Blackwell Global-Some important Details about This Broker

Sommario:Blackwell Global is a brokerage firm that offers a range of trading instruments across various asset classes, including stocks and securities, futures and options, precious metals, forex, CFDs, and cryptocurrencies. They provide multiple trading platforms catering to different trading needs. The company is regulated by the Securities and Futures Commission (SFC) and has a physical office in Hong Kong.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| Blackwell Global Review Summary | |

| Founded | 2010 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Stocks & Securities, Futures & Options, Precious Metals |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | 0.3 pips |

| Trading Platforms | AyersGTS, PoleStar Intelligence Platform, MT4, MetalDesk 2 |

| Minimum Deposit | $500 |

| Customer Support | telephone, email, online messaging, social media |

What is Blackwell Global?

Blackwell Global is a brokerage firm that offers a range of trading instruments across various asset classes, including stocks and securities, futures and options, precious metals, forex, CFDs, and cryptocurrencies. They provide multiple trading platforms catering to different trading needs. The company is regulated by the Securities and Futures Commission (SFC) and has a physical office in Hong Kong.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

Pros & Cons

| Pros | Cons |

| • Multiple Trading Platforms | • Reports of Severe Losses and Failed Withdrawals |

| • Social Media Presence | |

| • Diverse Trading Instruments | |

| • Regulated by SFC |

Blackwell Global Alternative Brokers

There are many alternative brokers to Blackwell Global depending on the specific needs and preferences of the trader. Some popular options include:

eToro - offers a user-friendly interface and a wide range of trading instruments, a good choice for beginners and those interested in social trading.

TD Ameritrade - Known for its comprehensive research offerings, educational resources, and a user-friendly trading platform, TD Ameritrade is a solid choice for investors seeking a combination of investment guidance and self-directed trading options.

Plus500 - A CFD service provider that offers a simple, user-friendly platform and a wide range of tradable instruments, making it suitable for those interested in CFD trading.

Is Blackwell Global Safe or Scam?

Blackwell Global is regulated by the Securities and Futures Commission (SFC). Regulation by a reputable financial authority is generally considered a positive factor as it imposes certain rules and safeguards to protect the interests of clients. However, there have been a number of reports of significant losses and withdrawal failures involving Blackwell Global. While it is not clear how many of these reports have been resolved, it is important to consider such reports and investigate further to understand the nature and frequency of these issues.

Market Instruments

A range of trading products are available for traders at Blackwell Global, a brokerage company.

The first recommendation is a wide range of stocks and securities from various exchanges around the world. This includes shares in publicly traded companies, enabling traders to buy and sell ownership of these companies and potentially benefit from price movements.

The second product offered by Blackwell Global is futures and options contracts. A futures contract is an agreement to buy or sell an asset in the future at a pre-determined price and date. An option contract gives the trader the right, but not the obligation, to buy or sell an asset at a specified price within a specified time.

The last is the trading of precious metals such as gold, silver, platinum and palladium. Precious metals are often used as a store of value and can be used as a hedge against inflation and economic uncertainty. Traders can speculate on the price movements of these metals through a variety of trading instruments.

Account & Leverage

The broker provides both Live account and Demo account for Futures & Options, Spot Gold, and Physical Bullion, and just provide live account for Securities. Demo account helps traders understand how the spot gold market operates and develop their trading skills without any financial consequences, and it also provides an opportunity to explore the bullion market and practice trading strategies.

Blackwell minimum deposit amount is $500 for Standard Account which will allow you to start live trading.

Leverage is a powerful tool which allows you to hold a larger position than the initial cash deposit. It is depending on the regulatory requirement each jurisdiction and regulation requires.

As a result, skilled traders in New Zealand may benefit from high leverage up to 1:400. Retail traders may employ a maximum of 1:30 for Forex instruments, 1:5 for cryptocurrencies, and 1:10 for commodities when dealing under European entity laws with UK or Cyprus restrictions.

| Types of Assets | Maximum Leverage |

| Forex | 1:30 |

| Cryptocurrencies | 1:5 |

| Commodities | 1:10 |

Spreads & Commissions

While the standard ECN account spread for EUR/USD is 0.3 pips combined with a $9 round commission each trade, the Blackwell spread, a variable tight spread, includes trading expenses in its price. ECN accounts, on the other hand, need more frequent balance management and are really a suitable choice for professional or active traders because they call for a high degree of expertise.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Blackwell Global | 0.3 | $9 |

| eToro | 1 | No commission (Spread-only) |

| TD Ameritrade | 0.3 | No commission (Spread-only) |

| Plus500 | Average of 0.6 | No commissions |

Trading Platform

Blackwell Global offers several trading platforms for its clients. Each product matches a different platform, and the following is an introduction to the different platforms:

AyersGTS is a trading platform for trading securities offered by Blackwell Global.AyersGTS typically provides access to real-time market data, advanced charting tools, order placement capabilities and portfolio management features. It may also provide research tools and analysis to assist traders in making informed investment decisions in the securities markets.

Blackwell Global offers the PoleStar Intelligence Platform for futures and options trading. It typically offers a range of features to help traders execute futures and options trades efficiently. The PoleStar Intelligence Platform may include real-time market data, customizable charts, order routing capabilities, risk management tools, and access to market research and analysis. It is designed to provide a powerful and effective trading environment for futures and options traders.

For spot gold trading, Blackwell Global offers the popular MetaTrader 4 (MT4) platform. MT4 is a widely used trading platform in the forex and spot gold markets. It provides traders with a range of tools and features to analyze and trade spot gold. The platform typically offers real-time price quotes, interactive charts, technical analysis indicators, and the ability to execute trades with various order types. MT4 is known for its user-friendly interface, flexibility, and extensive customization options, making it suitable for traders of all experience levels.

Blackwell Global offers the MetalDesk 2 platform for physical bullion trading. The platform is designed for traders interested in buying and selling physical precious metals such as gold and silver bullion or silver coins.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Blackwell Global | AyersGTS, PoleStar Intelligence Platform, MT4, MetalDesk 2 |

| eToro | eToro Platform |

| TD Ameritrade | thinkorswim, Web Platform, Mobile Apps |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

Deposits & Withdrawals

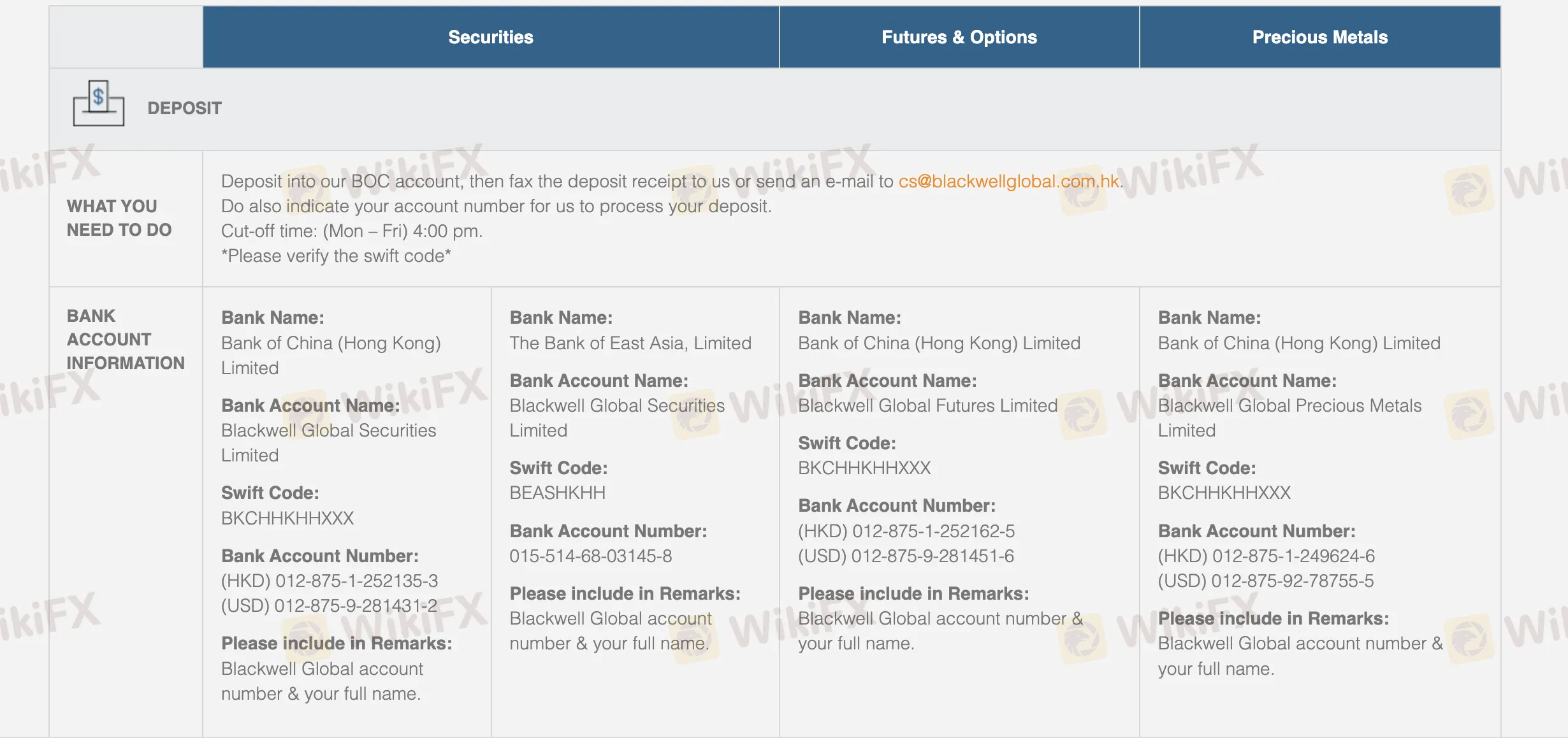

The broker accepts funds via bank wire or cheque deposit.

Bank wire deposits typically require clients to include specific information, such as their trading account number and name, to ensure proper allocation of funds. Once the transfer is initiated, it may take some time for the funds to be credited to the trading account, as the processing time can vary depending on the banks involved. It's important to note that cheque deposits usually take longer to process compared to bank wire transfers, as they need to go through the clearing process.

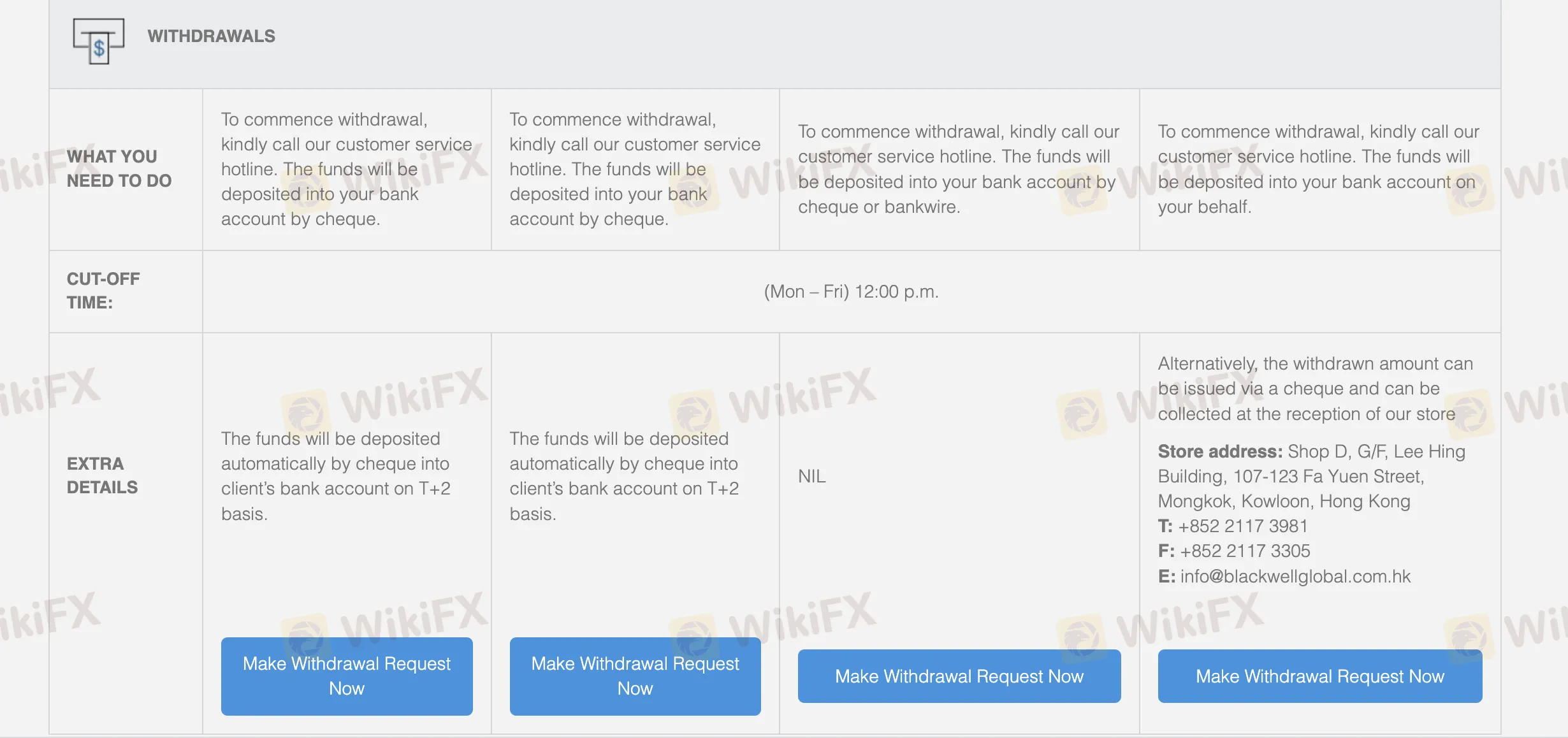

To start a withdrawal, the broker claims to be available by calling the customer service line. Funds will be deposited into your bank account via cheque.

| Blackwell Global | Most other | |

| Minimum Deposit | $500 | $100 |

Fees

With regard to all deposit and withdrawal methods, Blackwell Global doesn't charge any extra fees. However, the customer is responsible for paying all third-party costs, including bank fees and online payment provider fees. However, Deposit Bank Fees will be covered up to $100 on the basis of a SWIFT copy. In addition, the traders of a Professional level and higher will enjoy those fees covered by Blackwell too.

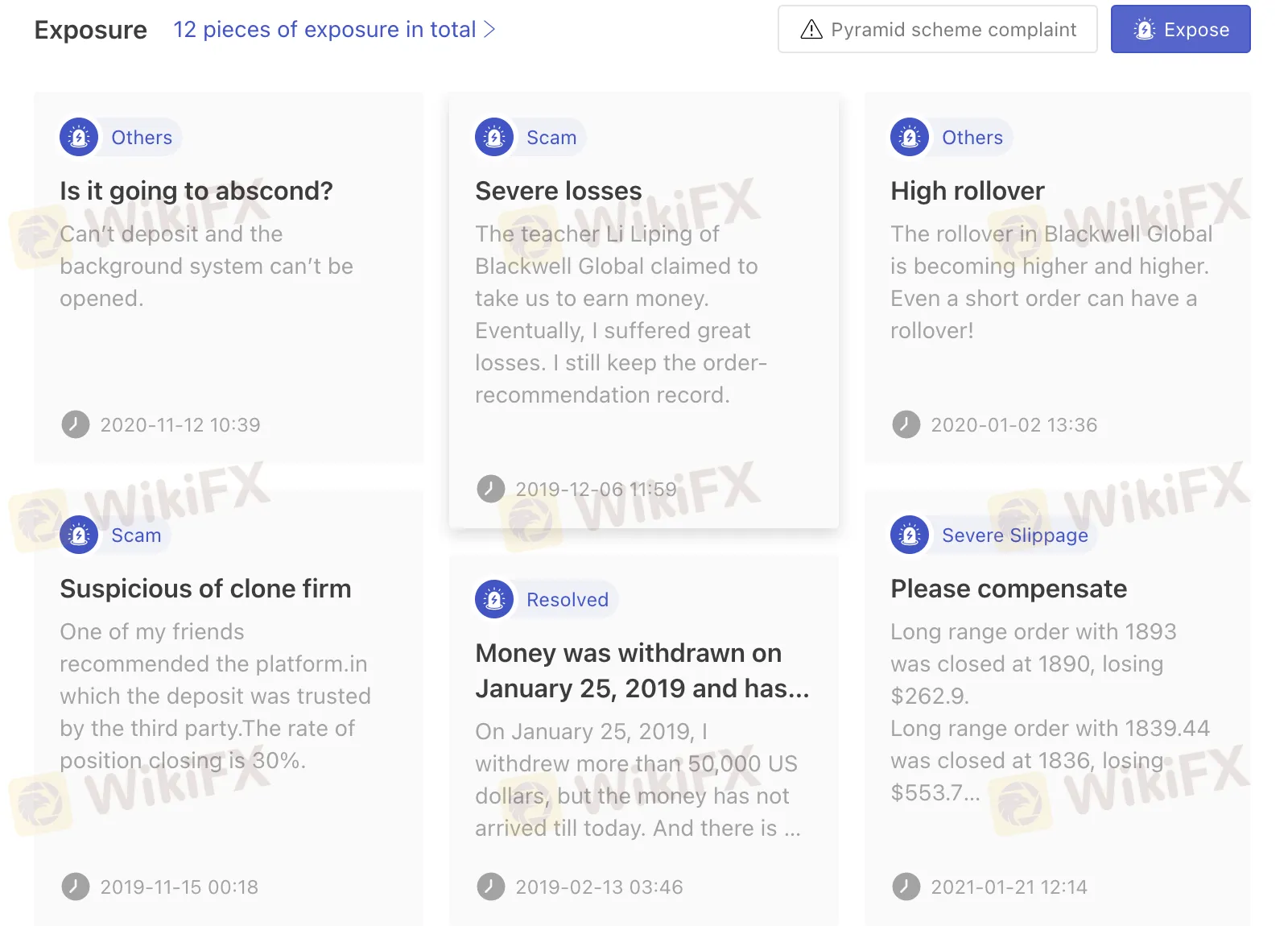

User Exposure on WikiFX

Some of you may see reports of severe losses or failed to withdrawal on our website. The business received several reports of this nature, however some of them appear to have been resolved. We urge traders to carefully examine the dangers of trading on unregulated platforms and review the information that is readily available. Before trading, you can study the facts about our platform. Please let us know in the “Exposure” area if you come across any such dishonest brokers or if you have yourself been a victim. We would appreciate that, and our team of professionals will make every effort to help you fix the issue.

Customer Service

Blackwell Global offers traders market research resources including daily market evaluations, fundamental analysis, and other financial data, as well as 24/7, online messaging service that is always prepared to promptly resolve any clients' technical concerns.

Customers can visit their office or get in touch with their customer service line using the information provided below:

Telephone: +85221539868

Email: cs@blackwellglobal.com.hk

Address: 26/F, Overseas Trust Bank Building, 160 Gloucester Road, Wanchai, Hong Kong

Moreover, clients could get in touch with this broker through the social media, such as Facebook, Twitter, Linkedin, and YouTube.

Pros and cons of customer service of it make a table:

| Pros | Cons |

| • 24/7 Availability | • N/A |

| • Various Contact Options | |

| • Social Media Presence |

Conclusion

In conclusion, Blackwell Global is a brokerage firm that provides access to a wide range of trading instruments and offers several trading platforms to cater to different trading preferences. The company is regulated by the SFC, which adds a layer of regulatory oversight. They provide market research resources and multilingual customer service to assist clients. However, it's important to note that there have been reports of severe losses and failed withdrawals, although some of these issues appear to have been resolved. Traders should exercise caution and conduct thorough research when considering Blackwell Global or any other brokerage firm, taking into account factors such as reputation, client feedback, and regulatory compliance. Making an informed decision requires a comprehensive evaluation of all relevant factors beyond the information provided here.

Frequently Asked Questions (FAQs)

Q1: What types of trading instruments are available at Blackwell Global?A1: Blackwell Global offers a variety of trading instruments, including stocks and securities, futures and options, precious metals, forex, CFDs, and cryptocurrencies.

Q2: Is Blackwell Global a regulated brokerage firm?A2: Yes, Blackwell Global is regulated by the Securities and Futures Commission (SFC), which provides a certain level of oversight and client protection.

Q3: What trading platforms does Blackwell Global provide?A3: Blackwell Global offers multiple trading platforms, such as AyersGTS for securities, PoleStar Intelligent Platform for futures and options, MT4 for spot gold, and MetalDesk 2 for physical bullion.

Q4: Does Blackwell Global have any regional restrictions?

A4: The information on this site is not directed at residents of the United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

WikiFX Trader

FXTM

Exness

DBG Markets

FXCM

MultiBank Group

CPT Markets

FXTM

Exness

DBG Markets

FXCM

MultiBank Group

CPT Markets

WikiFX Trader

FXTM

Exness

DBG Markets

FXCM

MultiBank Group

CPT Markets

FXTM

Exness

DBG Markets

FXCM

MultiBank Group

CPT Markets

Rate Calc