ABZ Capital Investments

Ikhtisar:Founded in 2019, ABZ Capital is an unregulated financial services provider that offers a plethora of trading tools and resources. It provides access to a wide array of trading instruments across different asset classes, including forex, metals, indices, and stocks with two choices of account types via the MT5 platform.

| ABZ Capital Investments Review Summary in 10 Points | |

| Founded | 2019 |

| Registered Country/Region | United Arab Emirates |

| Regulation | No Regulation |

| Market Instruments | nearly 2,000, forex, metals, indices, stocks |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| Spread | from 1.4 pips (Standard account) |

| Trading Platform | MT5 |

| Minimum Deposit | $100 |

| Customer Support | Phone: +971 50 726 2212, +971 52 985 5554 |

| Email: support@fxabzcapitals.com | |

| Address: 301, Dar al Riffa building, Khaled bin Alwaleed road, Bur Dubai, Dubai, UAE | |

| Contact form, FAQ | |

What is ABZ Capital?

Founded in 2019, ABZ Capital is an unregulated financial services provider that offers a plethora of trading tools and resources. It provides access to a wide array of trading instruments across different asset classes, including forex, metals, indices, and stocks with two choices of account types via the MT5 platform.

Pros & Cons

| Pros | Cons |

|

|

|

Is ABZ Capital Legit?

ABZ Capital operates without valid regulatory oversight, which raises significant concerns regarding the safety and legitimacy of the brokerage. While the firm claims that all client funds are held in segregated accounts with tier one banks, the absence of a regulatory framework to verify and enforce such claims poses potential risks to investors.

Market Instruments

ABZ Capital is a renowned financial services provider that offers nearly 2,000 markets across various asset classes. These include Indices, which are a representation of a basket of stocks from a specific exchange, or a group of companies with common characteristics.Forex, which is the most traded market in the world, where currencies are exchanged for one another. Stocks, which are shares of ownership in a company and represent a claim on a portion of the company's assets and earnings. Lastly, metals are rare earth minerals that are used in various industries such as construction, jewelry, and technology.

Services

ABZ Capital provides a comprehensive suite of financial services, which encompass financial advisory, where expert consultants offer personalized guidance on investment strategies, portfolio optimization, and risk management tailored to individual financial goals. Additionally, ABZ Capital excels in asset management, employing seasoned professionals who actively manage client assets across a variety of investment vehicles to maximize returns while mitigating risks. The firm also extends its expertise to broader investment services, facilitating access to a wide range of markets and opportunities.

Account Types

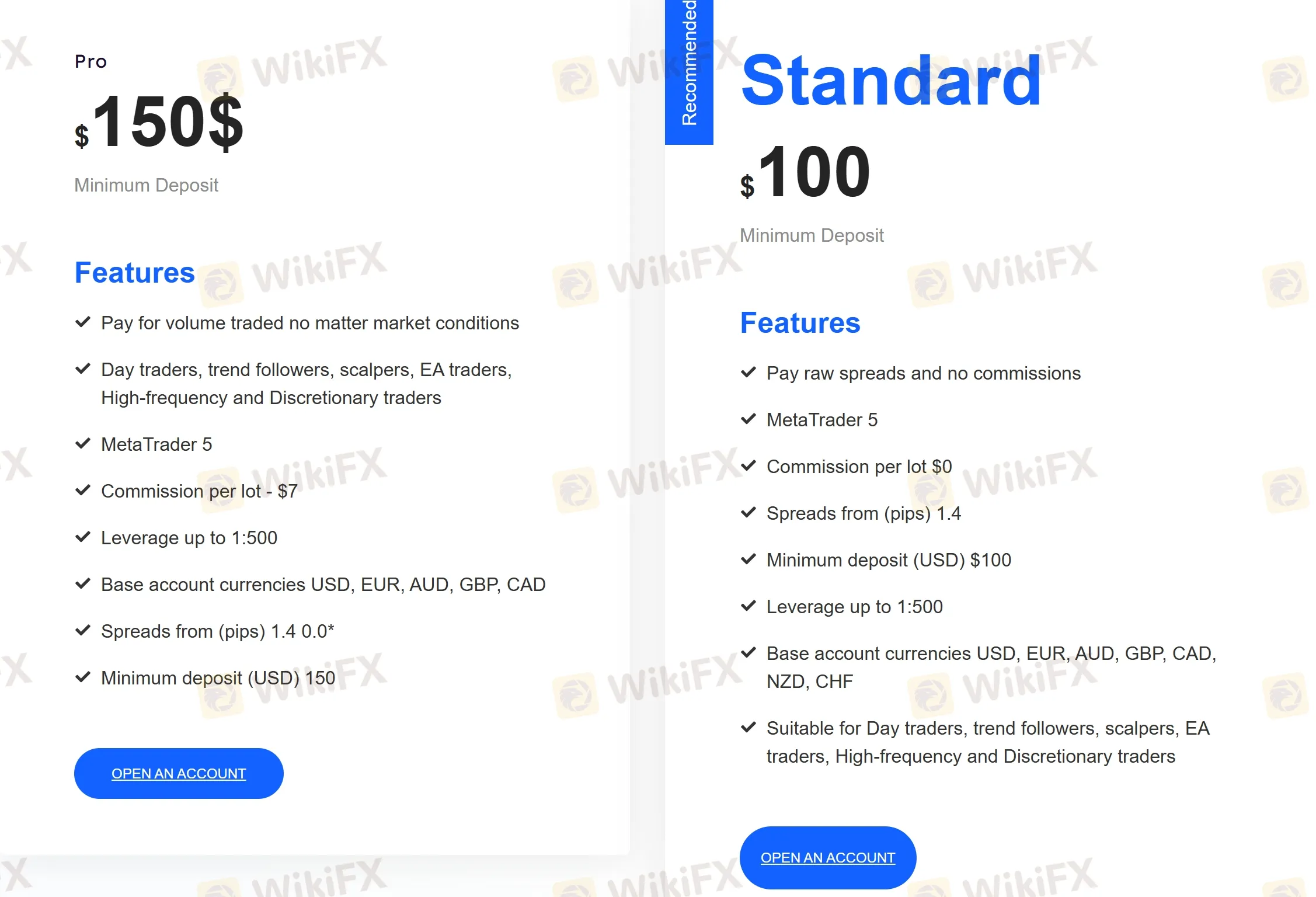

ABZ Capital caters to a diverse clientele by offering two distinct account types: Standard and Pro.

| Account Type | Minimum Deposit |

| Standard | $100 |

| Pro | $150 |

The Standard account, designed for newcomers or those with more conservative investment strategies, requires a minimum deposit of $100. This account provides access to basic trading tools and resources, making it an ideal choice for individuals new to investing or those who prefer a straightforward trading experience.

On the other hand, the Pro account is tailored for more experienced traders or those looking to employ more complex strategies. With a slightly higher minimum deposit requirement of $150, the Pro account offers enhanced features such as advanced analytical tools, lower spreads, and priority customer support.

Leverage

ABZ Capital Investments provides a maximum leverage ratio of 1:500. This ratio signifies that for every dollar deposited, traders can potentially control $500 worth of trades. By providing high leverage, investors can potentially earn substantial profits even with minor market fluctuations. This advantageous feature enables investors to increase their purchasing power and make larger trades without having to put up a significant amount of capital upfront.

Spreads & Commissions

ABZ Capital structures its spreads and commissions to accommodate different types of traders through its two main account offerings.

| Account Type | Spread | Commission |

| Standard | from 1.4 pips | $0 |

| Pro | from 0.0 pips | $7/lot |

The Standard account, ideal for beginners or those who prefer a simpler trading approach, features spreads starting from 1.4 pips and benefits from being commission-free, which simplifies cost management for users. This setup helps reduce the financial barrier for new traders and those not looking to engage in high-volume trading.

In contrast, the Pro account is designed for more experienced traders or those dealing with larger volumes, offering tighter spreads that start from 0.0 pips. However, this account does incur a commission of $7 per lot, which is a common structure for accounts that provide access to more competitive spreads.

Trading Platform

ABZ Capital provides its clients with the MetaTrader5 trading platform. MetaTrader5 is a popular and widely-used trading platform in the financial industry, known for its advanced charting capabilities, customizable interface, and user-friendly design. With the MetaTrader5 platform, ABZ Capital's clients can access a wide range of financial instruments, including forex, indices, and commodities, and execute trades quickly and efficiently.

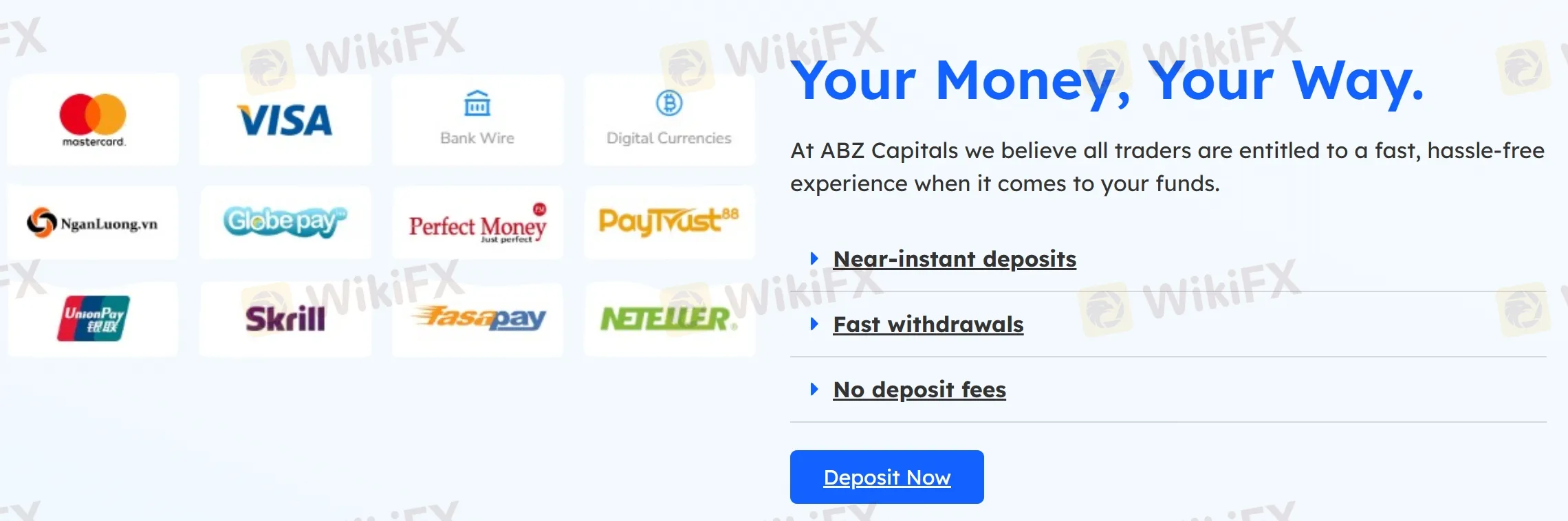

Deposits & Withdrawals

ABZ Capital offers a broad range of deposit and withdrawal options to accommodate its diverse clientele, including popular credit cards like MasterCard and Visa, traditional bank wires, and a variety of digital and electronic payment methods such as digital currencies, NganLuong.vn, Globepay, Perfect Money, PayTrust, UnionPay, Skrill, Fasapay, and Neteller. The firm prides itself on facilitating smooth financial transactions by not charging any deposit fees and ensuring near-instant deposit times, which allows traders to fund their accounts efficiently and start trading without unnecessary delays.

When it comes to withdrawals, ABZ Capital strives to process requests swiftly. The time it takes for funds to be credited back to clients' accounts varies depending on the chosen method and any necessary security verifications but generally occurs within a few business days.

Education

ABZ Capital is committed to empowering its clients with the knowledge and tools necessary for successful trading through its comprehensive educational offerings. The firm provides free education, including daily analysis reports that give traders insights into market trends, economic events, and potential trading opportunities. Additionally, ABZ Capital maintains an informative blog that features easy investing tips tailored specifically for newbies, helping them to grasp the fundamentals of trading and build confidence in their investment decisions.

Customer Service

ABZ Capital's support team can be reached through different channels for ultimate convenience.

- Contact Form

- Phone:+971 50 726 2212, +971 52 985 5554

- Email: support@fxabzcapitals.com

- Address:301, Dar al Riffa building, Khaled bin Alwaleed road, Bur Dubai, Dubai, UAE

Conclusion

In conclusion, ABZ Capital offers a robust trading platform that caters to a diverse range of traders with its competitive spreads, high leverage options, and two tailored account types. While the lack of regulatory oversight may pose concerns, the firm compensates with strong customer support, a user-friendly trading environment on MetaTrader 5, and a comprehensive suite of payment methods for convenient transactions.

Frequently Asked Questions (FAQs)

Is ABZ Capital regulated?

No. It has been verified that this broker currently has no valid regulation.

Does ABZ Capital offer demo accounts?

Yes.

What is the minimum deposit for ABZ Capital?

$100.

Does ABZ Capital offer MT4/5?

Yes. It supports MT5.

At ABZ Capital, are there any regional restrictions for traders?

Clients from the United States, United Kingdom, Canada, Australia, EU countries, Iceland, Liechtenstein, Norway, Russia, Afghanistan, Angola, Bahamas, Botswana, Myanmar, Cote d‘Ivoire (Ivory Coast), Crimea and Sevastopol, Cuba, Democratic People’s Republic of Korea (DPRK), Democratic Republic of Congo, Liberia, Ghana, Iran, Iraq, Mongolia, North Korea, Panama, Somalia, Sudan, Syria, Trinidad and Tobago, Yemen, and Zimbabwe are excluded.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Broker yang bersangkutan

WikiFX Broker

Berita Terhangat

【WikiEXPO Wawancara Ahli Global】Robert Hahm: Dari Manajemen Aset ke Inovasi AI

Kok Profitnya TERJUN BEBAS di 2025 ?! Review Keuangan Broker Forex APM Capital (Lunaro)

Aman Atau Berbahaya Untuk Trader Indonesia? Review Broker Forex PT. Java Global Futures Di Q4 2025

Pesan Khusus Natal WikiFX | Transparansi Sebagai Pengawal Kami, Kepercayaan Sebagai Dasar Kami

Menyongsong Bisnis 2026: XTB Raih Lisensi Kripto CySEC, Strategi Besar Broker Forex Kelas Dunia

Nilai Tukar