex is the foreign exchange market, the largest and most liquid financial market in the world. It is where currencies are traded against each other.

When you trade Forex, you are essentially betting on whether the value of one currency will go up or down relative to another currency. For example, if you think that the value of the US dollar will go up against the euro, you could buy USD/EUR. If you are correct, you will make a profit. If you are wrong, you will lose money.

There are several different ways to trade Forex. You can trade on a spot basis, which means that you are buying and selling currencies at the current market price. You can also trade on a forward basis, which means that you are agreeing to buy or sell a currency at a specific price in the future.

Accounts

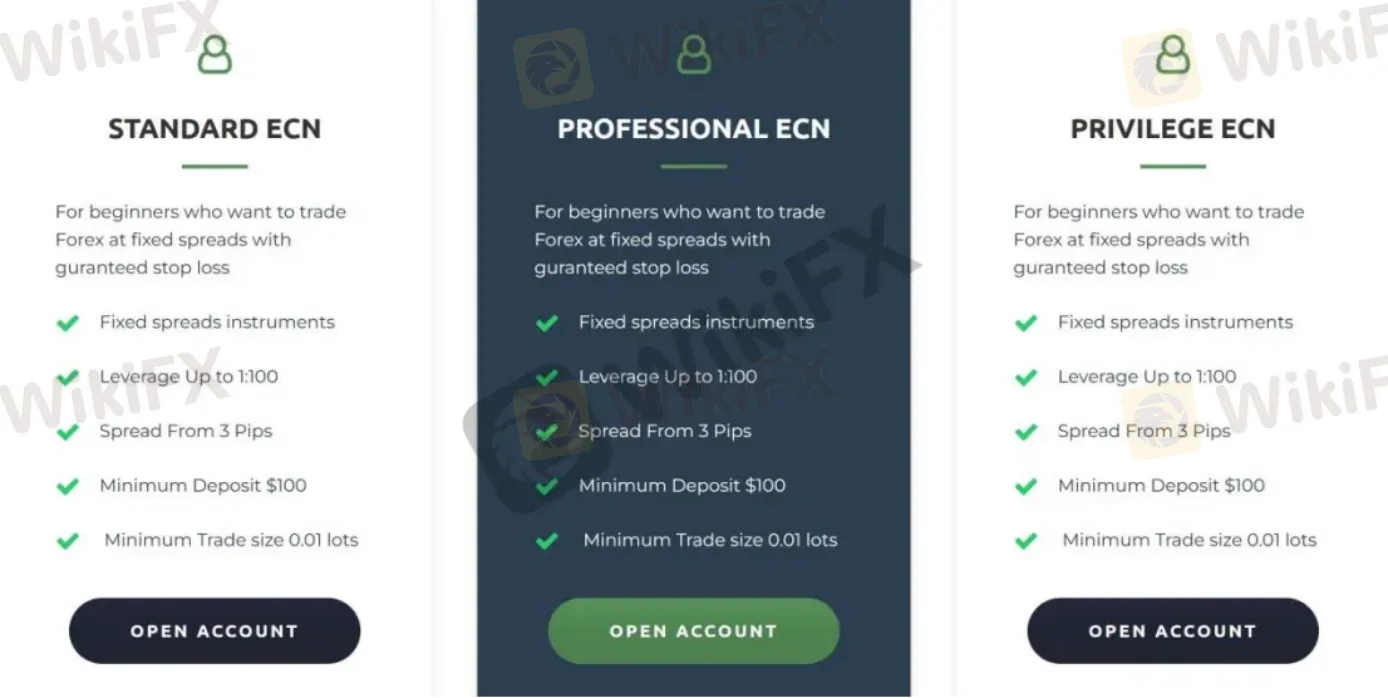

Apart from demo accounts, Cawada claims to offer three types of live trading accounts, namely Standard ECN, Professional ECN, and Privilege ECN, with a minimum initial deposit requirement of $100.

In addition to the different spreads and commissions, the three account types also have different features. For example, the Standard ECN account does not offer any additional features, while the Professional ECN account offers access to premium research and analysis tools. The Privilege ECN account also offers access to these tools, as well as a dedicated account manager.

Ultimately, the best account type for you will depend on your trading style and experience level. If you are a beginner, the Standard ECN account is a good option. If you are more experienced, the Professional ECN or Privilege ECN account may be a better fit.

Leverage

Cawada offers maximum leverage of up to 1:100, which means that you can control a position worth 100 times your initial deposit. For example, if you deposit $100, you could control a position worth $10,000.

Leverage can magnify your profits, but it can also magnify your losses. If the market moves against you, you could lose more money than you deposited.

Spreads & Commissions

Cawada claims that the average EUR/USD spread is 0.2 pips. However, according to the revealed information on the accounts, the spread is said to be from 3 pips on all account types. As for commissions, however, there is nothing detailed information available on Cawada's official site.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Cawada | 3 | N/A |

| FBS | From 0.5 | No commissions |

| IG | 0.6 | N/A |

| Admiral Markets | From 0.6 | No commissions |

Trading Platform

Official web said that the Cawada platform is a comprehensive trading platform that offers a wide range of features for traders of all levels. The platform is designed to be fast, reliable, and feature-rich, and it offers a huge range of products, faster processing speeds, the ability to hedge your positions, and included economic calendar.

The platform available for trading at Cawada is one of the most notable and preferred trading platforms the market offers - MetaTrader4 for Mac and Windows. This trading terminal is highly praised by traders and brokers alike due to its ease of use and great functionality. The MT4 offers top-notch charting and flexible customization options. It is especially popular for its automated trading bots, a.k.a. Expert Advisors.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Cawada | MT4 |

| FBS | MT4/5, Web trader |

| IG | MT4, IG Proprietary |

| Admiral Markets | MT4/5, Web trader |

Deposits & Withdrawals

On Cawadas official website, the broker seems to accept numerous means of deposit and withdrawal choices, consisting of Swift, Visa, MasterCard, Maestro, UnionPay, Alipay, WeChat, and i-Account. The minimum initial deposit requirement is said to be $100. However, specific info on fees and processing time are not revealed openly.

Cawada minimum deposit vs other brokers

| Cawada | Most other | |

| Minimum Deposit | $100 | $100 |

Customer Service

Cawada offers customer service via a variety of channels, including social media. They have a presence on Twitter, Facebook, LinkedIn, and Skype. You can contact them through these channels to get help with your account, trading questions, or other issues.

Customers can get in touch with their customer service line using the information provided below:

Email: support@cawada.com

Phone: +1 917 267 8536

Social Media: Twitter, Facebook, LinkedIn, and Skype.

Address: 123 Barack Road, Belize City, Belize.

Conclusion

Overall, Cawada is a forex broker that specializes in forex trading via the MT4 platform. However, it currently has no valid regulation. Traders should exercise caution and conduct thorough research when considering Cawada or any other brokerage firm, taking into account factors such as reputation, client feedback, and regulatory compliance. Making an informed decision requires a comprehensive evaluation of all relevant factors beyond the information provided here.

Frequently Asked Questions (FAQs)

| Q1: | Is Cawada a regulated brokerage firm? |

| A1: | No regulation. |

| Q2: | What trading platforms does Cawada provide? |

| A2: | Cawada offers MT4 platforms. |

| Q3: | Does Cawada offer demo accounts? |

| A3: | Yes. |

Broker yang bersangkutan

Baca lebih banyak

Jangan Sampai Salah, Ini 6 Tugas dan Tanggung Jawab Broker

Sebelum memutuskan bergabung penting bagi Anda mengetahui tugas dan tanggung jawab broker forex. Dunia investasi saham bisa dijadikan sebagai penghasilan tambahan yang sering dikatakan sebagai passive income.

Pembaruan Broker pada 1 Februari - 7 Februari

Squared Financial menambahkan GameStop dan lainnya dengan akses tidak terbatas. Pialang telah menambahkan semua saham populer, yang mengalami lonjakan permintaan besar-besaran.

Berita Mingguan Broker Per Tanggal 25/01 - 31/01

Organisasi Polisi Kriminal Internasional yang biasa dikenal sebagai INTERPOL mengeluarkan peringatan keras bahwa semakin sering penipu keuangan memburu korban baru di antara pengguna aplikasi kencan yang tidak sadar.

Berita Mingguan Broker Per Tanggal 18/01 - 24/01

Presiden Bank Sentral Eropa (ECB), Christine Lagarde telah menyatakan beberapa kekhawatiran tentang sifat anonim Bitcoin dan masa lalu cryptocurrency yang bermasalah - dalam kata-katanya, ini telah digunakan untuk beberapa "bisnis lucu".

WikiFX Broker

Berita Terhangat

Apakah Admiral Broker Aman? Perdagangan 2024 Menurun & Eksodus 46 Ribu Klien

Broker Forex M4Markets Luncurkan Aplikasi Berfokus pada Perdagangan Sosial

Berita Otoritas: ASIC Blokir 130 Website Per Minggu, CYSEC Peringatkan Peniru Penipu

CNMV Maret 2025 Menetralisir Ancaman 9 Broker Trading Online Berbahaya

Integrasi TradingView Dengan Platform GoTrade Indonesia PT Valbury Asia Futures

SkyLine Guide Malaysia Segera Diluncurkan: Membangun "Michelin Guide" Lokal untuk Industri Forex

Nilai Tukar