Strifor

Ikhtisar:Strifor, founded in 2015, is a brokerage registered in Mauritius. The trading instruments it provides cover crypto CFD, forex, shares, metals, indices, and commodities. It provides 3 types of account and Islamic account, with a minimum deposit of $0 on MT5 platform. However, it is unregulated and does not provide services for residents from certain areas.

| StriforReview Summary | |

| Founded | 2015 |

| Registered Country/Region | Mauritius |

| Regulation | No regulation |

| Market Instruments | Cryptos, forex, shares, metals, indices, commodities |

| Demo Account | / |

| Islamic Account | ✔ |

| Leverage | / |

| Spread | From 0 pip |

| Trading Platform | MT5 |

| Minimum Deposit | 0 |

| Customer Support | Phone: +230 463 7993 |

| Telegram: @strifor_official_bot | |

| Email: help@strifor.org | |

| Address: Suite 001, Ebene Junction Building, Rue de la Democratie, Ebene, 72201, Mauritius | |

| Regional Restriction | USA, Japan, Canada |

Strifor Information

Strifor, founded in 2015, is a brokerage registered in Mauritius. The trading instruments it provides cover crypto CFD, forex, shares, metals, indices, and commodities. It provides 3 types of account and Islamic account, with a minimum deposit of $0 on MT5 platform. However, it is unregulated and does not provide services for residents from certain areas.

Pros and Cons

| Pros | Cons |

| Wide range of trading instruments | Unregulated |

| Three types of account to choose from | Regional restriction |

| MT5 trading platform supported | Lack of leverage information |

| Islamic account available | Commission fees charged |

| Low minimum deposit of 0 |

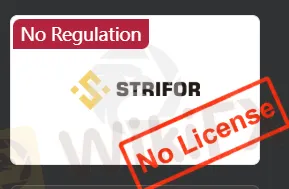

Is Strifor Legit?

Strifor doesn't have any license, which means traders should be more careful when trading through Strifor.

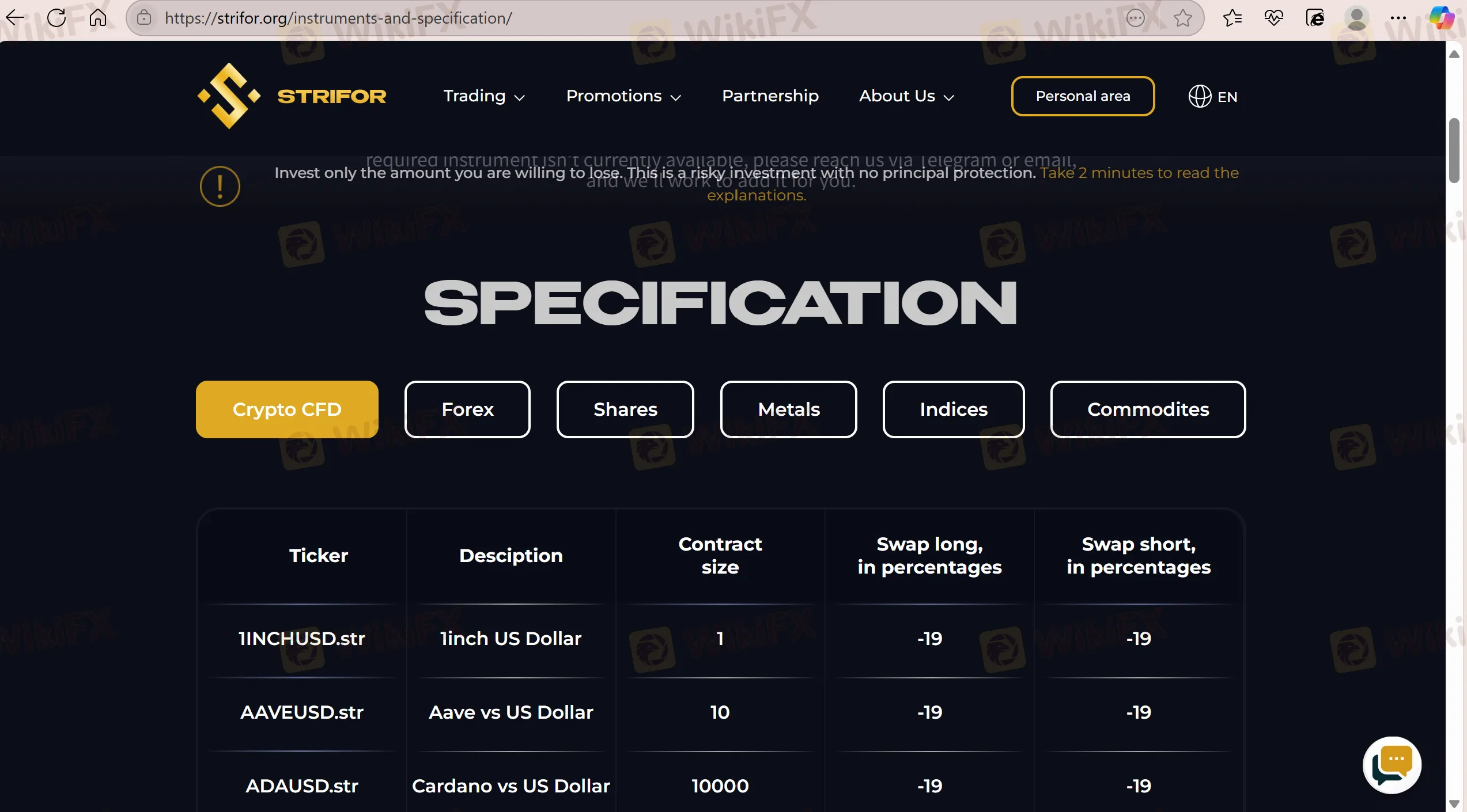

What Can I Trade on Strifor?

Strifor offers traders the opportunity to trade crypto CFD, forex, shares, metals, indices, commodities.

| Tradable Instruments | Supported |

| Cryptos | ✔ |

| Shares | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Futures | ❌ |

| Options | ❌ |

Account Types

Strifor offers 4 different types of accounts to traders, which are Basic Account, Advanced Account, Professional Account, Islamic Account.

| Account Type | Basic Account | Advanced Account | Professional Account | Islamic Account |

| Minimum deposit | 0 | 10000 | 20000 | 2000 |

| Spreads | From 0.1 pips | From 0 pip | From 0 pip | From 0.1 pips |

Strifor Fees

Strifor claims to offer low spreads from 0. For Basic Account, it charges $9 for currency pairs, $9 for metals, 0.005% for indices and 0.5% for crypto CFD.

| Account Type | Basic Account | Advanced Account | Professional Account | Islamic Account |

| Spreads | From 0.1 pips | From 0 pip | From 0 pip | From 0.1 pips |

| Swap | ✔ | ✔ | ✔ | / |

| Commissions | Сurrency pairs: 9$ | Сurrency pairs 8$ | Сurrency pairs 6$ | Сurrency pairs 13$ |

| Metals: 9$ | Metals: 8$ | Metals: 6$ | Metals: 13$ | |

| Indices: 0.005% | Indices: 0.004% | Indices: 0.003% | Indices: 0.016% | |

| Cryptos: 0.5% | Cryptos: 0.4% | Cryptos: 0.35% | / | |

| / | Commodities: 0.02% | Commodities: 0.01% | / | |

| / | Stocks: 0.25% | Stocks: 0.15% | / |

Trading Platform

Strifor's trading platform is MT5, which supports traders on PC and mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, Web, Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

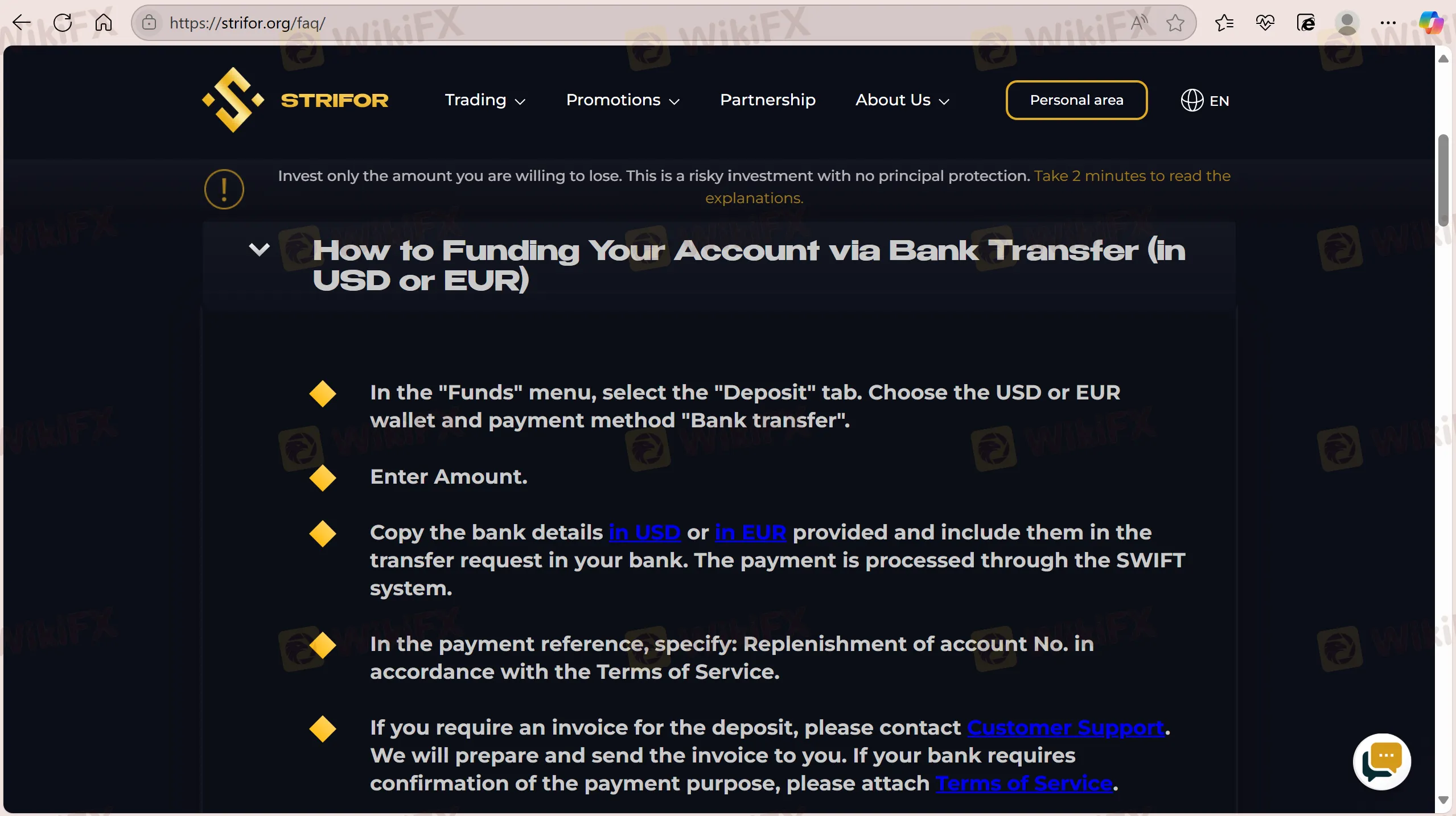

Deposit and Withdrawal

Strifor accepts payments done via bank transfer, credit cards, and cryptocurrencies. However, in terms of other details such as the processing time and fees, its official website does not reveal it.

Broker yang bersangkutan

WikiFX Broker

WikiFX Broker

Nilai Tukar