FlexTrade

Ikhtisar:Registered in the United States, FlexTrade Systems provides various trading technology services to the trading industry, including a multi-asset execution and order management system for equities, fixed income, foreign exchange, futures, and options. It serves valued clients in 45 countries.

| FlexTradeReview Summary | |

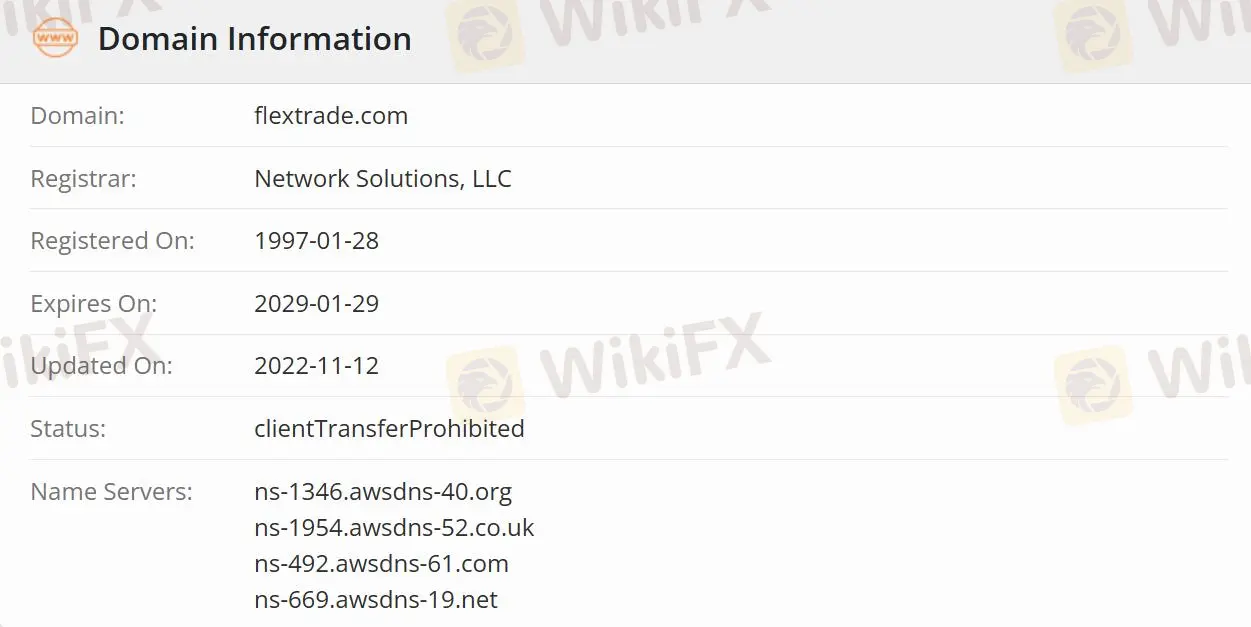

| Founded | 1997-01-28 |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Services | Asset Managers/Hedge Funds//High-Touch/Trading/Market Making/Low-Touch Trading/Program Trading/Derivatives Trading/Outsourced Trading/and Retail Trading |

| Customer Support | Office Phone: +1 516 627 8993/+1 516 304 3655/+44 20 3757 9310/+33 1 59 03 15 77/+65 6965 2100/+91 20 6724 5023/+852 3579 2200/+61 2 8103 4043 |

| Sales email: sales@flextrade.com | |

FlexTrade Information

Registered in the United States, FlexTrade Systems provides various trading technology services to the trading industry, including a multi-asset execution and order management system for equities, fixed income, foreign exchange, futures, and options. It serves valued clients in 45 countries.

Is FlexTrade Legit?

FlexTrade is not regulated, making it less safe than regulated brokers.

What products and solutions does FlexTrade have?

FlexTrade provides Asset Managers, Hedge Funds, and Sovereign Wealth/Pension Funds services for buyers, while High-Touch Trading/Market Making, Low-Touch Trading, Program Trading, Derivatives Trading, Outsourced Trading, and Retail Trading services for sellers.

The trading products that customers can choose from are FIexTRADER EMS, FIexONE OEM, Financial Financing, FlexFX, Flex Options, Flex Futures and FlexOMS.

Broker yang bersangkutan

WikiFX Broker

Berita Terhangat

Ekspansi Broker Robinhood Dalam Persaingan di Perdagangan Berjangka

HUKUMAN FCA Untuk Aksi ILEGAL Broker Forex Infinox Capital Limited

Pelakunya 3 WN ISRAEL ! Kejahatan Broker Binary Options US$ 451 Juta

Nilai Tukar